Medical Network Solution Market Outlook:

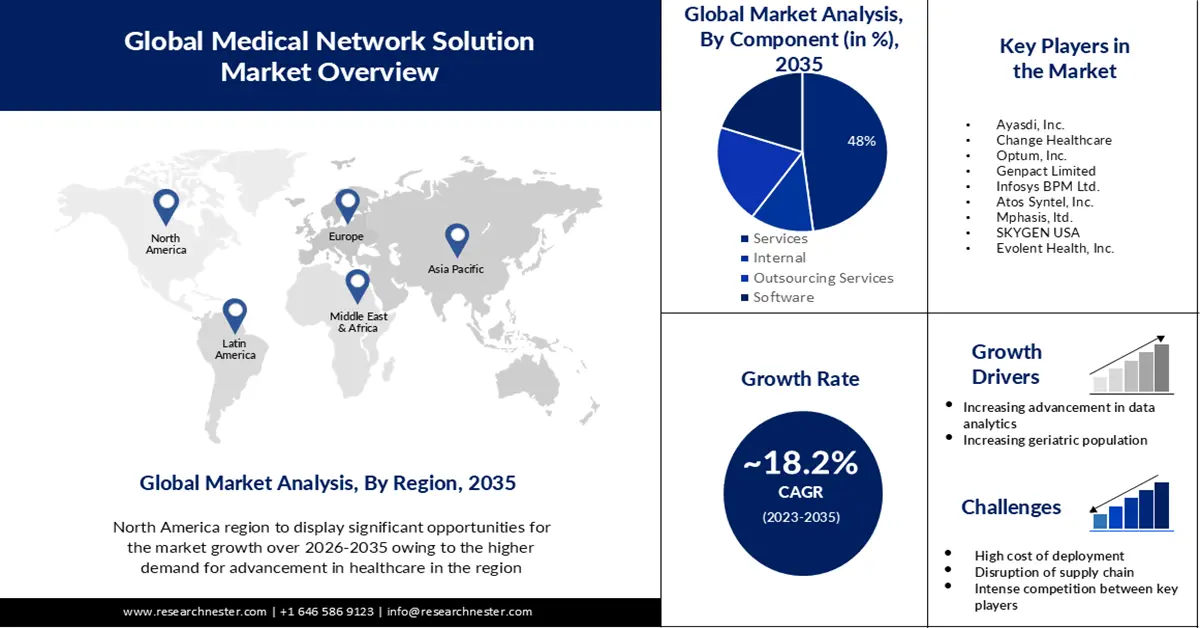

Medical Network Solution Market size was valued at USD 5.46 billion in 2025 and is set to exceed USD 29.06 billion by 2035, expanding at over 18.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical network solution is estimated at USD 6.35 billion.

The demand for provider network management payer services, which are expected to drive market growth, is supported by the increased use of healthcare insurance in managing medical expenses such as treatments, hospitalizations, and health checks. In November 2022, the Indian Brand Equity Foundation released a report on the Insurance Sector, which indicated an increased number of persons purchasing insurance policies. From 2021 to 2022, the net first-year premium increases for life insurers rose by 6,94%, amounting to USD 29.54 billion in India. According to the report, in May 2021 new business premiums of life insurance increased by 88.64% from USD 3.12 billion.

In addition, in the event of acquisition, merger or expansion medical network solutions are helping to connect new locations in these organizations. Therefore, an important contributor to the growth of medical network solutions markets is that healthcare organizations are able to operate as a single unit much more quickly with this type of medical network solutions.