Medical Oxygen Gas Cylinders Market Outlook:

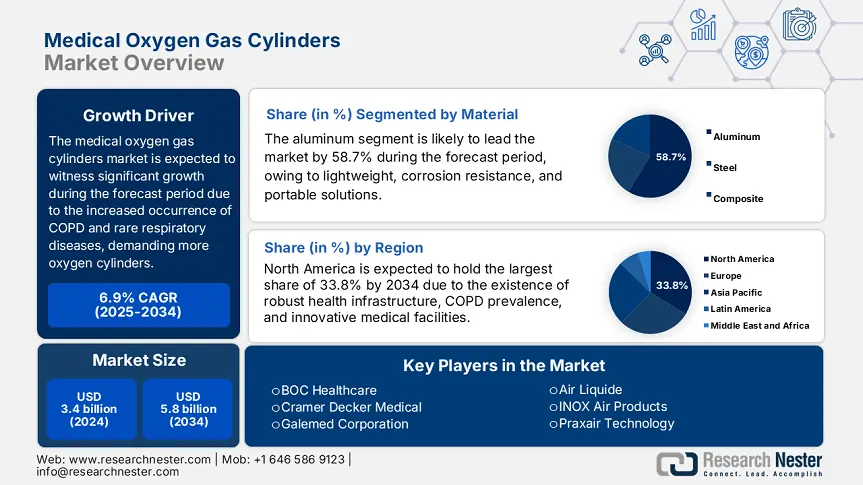

Medical Oxygen Gas Cylinders Market size was valued at USD 3.4 billion in 2024 and is expected to reach USD 5.8 billion by the end of 2034, registering around 6.9% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of medical oxygen gas cylinders is estimated at USD 3.8 billion.

The international medical oxygen cylinders market is positively influenced by an increase in the patient pool that demands respiratory support. As per an article published by the World Health Organization (WHO), chronic respiratory disorders, including asthma and COPD, affect more than 520 million people across nations, with hypoxemia-related conditions fueling the need for medical oxygen. Besides, in developing countries, a limitation in healthcare facilities has exacerbated oxygen shortage, with the WHO estimating that almost 25% of the required medical oxygen is available across these nations. Meanwhile, government-based strategies such as the WHO’s Global Oxygen Alliance have aimed to enhance accessibility in South Asia and Africa, thus suitable for market upliftment.

Furthermore, the worldwide trade in the market depends on a complicated supply chain that involves distribution logistics, precision manufacturing, and raw material sourcing. In this regard, the U.S. International Trade Commission (USITC) has reported that Germany, India, and China are ultimate exporters, while Africa and North America are considered importers. In 2023, the U.S. successfully imported USD 225 million of oxygen cylinders, initially from China. Besides this, the aspect of manufacturing includes high-grade aluminum and steel processing, pressure evaluation, and valve assembly, along with automation to diminish labor expenses by approximately 20%, thus creating a growth opportunity for the market.

Medical Oxygen Gas Cylinders Market - Growth Drivers and Challenges

Growth Drivers

-

Pressure in raw material and supply chain expenses: The market is continuously facing instability, owing to a rise in aluminum and steel expenses. In addition, the U.S.-based producer price index (PPI) has also increased to 4.9% year-over-year (YoY) as of 2024. Besides, export restrictions in China regarding aluminum, accounting for almost 65% of cylinders, have disrupted international supplies. Therefore, to combat these, organizations transitioned to composite materials, which are corrosion-resistant and lighter, thereby uplifting the market exposure globally.

-

Tactical collaborations and organizational progressions: Key players are augmenting artificial intelligence (AI) and Internet of Things (IoT) to improve oxygen delivery, which is positively impacting the medical oxygen gas cylinders. For instance, in 2024, Linde plc entered into a partnership with Teladoc Health to embed sensors into cylinders to diminish oxygen waste by at least 22%. Besides, in 2023, Air Linde’s acquisitions in Asia extended its manufacturing capability by 25% by targeting developing economies. Meanwhile, analytical maintenance algorithms will strive to be a USD 550 million market by the end of 2027 for cylinders, denoting continuous market growth.

