Medium-duty Truck Market Outlook:

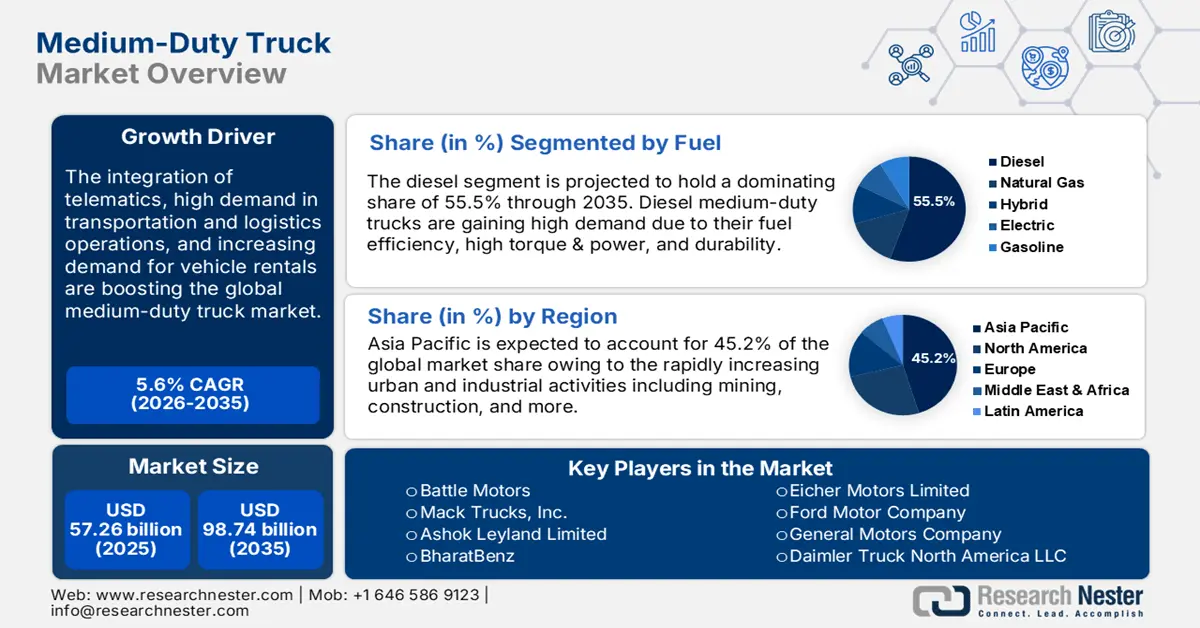

Medium-duty Truck Market size was over USD 57.26 billion in 2025 and is poised to exceed USD 98.74 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medium-duty truck is evaluated at USD 60.15 billion.

The global medium-duty truck market is expanding at a healthy pace and is expected to exhibit the same growth during the projected period. One of the significant trends augmenting the demand for medium-duty trucks is the boom in the e-commerce sector. Medium-duty trucks have a high payload capacity and are prime logistic vehicles for transporting high delivery volumes. Also, as medium-duty trucks can transport larger quantities of products/goods effectively, many e-commerce businesses find no to less need for heavy-duty vehicles.

The U.S. commercial truck sales totaled over 381,000 units during the first three quarters, with a dip in heavy-duty truck sales and falling short of 203,000 units as compared to Q1 to Q3 2023. However, medium-duty truck sales were up by 0.9% YTD, accounting for 178,000 units in the 2024 first three quarters. The Fed announced the reduction of 50 basis points to the federal funds rate, allowing the interest rates to slump across the economy. The lower interest rates are expected to be a tailwind for medium-duty truck sales and freight hauling in 2025, particularly in both residential and commercial construction sectors.

Considering this trend, many manufacturers are launching high-performance medium-duty trucks to earn high profits. The Ford Motor Company is one of the top manufacturers of medium-duty trucks, accounting for over 30% market share and its F-650 & F-750 Models are gaining boom in the marketplace. For instance, in April 2022, Ford F-650 & F-750 Models received the Work Truck’s Medium-Duty Truck of the Year for 2022 award. The prime reasons that supported these Ford models in achieving the award are their high performance, durability, maintenance, servicing, quality, and effectiveness. From this, it can be understood that the development of medium-duty trucks with advanced features is not only boosting their capabilities but also contributing to sales growth.

