Melanoma Therapeutics Market Outlook:

Melanoma Therapeutics Market size was valued at USD 7.05 billion in 2025 and is expected to reach USD 19.13 billion by 2035, registering around 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of melanoma therapeutics is evaluated at USD 7.72 billion.

The melanoma therapeutics market is rapidly advancing as the global burden of melanoma is increasing, which is reflected both in the number of diagnosed cases and in death rates. For instance, in January 2025, updated statistics by the American Cancer Society stated that the majority of skin cancer deaths are caused by melanoma, which makes up around 1% of all skin cancers. About 104,960 new cases of melanoma will be diagnosed in the US in 2025, composed of 60,550 in men and 44,410 in women. It is anticipated that total deaths by melanoma will be around 8,430 roughly 2,960 women and 5,470 men. Therefore, significantly raises the need for new treatment modalities.

In addition, the advancement in the molecular mechanism of the disease has made it possible to target therapies and immunotherapies, transforming the landscape of management. Funds from public-private sectors also increased simultaneously, so that trials and testing of new drugs and agents are undertaken effortlessly. For instance, in May 2024, over 30 scientists at prestigious academic and medical institutions in the US and overseas received USD 12.6 million from the Melanoma Research Alliance (MRA), the leading non-profit organization in the world for funding melanoma research.

Furthermore, the biotechnology firms proliferating and academia collaborating further accelerate these efforts while making it pertinent that the issue of melanoma is addressed multi-disciplinary. Early detection and prevention strategies advocacy, further raising awareness campaigns, and cause advancement for the sake of sustaining funding and research promise a rich pipeline of therapeutics for the patient population in the next few years. For instance, the MRF is dedicated to providing the best resources for treatment, survivorship, and support while raising awareness of melanoma prevention and early detection. In year 2021, the MRF's awareness campaign, (OutOfTheShadows) was implemented to raise awareness of mucosal melanoma.

Key Melanoma Therapeutics Market Insights Summary:

Regional Highlights:

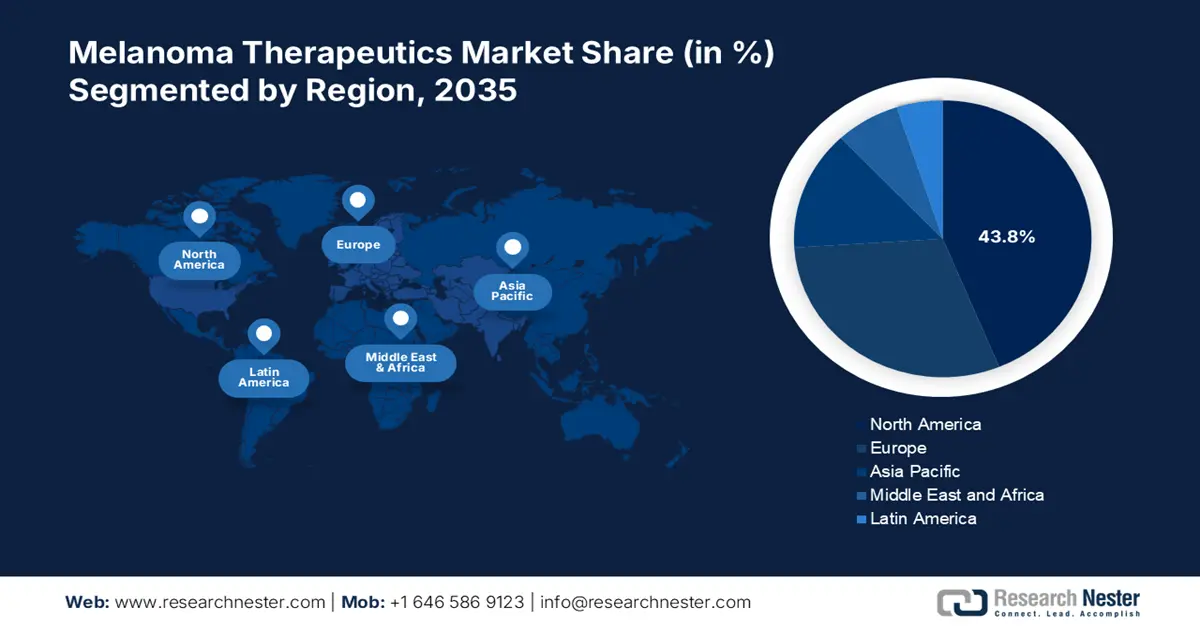

- North America’s 43.8% share in the Melanoma Therapeutics Market is driven by the presence of giant pharma companies with better-studied drugs, ensuring robust growth through 2035.

- The Asia Pacific region is projected to experience the fastest growth in the Melanoma Therapeutics Market from 2026 to 2035, driven by government initiatives and significant healthcare investments.

Segment Insights:

- The Immunotherapy segment is forecasted to exceed 61.3% market share by 2035, driven by breakthroughs in immune evasion understanding and innovative therapies transforming melanoma treatment.

