Medical Equipment Financing Market Outlook:

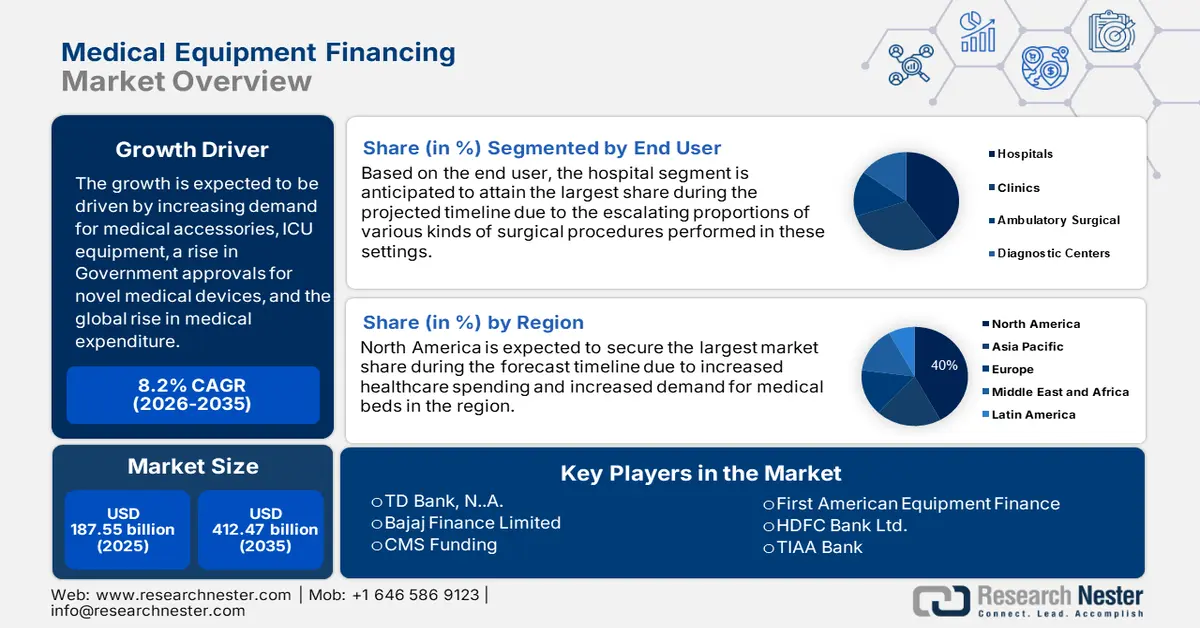

Medical Equipment Financing Market size was over USD 187.55 Billion in 2025 and is poised to exceed USD 412.47 Billion by 2035, growing at over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical equipment financing is estimated at USD 201.39 Billion.

The market growth is primarily driven by the growing geriatric population as old adults are more susceptible to diseases including chronic issues, cancer, orthopedic problems, and others. Based on the United Nations report, on a worldwide scale, 1 in 6 people estimated to be older than 65 by 2050, compared to 1 in 11 in the year 2019. Moreover, rising opportunities in the medical sector for finance companies are also estimated to drive the growth of the market in the coming years. Besides this, a sudden rise in COVID-19 cases is another significant factor projected to skyrocket the growth of the global medical equipment financing market over the forecast period.

In addition to these, factors that are believed to fuel the market growth of medical equipment financing include the propelled demand for medical accessories such as gloves, face masks, gowns, and medical equipment, including ventilators, oxygen cylinders, monitoring devices, and so on across the globe. According to the World Health Organization, more than half a million people need 1.1 million oxygen cylinders every day in low and middle-income countries. Moreover, each month 129 billion disposable masks are used throughout the world. Besides this, in 2020, more than 400 million medical masks have been distributed by UNICEF to assist the nations. Additionally, the increasing demand for diagnosis on account of the growing prevalence of several types of chronic diseases and infections across the world has been doubling the need for emergency equipment. This, as a factor, is also estimated to boost the market growth in the projected time frame.

Key Medical Equipment Financing Market Insights Summary:

Regional Highlights:

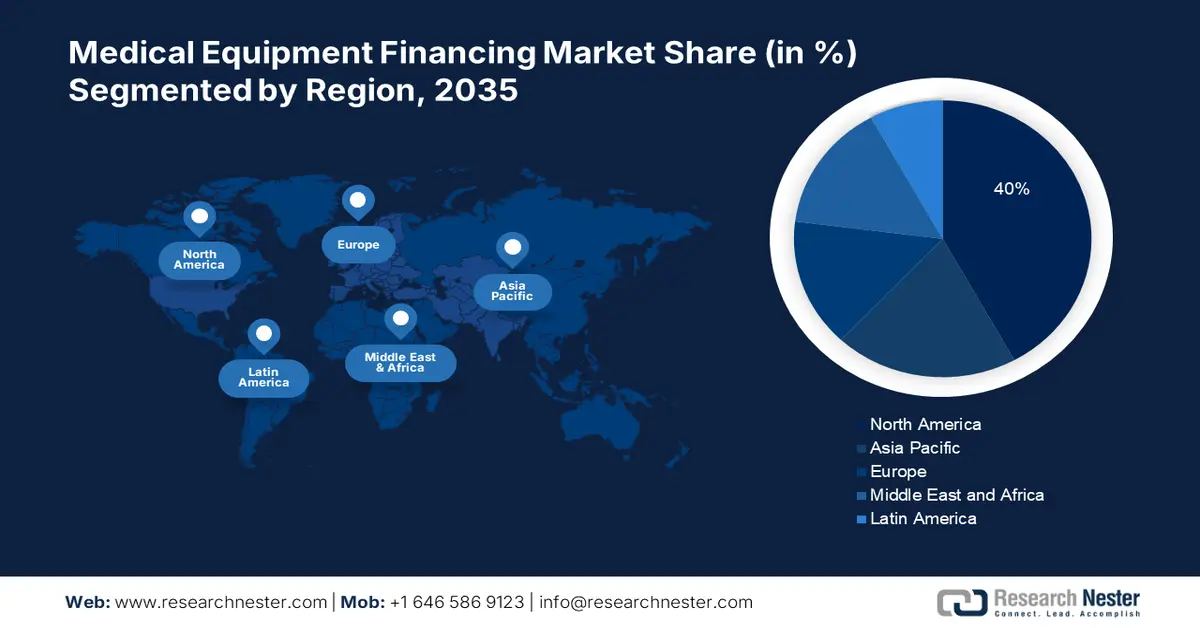

- North America medical equipment financing market will dominate more than 40% share by 2035, driven by increasing healthcare spending and growing number of hospital medical beds.

- Europe market sees a 26% share by 2035, driven by escalating adoption of AI-based medical equipment and surge in healthcare infrastructure.

Segment Insights:

- The hospitals segment in the medical equipment financing market is expected to capture a 56% share by 2035, driven by the rising number of surgical procedures and adoption of advanced equipment.

- The diagnostics equipment segment in the medical equipment financing market is expected to capture a 39% share by 2035, driven by the rising use of diagnostic machines and global increase in CT and X-ray scans.

Key Growth Trends:

- Growing Demand for ICU Equipments

- Increasing Usage of Medical Equipment

Major Challenges:

- Lower Awareness in Underdeveloped Countries Regarding Advanced Medical Equipment

- Extremely Careful Investments by the Businesses

Key Players: TD Bank, N.A., Bajaj Finance Limited, CMS Funding, First American Equipment Finance, HDFC Bank Ltd., JPMorgan Chase & Co., National Funding, Inc., TIAA Bank, Wells Fargo & Company, Macquarie Group Limited.

Global Medical Equipment Financing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 187.55 Billion

- 2026 Market Size: USD 201.39 Billion

- Projected Market Size: USD 412.47 Billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Medical Equipment Financing Market Growth Drivers and Challenges:

Growth Drivers

-

Surging Demand for Medical Accessories as of the Rise of COVID-19 - The rise of coronavirus has dynamically increased the need for various medical accessories comprising safety masks, sanitary liquid, PPEs, face shields, goggles, gloves, and so on to prevent virus infection. The requirement for ventilators, oxygen, medications, vaccines, and care beds was already so huge. Hence, the worldwide increasing number of COVID-19 cases is anticipated to surge the demand for medical accessories in the coming years. As per a report, Unicef distributed more than 6.4 million pairs of gloves, 1 million hospital gowns, and 1.8 million surgical masks in the first quarter of 2020.

-

Growing Demand for ICU Equipments - Common equipments including blood pressure monitors to more specialized ones such as dialysis machines, catheters, and many more are employed in intensive care units. ICU equipment is utilized to treat patients by monitoring their condition. The surge in several kinds of chronic disorders, along with the rising ratio of patients who need special intensive care are fueling the demand for ICU equipment across the globe. For instance, every year, more than 6 million central venous catheters are implanted in hospitalized and surgical patients in the United States.

-

Increasing Usage of Medical Equipment - The United States had nearly 70,000 ventilators in 2020, but at the peak of the pandemic, an additional 45,000 ventilators were needed to meet hospital demands.

-

Worldwide Rise in Healthcare Expenditure - In 2019, as estimated by The World Bank, worldwide healthcare spending amounted to around 9.83% of the global GDP. Moreover, healthcare expenditure in 17 OECD countries rose by approximately 6% on average in 2021.

-

Rise in Government Approvals for Novel Medical Devices – For instance, Prisma Health Inc. designed a “Y” splitter tube that received Food and Drug Administration (FDA) approval in an emergency situation as this technology allows a single ventilator can be administrated to four patients at a time.