Key Medium-duty Truck Market Insights Summary:

Regional Highlights:

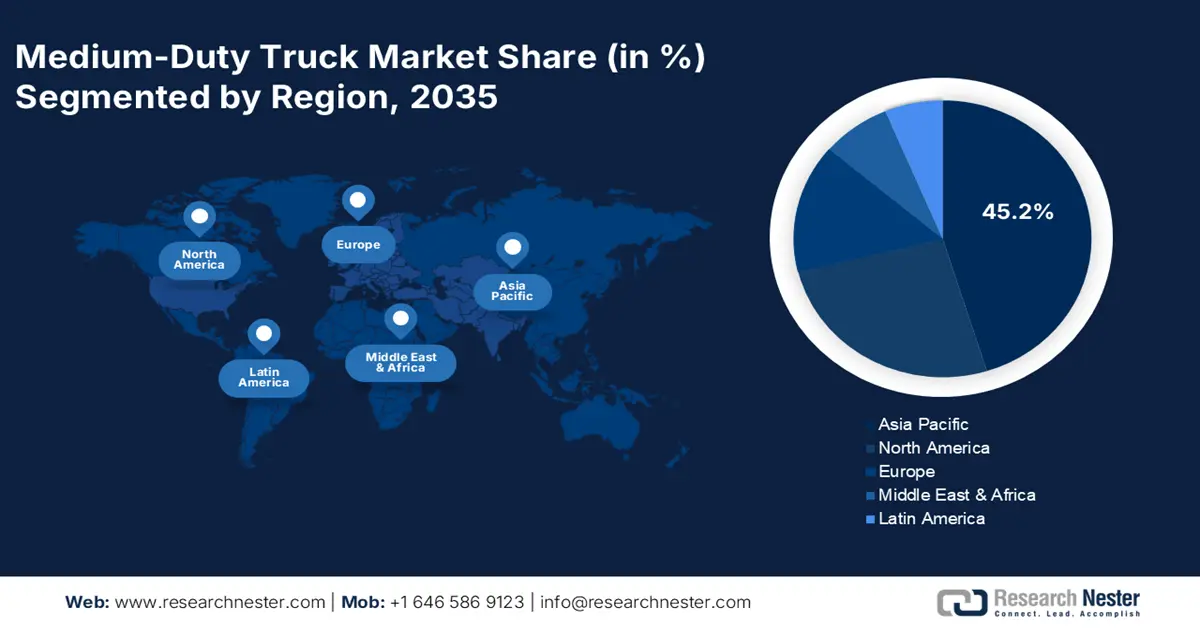

- Asia Pacific dominates the Medium-duty Truck Market with a 45.2% share, propelled by rising industrial and urban activities, ensuring strong growth through 2026–2035.

Segment Insights:

- The Diesel segment is projected to maintain over 55.5% share by 2035, driven by its fuel efficiency, high torque, and durability benefits.

- The Freight & Logistics segment of the Medium-duty Truck Market is projected to maintain over 45.3% share by 2035, driven by rising freight activities and demand for advanced trucks.

Key Growth Trends:

- Integration of telematics

- Shift towards electric trucks

Major Challenges:

- Economic downturns affect sales of modern medium-duty trucks

- High costs of modern medium-duty trucks

- Key Players: Battle Motors, Mack Trucks, Inc., Ashok Leyland Limited, BharatBenz, Eicher Motors Limited, Ford Motor Company, General Motors Company, and Daimler Truck North America LLC.

Global Medium-duty Truck Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.26 billion

- 2026 Market Size: USD 60.15 billion

- Projected Market Size: USD 98.74 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Medium-duty Truck Market Growth Drivers and Challenges:

Growth Drivers

- Integration of telematics: Most Class 4-7 OEMs offer comprehensive remote diagnostics platform for their fleets. Component suppliers and trailer makers also are actively introducing novel telematics solutions to the market each year, improving overall safety, efficiency, and performance. Vehicle telematics combined with GPS technology enables fleet managers to track medium-duty truck locations, fuel consumption monitorization, and driver’s behavioral analysis in real-time. Furthermore, such advanced capabilities appeal to end users to adopt advanced medium-duty trucks.

