Medical Rehabilitation Services Market Outlook:

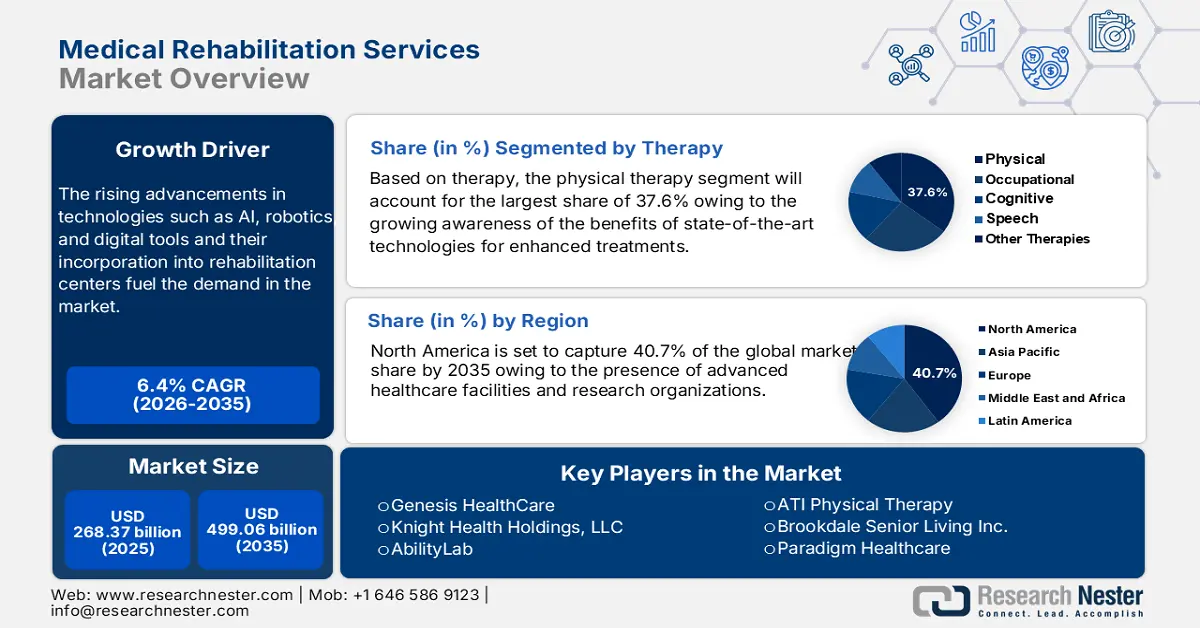

Medical Rehabilitation Services Market size was valued at USD 268.37 billion in 2025 and is expected to reach USD 499.06 billion by 2035, registering around 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical rehabilitation services is evaluated at USD 283.83 billion.

Medical rehabilitation services have significantly increased over the years with several factors driving its growth, including increasingly prevalent chronic diseases, such as stroke, heart disease, and musculoskeletal disorders. These require long-term rehabilitation to regain functionality, particularly among the rising geriatric population. Technological advancements such as robots, artificial intelligence, and wearable devices have also delivered reliable outputs in rehabilitation services enhancing effectiveness.

Furthermore, the availability of telerehabilitation services has facilitated remote patient treatment. In July 2023, WHO stated that rehabilitation services benefit over 2.4 billion people worldwide, accounting for nearly one-third of the total population. Thus, in support, WHO launched the Rehabilitation 2030 Initiative. Owing to such awareness among the masses and the increasing significance of early and sufficient rehabilitation, medical rehabilitation services are being enhanced and improvised globally. In March 2024, Trilife announced the expansion of its services by introducing a Nuero Rehabilitation and Sports Medical Center with 40 beds and an area covering 60,000 sq. ft., with all amenities equipped with advanced technologies to deliver outpatient care facilities.

