Medical Laser Market Outlook:

Medical Laser Market size was over USD 6.45 billion in 2025 and is projected to reach USD 19.5 billion by 2035, witnessing around 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical laser is evaluated at USD 7.13 billion.

The growth of the market can primarily be ascribed to the rising sales of lasers owing to growing demand in multiple medical branches such as cardiovascular, dentistry, dermatology, gynecology, and others. For instance, in 2021, lasers sales across the globe were valued at over USD 15 billion.

Global medical laser market trends such as, booming cases of cardiovascular diseases, and flourishing healthcare expenditure across the globe are projected to influence the growth of the market positively over the forecast period. Based on statistics provided by the World Health Organization (WHO), cardiovascular disease accounted for approximately 17.9 million deaths per year across the globe, while one-third of death is associated with geriatrics. Medical lasers are getting more enhanced owing to growing technological advancement. These lasers are used in therapies, for instance, photodynamic & photo rejuvenation therapies, surgeries, medical diagnosis, treatment, and others. A surgeon becomes more capable of accomplishing complex tasks during the surgery with the proper assistance of lasers. Hence, all these factors are expected to propel the growth of the market over the forecast period.

Key Medical Laser Market Insights Summary:

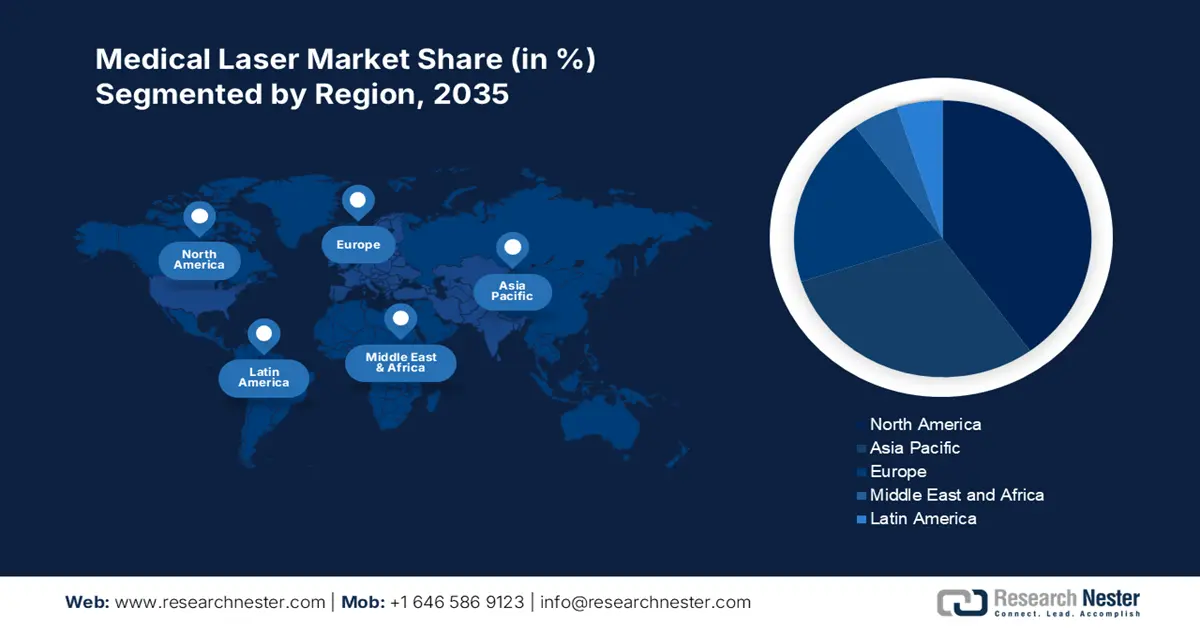

Regional Highlights:

- The North America medical laser market is predicted to capture 43.1% share by 2035, driven by skyrocketing number of cosmetic surgeries and rising demand for minimally invasive procedures.

Segment Insights:

- The ophthalmology segment in the medical laser market is anticipated to experience noteworthy growth during 2026-2035, fueled by the rising number of eye disorders and diseases.