Another important feature that telematics offers is predictive analysis, allowing fleet operators to make informed decisions and mitigate potential issues. This aids in mitigating the maintenance costs and timely servicing of the vehicle. For instance, in February 2024, Geotab, Inc. and Daimler Truck North America LLC joined hands to offer a new integrated telematics solution, which helps fleet managers to make fast and effective decisions. The data-as-a-service (DaaS) technology of Daimler Truck North America LLC and Geotab’s advanced platform with high-fidelity data leads to the development of one unified telematics solution that simplifies fleet management. Thus, such advancements when installed in medium-duty trucks are set to aid fleet managers in quick and effective decision making. - Shift towards electric trucks: Several governments have implemented stringent regulations on greenhouse gas emissions worldwide to reduce the carbon footprint. These regulations particularly are focused on the transportation sector as it is one of the major contributors to carbon emissions. To comply with these regulations many end users including, transportation is adopting EV medium-duty trucks. Some governments are also offering incentives in the form of tax credits or subsidies for those who are adopting elective vehicles (EVs). This financial incentivization tactic is appealing to fleet operators to adopt electric medium-duty trucks, leading to overall medium-duty truck market growth.

Challenges

- Economic downturns affect sales of modern medium-duty trucks: Economic downturns often reduce the need for transportation services, and as medium-duty trucks are majorly used in transportation and logistics services economic downfall can majorly hamper their sales. The majority of consumers cut back on spending during economic hard times, which directly lowers the demand for products and services. As a result, businesses rely on their old truck models to transport reduced volumes of products, affecting the demand for modern medium-duty truck.

- High costs of modern medium-duty trucks: The modern medium-duty trucks are integrated with advanced technologies and are expensive compared to conventional medium-duty trucks. Many small-scale end use organizations often hesitate to invest in advanced trucks due to their limited budgets, which hampers the sales of modern medium-duty trucks to some extent. The high cost of modern medium-duty trucks not only limits their sales but also keeps small end users deterred from advanced technologies.

Medium-duty Truck Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 57.26 billion |

|

Forecast Year Market Size (2035) |

USD 98.74 billion |

|

Regional Scope |

|

Medium-duty Truck Market Segmentation:

Fuel (Diesel, Natural Gas, Hybrid, Electric, Gasoline)

Diesel segment is anticipated to dominate medium-duty truck market share of over 55.5% by 2035 owing to rising adoption of diesel medium-duty trucks for fuel efficiency, high torque & power, and durability. Modern diesel engine medium-duty trucks are more fuel-efficient than gasoline counterparts. Diesel medium-duty trucks achieve lower carbon emissions, provide better mileage, and also reduce fuel costs, making them a prime choice for fleet operators. Furthermore, diesel engines produce high torque at lower revolutions per minute (RPM), which makes them effective models for frequent stop-and-go driving conditions. Also, as diesel engines can handle high stress and are less susceptible to wear and tear, they lead to lower maintenance and durability when installed in medium-duty trucks.

Application (Construction & Mining, Freight & Logistics, Others)

In medium-duty truck market, freight & logistics segment is set to account for revenue share of more than 45.3% by the end of 2035. The rise in freight and logistics activities across the world is augmenting the sales of medium-duty trucks. This static underscores that the rise in freight and logistics operations is estimated to have a positive influence on the demand for medium-duty trucks. The freight and logistics operators are also widely demanding advanced medium-duty trucks particularly those equipped with telematics as they offer high safety, efficient tracking systems, and cost-effectiveness in modern supply chain operations.

Our in-depth analysis of the medium-duty truck market includes the following segments:

|

Fuel |

|

|

Class |

|

|

Horsepower |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medium-duty Truck Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific industry is estimated to hold largest revenue share of 45.2% by 2035, primarily due to the rising industrial and urban activities. The rapid infrastructure development activities and swift migration of people towards urban cities necessitate the use of medium-duty trucks for construction and material transportation. Medium-duty vehicles with high-volume transportation capabilities are prime choice vehicles, particularly in transportation.