Key Medical Rehabilitation Services Market Insights Summary:

Regional Highlights:

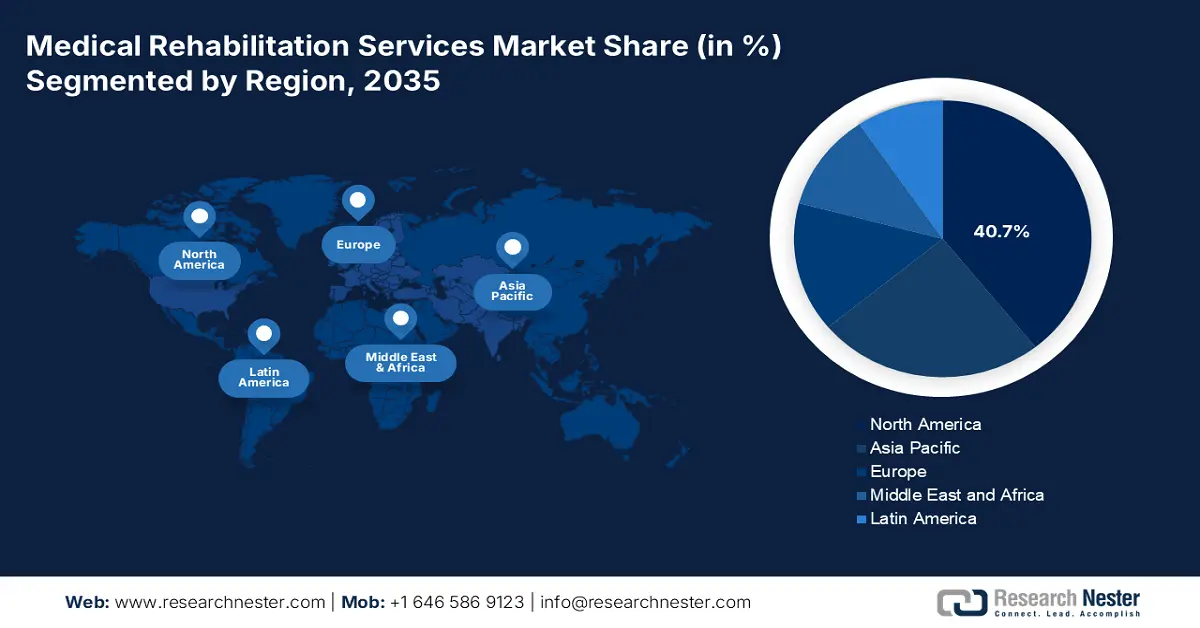

- North America leads the Medical Rehabilitation Services Market with a 40.70% share, propelled by a robust economy, technological infrastructure, and high investments, ensuring strong growth potential through 2035.

Segment Insights:

- Physical Therapy segment is forecasted to achieve substantial growth by 2035, driven by rising awareness, demand for preventive care, and advanced therapy technologies.

- The Outpatient segment is expected to dominate from 2026-2035, propelled by low-cost, convenient care preferences and telehealth enhancements.

Key Growth Trends:

- Innovation in rehabilitation technologies

- Rising awareness of rehabilitation benefits

Major Challenges:

- High upfront costs

- Shortage of skilled professionals

- Key Players: Genesis HealthCare, Icahn School of Medicine at Mount Sinai, Knight Health Holdings, LLC, Lifespan Physical Therapy Services, nMotion Physical Therapy.

Global Medical Rehabilitation Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 268.37 billion

- 2026 Market Size: USD 283.83 billion

- Projected Market Size: USD 499.06 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Medical Rehabilitation Services Market Growth Drivers and Challenges:

Growth Drivers

-

Innovation in rehabilitation technologies: Rehabilitation technologies are constantly being innovated. Digital tools, robotics, and AI have further boosted advancements in rehabilitation processes at a faster pace. New rehabilitation processes with exoskeletons, virtual reality applications for physical therapy, and AI-powered prosthetics transform the course of treatment toward personalized, efficient, and effective plans of action. Factors fueling growth in this field include the aging of the global population, growing rates of chronic disease, including stroke and musculoskeletal disorders, and greater attention toward higher quality-of-life outcomes following injury or surgery. Increasing development in sensor technology, wearable devices, and platforms for telehealth services further enhances rehabilitation service delivery access and also boosts demand. For instance, in May 2020, Suvitas launched virtual rehab services that include webinars, group therapy, and one-on-one private consultations.

