Medical Equipment Cooling Market Outlook:

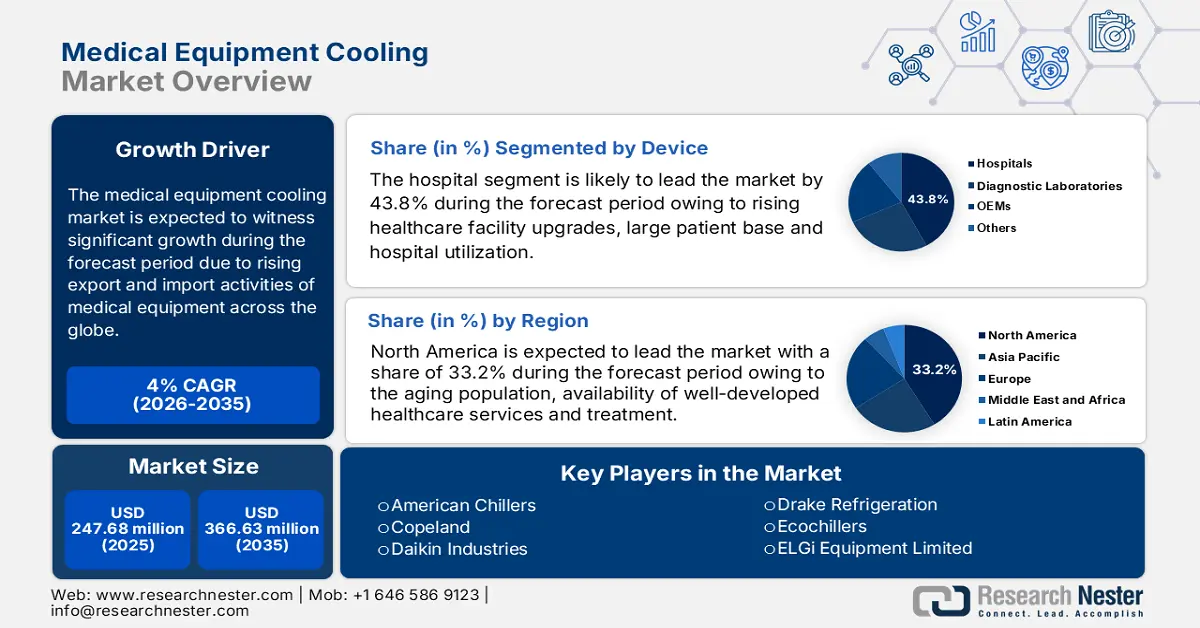

Medical Equipment Cooling Market size was over USD 247.68 million in 2025 and is anticipated to cross USD 366.63 million by 2035, witnessing more than 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical equipment cooling is assessed at USD 256.6 million.

The medical equipment cooling market is expected to witness significant growth during the forecast period due to rising export and import activities of medical equipment across the globe. Major Manufacturers in the U.S, Germany, and Japan develop high-performance medical devices, including medical equipment cooling systems, and export them to meet the global demand. The U.S. was the top exporter of health equipment in 2023 and the exports were valued at around USD 59.5 billion, followed by Germany at USD 54.4 billion. The fastest-growing export markets for medical equipment of the U.S. were the Netherlands (USD 5.4 billion), the UK (USD 348 million), and Mexico (USD 320 million). These countries are focused on exploring emerging markets such as India, China, and Africa as the healthcare and diagnostics infrastructure is rapidly expanding. This can be a result of rising prevalence of several diseases and the increasing need for effective cooling solutions for advanced diagnostic and therapeutic equipment.

Top Exporters of Medical Equipment in 2022

|

Country |

Export Revenue |

|

U.S. |

USD 33.3 billion |

|

Germany |

USD 17.6 billion |

|

Mexico |

USD 14.1 billion |

|

China |

USD 12 billion |

|

Netherlands |

USD 11.5 billion |

Source: OEC

One of the most widely used refrigerants in medical equipment cooling is HFC 134a as it is non-toxic and non-flammable. China is one of the largest exporters of HFC 134a accounting for 51.8% of global exports, followed by India and the U.S. According to data provided by the U.S. Environmental Protection Agency (EPA), in 2023, 49,582 metric tonnes of HFC-134a were produced and 44,910.2 metric tonnes were consumed as per the American Innovation and Manufacturing (AIM) Act. Following is a table with global producers of HFC-134a.

