Medical Polyoxymethylene Market Outlook:

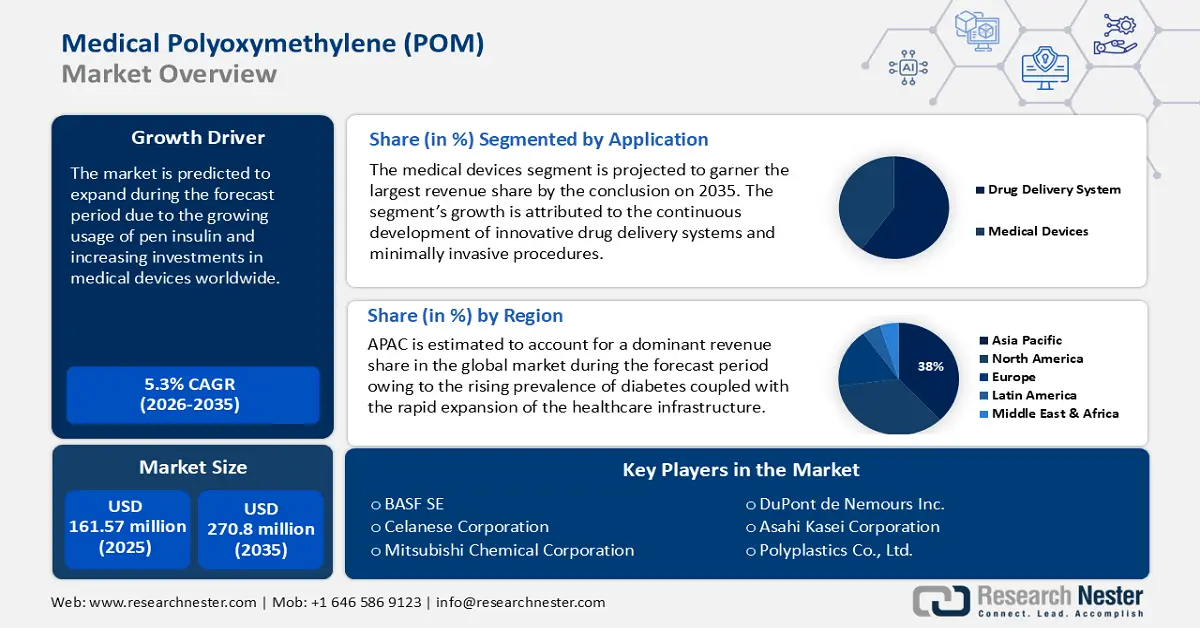

Medical Polyoxymethylene Market size was over USD 161.57 million in 2025 and is projected to reach USD 270.8 million by 2035, growing at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical polyoxymethylene is evaluated at USD 169.28 million.

The growth can be attribute to rise in prevalence of diabetes all around the world. A total of 537 million individuals (20-79 years old) worldwide has diabetes. By 2030, there would be 643 million diabetics worldwide, and by 2045, there would be 783 million, according to the international diabetes federation. Hence owing to this, the demand for insulin pen treatment is expected to increase. For instance, in the United States, there were 27, 860,691 visits for insulin treatment between 2016 and 2020. Treatment visits with insulin pens grew from 36.1% in 2016 to 58.7% in 2020.

Further, there has been growth in medical industry which is also estimated to boost the growth of the market. This growth in medical industry is further booming demand for healthcare and medical devices. Additionally, POM has a significant history in the medical industry, notably as an implantable substance. The use of polyoxymethylene in tissue engineering is made possible by its properties, including excellent dimensional stability and thermal stability that enable steam sterilization. This is anticipated to influence the market potential for the expansion of the global medical polyoxymethylene market. Moreover, POM is an appropriate material for tissue culture since it significantly inhibited hematopoietic stem cells' ability to grow and form colonies, whether it was used as a growth substrate or as a medium-wetted component. Consequently, this is expected to create a huge opportunity for the market for medical polyoxymethylene to expand.