Key Growth Trends:

- Collaborative Approaches

- Regulatory Support

Major Challenges:

- Geographical disparities

- Resistance Mechanism

- Key Players: Novartis AG, Genentech, Inc, AB Science (France), AgonOX (U.S.), Pfizer, Inc. (U.S.), and more.

Global Melanoma Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.05 billion

- 2026 Market Size: USD 7.72 billion

- Projected Market Size: USD 19.13 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Melanoma Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Collaborative Approaches: In the melanoma therapeutics market, collaborative approach is predominantly becoming a pivotal growth driver as it promotes synergy between organizations and companies. Such collaboration facilitates the exchange of knowledge and resources and also enhances acceleration in innovative research and clinical trials. For instance, in March 2023, Pfizer Inc. and Seagen Inc. announced that they reached a final merger agreement. Pfizer promised to pay for a total enterprise value of USD 43 billion. Pfizer's oncology portfolio is significantly enhanced by Seagen's medications, late-stage development initiatives, and innovative knowledge of antibody-drug conjugates (ADCs).

Such collaboration improves the development pipeline of novel therapeutic agents and can make possible a more robust response to the rising incidence of melanoma. For instance, in January 2022, Pfizer Inc. announced that the U.S. FDA approved CIBINQO (abrocitinib), an oral, once-daily Janus kinase 1 (JAK1) inhibitor to treat adults with refractory, moderate-to-severe atopic dermatitis (AD). A synergy of concerted efforts from all walks of stakeholders is aimed at grappling with the complexities of the aggressive form of cancer, thereby facilitating the speedier and more efficient release of efficacious remedies. Thus, contributing towards a more discriminative understanding that would help to move forward in patient care. - Regulatory Support: A remarkable stimulator in the melanoma therapeutics market includes persistent regulatory support as they render approvals on time and create conducive ecosystem for innovative drugs that are introduced. For instance, in March 2022, Novartis reported that the US FDA has approved PluvictoTM (lutetium Lu 177 vipivotide tetraxetan), formerly known as 177Lu-PSMA-617, to treat adult patients with prostate-specific membrane antigen–positive metastatic castration-resistant prostate cancer (PSMA-positive mCRPC). Hence, regulatory agencies have increasingly adopted streamlined pathways for the evaluation of novel therapies in response to the urgent need for effective melanoma interventions.

This accelerated process has the advantage of rapidly translating findings from research to clinical use so that patients receive innovative treatments quickly. For instance, according to the JCO Global Oncology statistics revealed in November 2023, the US FDA approved 161 new cancer treatments for a variety of solid tumor malignancies and indications between 2017 and 2022. Thus, the interest by regulatory agencies in oncology drug development indicates an urgent need for addressing the increase in the prevalence of melanoma, which subsequently improves the therapeutic options and quality of care available to patients.

Challenges

- Geographical disparities: The biggest challenge in the melanoma therapeutics market is geographical disparity as access to advanced treatments and diagnostic services remains unevenly distributed. The healthcare infrastructure is limited in underserved and rural areas, making it inaccessible for patients from those areas who lack services from specialized medical professionals. Furthermore, the deficiency of new therapy availability only worsens health outcomes for the affected population and delays diagnosis and commencement of treatment. As more novel melanoma drugs are developed, equity of access will be necessary and would require customized interventions and policy to close gaps toward better overall health equity.

- Resistance Mechanism: It is probably the biggest obstacle that threatens to defeat all efforts in market by greatly complicating treatment efficacy and patient outcome. With progression, melanoma often develops adaptive ways to survive through the effects of targeted therapies and immunotherapies such as genetic mutation, changes in signaling pathways, and immune-evading mechanisms-all of which work together to destroy the efficacy of current treatments. Overcoming these resistance mechanisms will be a challenge for next-generation therapies, thereby leading to ongoing research in new combination strategies and alternative approaches that can enhance the durability of therapeutic responses in melanoma patients.

Melanoma Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 7.05 billion |

|

Forecast Year Market Size (2035) |

USD 19.13 billion |

|

Regional Scope |

|

Melanoma Therapeutics Market Segmentation:

Product (Immunotherapy, Chemotherapy, Radiation Therapy, Targeted Therapy)

Immunotherapy segment is set to capture over 61.3% melanoma therapeutics market share by 2035, representing an enormous change in the treatment paradigm of this intensified skin cancer area. This shift comes from an augmented understanding of the mechanisms of immunology involved in immune evasion, where groundbreaking therapies have succeeded in revolutionizing management strategies. For instance, in February 2024, a team of UF Health Cancer Center researchers developed a first-of-its-kind compound, the new PROTAC, called NR-V04 that could open a new avenue for using immunotherapy to treat various types of cancer. Thus, the scope of melanoma therapeutics and the significance of immunotherapy can be expected to expand there.

