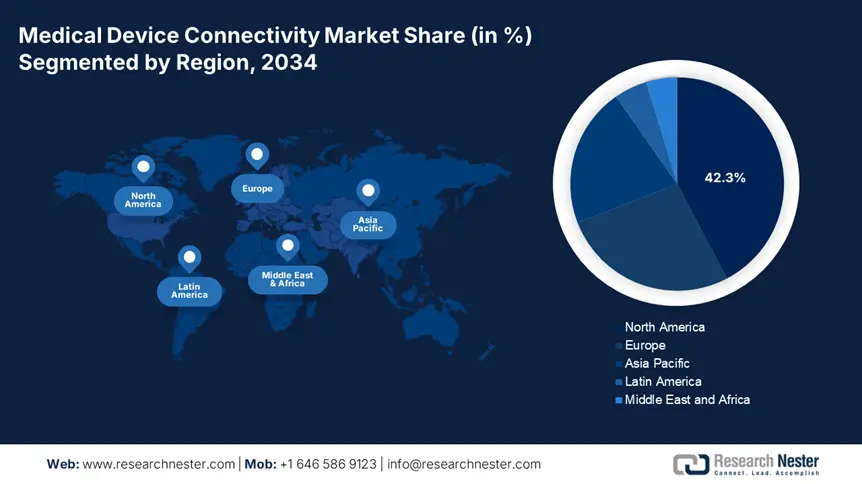

Medical Device Connectivity Market - Regional Analysis

North America Market Insights

North America is the dominant region in the medical device connectivity market and is expected to hold the market share of 42.3% at a CAGR of 10.8% by 2034. The region is driven by the strong government policy, widespread EHR adoption, and advanced healthcare infrastructure. The region will experience a sustained growth in the forecast period from 2025 to 2034. Federal investments in healthcare interoperability through CMS and Medicare rules have put the United States ahead, while digital health frameworks and federal-provincial cooperation have strengthened uptake in Canada. Further, the increased Medicaid and Medicare support in rising chronic illness prevalence demand real-time monitoring systems for better health care outcomes.

The U.S. market is still on the move, fueled by government investment in healthcare IT and outreach of EHR integration policies. The CDC report indicates that more than 85.4% of U.S. hospitals employ connected medical devices, but just 28.2% of small hospitals have reached complete interoperability because of the cost hurdle. The NIH and AHRQ together funded nearly USD 5.4 billion in health tech innovation in 2023, such as remote monitoring and device integration. Medicaid reported USD 1.6 billion in 2024 towards Medical Device Connectivity treatments, with new reimbursement codes improving access by 10.3%. In contrast, Medicare spending increased by 15.5% from 2020 to 2024, totaling USD 800.5 million, owing to increased device access for geriatric and chronic disease patients. Even with infrastructure lacunas in rural areas, more extensive EHR policies and payer alignment have established the U.S. as the leading market for Medical Device Connectivity.

North America- Government Investment & Policy Funding (2021–2025)

|

Country |

Initiative / Policy |

Focus Area |

Launch Year |

Funding Amount |

|

U.S. |

National Digital Health Strategy (ONC) |

Secure interoperability & device integration |

2022 |

USD 1.5 billion |

|

Telehealth Expansion for Chronic Care Act |

Reimbursement for remote device monitoring |

2023 |

USD 850.6 million |

|

|

Canada |

Canada Health Infoway – ACCESS 2022 Initiative |

Device-EHR interoperability & patient access |

2022 |

CAD 300.3 million |

|

Digital Health and Innovation Adoption Program (DHIAP) |

Provincial funding for connectivity platforms |

2024 |

CAD 420.6 million |

Asia Pacific Market Insights

The APAC is the fastest-growing region in the medical device connectivity market and is poised to hold the market revenue share of 21.2% at a CAGR of 11.6% by 2034. The region has a strong growth and is fueled by increasing chronic disease burden, rapid healthcare digitization, and government investment in health tech infrastructure. Leading economies such as China, India, Japan, South Korea, and Malaysia are spearheading this shift by incorporating cloud-based data sharing platforms, electronic health record (EHR) systems, and real-time monitoring into clinical procedures. Further according to government releases, China and Japan together lead the market by holding 60.2% overall share in the region due to strong and expansive hospital networks. The region has strong telehealth, surging the demand for interoperable devices and cloud-based connectivity platforms.

China is the leading nation and is expected to have a market share of 9.5% by 2034. As per the National Medical Products Administration (NMPA), government expenditure in China on Medical Device Connectivity increased by 15.7% over the past five years, driven by hospital infrastructure enhancements and local health tech manufacturing. In 2023, more than 1.9 million patients received benefit from connected care technology. The Healthy China 2030 plan helped market to drive this trend by focusing on telemedicine and integration of rural hospitals with devices. Both domestic manufacturing and interoperable device certification are encouraged by the policies of the country, facilitating greater public access and less dependency on imports.

APAC- Government Investment & Policy Funding (2021–2025)

|

Country |

Initiative / Policy |

Focus Area |

Launch Year |

Funding Amount / Notes |

|

Australia |

National Digital Health Strategy 2021–2027 (ADHA) |

Health IT & device data integration |

2021 |

AUD 309.4 million (Phase 1) |

|

Japan |

Smart Hospitals Promotion Project (MHLW) |

AI-based device-EHR integration in tertiary hospitals |

2022 |

USD 3.7 billion (till 2025) |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

Nationwide digital health record and connectivity |

2021 |

INR 1,600.8 crore (~USD 200.3 million) |

|

South Korea |

Smart Medical Infrastructure Strategy (MOHW) |

Interoperable device platforms in small hospitals |

2022 |

KRW 400.6 billion (~USD 340.3 million) |

|

Malaysia |

MyHDW & Hospital Digitalization Program (MOH) |

EHR-device data integration & health informatics |

2023 |

MYR 500.7 million (~USD 110.2 million) |

Europe Market Insights

Europe is actively expanding in the medical device connectivity market and is projected to hold the market share of 26.8% at a CAGR of 9.9% by 2034. The market is fueled by robust regulatory frameworks, rising hospital digitization initiatives, and rising investments in EHR integration and real-time patient monitoring. The UK, Germany, and France together are dominating the market in the EU region toward interoperable device systems as they support digital health strategies. Standardized data exchange and infrastructure enhancements are being promoted by the European Health Data Space (EHDS) program, which is backed by health.ec.europa.eu, and these are essential for linked medical devices. Further, nearly 70.4% of hospitals are actively adopting one layer of device connectivity, which is a rise from 54.3% since 2020. This shift impacts the long-term structural reforms, making digital health crucial in healthcare systems.

Germany is the largest stakeholder in the medical device connectivity market and is anticipated to maintain the revenue share of 9.4% in 2034. During 2024, the nation spent more than €4.5 billion for digital infrastructure enhancement under the Hospital Future Act. The law actively funds device-EHR integration, cybersecurity, and cloud solutions for public hospitals. The Federal Ministry of Health (BMG) indicated a 12.6% growth in the demand for connectivity of medical devices between 2021 and 2024, fueled by aging populations and decentralized care systems. The German Medical Association stated that more than 85.3% of hospitals had implemented connected devices in 2023. Further, the active implementation of digital devices in hospitals makes health data standardization and digital reimbursements easier in the country.