Medical Power Supplies Market Outlook:

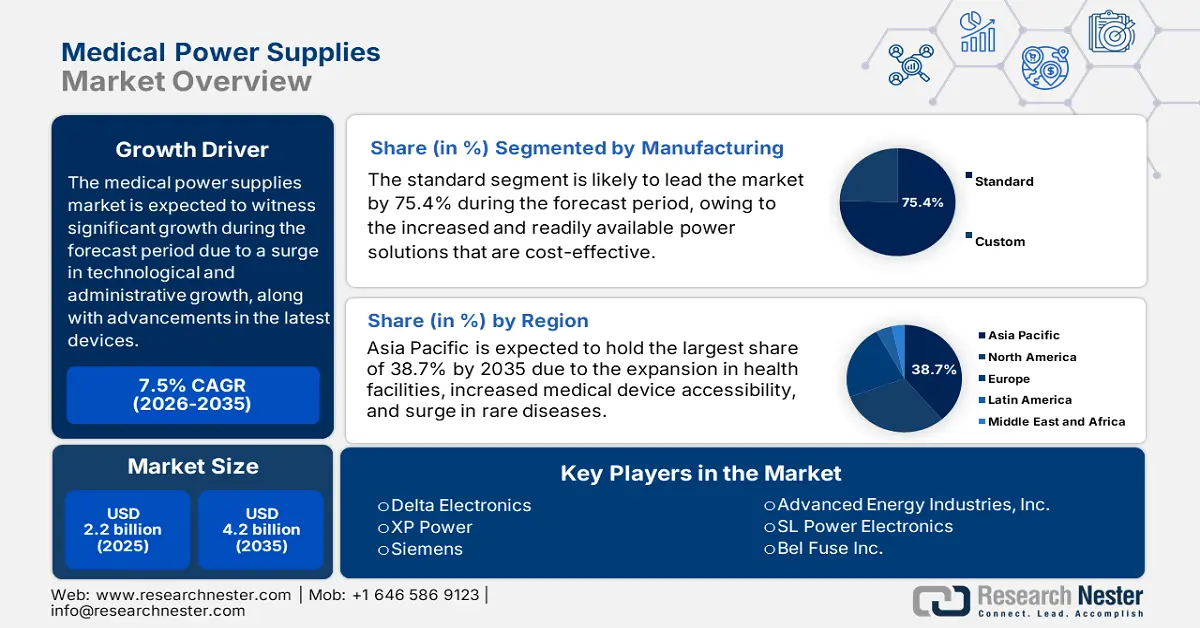

Medical Power Supplies Market size was valued at USD 2.2 billion in 2025 and is expected to reach USD 4.2 billion by the end of 2035, increasing at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of medical power supplies is estimated at USD 2.3 billion.

The international market is witnessing strong growth, attributed to a combination of regulatory, demographic, and technological tailwinds that are not only extending but also gradually reshaping. Aspects of device innovation, technological progression, sudden shifts in demographics, and modifications in the healthcare paradigm are certain factors that are positively impacting the overall market. According to an article published by the World Health Organization (WHO) in 2025, there are more than 2 million numerous kinds of medical devices across different nations, which are readily categorized into over 7,000 generic device groups, which caters to aiding several diseases.

Moreover, the presence of safety standards, strict administrative policies, along with expansion in healthcare infrastructure and regional development, are also driving the medical power supplies industry globally. For instance, as per the 2023 National Medical Devices Policy, the medical device industry in India is striving to escalate the growth path with a patient-centric strategy to cater to the healthcare demand of patients by creating an advanced and internationally competitive sector. In addition, the purpose of this policy is to make the market emerge as one of the leaders in the progression and innovation of medical devices by gaining 10% to 12% share in the expanded global market for the upcoming 25 years, thus suitable for the market’s growth.

Key Medical Power Supplies Market Insights Summary:

Regional Insights:

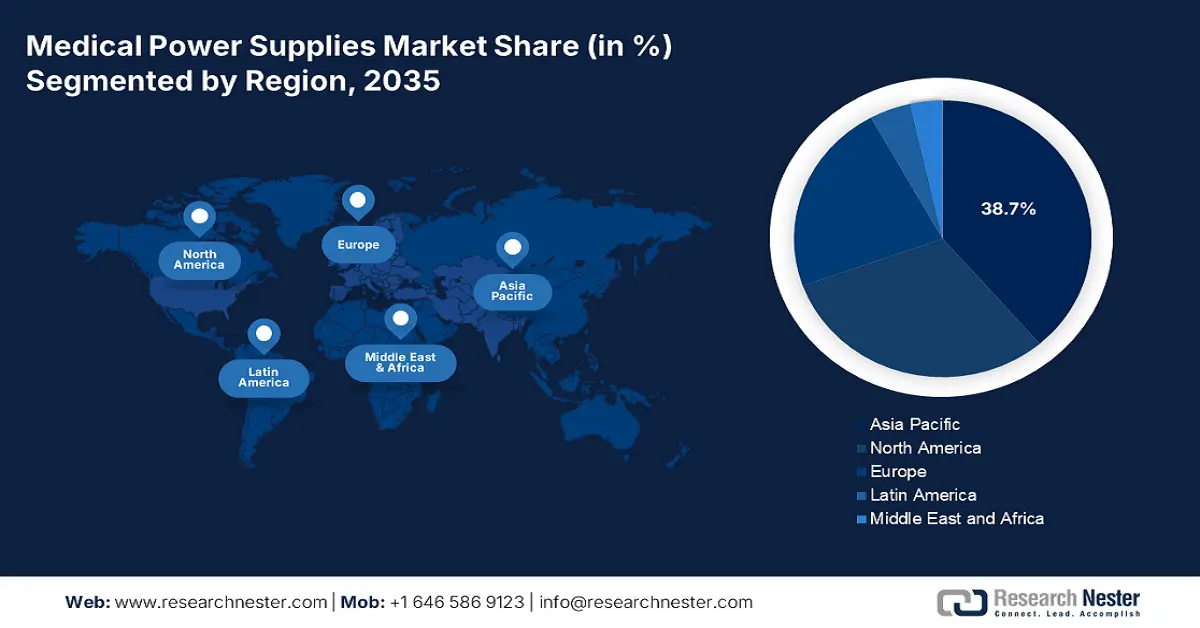

- Asia Pacific in the Medical Power Supplies Market is projected to secure the highest share of 38.7% by 2035, propelled by the expansion of healthcare infrastructure, medical tourism centers, and the rising prevalence of chronic disorders.

- Europe is anticipated to emerge as the fastest-growing region by 2035, supported by stringent regulatory frameworks, cohesive funding, and initiatives under the EU4Health Programme.

Segment Insights:

- The standard segment in the Medical Power Supplies Market is forecasted to dominate with a 75.4% share by 2035, driven by the demand for cost-effective, compliant, and reliable power solutions used across diverse medical devices.

- The embedded segment is projected to hold the second-largest share by 2035, owing to technological advancements addressing elderly care and chronic disease management.

Key Growth Trends:

- Robotic systems and minimally invasive surgical (MIS) proliferation

- Increase in the demand for cybersecurity

Major Challenges:

- Cost containment reforms and government-based pricing pressures

- Payer scrutiny and reimbursement hurdles

Key Players: Delta Electronics (Taiwan), XP Power (Singapore), Siemens (Germany), Advanced Energy Industries, Inc. (U.S.), SL Power Electronics (U.S.), Bel Fuse Inc. (U.S.), FRIWO Gerätebau GmbH (Germany), Astrodyne TDI (U.S.), CUI Inc. (U.S.), Traco Power (Switzerland), Mean Well (Taiwan), Vicor Corporation (U.S.), Ericsson Power Modules (Sweden), Delta Electronics (Taiwan), XP Power (Singapore).

Global Medical Power Supplies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: South Korea, Brazil, Singapore, Mexico, Indonesia

Last updated on : 25 September, 2025

Medical Power Supplies Market - Growth Drivers and Challenges

Growth Drivers

- Robotic systems and minimally invasive surgical (MIS) proliferation: The aspect of robotic systems enhancing MIS by offering surgeons effective control, precision, and improved visualization through small incisions is readily driving the medical power supplies market globally. According to an article published by NLM in June 2025, AI-powered robotic surgeries reduce operative duration by 25%, along with a diminish in intraoperative complications by 30%. Besides, the January 2025 NLM article stated that for robotic-assisted surgery (RAS), there has been an increase in the MIS rate from 56.1% to 57.0%, while it increased from 60.5% to 65.8% for RAS utilized in hospitals, thereby suitable for the overall market’s exposure.

- Increase in the demand for cybersecurity: This is essential to offer protection to sensitive patient data from harmful breaches and ensure the availability and integrity of medical records, thereby suitable for uplifting the medical power supplies sector internationally. In this regard, the December 2023 report indicated that 53% of connected medical devices, along with other internet of things devices, especially in hospitals, experience critical vulnerabilities. Besides, an estimated 1/3rd of healthcare-based Internet of Things (IoT) devices identified severe risks, which potentially impacted device function and operations, thus increasing the demand for cybersecurity for medical devices.

- Surge in artificial intelligence: AI is increasingly essential in healthcare for optimizing treatment and diagnostics, as well as enabling personalized medicines, streamlining administrative tasks, and escalating drug discovery. Based on this, the August 2022 NLM article published a clinical study that was conducted on 789 respondents through a survey. The study demonstrated that 65% of them were highly aware of AI applications in clinical trials, 10% to 30% already utilized AI, and 74.2% lacked the knowledge, thus denoting the necessity of creating awareness to uplift the market globally.

2025 Incidence Rate of Infectious Disease Driving the Market

|

Outbreak Name |

Reported |

Cases |

Deaths |

CFR (%) |

|

Respiratory Infections |

|

|||

|

Influenza |

771 |

3,285,450 |

577,523 |

17.5 |

|

MERS-CoV |

305 |

6,418 |

1,793 |

27.9 |

|

Vector-Borne Infections |

|

|||

|

Yellow Fever |

164 |

779,323 |

3,434 |

0.4 |

|

Dengue |

73 |

12,977,361 |

12,327 |

0.1 |

|

Waterborne or Foodborne Infections |

|

|||

|

Cholera |

289 |

4,904,288 |

149,988 |

3.0 |

|

Poliovirus |

112 |

5,569 |

91 |

1.6 |

|

Direct Contact Infections |

|

|||

|

Ebola |

342 |

226,701 |

142,813 |

63.0 |

|

Lassa Fever |

44 |

8,934 |

1,617 |

18.1 |

|

Other Infection Outbreaks |

|

|||

|

Meningitis |

178 |

609,772 |

60,299 |

9.8 |

|

Haemorrhagic fever |

68 |

8,095 |

5,151 |

63.6 |

Source: NLM, May 2025

Air Pumps 2023 Export and Import Data

|

Countries/Components |

Export |

Import |

|

China |

USD 23 billion |

USD 5.2 billion |

|

Germany |

USD 10.5 billion |

USD 5.9 billion |

|

U.S. |

USD 7.7 billion |

USD 14.7 billion |

|

World Trade |

USD 89.4 billion |

|

|

World Trade Share |

0.4% |

|

|

Product Complexity |

1.1 |

|

|

Export Growth |

1.1% |

|

Source: OEC, August 2025

Challenges

- Cost containment reforms and government-based pricing pressures: The presence of national healthcare systems, especially in Europe, has leveraged their purchase power through federal tender processes that vigorously prioritized the low expense. Besides, agencies, such as Germany’s GBA, readily evaluated the clinical advantage of the latest technologies, and if demonstrated suitable patient outcomes, then it is subject to intensified price competition, thus causing a hindrance in the medical power supplies market growth internationally. This has further created a paradox, wherein manufacturers are actively investing in increased efficacy to recoup R&D.

- Payer scrutiny and reimbursement hurdles: The reimbursement landscape in the market is a severe and indirect roadblock. Players, such as the U.S. Centers for Medicare & Medicaid Services (CMS) reimburse, especially for complete medical procedures or devices. Therefore, the manufacturer’s success is overall reliant on the medical device OEM’s capability to achieve suitable reimbursement for the final product. Besides, the payer’s focus on affordability for the entire treatment pathway caters to component advancement, which is frequently undervalued by developing huge disincentives for OEMs to implement.

Medical Power Supplies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Medical Power Supplies Market Segmentation:

Manufacturing Segment Analysis

Based on manufacturing, the standard segment in the medical power supplies market is anticipated to garner the largest share of 75.4% by the end of 2035. The segment’s growth is highly attributed to high-volume demand for readily available, cost-effective, and reliable power solutions, which are utilized in a wide array of required medical devices, including patient monitors and diagnostic imaging systems. Additionally, the segment’s dominance is readily underpinned by economies of scale, which permit manufacturers to provide compliance and competitive pricing with universal safety regulations, such as IEC 60601-1, guaranteeing comprehensive applicability.

Architecture Segment Analysis

Based on the architecture, the embedded segment in the medical power supplies market is expected to cater to the second-largest share during the projected timeline. The segment’s exposure is highly fueled by the aspect of innovation in technologies to provide sufficient care, particularly to the elderly population and patients extremely suffering from diseases. In this regard, the December 2022 NLM article stated that the WHO has estimated the global population more than 60 years of age will increase from 12% to 22% by the end of 2050. Owing to this surge, health and medical-based technological developments are readily oriented towards patient monitoring in both hospital and home environments, which are of special relevance.