-

Rising awareness of rehabilitation benefits: The rising awareness of the benefits of rehabilitation drives growth in medical rehabilitation services. Rising recognition of rehabilitation in enhancing recovery, and managing chronic conditions, has led to their increased acceptance as a component of health care. Both the patients and doctors are aware of the capabilities rehabilitation holds in revitalizing functions after surgery, trauma, or illness for fast recovery. Moreover, public health initiatives to educate people about the effective management of disability along with experiences of success have also played a role in increased awareness. This has turned more people toward rehabilitative care as part of their treatment plan. As per an article published by the National Library of Medicine, in September 2022, general medical insurance in Japan also covers acute and post-acute (or recovery) intensive rehabilitation. The increasing awareness and insurance facilities are, thus, bringing rehabilitation to the center of long-term care, and the medical rehabilitation services market is growing.

- Increasing cases of chronic disease: The incidences of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders are growing worldwide. These are resultant factors of aging populations, sedentary lifestyles, inappropriate diets, and rising obesity rates. Other contributing factors for increasing chronic disease cases include urbanization and hypertension. Better health care and improved diagnostics approaches help in detecting chronic diseases at an earlier stage, hence raising reported cases. This trend is projected to hugely burden the healthcare sector with a need for long-term management solutions, preventive care strategies, and innovation in chronic disease treatment and monitoring.

Challenges

-

High upfront costs: Initial high costs of services in medical rehabilitation owe much to equipment, current technology, and the investment in human capital in the form of hiring highly trained healthcare professionals. Toward this end, facilities have to purchase the latest devices, which include robotic-assisted therapy machines, highly advanced diagnostic equipment, and electronic health records systems, all of which involve huge capital expenditure. Secondly, the cost of hiring and retaining experienced rehabilitation experts including physical and occupational therapists adds more to the financial burden. Despite such challenges, multiple growth drivers help fuel the expansion of the sector. Advances in telerehabilitation and personalized care are opening up new opportunities for cost-effective, accessible services that pay off with initial capital expenses over time.

-

Shortage of skilled professionals: The shortage of skilled professionals in medical rehabilitation services raises a critical concern related to the quality and accessibility of care. Such a gap is driven primarily by a lack of job-force renewal among aging professionals to keep pace with growth in demand. With the continued increase in the incidence of chronic conditions, demand for rehabilitation is increasing, however, most facilities continue to have major problems with attracting and retaining qualified therapists and nurses as well as necessary support staff. Staffing shortages lead to increased workload for staff members with attendant detriments to patient safety and outcomes. A lack of available professionals would also result in an increase in wait time for patients, thus reducing access to prompt rehabilitation services and eventually the recovery process.

- Roadblocks in the integration of technology: The biggest challenge of implementing technology into medical rehabilitation is that the opportunity for many modern tools, including telerehabilitation platforms and wearable devices or electronic health records, is difficult to utilize for various facilities as they require long training periods, cost-intensive investments in infrastructure, and proper organization of new technologies in established workflows. Also, not all rehabilitation professionals have the competency to use modern technologies, meaning that there will always be inconsistencies in the care provided to patients. Moreover, many growth drivers are pushing for the integration of technology in rehabilitation, of which the demand for remote care solutions has now been seriously exacerbated by COVID-19 thus hindering the growth in the medical rehabilitation services market.