Key Growth Trends:

- Growing Dental Problems in the Global Population

- Rising Inclination of Tattoos in the Younger Generation

Major Challenges:

- Possibility of Side Effects owing to Laser Surgeries

- Higher Cost Associated with the Treatment

Key Players: El.En. S.p.A., Lumenis Be Ltd., Cynosure LLC, BIOLASE, Inc., IRIDEX Corporation, Cutera, Inc., Candela Corporation, Ellex Inc., Topcon Corporation, Lumentum Operation LLC.

Global Medical Laser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.45 billion

- 2026 Market Size: USD 7.13 billion

- Projected Market Size: USD 19.5 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Medical Laser Market Growth Drivers and Challenges:

Growth Drivers

- Growing Dental Problems in the Global Population- As of 2020, nearly 65% population of the USA observed visiting dentists while the prevalence of dental visits by children was found to be the highest, estimated to be around 85% in a similar year. The dentistry segment is projected to have a higher demand for lasers since they are utilized to reshape the gums and to remove the root canal. Other procedures performed in dentistry that requires lasers are dentinal hypersensitivity, bleaching, restorative removal, curing, caries prevention, and others. Hence, such a higher demand for lasers is expected to hike the growth of the market during the forecast period.

- Rising Inclination of Tattoos in the Younger Generation- In 2021, approximately 55% of adults in the United States were observed to have at least 1 tattoo, while around 6% of geriatrics were noticed to have 1 tattoo.

- Increasing Requirement for Minimally Invasive Surgeries- For instance, nearly 250,000 cholecystectomies are performed every year across the globe. Additionally, the rate of repair of inguinal hernia was estimated to be around 8 per 100,000 individuals in the United States.

- Significant Demand for Lasers in Dermatology- The skin treatment segment was projected to generate a revenue of approximately USD 0.60 billion in 2022.

Challenges

-

Possibility of Side Effects owing to Laser Surgeries

-

Higher Cost Associated with the Treatment

-

The expensive expense of medical laser therapy prevents it from being widely used in both rich and developing nations. As an illustration, the price of LASIK eye surgery can range from USD 1,050 to USD 4,050 per eye. Furthermore, in the United States, the average cost of LASIK surgery in 2020 was USD 2,600 per eye, which was more expensive than in 2019.

-

Requirement for Higher Initial Investment

Medical Laser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 6.45 billion |

|

Forecast Year Market Size (2035) |

USD 19.5 billion |

|

Regional Scope |

|

Medical Laser Market Segmentation:

Application Segment Analysis

The global medical laser market is segmented and analyzed for demand and supply by application into cardiovascular, dentistry, dermatology, gynecology, ophthalmology, and others, out of which, the ophthalmology segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to rising cases of disorders and diseases of the eye.

Our in-depth analysis of the global market includes the following segments:

|

By Laser Type |

|

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Laser Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 43.1% market share by 2035, driven by skyrocketing number of cosmetic surgeries and rising demand for minimally invasive procedures. America was estimated to register the highest number of cosmetic surgeries across the globe. For instance, in 2020, more than 5 million surgical and cosmetic procedures were performed solely in the USA, up from approximately 1 million in 1997. Moreover, rising demand for minimally invasive procedures and growing cases of ophthalmic disorders are further estimated to hike the growth of the market in the region over the forecast period.

Medical Laser Market Players:

- El.En. S.p.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lumenis Be Ltd.

- Cynosure LLC

- BIOLASE, Inc.

- IRIDEX Corporation

- Cutera, Inc.

- Candela Corporation

- Ellex Inc.

- Topcon Corporation

- Lumentum Operation LLC

Recent Developments

-

IRIDEX Corporation to receive the regulatory clearance for its product Cyclo G6 to be sold in the market. Cyclo G6 has been developed for the treatment of glaucoma disease. Furthermore, Cyclo is launched in China along with the company’s distributors Topcon and Clinico.

-

El.En. S.p.A.’s company Quanta System S.p.A. to donate surgical laser to the Onlus Manzo-Prod-Action.Aid. The laser has been donated for physiotherapy and dermatological application and it’ll be installed in Zimbabwe.

- Report ID: 4437

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Laser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.