Medical Kiosk Market Outlook:

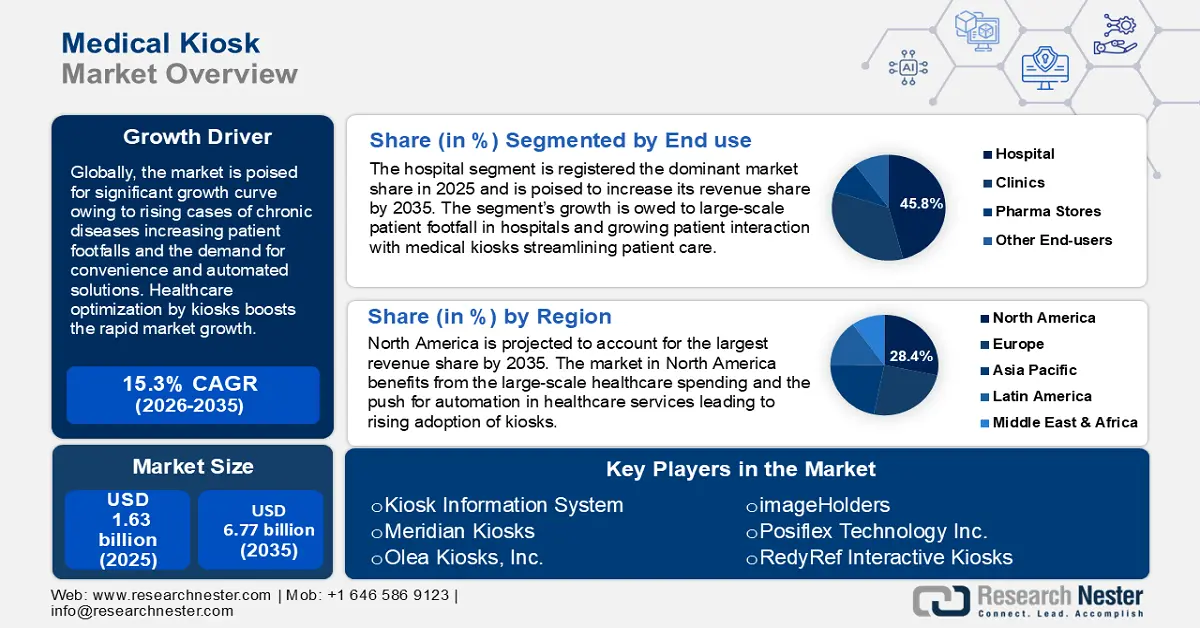

Medical Kiosk Market size was valued at USD 1.63 billion in 2025 and is likely to cross USD 6.77 billion by 2035, expanding at more than 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical kiosk is assessed at USD 1.85 billion.

In 2025, the industry size of medical kiosk is estimated at USD 1.5 billion. The market’s growth is attributed to the rising demands for efficient healthcare delivery systems and rapid technological advancements in point-of-care solutions. Medical kiosks are self-service terminals designed to facilitate various healthcare services from patient check-in, health assessments, consultations, and more. They streamline the healthcare process making healthcare solutions easier for patients which contributes to robust market growth.

A major driver of the medical kiosk market’s growth is the rising percentage of chronic diseases globally which increases the footfall of patients and engagement with medical kiosks. For instance, in May 2023, the World Health Organization (WHO) reported that deaths due to chronic diseases are projected to account for 86% of 90 million deaths each year by 2050. The projected number is a 90% increase from the World Health Statistics data of 2019. Additionally, WHO World Health Statistics 2023 reported 41 million deaths each year from chronic deaths which accounted for 74% of deaths globally in 2023. Due to rising cases globally, patients demand reduced wait times for treatment and a streamlined approach to patient management leading to rising demands for medical kiosks.

The medical kiosk market provides ample opportunities for expansion, especially in emerging economies. With growing 5G penetration improving connectivity, telehealth functionalities in Kiosks can improve access to a large section of population where awareness on healthcare is rising. Self-assessment and telehealth services in kiosks can also dispel stigma owing to which a section of patients are reticent in seeking healthcare. Furthermore, innovations in medical kiosks will also boost the penetration in rural areas. A February 2024 collaboration between Five Star Bank and Rochester University Medical Center has enabled URMC telehealth technology to scale and sustain in rural communities of New York. The medical kiosk market is poised for steady growth owing to growing trends for patient-centered care and focus on preventive healthcare measures.

Key Medical Kiosk Market Insights Summary:

Regional Highlights:

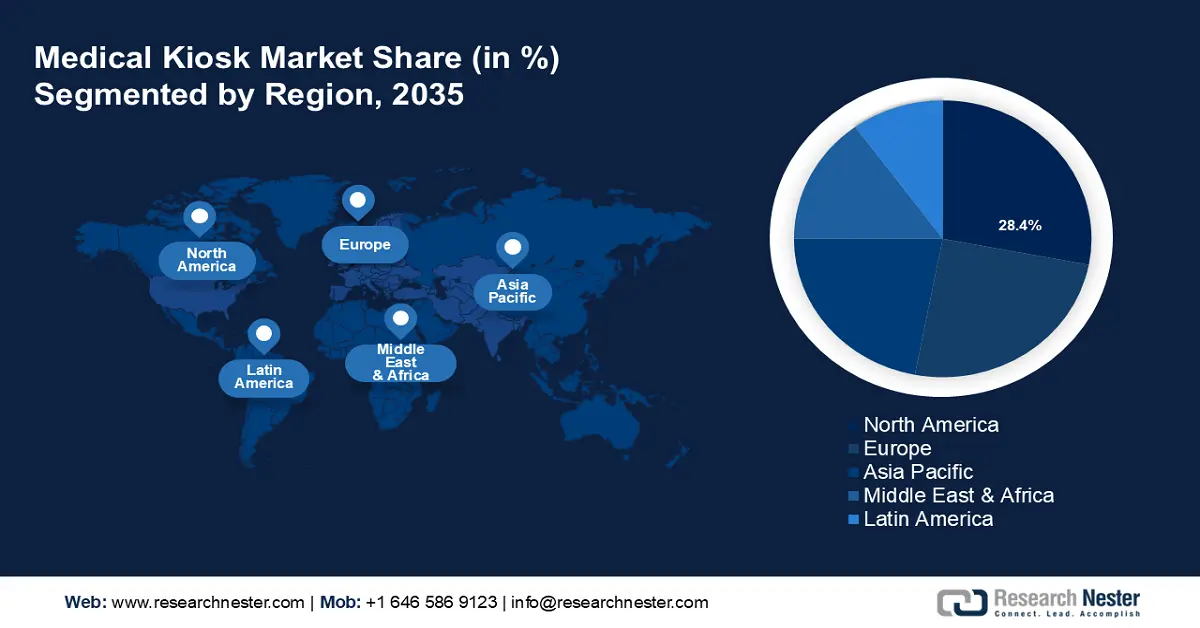

- North America leads the medical kiosk market with a 28.4% share, driven by rising demand for patient convenience and digital health solutions, fostering growth through 2026–2035.

- Europe is expected to experience the fastest growth in the Medical Kiosk Market from 2026 to 2035, driven by EU investment and a push for healthcare digitization.

Segment Insights:

- The Hospitals segment is projected to grow significantly with a 45.8% share by 2035, driven by rising demands for effective healthcare solutions and patient-centric care in high-traffic hospital settings.

- The Clinics segment of the Medical Kiosk Market is anticipated to experience significant growth from 2026-2035, fueled by increasing private clinic installations and rising healthcare spending.

Key Growth Trends:

- Rising automation in healthcare

- Growing demand for patient-centric care

Major Challenges:

- High costs of investment and maintenance

- Growing data security and privacy concerns

Key Players: Kiosk Information System, Meridian Kiosks, Olea Kiosks, Inc., Kiosk Group, Inc., imageHolders, Glory Global Solutions Limited, Posiflex Technology Inc., RedyRef Interactive Kiosks.