Global HFC-134a Producers

|

Company Name |

Country |

|

AGC Inc. |

Japan |

|

Arkema Daikin Advanced Fluorochemicals Co., Ltd. |

China |

|

Arkema Inc. Fluorochemicals Division |

U.S. |

|

Daikin Industries, Ltd. |

Germany |

|

Foosung Co., Ltd. |

South Korea |

|

Koura |

UK |

Source: EPA

Key Medical Equipment Cooling Market Insights Summary:

Regional Highlights:

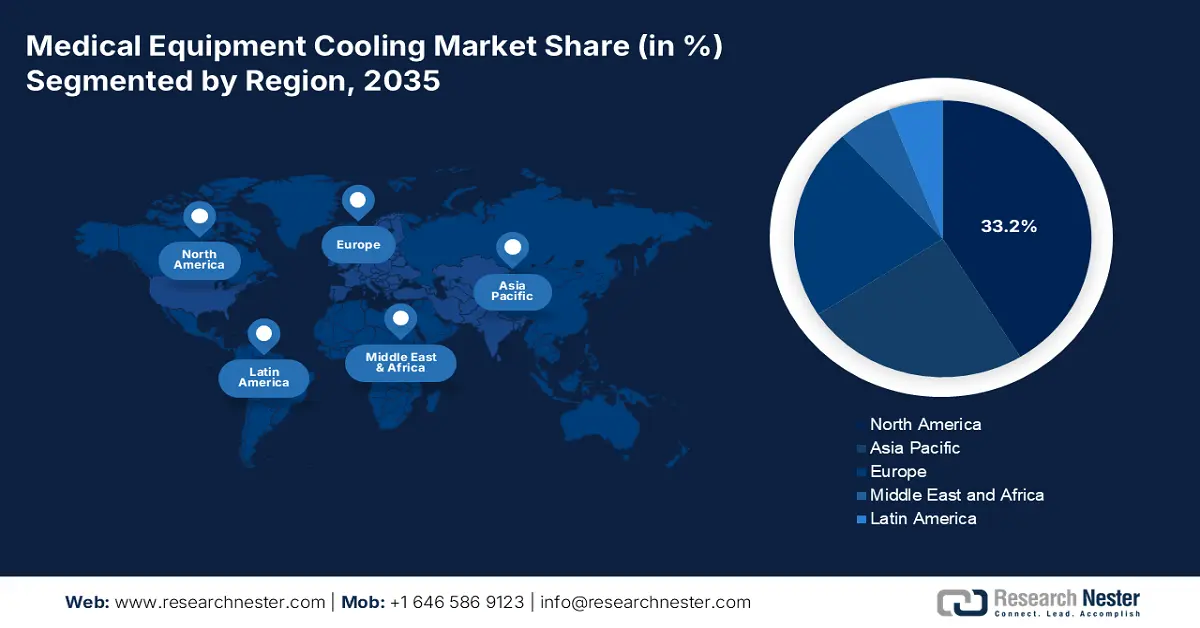

- North America commands the Medical Equipment Cooling Market with a 33.2% share, propelled by the aging population, well-developed healthcare services, and rising demand for advanced cooling systems for medical equipment, ensuring growth through 2026–2035.

Segment Insights:

- The Hospitals segment is anticipated to achieve a 43.8% market share by 2035, propelled by healthcare facility upgrades and the adoption of advanced cooling technologies.

- The Liquid-based Cooling segment of the Medical Equipment Cooling Market is anticipated to hold a significant share by 2035, driven by increasing demand for efficient thermal management solutions in medical equipment.

Key Growth Trends:

- Rapid advancements in cooling systems

- Rising prevalence of chronic diseases

Major Challenges:

- High maintenance and operational complexity

- Limited awareness and accessibility in many developing regions

- Key Players: Copeland, Daikin Industries, Drake Refrigeration, Ecochillers, ELGi Equipment Limited, Filtrine, General Air Products, Glen Dimplex Group, Haskris, Ingersoll Rand, Johnson Thermal Systems, KKT chillers, Laird Thermal Systems, Motivair Corporation and Thermal Care.

Global Medical Equipment Cooling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 247.68 million

- 2026 Market Size: USD 256.6 million

- Projected Market Size: USD 366.63 million by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Medical Equipment Cooling Market Growth Drivers and Challenges:

Growth Drivers

- Rapid advancements in cooling systems: Rapid advancements in cooling technology have resulted in better accessibility to advanced medical equipment cooling solutions, enabling enhanced performance and longevity. Liquid cooling systems, spot-cooling technology, magnetic refrigeration, pumpable ice technology, and electrocaloric cooling are revolutionizing the industry. One of the recent examples is the launch of ColdVest, a portable FDA class 1 medical device launched by ColdVentures in June 2024. This device is equipped with endothermic cooling technology that reduces core body temperature without the need for refrigeration, making it ideal for emergencies and use in high-temperature environments.

- Rising prevalence of chronic diseases: Increasing population and urbanization across the globe have resulted in higher demand for medical facilities, hospitals, diagnostic centers, and specialized healthcare services. The growing burden of chronic diseases such as cardiovascular diseases, cancer, and diabetes has led to the expansion of healthcare facilities and investment in modern equipment. This has resulted in increasing demand for advanced tools such as MRI, CT, and PET scans for diagnostics.

However, these devices generate substantial heat during operation, making cooling systems essential to maintain optimal functionality and prevent overheating. Different types of advanced cooling systems are widely used across healthcare sectors, laboratories, and research labs. This resulted in growing need for high-performance medical equipment that necessitates effective cooling solutions to ensure optimal operations. Other factors such as stringent regulatory norms, high preference for eco-friendly and energy-efficient cooling systems and rising investments in developing lightweight, compact and efficient cooling solutions are expected to fuel medical equipment cooling market growth going ahead.

Challenges

- High maintenance and operational complexity: Cooling systems require regular maintenance such as cleaning air filters, cooling coils, and refrigerants to prevent breakdowns, especially in mission-critical environments such as MRI or CT scan operations. Thus, maintenance adds to overall expenses, limiting the adoption of medical equipment cooling solutions. In addition, operational complexity in terms of excess power consumption, and integration with sophisticated medical devices lead to higher operational costs and environmental concerns.

- Limited awareness and accessibility in many developing regions: Although advanced medical equipment cooling solutions are rapidly gaining traction, several hospitals, clinics, and other healthcare centers, especially in developing economies lack enough funds to deploy these technologies. This can restrain market growth during the forecast period. In addition, many healthcare centers lack advanced healthcare infrastructure. This can limit the adoption of medical equipment cooling solutions and hamper medical equipment cooling market growth going ahead.

Medical Equipment Cooling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 247.68 million |

|

Forecast Year Market Size (2035) |

USD 366.63 million |

|

Regional Scope |

|

Medical Equipment Cooling Market Segmentation:

Product Type (Liquid-based Cooling, Air-based Cooling)

Based on product type, the liquid-based cooling segment in medical equipment cooling market is expected to account for a significant revenue share during the forecast period owing to increasing demand for thermal management systems and solutions and high preference for liquid-based cooling systems for better performance and reliability. One of the recent developments is the launch of the SPC Series Liquid to Liquid Cooling Heat Exchanger by Diversified Heat Transfer (DHT) in December 2024. This product is designed to meet the demanding cooling needs for medical equipment such as MRI machines, CT scanners, electron microscopes, and PET scanners. In addition, rapid advancements in materials and cooling technologies have resulted in the rising development of efficient thermal management solutions. This is expected to boost segment growth during the forecast period.

End use (Original Equipment Manufacturers (OEMs), Hospitals, Diagnostic Laboratories, Others)

The hospital segment is likely to hold medical equipment cooling market share of over 43.8% by the end of 2035 owing to rising healthcare facility upgrades, large patient base and hospital utilization, and increasing adoption of advanced cooling technologies. High usage of cooling systems for uninterrupted performance of medical equipment during surgeries and operations results in the growing need for precise cooling solutions. The segment growth is also rising as many hospitals are transitioning towards greener practices to reduce energy consumption and environmental impact.

Our in-depth analysis of the global medical equipment cooling market includes the following segments:

|

Product Type |

|

|

Compressor |

|

|

Configuration |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Equipment Cooling Market Regional Analysis:

North America Market Forecast

By 2035, North America medical equipment cooling market is projected to capture over 33.2% revenue share owing to the aging population, availability of well-developed healthcare services and treatment, and rising need for advanced cooling systems for diagnostic imaging systems and therapeutic equipment. In addition, increasing export activities in the region, high prevalence of chronic diseases such as cardiovascular disorders, cancer, and diabetes, and rising investments by public and private sectors to develop advanced medical equipment cooling solutions are expected to fuel market growth going ahead.

In the U.S., the medical equipment cooling market is expected to witness significant growth owing to rising demand for advanced diagnostics and therapeutic equipment, presence of well-established healthcare infrastructure and facilities, and rising investments by key players to develop advanced cooling medical systems. The government also plays a key role in supporting the market growth. For instance, the U.S. federal government in the fiscal year 2021, spent around USD 8.2 billion for medical supplies, including cooling systems. Moreover, stringent regulatory norms for equipment safety and performance and growing demand for minimally invasive and precision-based treatments is expected to increase the adoption of medical equipment cooling systems and devices going ahead.

The Canada medical equipment cooling market is expected to register a rapid revenue CAGR by the end of 2035 owing to the rising prevalence of various chronic diseases, technological advancements in medical cooling systems, and increasing investments in improving healthcare infrastructure. Canada presents significant opportunities for U.S. exporters of medical devices and according to the International Trade Administration, the U.S was the largest exporter in 2022, totaling USD 3.2 billion.

Asia Pacific Market Statistics

Asia Pacific market in medical equipment cooling market is expected to expand at a robust CAGR throughout the forecast period owing to rapid expansion of hospitals, diagnostic centers, and research facilities opting for advanced medical equipment cooling systems and government initiatives to promote the adoption of devices. Countries such as India, Singapore, and Japan are steadily becoming hubs for medical tourism due to the availability of advanced diagnostic and therapeutic devices at affordable rates. This is also expected to boost the demand for efficient medical device cooling solutions and technologies.

The healthcare and medical sector in India has rapidly expanded over the past few years and a wide range of medical devices including medical equipment cooling systems are manufactured in the country. According to the India Brand Equity Foundation (IBEF), around USD 10.73 billion was allocated for the healthcare and medical devices sector in the Union Budget 2024-25 and the FDI inflow of this sector was USD 3.28 billion between April 2000- March 2024. The demand for medical equipment cooling systems and solutions is rising in the country owing to rising prevalence of several chronic diseases, improving healthcare infrastructure, and increasing need for effective cooling solutions for medical devices.

In China, the medical equipment cooling market is likely to rise at a steady pace between 2025 and 2035 owing to rapidly expanding healthcare infrastructure, rapid adoption of medical equipment cooling systems, and increasing investments by public and private sectors to develop high-performance cooling technologies for effective and accurate operations. According to a report by OEC, China had the highest import potential with an import gap of USD 122 million in 2023.

Key Medical Equipment Cooling Market Players:

- Atlas Copco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Chillers

- Copeland

- Daikin Industries

- Drake Refrigeration

- Ecochillers

- ELGi Equipment Limited

- Filtrine

- General Air Products

- Glen Dimplex Group

- Haskris

- Ingersoll Rand

- Johnson Thermal Systems

- KKT chillers

- RIGID HVAC

- Laird Thermal Systems

- Legacy Chillers

- Lytron Chillers

- Motivair Corporation

- Thermal Care

The global medical equipment cooling market is quite competitive, comprising key players striving to enhance their market position and cater to the rising demand for advanced medical devices and the need for effective thermal management solutions. Glen Dimplex Group, Legacy Chiller Systems, Inc., Laird Technologies, Inc., and American Chillers are some of the leading companies in the market focused on providing innovative solutions and extensive product portfolios. These companies are adopting several strategies such as mergers and acquisitions, partnerships, product launches, joint ventures, and license agreements. Here are some other key players operating in the medical equipment cooling market:

Recent Developments

- In June 2024, Enhanced Innovation announced the launch of Phloton, a portable battery-powered cooling device specially designed to transport and store medical supplies such as vaccines and diagnostic samples.

- In October 2022, Secop announced the development of ultra-low temperature active medical cooling technology.

- Report ID: 6869

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Equipment Cooling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.