Technology Segment Analysis

Based on technology, the AC-DC power supplies segment in the medical power supplies market is projected to gather the third-largest amount by the end of the forecast period. The segment’s development is highly driven by patients’ dependence on electric gadgets and appliances and investment provision in the renewable sector, which are in turn suitable for adoption in health and medical services. As per a report published by Energy Reports in November 2022, the median AC-DC converter efficiency for LEDs is 92.2% and 88.8%, which readily contributes towards the segment’s development. Besides, the DC-AC inverter market is continuously growing due to rapid urbanization and renewable energy source adoption, which is suitable for medical power supplies.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Manufacturing |

|

|

Architecture |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Power Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Power Supplies Market - Regional Analysis

APAC Market Insights

Asia Pacific in the medical power supplies market is anticipated to garner the highest share of 38.7% by the end of 2035. The market’s exposure in the region is highly attributed to an expansion in health and medical infrastructure, a rise in the middle class, increased healthcare accessibility, the presence of medical tourism centers, and an upsurge in chronic disorders. For instance, as per an article published by JAMDA in 2023, 81.1% of adults in China have at least 1 common chronic disorder, which represents 179.9 million people. Besides, 37.1% of the population from Northeast China and 14.8% from South China demonstrated an increase in cardiovascular disorders, thus creating a huge opportunity for the market’s upliftment.

The market in China is gaining increased traction, owing to government-based self-sufficiency in technologies, an increase in medical device purchases, centralized procurement, a surge in the aging population, and the dominance of large-scale regional OEMs. Besides, ongoing innovation in medical products, particularly in the oncology field, is boosting the market’s growth in the country. In this regard, as per the July 2023 NLM article, the median clinical trial expenses for an advanced drug are USD 33.4 million, while tan approximate duration for the average drug development cycle is almost 13.5 years and 8 years for conducting clinical trials. Therefore, this creates an optimistic outlook for the overall market, bolstering its exposure and demand in the country.

The medical power supplies market in India is developing due to government-specific public health strategies, the presence of the production-linked incentive (PLI) scheme, extreme fragmentation in the market, and innovation in medical expenses. According to the July 2025 Observer Research Foundation article, the medical device industry in the country is expected to develop and grow from USD 11 billion to USD 50 billion by the end of 2030. Besides, the government has introduced the Draft New Drugs, Medical Devices, and Cosmetics Bill 2022, along with the National Medical Devices Policy 2023 to cater to medical system barriers and generate an investor-friendly scenario, thereby suitable for the market’s growth in the country.

X-Ray Machines 2023 Export and Import

|

Countries |

Export |

Import |

|

China |

USD 172,000 |

USD 49.1 million |

|

Japan |

USD 115,000 |

USD 20.1 million |

|

Indonesia |

USD 330,000 |

USD 60,000 |

|

Malaysia |

USD 37,400 |

USD 90,500 |

|

Singapore |

USD 22,200 |

- |

|

Indonesia |

- |

USD 60,000 |

|

South Korea |

- |

USD 565,000 |

Source: OEC, August 2025

Europe Market Insights

Europe in the medical power supplies market is predicted to be the fastest-growing region during the forecast timeline. The market’s exposure in the region is highly fueled by the existence of strict regulatory frameworks, the EU4Health Programme, cohesive funding, pressure from the circular economy, green deal, and a surge in prices from National Tendering Systems. As per the 2025 EIB article, an estimated €1.9 billion has been generously allocated in financing for life sciences and health as of 2024, with over 7 million people in the region gaining access to enhanced healthcare and medical services. Besides, the aspect of international partnership is necessary to initiate health progress and gain the UN sustainable development, thus boosting the market in the overall region.

The medical power supplies market in Germany is gaining increased exposure, owing to manufacturing dominance and centers, early implementation of advanced technology, the presence of a robust reimbursement system for progression, and the existence of a centralized decision-making system. As stated in the May 2025 Deutschland article, almost 3 quarters of 30 drugs with the latest active ingredients have been placed in the country in 2023, while almost 400 biotechnological drugs, with more than 350 active ingredients that have also been approved. This has positively impacted bioreactors, filtration equipment, and chromatography systems that cater to the overall market.