Global Medical Kiosk Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.63 billion

- 2026 Market Size: USD 1.85 billion

- Projected Market Size: USD 6.77 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (28.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: United States, Canada, Germany, Japan, India

Last updated on : 14 August, 2025

Medical Kiosk Market Growth Drivers and Challenges:

Growth Drivers

-

Rising automation in healthcare: Rapid advancement of technology in the healthcare sector has led to growing integration of automation in healthcare. Automated solutions streamline patient care thereby increasing demand for automated solutions such as medical kiosks. The large-scale adoption of electronic health records (EHRs) in medical kiosks allows for efficient patient check-in, registration, and access to medical records drastically reducing administrative workload and improving overall patient satisfaction.

Additionally, artificial intelligence integration in kiosks is drastically improving patient interactions with medical kiosks. For instance, in November 2023, Primary Care player Forward launched AI integrated, self-service Care Pods after raising USD 100 million in funding. - Growing demand for patient-centric care: Post COVID-19 pandemic, there has been a shift in trend for patient-centric and personalized healthcare. For instance, a healthcare statistics report indicates 82.1% of patients in the U.S. stating that premium customer service is the most vital factor considered while choosing healthcare, while 39.2% of patients stated that a positive digital experience with a healthcare provider positively influenced retaining the provider. The self-service option in medical kiosks inculcates patient-centric care by allowing them to take charge of their healthcare requirements.

Automated check-ins, medication refills, and quick health assessments reduce in-person travel and appointments benefiting patients and drastically increasing their footfalls in healthcare providing solutions. Additionally, integration of telemedicine services in kiosks significantly boosts the medical kiosk market’s growth as patients can partake in a virtual session with a doctor. - Cost-efficiency and workforce optimization: Medical kiosks are a cost-effective solution for healthcare providers owing to cost savings from reducing the dependency on on-site administrative staff and optimizing the use of resources. Kiosks automate patient registration, billing, and basic health assessments, minimizing operational costs. For instance, in September 2020, a study was published in the National Library of Medicine (NLM) that concluded health kiosks as cost-effective tools that can improve health indicators in countries if integrated in the formal health system.

Additionally, medical kiosks in healthcare services can recover the initial cost of investment in a short period of time by significantly reducing administrative costs. The medical kiosk market will continue to experience robust growth as medical kiosks streamline workforce optimization in healthcare services.

Challenges

-

High costs of investment and maintenance: The initial investment in purchasing and installing medical kiosks can be high, which can deter small-scale healthcare providers from installing kiosks, hampering the medical kiosk market’s reach. The kiosks also require regular maintenance and software updates, with data privacy concerns looming that can add to costs. The high rate of maintenance costs can be a challenge in emerging economies. Additionally, kiosks suffering from lack of maintenance can deter patients from engaging with them, leading to a decrease in the market’s revenue share.

- Growing data security and privacy concerns: Medical kiosks can be prone to security violations, putting sensitive medical data at risk. Due to kiosks collecting and storing vast amounts of patient data, it is imperative for health kiosk providers to inculcate stringent security measures, and any data security breaches can stymy the medical kiosk market’s growth. Data breaches can cause significant financial loss and long-term damage to the reputation of healthcare providers. For instance, in June 2020, Babylon Health suffered a software error that led to a patient’s data breach.

Medical Kiosk Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 1.63 billion |

|

Forecast Year Market Size (2035) |

USD 6.77 billion |

|

Regional Scope |

|

Medical Kiosk Market Segmentation:

End use (Hospitals, Clinics, Pharma Stores, Other end- users)

The hospitals segment will account for 45.8% revenue share by 2035. The segment is poised to increase its revenue share by the end of 2035. The growth of the segment is attributed to the rising demands for effective healthcare solutions and patient-centric care, and the high footfall of patients in hospitals interacting with medical kiosks. Global and regional medical kiosk market players find new opportunities in the segment to integrate electronic health records (EHRs) and telemedicine services in a hospital’s medical kiosk. Additionally, hospitals account for the largest patient footfall owing to the presence of multiple specialties, correlating with the rapid growth of the segment. For instance, in February 2021, Apollo Hospitals in India reported a 70% increase in footfall in outpatient departments (OPD).