Challenges

-

Patient cost-effectiveness in developing markets: The aspect of affordability is the ultimate gap to the medical oxygen gas cylinders market access in emerging economies, wherein almost 68% of rural patients in India are unable to afford cylinder refills despite administrative subsidies. Besides, the yearly expense of oxygen therapy in Brazil has exceeded USD 1,250, which is almost half the average yearly income in the majority of regions. This economic realism has pressurized complex triage decisions, with maximum health systems limiting oxygen to only critical patients. Meanwhile, manufacturers are experiencing dual risks of quality maintenance while lowering expenses to sustainable levels, thus negatively impacting the overall market.

-

Failures in last-mile delivery and logistics: Physical risks of heavy oxygen cylinders distribution have developed huge logistical obstacles, especially in emerging markets, creating a hindrance in the medical oxygen gas cylinders market. For instance, in sub-Saharan Africa, an estimated 35% of cylinders are damaged while transporting, owing to inadequate handling and poor road facilities. Additionally, in developed nations, the last-mile issue exists, wherein rural patients in the U.S. experience an average delay in delivery of almost 7 to 9 days, pertaining to cylinder refills. Therefore, these distribution catastrophes undergo severe consequences for patients with chronic respiratory diseases, thereby lowering the market exposure.

Medical Oxygen Gas Cylinders Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.9% |

|

Base Year Market Size (2024) |

USD 3.4 billion |

|

Forecast Year Market Size (2034) |

USD 5.8 billion |

|

Regional Scope |

|

Medical Oxygen Gas Cylinders Market Segmentation:

Material Segment Analysis

The aluminum segment in the market is projected to garner the largest share of 58.7% by the end of 2034. The segment’s growth is effectively driven by corrosion resistance as well as the existence of its superior strength-to-weight ratio. In addition, an increase in the need for lightweight and transportable oxygen solutions, especially in remote healthcare settings, where the ease of transport is severe. Besides, as per the U.S. FDA report, aluminum-based cylinders readily demonstrate an estimated 38% better durability in comparison to steel alternatives for long-lasting clinical usability, thus suitable for the segment’s upliftment.

Product Type Segment Analysis

The portable cylinders segment in the medical oxygen gas cylinders market is expected to hold the second-largest share of 51.7% by the end of the forecast timeline. The segment’s exposure is effectively driven by a rise in aging populations, along with the COPD prevalence, demanding mobile oxygen solutions, and a sudden transition towards remote respiratory care services. Besides, the WHO reported that there has been a surge in the portable cylinder adoption to 25% during the post-pandemic, since patients have prioritized remote treatment options. Meanwhile, technological progressions such as IoT-powered smart cylinders are also augmenting the segment’s appeal globally.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Oxygen Gas Cylinders Market - Regional Analysis

North America Market Insights

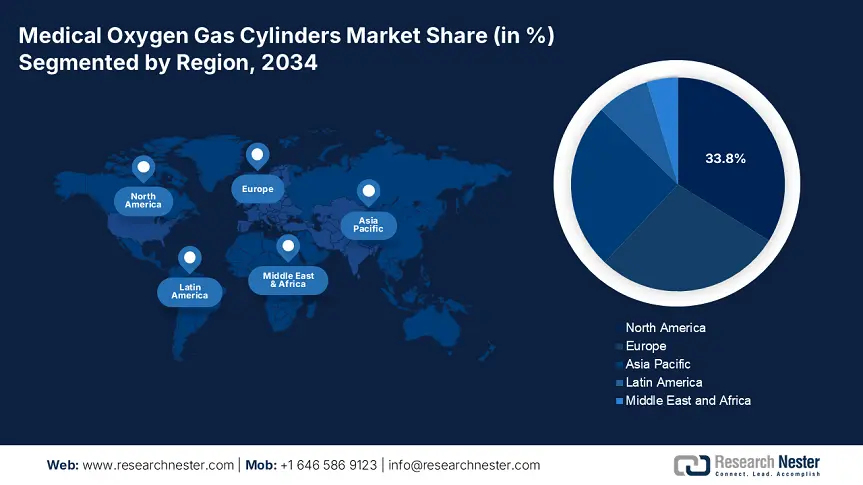

North America in the medical oxygen gas cylinders market is considered the dominating region, with a projected market share of 33.8%, along with a 32.5% growth rate by the end of 2034. The market’s growth in the region is effectively fueled by an upsurge in the COPD incidence, affecting almost 37 million people in the region, the presence of progressive health and medical facilities, and a strong reimbursement system. Besides, the U.S. is accounting for the majority of the region’s market demand, which is backed by Medicare services. Meanwhile, Canada is also contributing to the market’s development with provincial health systems.