The medical power supplies market in the UK is also growing due to the presence of the single-payer system, comprising a centralized purchasing facility, the existence of the post-Brexit regulatory autonomy, a tactical focus on research and development and life sciences, and a strong academic-industrial complex. As per the November 2023 ITA data report, the medical technological industry in the country has generated a yearly turnover of almost USD 33 billion. In addition, the public funded National Health Services (NHS) readily accounts for an estimated 86% of the country’s health and medical provision, thus suitable for the market’s upliftment.

North America Market Insights

North America in the medical power supplies market is expected to account for a considerable share by the end of the forecast duration. The market’s growth in the region is highly driven by the presence of strict regulatory policies, an increase in healthcare expenditure, advanced health facilities, the robust presence of notable players, and aging demographics. According to a data report published by AMA in April 2025, healthcare spending in the U.S. enhanced by 7.5% as of 2023, amounting to USD 4.9 trillion. This growth denotes a significant rise in comparison to 4.6% previously in 2022. In addition, the healthcare gross domestic product (GDP) was 17.6%, thereby proliferating the market in the overall region.

The market in the U.S. is significantly growing, owing to the country’s dominance in the region, presence of reimbursement policies, including Medicaid and Medicare, venture capital funding, private sector investment, federal and defense procurement, and litigation environment. Besides, the Data and Systems Group (DSG) in the Center for Medicaid and CHIP Services (CMCS) generously offers guidance, technical assistance, funding, and oversight to reimbursement agencies. As per the 2025 Medicaid government article, the federal share for operations and development of the States’ system accounts for USD 5 billion every year, thus uplifting the market in the country.

The medical power supplies market in Canada is also growing due to the existence of decentralized healthcare systems, increased emphasis on cost-effectiveness, rural healthcare facilities, focus on robust public health research, government funding, and a small-scale regional market. According to an article published by ITA in November 2023, the medical device market was approximately USD 6.8 billion, which is projected to surge by 5.4% by the end of 2028. Besides, the overall health and medical spending in the country has been estimated to be CAD 331 billion within the same year, which is positively impacting the overall market in the country.

2023 Healthcare Spending in North America

|

Components (current price and PPP adjusted) |

U.S. (USD) |

Canada (USD) |

|

GDP Per Capita |

82,697 |

64,440 |

|

Health Expenditures Per Capita |

13,432 |

7,013 |

|

Current Expenditure |

12,742 (2022) |

6,845 (2022) |

|

Health Expenditure as GDP % |

16.7% |

11.2% |

|

Cumulative % Change in annual GDP and Health Expenditures Per Capita |

43.6% |

51.0% |

|

Average Annual Growth Rate in Health Expenditures Per Capita |

4.1% |

6.7% |

Source: Health System Tracker, April 2025

Key Medical Power Supplies Market Players:

- Delta Electronics (Taiwan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- XP Power (Singapore)

- Siemens (Germany)

- Advanced Energy Industries, Inc. (U.S.)

- SL Power Electronics (U.S.)

- Bel Fuse Inc. (U.S.)

- FRIWO Gerätebau GmbH (Germany)

- Astrodyne TDI (U.S.)

- CUI Inc. (U.S.)

- Traco Power (Switzerland)

- Mean Well (Taiwan)

- Vicor Corporation (U.S.)

- Ericsson Power Modules (Sweden)

- Delta Electronics (Taiwan)

- XP Power (Singapore)

The international market is discreetly consolidated and characterized by strong competition between large-scale electronic organizations and specialized niche players. Besides, notable tactical approaches, including robust focus on R&D for higher efficiency and miniaturization, frequently utilize Wide Bandgap semiconductors, such as SiC and GaN. Meanwhile, organizations are intensely integrating partnerships and tactical acquisitions to extend their geographic reach and product portfolios, particularly in the high-growth Asia Pacific market. Moreover, leading players are initiating investments in value-added and customization services, providing application-specific and pre-certified solutions to diminish their OEM customers’ regulatory burden and time-to-market, thus suitable for the overall market.

Here is a list of key players operating in the global market:

Recent Developments

- In February 2025, Arterex has successfully acquired Adroiy USA Inc. to effectively make expansions in medical manufacturing, machining capabilities, as well as metal fabrication by specializing in fully packaged and assembled medical devices.

- In October 2024, Philips has been one of the driving forces based on which the Health Finance Coalition (HFC) and AfricInvest effectively achieved the final round of financing for the Transform Health Fund (THF) to overcome the gap for small and medium enterprises (SMEs) in Africa’s healthcare industry.

- Report ID: 8122

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Power Supplies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.