The clinics segment is poised to increase its revenue share during the forecast period owing to an increasing percentage of private clinics integrating the installation of medical kiosks. The WHO World Health Expenditure database indicates an increase in healthcare spending in almost all WHO member states. For instance, South Korea witnessed a 9.7% increase in healthcare spending in 2021 from 2020. The trend of increasing expenditure on healthcare bodes well for the segment and the overall medical kiosk market. Clinics account for a high-footfall from patients, leading to increasing engagement with medical kiosks, boosting the segment’s growth. Additionally, self-care kiosks in clinics can reduce patient overcrowding leading to better optimization of resources. For instance, in August 2024, 2000 telehealth kiosks were announced to be deployed in rural Malaysia in collaboration with MEASAT and Mudah Healthtech to relieve overcrowding.

Type (Check-in kiosk, Payment kiosk, Way finding kiosk, Telemedicine kiosk, Patient education kiosk, Other kiosk)

The check-in kiosk segment in medical kiosk market is projected for rapid growth by the end of 2035 owing to greater convenience offered to consumers, which increases the demand for installation of these kiosks. Private clinics and hospitals are integrating check-in kiosks to streamline the registration and appointment process to reduce wait times. Check-in kiosks contribute to enhancing patient satisfaction, which can lead to a higher patient retention rate for healthcare providers.

A key growth driver of the segment is the prevalence of contactless healthcare solutions post-pandemic. Major medical kiosk market players are seeking to integrate innovative solutions to check-in kiosks, such as symptom screenings, which are poised to fuel the segment’s growth further. For instance, in August 2024, Olea Kiosks launched the Chicago Healthcare check-in kiosk with audio navigation for enhanced user experience.

Our in-depth analysis of the global market includes the following segments:

|

End use |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Kiosk Market Regional Analysis:

North America Market Analysis

North America industry is predicted to hold largest revenue share of 28.4% by 2035, owing to rising demands for patient convenience. Regional and global market players are utilizing the new opportunities in North America to integrate kiosks with telehealth services to offer personalized health assessments and medication refills. An increasing percentage of hospitals and clinics in the region are embracing digital solutions to patient flow by integrating medical kiosks and improving operational efficiency. The rising demands to improve patient experience are estimated to open new revenue streams in the medical kiosk market in North America.

The U.S. leads the revenue share in North America due to its large-scale spending on healthcare and increasing prioritization on patient convenience solutions. In June 2024, Reuters reported U.S. healthcare spending to have increased by 7.5% in 2023 to USD 4.8 trillion, outpacing the GDP growth rate of 6.1%. The report indicated the spending on private insurance and Medicaid to have boosted the growth as per the U.S. Centers for Medicare and Medicaid Services (CMS).

The increased coverage of medical insurance and government investments in healthcare boosts the medical kiosk market as the focus shifts to patient-centric care, paving the way for greater installations of medical kiosks in hospitals and clinics. For instance, in June 2024, Delaware Country announced the installation of automated health care kiosks in Chester, Media, and Yeadon that will dispense tests for free and provide results for flu, COVID-19, STDs, and HIV.

Canada is poised to increase its revenue share in North America by the end of 2035 owing to the high-rate of healthcare spending and increased adoption of automated health kiosks to streamline medical services to patients. For instance, the Canadian Medical Association (CMA) estimated the total health expenditure in Canada to reach USD 344 billion in 2023, accounting for USD 8.7 thousand per person, which is 12.1% of the GDP. Additionally, in February 2023, USD 2 billion in funding was announced for the Canada Health Transfer (CHT) to improve healthcare in the nation and enhance medical infrastructure.