Drug Type (Branded Drugs, Generic Drugs)

In the melanoma therapeutics market, branded drugs have taken a leading edge due to significant investment and innovation in developing therapeutic agents for the challenging disease. Branded medication with more stringent validation within clinics, thus make available a healthy range of clinically guaranteed options. It is backed up through robust data within their respective efficiency and safety profile. For instance, in October 2023, The Food and Drug Administration authorized nivolumab (Opdivo, branded under Bristol-Myers Squibb Company) as an adjuvant treatment for patients 12 years of age and older who have had Stage IIB/C melanoma removed entirely. As the market continues to grow, the branded drugs underlines their importance for the advancement of melanoma care and the subsequent survival of the patient.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Drug Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Melanoma Therapeutics Market Regional Analysis:

North America Market Statistics

North America in melanoma therapeutics market is set to capture over 43.8% revenue share by 2035 owing to the presence of giant pharma company establishments equipped with better-studied drugs. It helps in ensuring well-targeted results in patients in terms of achieving a favorable outcome. For instance, in December 2022, Moderna, Inc. announced the Phase 2b KEYNOTE-942/mRNA-4157-P201 trial of mRNA-4157/V940 in combination with KEYTRUDA, Merck's anti-PD-1 therapy, demonstrated a statistically significant and clinically meaningful improvement in the primary endpoint of recurrence-free survival (RFS).

The U.S. market is witnessing profitable growth due to ongoing collaborations in the development of novel drugs for treating melanoma. For instance, in December 2024, by linking Japan innovators with Texas Medical Center specialists and offering a route for US market expansion, the TMC Japan BioBridge and JACT (Japan-Accelerator Cancer Therapeutics and Medical Devices) strategic partnership seeks to improve cancer treatment. Texas Medical Center (TMC) announced a partnership with Mitsui Fudosan Co., Ltd. and The National Cancer Center, Japan's preeminent cancer treatment facility.

The melanoma therapeutics market in Canada is significantly growing due to the preparedness of agencies and companies to combat the disease unanimously. For instance, in May 2024, to increase the efficacy of the standard of care for advanced melanoma, the Canadian Cancer Society (CCS) is collaborating with a group of 12 researchers and partners. This collaboration will lead one of the largest randomized controlled clinical trials in the world that will use fecal microbiota transplantation (FMT). The Canadian Cancer Trials Group will be in charge of this phase II trial, which is funded by USD 1 million each from CCS and the Weston Family Foundation.

Asia Pacific Market Analysis

The melanoma therapeutics market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe. Furthermore, the market's prominence is reinforced by government initiatives and significant healthcare investments, which firmly establish the market as a major player in melanoma therapeutics. For instance, in July 2023, under the Rashtriya Arogya Nidhi (RAN) Umbrella scheme and the Health Minister's Discretionary Grant (HMDG), financial aid is given to needy patients. It includes families below the poverty line who have serious, life-threatening illnesses such as cancer. To cover a portion of the treatment costs, HMDG offers financial assistance up to Rs. 1,25,000, while RAN's Umbrella Scheme offers financial assistance up to Rs. 15 lakhs.

The market in India is remarkably expanding, attributable to the rising cases of melanoma in the country. For instance, in December 2021, according to GLOBOCAN 2020 data published by the National Library of Medicine, MM recorded 3,916 cases (0.3% of all cases) and was ranked 32nd in India in terms of annual incidence. Furthermore, early detection and treatment rates are rising as a result of growing awareness of skin cancer and improvements to the healthcare system.

The melanoma therapeutics market in China is gaining noteworthy traction owing to the rapid progress in developing novel drugs. For instance, in September 2023, Shanghai Junshi Biosciences Co., Ltd. revealed that the primary endpoint—progression-free survival of a multi-center, randomized, controlled phase III clinical study has reached the pre-established efficacy boundary. Dacarbazine and the company's toripalimab are assessed by MELATORCH as first-line therapies for metastatic or incurable melanoma.

Key Melanoma Therapeutics Market Players:

- AstraZeneca

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Private Limited

- Mylan N.V.

- Sun Pharmaceutical Industries Limited

- Sanofi S.A.

- Bayer AG

- Lilly

- Merck & Co., Inc.

- GSK plc

- Novartis AG

- AbbVie Inc.

- Bausch Health Companies Inc.

- F. Hoffmann-La Roche Ltd

- Amgen Inc.

- Bristol-Myers Squibb Company

- Novartis AG

- Genentech, Inc

- AB Science (France)

- AgonOX (U.S.)

- Pfizer, Inc. (U.S.)

The prominent players in the market are highly competitive as they emphasize expanding their portfolios through thorough research in offering treatment options. For instance, in May 2024, Johnson & Johnson announced that 34 clinical studies and real-world evidence presentations from the company's robust pipeline and product portfolio for tumor oncology, as well as hematologic malignancies, will be featured at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting.

Here's the list of some key players:

Recent Developments

- In October 2024, H.I.G. Capital unveiled that one of its affiliates has acquired SkinCure Oncology Intermediate LLC. With this acquisition, they aim to escalate the implementation of their company's vision and growth strategy.

- In July 2024, BioNTech SE reported positive topline data in the ongoing Phase 2 clinical trial (EudraCT No.: 2020-002195-12; NCT04526899), in patients with unresectable stage III or IV melanoma whose disease had advanced following anti-PD-(L)1-containing treatment.

- Report ID: 7144

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Melanoma Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.