Challenges

- Lower Awareness in Underdeveloped Countries Regarding Advanced Medical Equipment - Many regions in underdeveloped and developing countries stick to the existing conventional medical equipment rather than choosing the new advanced one. Therefore, such a type of unawareness is anticipated to hamper the market growth in the coming years.

- Extremely Careful Investments by the Businesses

- Higher Risk of Medical Equipment Obsolesce

Medical Equipment Financing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 187.55 Billion |

|

Forecast Year Market Size (2035) |

USD 412.47 Billion |

|

Regional Scope |

|

Medical Equipment Financing Market Segmentation:

Equipment Segment Analysis

The global medical equipment financing market is segmented and analyzed for demand and supply by equipment into diagnostics equipment, patient monitoring equipment, therapeutic equipment, laboratory equipment, and medical furniture. Out of these segments, the diagnostics equipment segment is anticipated to hold the largest medical equipment share of about 39% in the year 2035. The growth of the segment can be attributed to the rising use of various diagnostic machines including computed tomography scans, x-rays, magnetic resonance imaging, ultrasound, and others to detect various disorders across the globe. As per the World Health Organization estimations 3.6 billion diagnostic procedures, including X-rays, are performed each year across the globe. Among these, 3.6 billion x-rays make up 40% of all medical imaging. In addition to this, currently, there are 300 million CT scans performed worldwide annually, an increase of 4% over the previous year. Besides this, the growing occurrence of various types of infectious disorders, coupled with the surging demand for ventilators is also anticipated to skyrocket the segment growth over the projected time frame.

End-user Segment Analysis

The global medical equipment financing market is also segmented and analyzed for demand and supply by end-user into hospitals, clinics, ambulatory surgical centers, and diagnostic centers. Amongst these four types of segments, the hospitals segment is expected to garner a significant share of around 56% in the year 2035. The growth of this segment can be attributed to the escalating proportion of various kinds of surgical procedures performed on hospitals’ premises, along with the rising adoption of novel medical equipment installed by hospitals throughout the world. On the other hand, the diagnostic centers segment is projected to witness an impressive CAGR during the forecast period, owing to the rising development and integration of novel diagnostic equipment and rapid testing kits across the globe. In addition to this, the emerging role of various medical equipment finance organizations in funding research and development activities is also projected to provide huge opportunities for segment growth in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Equipment |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Equipment Financing Market Regional Analysis:

North American Market Insights

The market share of medical equipment financing in North America industry is expected to hold largest revenue share of 40% by 2035. The growth of the market can be attributed majorly to the augmenting healthcare spending, followed by the surging count of medical beds in the region’s hospitals. According to the Centre for Medicare and Medicaid Services, national health expenditure of the United States has increased by 9.7% amounting to USD 4.1 trillion in 2020, and it is around 19.7% of the national GDP. Moreover, in 2019, there were around 800,000 beds in community hospitals out of which nearly 60,000 are medical-surgical intensive care beds. In addition to this, the increasing need for therapeutic devices such as portable ventilators, dialysis equipment, and ICU equipment, and rising finance services for medical diagnostic devices are also estimated to elevate the market growth further in the North American region throughout the forecast period.

Europe Market Insights

The European medical equipment financing market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the escalating adoption of AI-based medical equipment, coupled with the surge in healthcare infrastructure in the region. Besides this, significant economic growth in various countries of Eastern Europe is also projected to push the market growth further in the European region in the coming years.

APAC Market Insights

Further, the market in the Asia Pacific, amongst the market in all the other regions, is projected to hold a majority of the share of about 19% by the end of 2035. The growth of the market can be attributed majorly to the significant rise in the finance sector in the region, along with the increasing setup of advanced laboratories, hospitals, diagnostic centers, and so on in various countries in the region. Moreover, rising investment by the government to establish a more solid medical sector is also projected to skyrocket the growth of the medical equipment financing market in the APAC region in the projected time frame.

Medical Equipment Financing Market Players:

- TD Bank, N.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bajaj Finance Limited

- CMS Funding

- First American Equipment Finance

- HDFC Bank Ltd.

- JPMorgan Chase & Co.

- National Funding, Inc.

- TIAA Bank

- Wells Fargo & Company

- Macquarie Group Limited

Recent Developments

-

Wells Fargo & Company founded the Siemens Healthineers Medical Equipment Finance Program to deliver effective, and comprehensive financing strategies throughout the United States. Through this program, Wells Fargo is estimated to provide profitable lease and credit products, thorough transaction assistance, and additional services to the Siemens Healthineers to assist the sales process.

-

TD Bank, N.A. announced an agreement to purchase First Horizon Corporation in a cash transaction. Through this acquisition, TD Bank is all set to strengthens its long-term expansion strategy in the US by acquiring a premier regional bank having a cohesive culture and risk-management strategy.

- Report ID: 4563

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Equipment Financing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.