The large-scale spending on healthcare is poised to boost the medical kiosk market as more market players find the opportunity to install automated healthcare kiosks in hospitals and clinics across the nation. For instance, October 2023, Island Health announced that it will install health kiosks outside emergency rooms at North Island Hospital, Nanaimo General Regional Hospital, and Victoria General Hospital.

Europe Market Analysis

Europe is poised to account for the fastest revenue growth during the forecast period due to a growing push for digitization of healthcare services, and increasing expenditure on healthcare. For instance, in December 2023, the European Union (EU) announced its decision to invest upwards of USD 848.4 million on Digital Europe programs, and the decision is in alignment with the European Commission’s push to provide citizens with access to high-quality digital services in healthcare. The growing push for digitized services in healthcare across Europe fuels the robust growth of the market, as contactless solutions provided by kiosks streamline patient experience and reduce the burden on healthcare providers.

Germany is a leading market in Europe and is projected to increase its revenue share by the end of 2035. The medical kiosk market’s growth is owed to a robust healthcare infrastructure and emphasis on digital transformation of healthcare spaces. Germany has been actively pushing for digital health solutions and passed the Digital Care Act (DVG) in 2019 to boost digitization and innovation in the health care sector.

Additionally, Germany ranks the highest in healthcare spending in Europe with 12.9% expenditure in healthcare relative to GDP in 2021. The government push for making healthcare accessible to all and the rising focus on digital health solutions empower medical kiosk market players to innovate in new artificial intelligence powered kiosks to be installed in hospitals, clinics, or in rural areas. For instance, in 2023, the International Journal of Integrated Care reported that Germany will start offering 1000 health kiosks in rural areas with telemedicine connectivity to serve as a first point of contact.

France is projected to have a rapid growth in market share in Europe during the forecast period. A key driver is the revenue boom of the self-service kiosk market, which leads to greater expansion opportunities for the medical kiosk market in France. Spending on healthcare has seen a boom in France, as the country accounted for 12.3% of healthcare spending relative to its GDP in 2021, second only to Germany in Europe.

Additionally, France is actively pushing for digital health applications and introduced a fast-track market access pathway for telemonitoring systems in March 2024. The trends bode well for the medical kiosk market’s growth in the country as health kiosks integrated with telemonitoring systems witness a rise in demand. Local and global self-service solution providers are jostling to integrate AI in their automated medical kiosks to avail themselves of the growing opportunities in the medical kiosk market.

Key Medical Kiosk Market Players:

- Kiosk Information System

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Meridian Kiosks

- Olea Kiosks, Inc.

- Kiosk Group, Inc.

- imageHolders

- Glory Global Solutions Limited

- Source Technologies

- Posiflex Technology Inc.

- RedyRef Interactive Kiosks

- Fabcon LLC

- Babylon Health

- DynaTouch Corporation

The medical kiosk market is poised to have a robust growth during the forecast period. Key market players are leveraging new opportunities in the market by integrating artificial intelligence (AI) and telecommunication services in self-help kiosks in healthcare spaces.

Some of the key market players are:

Recent Developments

- In April 2024, Kiosk Operators LLC acquired Wellmation to facilitate patient access to healthcare and pharmaceuticals. The acquisition will allow KO to provide tailored solutions of self-service kiosks to the healthcare industry.

- In November 2023, Versicles Technology launched an AI-driven digital health kiosk to bridge the gap between detection and healthcare in India. The kiosk will be equipped with a touch screen to provide video instructions to users.

- In May 2022, UniDoc Health Group launched its H3 Cube virtual care solutions kiosk. The kiosk will allow patients a live virtual visit with a healthcare professional utilizing fully integrated medical devices in a controlled environment.

- In September 2022, OMNIQ’s self-service patient management kiosks were integrated in Israel’s newest state of art emergency medical hospital. Patients can use the kiosks to scan their unique wristbands and then be redirected by robots to their appointments.

- Report ID: 6526

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Kiosk Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.