U.S. market is significantly growing, with an upsurge in the Medicare spending on oxygen therapy by 25% yearly to reach USD 850 million as of 2024. Besides, portable cylinders in the country have already captured almost 62.5% of sales, which is fueled by the existence of 36 million COPD patients and increased home healthcare services. Meanwhile, IoT-driven smart cylinders are also gaining traction, with approximately USD 125 million investment as of 2023 for home monitoring solutions, thereby suitable for uplifting the overall market in the country.

The medical oxygen gas cylinders market in Canada is gradually gaining increased traction with a 6.8% growth rate, which is driven by the aging population and provincial health and medical investments. Besides, Ontario is deliberately leading with an estimated 28% increase in funding provision as of 2024, which covers 200,150 patients every year. Meanwhile, Health Canada’s USD 3.4 billion budget for respiratory care includes USD 55 million for sustainable cylinder manufacturing. Additionally, portable units cater to almost 60% of sales, with rural locations displaying 32% high adoption rates, thus denoting a positive outlook for the overall market.

Concise Trade and Supply Chain Facilities for the North America Medical Oxygen Cylinders Market (2021-2025)

|

Category |

2021 |

2023 |

2025 |

|

U.S. Aluminum Imports |

45% of total demand |

50% of total demand |

55% of total demand |

|

Canada Steel Production |

120,100 tons/year |

135,200 tons/year (+13%) |

150,500 tons/year (+21%) |

|

Cross-Border Trade |

USD 288 million |

USD 327 million (+14.2%) |

USD 390 million (+19.5%) |

|

Regional Manufacturing Facilities |

20 major plants |

24 major plants (+22.5%) |

27 major plants (+14.5%) |

|

Localization Rate |

U.S.: 60% |

U.S.: 58.5% |

U.S.: 63% |

|

Emergency Stockpiles |

U.S.: 1.3 million units |

U.S.: 1.7 million units (+25.5%) |

U.S.: 1.9 million units (+20.1%) |

APAC Market Insights

Asia Pacific in the medical oxygen gas cylinders market is expected to be the fastest-growing region with a market share of 25.3% and a 7.6% growth rate during the forecast duration. The market’s upliftment in the region is highly attributed to the presence of post-pandemic healthcare policies, a rise in respiratory disorders, and an upsurge in the aging population. China is readily dominating with the National Medical Products Administration (NMPA)-based funding for medical device stimulus as of 2023, along with the market’s 9.5% growth rate in India, which is possible through expansion in administrative coverage, thereby suitable for bolstering the market exposure in the overall region.

The medical oxygen gas cylinders market in China is gradually growing, with an expected revenue share of 47% by the end of the projected timeline. The market’s development is attributed to an increase in the disease prevalence, along with huge investments from the government. Besides, the NMPA has effectively allocated USD 5.2 billion in 2023 to augment respiratory care facilities by targeting 2.2 million COPD patients in the country. In addition, regional manufacturers effectively supply almost 78% of domestic demand through 47 specialized production infrastructures, which are concentrated in Jiangsu and Guangdong provinces.

The market in India is increasing at a growth rate of 9.4%, which is readily driven by an expansion in the Ayushman Bharat service to approximately 550 million beneficiaries. Additionally, the government expenditure has also reached USD 2.2 billion as of 2023 by supporting 2.8 million respiratory patients. Besides, portable cylinders in the country cater to 68% of sales, and at the same time, remote healthcare solution has risen by 35% yearly, particularly during post-COVID. Meanwhile, localized manufacturers such as INOX Air is dominating at least 60% of the market share, which is positively impacting the overall market development in the country.

Europe Market Insights

Europe in the medical oxygen gas cylinders market is expected to account for a considerable share of 28.2% during the forecast period. The market’s exposure in the region is highly attributed to post-pandemic respiratory care investments, along with a rise in aging populations. Germany is deliberately dominating the region based on an increase in healthcare spending since 2024. This is followed by the UK, owing to the aspect of the NHS budget provision for oxygen therapy. Besides, the Europe Health Data Space strategy has effectively committed €2.9 billion to uplift oxygen supply chains, which in turn creates an optimistic outlook for the market in the region.