The rapid industrialization and e-commerce growth in China are pushing the demand for advanced medium-duty trucks. For instance, according to the International Trade Administration report, China is the world’s largest market for e-commerce and contributes to 50% of global transactions. This highlights that the huge freight and logistics operations carried out in China directly fuel the demand for advanced medium-duty trucks.

India is witnessing high mining operations with an estimated 1319 carried out in FY 2022, 545 for metallic mineral mining and 775 for non-metallic minerals respectively. The rising mining activities are fuelling the need for modern high-performance, medium-duty materials for material transportation. Thus, the expanding mining activities are expected to offer lucrative opportunities for modern medium-duty truck manufacturers in India.

North America Market Statistics

The North America medium-duty truck market is projected to expand at a healthy CAGR during the projected timeframe. The continuous advancements in truck production and strict regulations on carbon emissions are anticipated to boost the adoption of modern medium-duty trucks in the region. The end use industries such as construction, freight, and logistics are highly advanced and open to employing the latest technologies, which is contributing to the increasing sales of modern medium-duty trucks for transportation purposes.

In the U.S., strict environmental regulations are the prime factors augmenting the sales of electric medium-duty truck market. For instance, in March 2024, the U.S. Environmental Protection Agency announced a new set of national pollution standards for passenger vehicles, light-duty trucks, and medium-duty trucks for model years 2027 through 2032 and beyond. These new set of standards are anticipated to mitigate over 7 billion tons of carbon emissions in the coming years. Thus, to comply with these regulations the manufacturers are more focused on the production of sustainable medium-duty trucks, and end use organizations are also adopting EV medium-duty trucks to align with sustainability trends.

The swiftly expanding e-commerce sector in Canada is pushing the demand for advanced and reliable delivery vehicles such as modern medium-duty trucks. The logistics companies in the country are highly advanced and invest more in innovative delivery solutions such as medium-duty trucks with telematics and advanced driver-assistance systems. Furthermore, the country’s zero-emission initiative is driving the electrification trend in the medium-duty truck market. Road transportation is a major contributor to the air population growth and to mitigate this government is implementing strict clean transportation regulations, further fuelling the sales of EV medium-duty vehicles.

Key Medium-duty Truck Market Players:

- Battle Motors

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mack Trucks, Inc.

- Ashok Leyland Limited

- BharatBenz

- Eicher Motors Limited

- Ford Motor Company

- General Motors Company

- Daimler Truck North America LLC

- Mercedes-Benz Group AG

- PACCAR Inc.

- Tata Motors Limited

- Traton Group

- Scania AB

- Navistar International Corporation

- Volvo Group

- Iveco S.p.A.

- Kenworth Truck Company

- Peterbilt Motors Company

- Dongfeng Motor Corporation

- Western Star Trucks

Key players in the medium-duty truck market are employing several organic and inorganic strategies such as technological advancements, strategic collaborations and partnerships, mergers and acquisitions, and regional expansions to earn high profits. The industry giants are collaborating with other players and tech firms to develop medium-duty trucks with advanced features such as telematics, GPS, and advanced driver-assistance systems.

To grab sustainability trend opportunities, the leading companies are focusing on introducing EV medium-duty trucks. The strict environmental regulations across the world are necessitating end use organizations to adopt sustainable vehicles including EV medium-duty trucks, boosting the profit shares of medium-duty truck market players. Furthermore, they are entering into regional expansion strategies to tap new revenue streams.

Some of the key players medium-duty truck market include:

Recent Developments

- In September 2024, Battle Motors revealed the launch of the Striker Non-CDL Class 6 Truck with high durability, comfort, and safety. With this launch, the company is set to stand out in the medium-duty truck market.

- In August 2024, Mack Trucks, Inc. announced the launch Mack MD series of diesel and electric medium-duty trucks. The company’s move represents the alignment towards sustainability trends and to meet the evolving consumer demands.

- In May 2023, Freightliner Trucks a division of Daimler Truck North America LLC, announced the launch of eM2 series production of battery electric tricks for medium-duty applications. Through this launch, the company is expanding its EV portfolio and contributing to the Net-Zero emission goal.

- Report ID: 6653

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medium-duty Truck Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.