Medical Rehabilitation Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 268.37 billion |

|

Forecast Year Market Size (2035) |

USD 499.06 billion |

|

Regional Scope |

|

Medical Rehabilitation Services Market Segmentation:

Therapy (Physical, Occupational, Cognitive, Speech)

Physical therapy segment is anticipated to account for more than 37.6% medical rehabilitation services market share by the end of 2035. This is primarily attributed to the rising awareness about the advantages of physical therapies amongst the population. In addition, improved technology, enhanced patient engagement, and accessibility along with an increased emphasis on preventive care and rehabilitation for chronic diseases foster the growth. This results in improving patient outcomes, reducing pain, and facilitating speedy recovery from surgeries and accidents.

Advances in the treatment of modalities, including computer-assisted therapy and customized exercise programs tailored to individual needs, will improve patient outcomes and satisfaction and fuel further demand for physical therapy services. In August 2020, PRN, a privately held company, and MemorialCare, a well-known nonprofit integrated health system entered into a joint venture partnership to operate 17 full-service physical therapy centers that are community-based to render a vast range of services, including sports medicine, occupational therapy, and physical therapy.

Service Type (Outpatient, Inpatient)

The outpatient segment is expected to dominate the medical rehabilitation services market. which include the growing preference for low-cost and convenient care and enhancements in telehealth technologies. Increasing emphasis on preventive and post-acute care also contributes to this growth. Tele-rehabilitation has also grown over the past years making a tremendous stride since the pandemic, as patients are generally in favor of virtual consultations and rehabilitation sessions that can fill out their time allocations free of travel costs.

In addition, joint ventures between technology companies and rehabilitation service operators are arising, bringing several new and innovative digital platforms and applications. These services are aimed at enhancing engagement and adherence to therapy regimens and bid to integrate services into a cohesive package that saves the patient's time. Furthermore, this model has gained popularity owing to the shorter treatment times, rising demand for occupational therapies, and availability of specialized outpatient centers.

End Use (Hospitals, Homecare Settings, Rehabilitation Center)

The hospital segment is poised to dominate the medical rehabilitation services market owing to the prevalent demand for specialized care for post-acute and chronic diseases. Also, hospitals are well-equipped with interdisciplinary teams and cutting-edge technologies that enable them to provide enhanced and efficient rehabilitation treatments. Furthermore, compared to independent rehabilitation facilities or home-based care, hospitals have better infrastructure such as advanced diagnostic facilities, skilled nursing staff, and their capacity to manage complex situations and a higher level of trust.

The growth and development of rehabilitation services in hospital settings are also motivated by the need to achieve quantifiable outcomes, such as increased mobility and functional independence thus fostering the hospital segment growth. For instance, patient satisfaction with hospital services rose from 79.9% in 2018 to 92.6% in 2020, according to national statistics. In May 2024, CARE Hospital expanded its services by introducing the launch of a new Sports Medicine and Rehabilitation Center that is technically advanced in delivering services.

Our in-depth analysis of the global medical rehabilitation services market includes the following segments:

|

Therapy |

|

|

Service Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Rehabilitation Services Market Regional Analysis:

North America Market Statistics

North America industry is anticipated to hold largest revenue share of 40.7% by 2035, primarily due to a robust economy, advanced technological infrastructure, and high investments in developments. Additionally, it hosts a huge, diversified consumption base and rich purchasing power to drive demand for goods and services. An additional incentive to the growth process is the availability of global leadership in corporations, deep financial markets framework, and favorable regulatory environments. Furthermore, the region also focuses on sustainability and digital transformation, hence placing it well for future expansion across multiple industries.

A strong healthcare infrastructure in Canada, combined with government grants and incentives towards public healthcare services, enhances the growth of rehabilitation services. Overall, increased consciousness about the role of rehabilitation in recovery and long-term management of health increases the growth of the industry. For instance, in June 2023, the Government of Canada and UNDP collaborated to guarantee that public health and recovery centers are appropriately planned and established under the National Strategy for creating Ukraine as a barrier-free environment.