The medical oxygen gas cylinders market in Germany is gaining increased traction, with an anticipated 40% of the regional revenue by the end of 2034, owing to an increase in the COPD prevalence and the presence of a strong healthcare infrastructure. The Federal Ministry of Health made an allocation of €4.7 billion as of 2024, especially for respiratory care, of which 25% has been set aside for ICU-grade cylinders due to increased demand since 2021. Besides, the country is leading in technological implementation, with IoT-based advanced cylinders capturing almost 30% of the market share, thus suitable for the market growth.

UK market is significantly growing, by grabbing 29% of the region’s market share, with an increase in the NHS expenditure reaching £1.6 billion, accounting for 8.2% of the overall healthcare budget as of 2023. Besides, the aspect of post-Brexit local policies upsurged regional production by almost 40%. Meanwhile, the demand for portable cylinders increased to 35% based on an escalation in the home healthcare integration, which serves approximately 6.2 million COPD patients in the country. Therefore, all these factors are effectively responsible for bolstering market growth opportunities.

Government Policies and Funding for Medical Oxygen Cylinders in France, Italy, and Spain (2021-2025)

|

Country |

Initiative |

Launch Year |

Funding/Policy Impact |

|

France |

"Oxygène 2025" Plan |

2022 |

€855 million for rural oxygen infrastructure |

|

Hospital Oxygen Modernization Fund |

2021 |

Upgraded 320+ facilities with smart cylinders |

|

|

Italy |

National Respiratory Care Strategy |

2023 |

€520 million (5.2% annual increase until 2025) |

|

Emergency Stockpile Expansion |

2021 |

+2 million cylinders added to national reserves |

|

|

Spain |

"Plan Oxígeno" Rural Access Program |

2022 |

€325 million to reduce 22% supply gaps |

|

Medical Device VAT Reduction (17%→7%) |

2023 |

Boosted domestic sales by 20% |

Key Medical Oxygen Gas Cylinders Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is extremely unified with the presence of various organizations, including Air Products, Air Liquide, and Linde, collectively accounting for 55% of the overall market. Besides, administrative compliance, sustainability, emerging market expansion, lightweight progression, and IoT adoption are a few strategies that have been implemented by other international companies. For instance, through innovation in lightweight, Teijin’s carbon-fiber cylinders diminished weight by at least 35%. Meanwhile, firms in the U.S. have invested in achieving FDA 510(k) approvals for portable designs, thus suitable for market upliftment.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Linde plc |

Ireland |

18.9% |

Leading producer of high-pressure aluminum/steel cylinders for hospitals & home care |

|

Air Liquide |

France |

15.8% |

Specializes in portable oxygen systems and IoT-enabled smart cylinders |

|

Air Products & Chemicals |

U.S. |

12.7% |

Focuses on lightweight cylinders for emergency medical services (EMS) |

|

Praxair Technology |

U.S. |

10.4% |

Provides FDA-compliant cylinders with integrated safety valves |

|

INOX Air Products |

India |

8.6% |

Dominates South Asian market with cost-effective steel cylinders |

|

GCE Group |

Sweden |

xx% |

Known for precision medical gas regulators and cylinder valves |

|

Catalina Cylinders |

U.S. |

xx% |

Manufactures composite cylinders for military and aerospace applications |

|

Cramer Decker Medical |

U.S. |

xx% |

Produces portable oxygen kits for home healthcare |

|

Oxygen & Argon Works Ltd |

UK |

xx% |

Supplies NHS-approved cylinders with telemetry capabilities |

|

HERSILL |

Spain |

xx% |

Focuses on ICU-grade cylinders and oxygen concentrators |

|

Galemed Corporation |

Taiwan |

xx% |

Specializes in neonatal oxygen delivery systems |

|

BOC Healthcare |

Australia |

xx% |

Provides cylinders for remote healthcare in Oceania |

|

K-MED Health |

South Korea |

xx% |

Develops ultra-lightweight aluminum cylinders for ambulances |

|

Meditech Systems |

Malaysia |

xx% |

Supplies ASEAN hospitals with cost-effective oxygen solutions |

|

Oxymat A/S |

Denmark |

1% |

Innovates in oxygen conservation devices for cylinders |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Linde plc unveiled its cutting-edge SmartO2 IoT-powered aluminum cylinders with actual oxygen tracking by collaborating with at least 60 hospitals in Europe to lower wastage by approximately 33%.

- In April 2024, Air Liquide effectively made an investment of USD 250 million to strengthen the portable cylinder production in Texas by targeting a 45% increase in the outcome for the home healthcare demand in North America.

- Report ID: 7938

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Oxygen Gas Cylinders Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert