Medical Endoscope Image Processor Market Outlook:

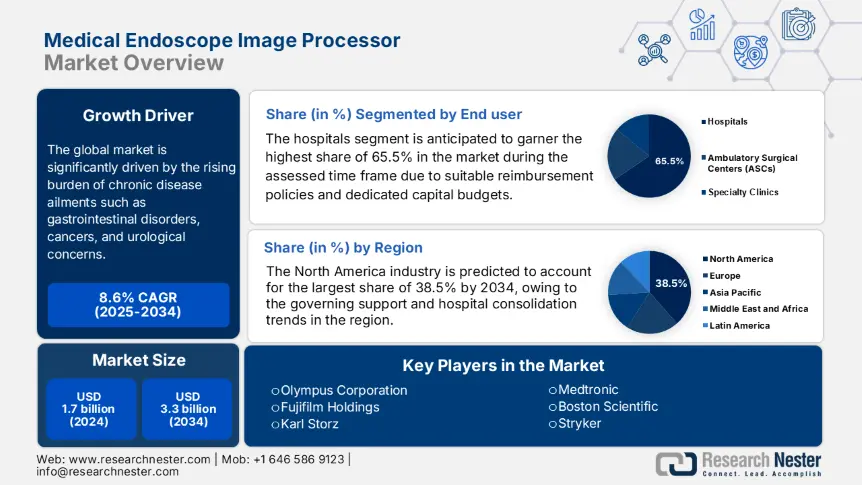

Medical Endoscope Image Processor Market size was valued at USD 1.7 billion in 2024 and is projected to reach USD 3.3 billion by the end of 2034, rising at a CAGR of 8.6% during the forecast period, from 2025-2034. In 2025, the industry size of medical endoscope image processor is estimated at USD 1.9 billion.

The global market is significantly driven by the rising burden of chronic disease ailments such as gastrointestinal disorders, cancers, and urological concerns. For instance, according to the report published by the World Health Organization (WHO) in 2023, it estimates colorectal cancers to surpass 3.6 million yearly diagnoses, which marks a 60.6% up by the end of 2040, creating a greater necessity for endoscopic diagnostics. During the same time, data from the National Institute of Health (NIH) revealed that gastroesophageal reflux disease (GERD) affects approximately 20.5% of the U.S. population. This growing burden directly impacts the increased procurement of medical endoscope equipment, especially in high-volume healthcare settings.

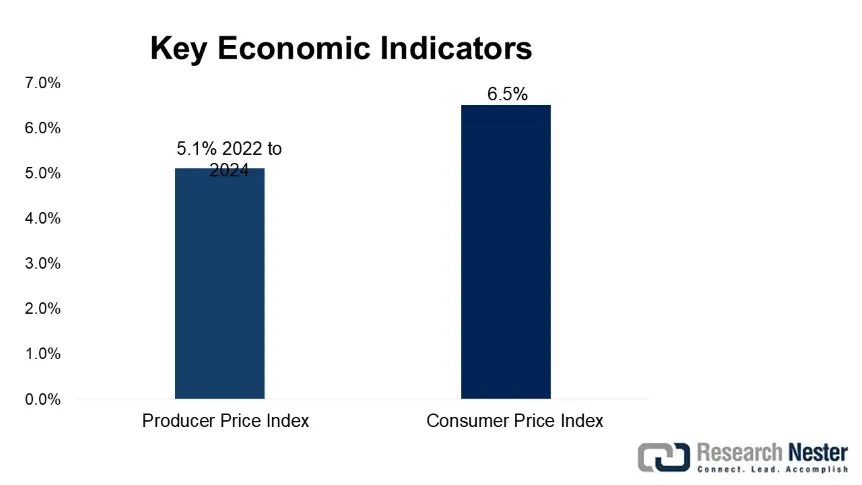

Furthermore, the supply chain aspect of endoscope image processors comprises specialized manufacturing of optical sensors, imaging chips, and high-performance processors, which are critically sourced from Japan, Germany, and the U.S. The U.S. Bureau of Labor Statistics in 2024 stated that the Producer Price Index (PPI) for medical imaging equipment displayed a 5.1% increase from 2022 to 2024, owing to the semiconductor shortages. Likewise, the Consumer Price Index (CPI) has also grown by 6.5% for endoscopic services, highly attributed to the increasing healthcare expenses.

Medical Endoscope Image Processor Market - Growth Drivers and Challenges

Growth Drivers

-

Early detection mandates and advances: The mandates imposed on early disease detection are effectively rearranging the growth dynamics of the market. In this regard Robert Koch Institute in 2025 notes that in Germany, the prevalence of Barrett’s esophagus, a crucial endoscopic screening target, has risen by 18.6% over the last decade, surpassing 1.7 million cases. Meanwhile, the study by the Agency for Healthcare Research and Quality (AHRQ) in 2022 found that AI-based endoscopic diagnostics reduced hospitalizations by 22.8% in early-stage GI cancer cases, thereby conserving USD 3.7 billion in the U.S. healthcare expenditure in a span of two years.

-

Cutting-edge technological breakthroughs: The advancements in terms of AI, 4k, 8k, and 3D imaging are readily shaping the foundation of the market. As evidence, the report from the U.S. FDA stated that its Digital Health Center of Excellence observed a 41.4% increase in AI-based endoscopy submissions in 2024, reflecting a greater evolution of technology in this field. On the other hand, in Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) successfully fast-tracked approvals for 3D endoscopy processors, gaining 15.4% higher surgical accuracy in clinical trials, thus denoting a positive market outlook.

-

Strategic organizational partnerships: The existence of suitable expansion collaborations implemented by the key pioneers allows a profitable business environment in the medical endoscope image processor market. For instance, in 2024, Olympus announced a partnership with NVIDIA to integrate real-time AI analytics, which boosted the processor sales by a significant 19.6% in the first quarter of 2025. Similarly, Mayo Clinic entered into an alliance with Fujifilm on AI-powered endoscopy, which reduced procedure time by 25.4% making it suitable for standard market growth.

Challenges

-

Budget constraints in hospital settings: The aspect of cost-effectiveness is a considerable barrier in the medical endoscope image processor market. In this regard, the Centers for Disease Control and Prevention (CDC) report published in 2024 underscores that 60.7% of the ambulatory surgical centers in the U.S. defer 4k upgrades owing to the exacerbated costs of USD 255,000. However, Karl Storz implemented a leasing program that increased adoption by a significant 35.4% in the hospitals based in Germany.

-

Cybersecurity and data privacy concerns: The global medical endoscope image processor market experiences a major hurdle in terms of cybersecurity and data breaches, which hampers its adoption in almost all nations. For instance, in 2024, Europe’s GDPR imposed penalties for data breaches that deterred cloud-based AI-adoption, thus triggering privacy concerns. Boston Scientific addressed such issues by embedding on-device AI to comply which gained 20.6% of market share in Europe.

Medical Endoscope Image Processor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.6% |

|

Base Year Market Size (2024) |

USD 1.7 billion |

|

Forecast Year Market Size (2034) |

USD 3.3 billion |

|

Regional Scope |

|

Medical Endoscope Image Processor Market Segmentation:

End user Segment Analysis

The hospitals segment is anticipated to garner the highest share of 65.5% in the medical endoscope image processor market during the assessed time frame. The dominance of the segment is effectively attributed to the suitable reimbursement policies and dedicated capital budgets. Medicare’s 2024 reimbursement changes are enabling 25.4% higher facility payments for technologically advanced endoscopies, whereas 25.9% of hospitals in the U.S. are currently emphasizing dedicated capital budgets for endoscopic imaging. Besides, the 3-year ROI period for AI-processors denotes a wider segment scope.

Application Segment Analysis

The gastroenterology segment is projected to attain a lucrative share of 47.6% in the medical endoscope image processor market by the end of 2034. The segment’s growth originates from the expanded screening guidelines by the CDC in 2024, which recommends beginning screenings at age 45, down from 50. This, in turn, resulted in surveillance intervals being shortened by 30.5% in high-risk patients. The CDC also observed a 28.5% increase in screening volumes, which is displayed by 75.5% for new processor sales going to GI suites, thus denoting a positive market outlook.

Product Type Segment Analysis

The 4k/8k image processors segment is predicted to grow at a considerable rate, with a share of 42.7% in the medical endoscope image processor market during the discussed timeline. The mandates necessitating 4k resolution systems for all sorts of cancer screening endoscopes have created a massive upgrade cycle for this subtype. As evidence NIH study in 2023 observed a 37.4% improved polyp detection rate when compared to HD systems, whereas the FDA underscores 29.3% in false positives during Barrett’s esophagus surveillance. Furthermore, they also enable 45.5% faster procedure times owing to the enhanced visualization capabilities, hence suitable for standard market expansion.

Our in-depth analysis of the global medical endoscope image processor market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Modality |

|

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

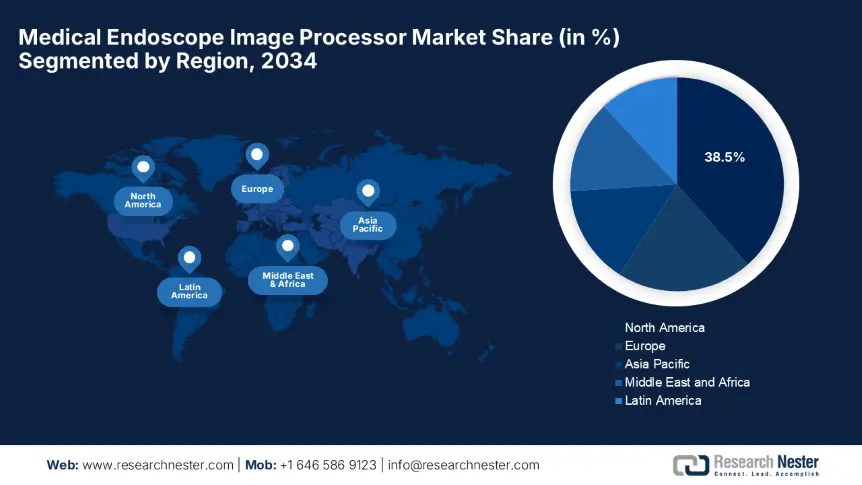

Medical Endoscope Image Processor Market - Regional Analysis

North America Market Insights

North America medical endoscope image processor market is dominating the global dynamics with the largest revenue share of 38.5% during the forecast timeline. The region’s leadership is attributed to the governing support and hospital consolidation trends. The U.S. accounts for 90.5% of regional demand, whereas Canada contributes the remaining through substantial funding grants. Besides, the FDA’s expedited Breakthrough Device pathway reduces the approval timelines by 6 months for the advanced processors, attracting more players to establish their footprint in this field. Further, 65.4% of ASCs are outsourcing endoscopy services to reduce expenses, thus benefiting market growth.

The U.S. is dominating the medical endoscope image processor market on account of strong reimbursement policies and higher awareness of early diagnosis. The Centers for Medicare & Medicaid Services (CMS) in 2024 expanded its reimbursements for AI-based endoscopy systems, whereas private insurers are enabling coverage for 45.4% of advanced endoscopy costs, marking a 30.9% up from 2022. Besides, the Agency for Healthcare Research and Quality (AHRQ) in 2023 reported that these advanced processors to reduce misdiagnosis by 29.6% hence making it preferable both by service providers and consumers.

Canada is gaining enhanced traction in North America’s medical endoscope image processor market, driven by its strong financial backing from public healthcare systems. In this context, Ontario invested a total of USD 420.6 million in terms of endoscopy upgrades. Besides, the Canadian Institute for Health Information (CIHI) notes that Health Canada concentrates on AI-integration, with 15.4% of hospitals predicted to adopt 4k systems by the end of 2026. Further, the public funding enables coverage of 70.5% of endoscopy expenses, wherein rural access still creates a gap in the market expansion.

APAC Market Insights

Asia Pacific is likely to exhibit the fastest growth in the medical endoscope image processor market from 2025 to 2034. The region’s upliftment in this sector is extensively propelled by the rising instances of cancer, healthcare digitalization, and government-led screening programs. Besides, the landscape is dominated by Japan, which is followed by China, India, South Korea, and Malaysia. South Korea contributes towards the regional expansion by prioritizing 3D endoscopy, with 30.6% of hospitals in the country of hospitals adopting AI-based tools. The 20.5% budget increment in Malaysia aims to modernize equipment, thus positioning Asia Pacific as a global hotspot in this field.

China is readily blistering growth in the medical endoscope image processor market with extensive support from domestic manufacturing capabilities and technological adoption. In this regard, the National Medical Products Administration (NMPA) report in 2024 stated that about 1.8 million patients received care through AI-assisted endoscopies, with a 40.5% cost reduction when compared to imported systems. Meanwhile, in 2023, it approved 8 new devices, deliberately capturing 60.5% of the market in the country. Besides the government initiatives, such as Healthy China 2030, assigned USD 7.2 billion for endoscopic upgrades with a prime focus on 90.4% 4k adoption in tier 3 hospitals by the end of 2027.

India medical endoscope image processor market is growing at a rapid pace, facilitated by expedited government support and private sector partnerships. The Ayushman Bharat scheme aims to develop 52,000 new HD endoscopy units by 2030, whereas the government spending has surpassed USD 2.3 billion yearly. Meanwhile, AIIMS' collaboration with Olympus aims to cut costs by a significant 35.4% through localized assembly stated in the Central Drugs Standard Control Organization (CDSCO) 2024 study. Further, the National Cancer Screening Program implemented in 2023 prioritized AI-colonoscopy in 100 districts, thus creating a prolific market opportunity.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Japan |

AMED AI-Endoscopy R&D Fund |

$168.8 |

2023 |

|

South Korea |

K-FDA AI Medical Device Fast-Track |

$225.6 |

2024 |

|

Australia |

MBS Reimbursement for AI-Endoscopy |

$80.7 |

2025 |

|

Malaysia |

Medical Device Transformation Plan |

$110.4 |

2023 |

Sources: AMED, K-FDA, MOH, Health.gov.au

Europe Market Insights

Europe is predicted to retain its position as the second-largest stakeholder in the medical endoscope image processor market, catered by its nationwide regulatory harmonization and rising cancer screening mandates. Germany and France have been leading this landscape with the presence of suitable reimbursements, whereas the UK closely follows this growth, emphasizing AI-assisted colonoscopies. Besides, the EU Medical Device Regulation (MDR) compels with 100% digital endoscope integration by the end of 2027, creating a €3.6 billion upgrade market, hence reinforcing the region’s captivity in this field.

Germany represents itself as the technological leader in the medical endoscope image processor market due to its widespread industrial collaborations and strong export hub. The market also gets support from the Federal Ministry of Health’s (BMG) Digital Healthcare Act, which reimburses AI endoscopy at €152 per procedure. On the other hand, Karl Storz, in collaboration with Fraunhofer Institute, developed real-time tumor detection AI, which has been appreciably adopted in 30.8% of hospitals in the country. Furthermore, 40.4% of processors made in Germany are exported to Asia, hence making it suitable for standard market growth.

France medical endoscope image processor market is gaining enhanced recognition due to its public health focus. The country witnessed a 15.5% faster cancer detection rate while leveraging AI, compelling manufacturers to introduce more of such efficacious products. Besides, the Ministry of Health in 2023 notes that the country received €300.7 million in public-private funds for 3D endoscopy R&D, fostering a favorable business environment. Further, the country’s National Authority for Health (HAS) mandated AI in all public hospital endoscopies, providing a huge opportunity for pioneers.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

UK |

NHS Long Term Plan - Diagnostics |

$630.3 |

2021 |

|

Italy |

Piano Nazionale di Ripresa e Resilienza (PNRR) |

$215.6 |

2023 |

|

Spain |

Digital Health Strategy |

$160.8 |

2022 |

Sources: NHS England, Governo Italiano, Sanidad.gob.es

Key Medical Endoscope Image Processor Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The medical endoscope image processor market represents an intensifying dynamic dominated by Japan and Germany-based pioneers emphasizing 4k technology and regulatory advantages. The U.S.-based firms, such as Medtronic and Boston Scientific, compete in terms of AI collaborations. R&D funds, geographic expansion, and merger acquisitions are a few strategies undertaken by the international players to uplift the market. In this regard, Fujifilm expanded to ASEAN to capture 30.75% of portable endoscopy demand, whereas Medtronic’s FDA-cleared GI Genius reduces missed lesions by a significant 40.5%.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Olympus Corporation |

Japan |

22.8% |

Global leader in 4K/8K endoscopy systems and AI-integrated image processors |

|

Fujifilm Holdings |

Japan |

18.9% |

Pioneering AI-endoscopy (CAD EYE) and portable processor solutions |

|

Karl Storz |

Germany |

15.4% |

High-precision 3D imaging systems for complex surgical applications |

|

Medtronic |

U.S. |

12.8% |

AI-powered GI processors (GI Genius) and urology imaging solutions |

|

Boston Scientific |

U.S. |

8.9% |

Specialized processors for biliary and pulmonary endoscopy |

|

Stryker |

U.S. |

xx% |

HD imaging processors for arthroscopy and ENT procedures |

|

Richard Wolf |

Germany |

xx% |

Modular processor systems for laparoscopy and hysteroscopy |

|

Cook Medical |

U.S. |

xx% |

Disposable endoscopy processors for cost-sensitive markets |

|

Smith & Nephew |

UK |

xx% |

Compact portable processors for ASCs and rural healthcare |

|

Mindray Medical |

China |

xx% |

Cost-competitive HD processors for mid-tier hospitals |

|

Aohua Photoelectric |

China |

xx% |

Dominant domestic Chinese manufacturer of endoscopic equipment |

|

Maxer Endoscopy |

Germany |

xx% |

Refurbished processor solutions for budget-conscious facilities |

|

Shaili Endoscopy |

India |

xx% |

Localized HD processors under India's manufacturing initiative |

|

B Braun |

Germany |

xx% |

Integrated fluid management and imaging systems |

|

Shenzhen Seenmed |

China |

xx% |

OEM components and processors for emerging markets |

|

LocaMed |

Malaysia |

xx% |

Portable processor solutions for ASEAN healthcare markets |

|

Cogentix Medical |

U.S. |

xx% |

Specialized urology image enhancement technologies |

|

EndoChoice |

Australia |

xx% |

AI-driven diagnostic processors for the Pacific region |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Medtronic expanded its AI endoscopy platform to Europe by securing CE Mark approval. The system cuts diagnosis time by 35.4% for colorectal cancer screenings, and early adoption in Germany and France boosted its revenue in Europe by 22.8% in the 2nd quarter of 2024.

- In April 2024, Sony upgraded its 8K imaging chipset by enabling real-time 3D tumor mapping, adopted by Karl Storz and Olympus. It improves surgical precision by 30.7% in pancreatic cancer cases.

- Report ID: 7926

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert