Medical Equipment Cooling Market Outlook:

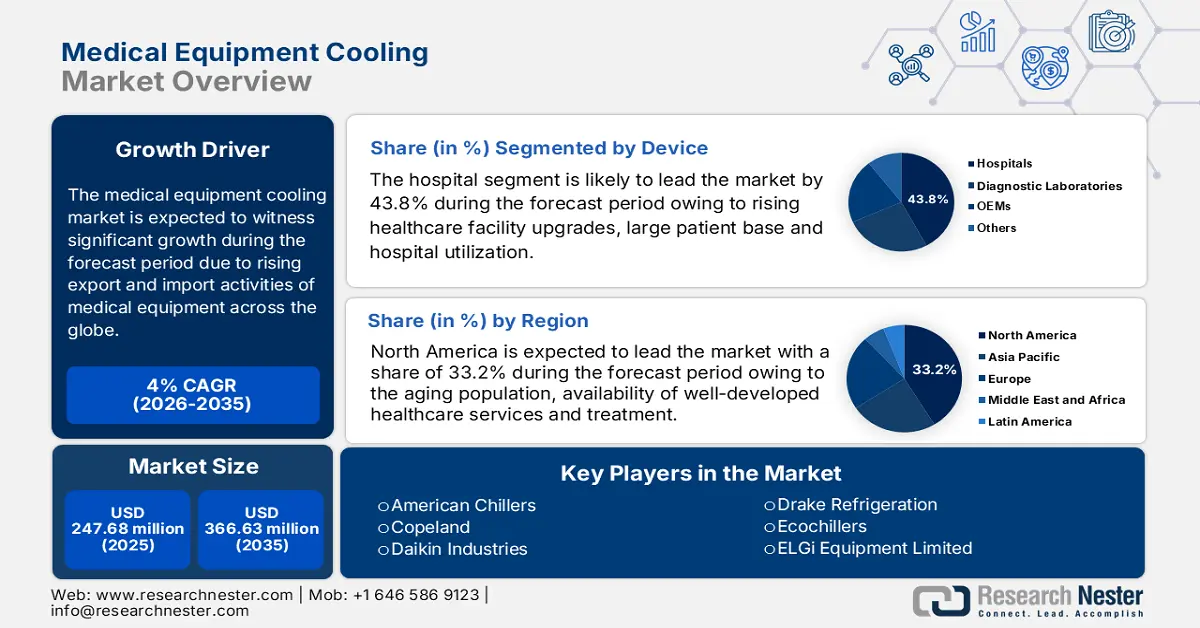

Medical Equipment Cooling Market size was over USD 247.68 million in 2025 and is anticipated to cross USD 366.63 million by 2035, witnessing more than 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical equipment cooling is assessed at USD 256.6 million.

The medical equipment cooling market is expected to witness significant growth during the forecast period due to rising export and import activities of medical equipment across the globe. Major Manufacturers in the U.S, Germany, and Japan develop high-performance medical devices, including medical equipment cooling systems, and export them to meet the global demand. The U.S. was the top exporter of health equipment in 2023 and the exports were valued at around USD 59.5 billion, followed by Germany at USD 54.4 billion. The fastest-growing export markets for medical equipment of the U.S. were the Netherlands (USD 5.4 billion), the UK (USD 348 million), and Mexico (USD 320 million). These countries are focused on exploring emerging markets such as India, China, and Africa as the healthcare and diagnostics infrastructure is rapidly expanding. This can be a result of rising prevalence of several diseases and the increasing need for effective cooling solutions for advanced diagnostic and therapeutic equipment.

Top Exporters of Medical Equipment in 2022

|

Country |

Export Revenue |

|

U.S. |

USD 33.3 billion |

|

Germany |

USD 17.6 billion |

|

Mexico |

USD 14.1 billion |

|

China |

USD 12 billion |

|

Netherlands |

USD 11.5 billion |

Source: OEC

One of the most widely used refrigerants in medical equipment cooling is HFC 134a as it is non-toxic and non-flammable. China is one of the largest exporters of HFC 134a accounting for 51.8% of global exports, followed by India and the U.S. According to data provided by the U.S. Environmental Protection Agency (EPA), in 2023, 49,582 metric tonnes of HFC-134a were produced and 44,910.2 metric tonnes were consumed as per the American Innovation and Manufacturing (AIM) Act. Following is a table with global producers of HFC-134a.

Global HFC-134a Producers

|

Company Name |

Country |

|

AGC Inc. |

Japan |

|

Arkema Daikin Advanced Fluorochemicals Co., Ltd. |

China |

|

Arkema Inc. Fluorochemicals Division |

U.S. |

|

Daikin Industries, Ltd. |

Germany |

|

Foosung Co., Ltd. |

South Korea |

|

Koura |

UK |

Source: EPA