In the U.S. advancements in medical technology such as telemedicine, artificial intelligence, and robots, are continuously enhancing the efficacy and accessibility of rehabilitation services. Investment in rehabilitation for better patient outcomes and fewer readmissions to hospitals is rising, driven by increased emphasis on value-based care and post-acute treatment in the healthcare system. For instance, to help people with physical or mental disabilities find work and lead more independent lives, the Rehabilitation Services Administration (RSA) is in charge of grant programs.

Asia Pacific Market Analysis

The Asia Pacific medical rehabilitation services market has been expanding significantly for several due to governments and healthcare organizations promoting investments in new technology in fields such as robotic-assisted therapy and telerehabilitation, thus increasing the efficacy and accessibility of rehabilitation programs. Moreover, big data analytics and artificial intelligence have also been incorporated into rehabilitation services, enabling the creation of individualized treatment regimens that improve patient outcomes. Furthermore, the easy availability of services due to the growth of community-based rehabilitation programs and outpatient rehabilitation centers is fueling the growth.

China's aging population is projected to become a key contributor to growth since the government aims to focus on enhancing rehabilitation centers owing to the increased incidence of age-related conditions. Moreover, investments made in the healthcare infrastructure and innovation aspects of China also contribute towards accessibility to services. The local government is significantly pushing for healthcare reforms, including the expansion of community-based healthcare services, significantly contributing to the overall medical rehabilitation services market growth in the country.

The emergence of telemedicine and private sector investment in India has contributed to the country's push towards modernizing healthcare, further expanding its market growth. Such commitment to better availability and quality of services remains one of the reinforcing factors for medical rehabilitation services in Asia Pacific. For instance, in January 2023, it was announced that rehabilitation services and technologies will witness a significant boom in India by 2028 achieving a medical rehabilitation services market value of USD 35 billion.

Key Medical Rehabilitation Services Market Players:

- AbilityLab

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Athletico Physical Therapy

- ATI Physical Therapy

- Brookdale Senior Living Inc.

- Genesis HealthCare

- Icahn School of Medicine at Mount Sinai

- Knight Health Holdings, LLC

- Lifespan Physical Therapy Services

- nMotion Physical Therapy

- Paradigm Healthcare

- Select Medical Holdings Corporation

- SuVitas

- The University of Chicago Medical Center

- U.S. Physical Therapy, Inc.

- Vibra Healthcare, LLC.

Companies in the medical rehabilitation services market are becoming active in their strategic initiatives to increase their profit pool and seize the increasing demand for rehabilitation care. Firms are expanding capabilities in the integration of technologies, advancement of rehabilitation equipment, and better analytics to deliver improved patient outcomes and easier delivery of services. Many collaborations and partnerships are seen to be emerging with healthcare providers and various research institutions towards the development of evidence-based rehabilitation programs.

Companies are also developing their service portfolios to encompass whole-person care, which includes factors of both physical and mental health. This proactive approach, besides placing them strongly in the market, allows them to play a larger role in improving the caliber of rehabilitation services offered to patients. For instance, in August 2024, Quadria Capital announced to deployment of an estimation of around USD 1 billion towards the Indian healthcare system seeking stakes in improving rehabilitation centers and clinics. Some prominent players in the market are:

Recent Developments

- In May 2024, Loma Linda University Health and Lifepoint Rehabilitation announced their joint venture partnership to establish a new inpatient rehabilitation facility in Loma Linda.

- In November 2023, Syrebo's first move to expand its product line beyond hand rehabilitation was the Upper Limb Rehabilitation Robot SY-UEA2, introduced at MEDICA. With its fully functional mobile chassis and precise optical positioning technology, SY-UEA2 offers users a range of target-oriented training options to help them retrain their upper limb functionality.

- Report ID: 6529

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.