Medical Composites Market Outlook:

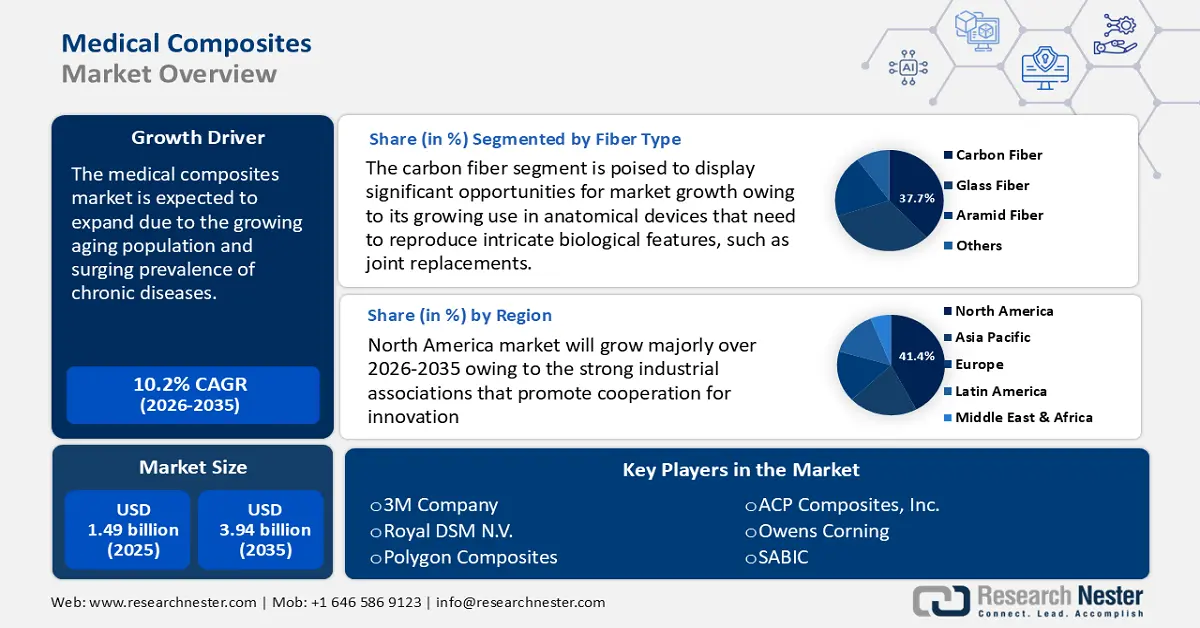

Medical Composites Market size was valued at USD 1.49 billion in 2025 and is likely to cross USD 3.94 billion by 2035, registering more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical composites is assessed at USD 1.63 billion.

The global medical composites market is expected to propel due to the increasing geriatric population and chronic diseases. According to a World Health Organization (WHO) report released in October 2024, the proportion of the population that is 60 years of age or older would rise from 1 billion in 2020 to 1.4 billion. The number of individuals in the world who are 60 years or older is expected to increase to 2.1 billion by 2050. Between 2020 and 2050, the population of people 80 or older is predicted to treble, reaching 426 million.

Advanced composites are extensively used in orthotics and prosthetic limbs, including braces, insoles, splints, spinal jackets, and helmets. Additional uses include implants, slow-release pill casings, surgical meshes, medical equipment, knee and hip replacements, and catheter tubing. The creative application of carbon fiber, glass fiber, and other composites has produced more durable, long-lasting, and efficient aids, significantly improving users' quality of life. This development represents a leap towards more individualized and responsive healthcare solutions as well as a technological advancement.

Recent developments indicate significant expansion in the production capacity of advanced composites across various industries, including potential applications in the medical field. In July 2023, Toray Advanced Composites, a pioneer in the creation and manufacturing of sophisticated thermoplastic and thermoset composite materials, announced the growth of its plant operations in Morgan Hill, California, U.S. The new building will expand the campus's current facilities by 74,000 square feet (6,800 square meters). Similarly, in March 2024, Jindal Advanced Materials partnered with Italy’s MAE S.p.A. to invest USD 324 million in establishing a carbon fiber plant in India with an annual capacity of 3,500 metric tons.

Key Medical Composites Market Insights Summary:

Regional Highlights:

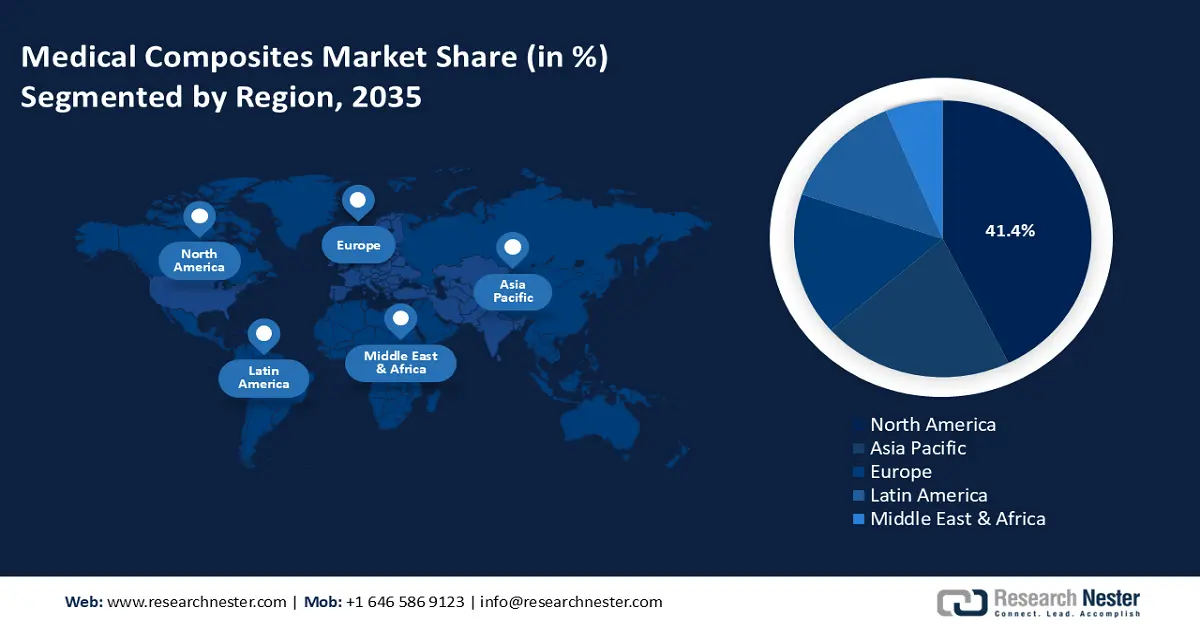

- North America dominates the medical composites market with a 41.4% share, driven by the presence of sizable medical device companies and well-established healthcare infrastructure, ensuring strong growth through 2035.

- Asia Pacific's medical composites market is set for significant growth by 2035, fueled by increased medical tourism and rapid economic development.

Segment Insights:

- The Diagnostic Imaging segment is projected to experience significant growth from 2026 to 2035, fueled by radiolucency and lightweight composite use.

- The Carbon Fiber segment of the Medical Composites Market is expected to hold a 37.7% share by 2035, propelled by its strength, biocompatibility, and durability in medical applications.

Key Growth Trends:

- Expanding utilization in precision surgeries and modern dental restorations

- Recent advances in the applications of medical composites

Major Challenges:

- Intensive clinical validation and compliance procedures

- High cost of carbon fiber

Key Players: 3M Company, Royal DSM N.V., Polygon Composites, ACP Composites, Inc., Shanghai Cedar Composites Technology Co., Ltd., Owens Corning, SABIC, SGL Carbon SE, Zeus Industrial Products Inc., Toray Industries Inc..

Global Medical Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.49 billion

- 2026 Market Size: USD 1.63 billion

- Projected Market Size: USD 3.94 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Medical Composites Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding utilization in precision surgeries and modern dental restorations: The increasing demand for minimally invasive surgical techniques is positively impacting the medical composites sector. The ONP Hospitals stated that the U.S. performs over 4,800,000 laparoscopic procedures annually, and nearly a third of the approximately 15 million laparoscopic surgeries performed globally. Minimally invasive procedures offer numerous advantages, including accelerated healing, a reduction in complications, and enhanced patient comfort. Medical composites are particularly well-suited to capitalize on these benefits. The lightweight nature of these devices renders them ideal for the development of thin and flexible instruments utilized in minimally invasive surgery.

- Furthermore, the advancement of composites has significantly improved various processes, such as osseointegration in dental implants, where the implant integrates with the jawbone, thereby serving as a long-term replacement for teeth. Applications of medical composites include dental crowns, bridges, braces, veneers, composite resin fillings, and dental bonding agents. The integration of strength, aesthetic appeal, and biocompatibility within medical composites is transforming the landscape of oral health care, facilitating the creation of more durable and effective dental solutions.

-

Recent advances in the applications of medical composites: Composite materials are lightweight and flexible, leading to advancements in wearable medical devices such as biosensors and medication delivery systems. These devices offer vital data for patients and healthcare practitioners, enabling ongoing health monitoring. Examples include rehabilitation exoskeletons, fitness trackers, health monitoring bracelets, and advanced hearing aids, all contributing to the growth of the medical composites sector. Recent research indicates that shipments of wearable bands increased by 0.2% to 44.3 million units worldwide in 2024. With shipments increasing 6% year over year, basic watches remained the market leader, primarily due to Xiaomi and Huawei. Therefore, the increasing sales of wearable fitness trackers is expanding the growth of the medical composites market.

-

Furthermore, recent advances in collagen composite is also escalating the market, particularly through antibacterial functionalization and 3D printed architecturalization. Antibacterial strategies such as metallic nanoparticles, bioactive peptides, and photothermal agents, help prevent infections in implants and wound dressings, improving patient outcomes. Meanwhile, 3D printing enables precise, customizable, and bioactive scaffolds for bone, cartilage, and soft tissue regeneration, enhancing structural integrity and tissue integration. As demand grows for infection-resistant, biocompatible, and patient-specific medical composites, the medical composites market is witnessing increased R&D investments, shaping the future of biomedical engineering.

Challenges

-

Intensive clinical validation and compliance procedures: Medical composite product development entails costly clinical testing and drawn-out procedures. Some medical devices' critical nature imposes strict limitations on them. For instance, although carbon-fiber and polyether ketone (PEEK) implants have been in use for the past 20 years, the FDA has not yet released comprehensive guidelines for composite implants. These devices are required to be biocompatible and meet ISO biocompatibility testing requirements since they need to stay inside the human body. Therefore, the medical composites market's expansion is hindered by onerous rules and lengthy regulatory processes.

-

High cost of carbon fiber: For many governments, research institutes, and carbon fiber manufacturers worldwide, finding and developing low-cost technologies for the commercial manufacturing of low-cost carbon fiber composites is a top priority. Production procedures need to be incorporated into new medical composite applications and technologies to improve product stability. To lower the manufacturing costs of carbon fiber-reinforced products through technological and process solutions, production and development projects are being carried out. These projects also aim to establish the foundation for a full-fledged use of carbon products in medical technology.

Medical Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.49 billion |

|

Forecast Year Market Size (2035) |

USD 3.94 billion |

|

Regional Scope |

|

Medical Composites Market Segmentation:

Fiber Type (Carbon Fiber, Glass Fiber, Aramid Fiber, Others)

Carbon fiber segment is projected to account for medical composites market share of more than 37.7% by the end of 2035. The segment is expected to dominate the market due to its exceptional mechanical qualities. Carbon fibers are lightweight, strong, stiff, and temperature tolerant. Despite being lightweight, they are extremely long-lasting, which makes them ideal for uses requiring flexibility and strength. These characteristics result in implants and medical equipment that are less prone to break or malfunction under pressure.

Additionally, complex designs that maximize functionality while reducing bulk and size are possible with carbon fiber composites. This is extremely useful for anatomical devices that need to reproduce intricate biological features, such as joint replacements. Additionally, carbon fibers are biocompatible and, unlike certain other materials, do not deteriorate over time in the body. Further, carbon composites resist corrosion, which is crucial for any material that is introduced into or comes into contact with bodily fluids and tissues.

Application (Diagnostic Imaging, Composite Body Implants, Dental Composites)

The diagnostic imaging segment in medical composites market is forecasted to hold a significant share during the projected period. The segment is growing since composites are essential to computed tomography, magnetic resonance imaging, X-ray, and ultrasound technologies. In this industry, composite materials are preferred because they combine durability, design versatility, and radiolucency. Composites enable the production of massive, precisely formed components for CT and MRI systems that do not impede or impair scan quality. They can accommodate the intricate geometries required to provide high-resolution images from various perspectives.

In addition, composites are lightweight, non-corrosive, and simple to form into seamless, massive pieces. Composites are used instead of conventional heavier metals in X-ray equipment components such as tubes, frames, casings, and parts near the patient. Their radiolucency doesn't produce unwanted artifacts or obstruct photos. Additionally, lighter composite housings enhance ergonomics and mobility. Composites are used to create robust probes and wand attachments for ultrasonic machines that efficiently transfer high-frequency sound waves. They use ultrasonic energy propagation for diagnosis without signal distortion or attenuation.

Our in-depth analysis of the global medical composites market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Composites Market Regional Analysis:

North America Market Statistics

North America in medical composites market is expected to capture over 41.4% revenue share by 2035. The region's need for innovative composite materials has been fueled by the existence of sizable medical device companies such as Vermont Composites, Inc. and well-established healthcare infrastructure. Strong industrial associations that promote cooperation for innovation are another advantage for the region's manufacturers. Strict guidelines for product approvals also set the standard for quality and encourage producers to keep improving their materials. The high level of integration in this regional medical supply chain makes it easier to get components and raw materials.

The medical composites market is expanding in the U.S. owing to the aging population, the increasing prevalence of chronic diseases, and the expansion of minimally invasive surgeries which have surged the demand for lightweight, durable, and biocompatible composites. According to the U.S. Department of Health and Human Services, an estimated 129 million U.S. citizens suffer from at least one serious chronic illness. Chronic diseases that may be prevented and treated account for five of the top ten causes of death in the nation, or are closely linked to them. The number of residents living with numerous chronic illnesses is rising; 42% have two or more, and 12% have at least five. Approximately 90% of the USD 4.1 trillion spent on health care each year goes toward treating and managing mental health issues and chronic illnesses.

Also, advances in 3D printing, nanotechnology, and antibacterial functionalization have further enhanced the performance of medical composites in areas such as orthopedics, prosthetics, and regenerative medicine. Additionally, strong R&D investments, regulatory approvals, and collaborations between medical device manufacturers and material science companies are accelerating innovation.

The medical composites market is expanding in Canada as a result of increased interest in dental aesthetics, poor oral hygiene, and the growing prevalence of tooth loss brought on by aging. Statistics Canada reported that in 2024 Four percent of persons over the age of 18 said they had lost all of their natural teeth. The majority of toothlessness afflicted seniors; 11% of people 60 and older reported losing all of their natural teeth, compared to 1% of adults 18 to 59. Also, by improving accuracy and reducing recuperation periods, digital dentistry—which includes 3D imaging and AI-assisted procedures—is predicted to revolutionize the field. It is expected that a wide range of people will be able to access implants due to the trend toward less invasive procedures and the availability of more reasonably priced implant solutions. Further, the growing use of implants for full-mouth rehabilitation will accelerate the demand for medical composites in the nation

APAC Market Analysis

Asia Pacific medical composites market is expected to grow at a significant rate during the projected period. Major macroeconomic drivers supporting the region's healthcare sector include increased medical tourism, rapid economic development, and rising disposable incomes. Expanded healthcare capabilities and more access to healthcare are being observed in nations including China, India, Japan, and South Korea. As a result, there is a greater need for medical devices and, consequently, medical composites. Additionally, the region's inexpensive labor and resources offer a compelling value proposition for international medical device manufacturers looking to outsource production. Consequently, numerous global producers of medical composites have established production facilities to satisfy the growing demand in the region.

Furthermore, in China, the expanding healthcare sector and increasing adoption of advanced medical technologies are primarily driving the medical composites market growth. The nation’s emphasis on improving healthcare infrastructure, coupled with government initiatives to modernize medical equipment manufacturing, further propels market growth. WHO revealed that the 2030 plan, which was drafted by more than 20 departments, outlines a vision for a greatly expanded health sector that will support the country's economy. This will significantly raise the standard and caliber of healthcare provided throughout the nation by using China's health research and technological innovation, which is among the greatest in the world.

Similarly, in India, the rapid expansion of the medical device industry, along with government initiatives promoting local manufacturing has boosted the adoption of medical composites. The India Brand Equity Foundation (IBEF) announced that the medical devices industry in India is projected to be worth USD 15.35 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.35% to reach USD 20.51 billion by 2029. An estimated 1.65% of the worldwide medical device industry is held by India. Additionally, the growing awareness of high-quality, lightweight materials in healthcare is driving hospitals and research institutions to incorporate medical composites for better patient outcomes.

Key Medical Composites Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Royal DSM N.V.

- Polygon Composites

- ACP Composites, Inc.

- Shanghai Cedar Composites Technology Co., Ltd.

- Owens Corning

- SABIC

- SGL Carbon SE

- Zeus Industrial Products Inc.

- Toray Industries Inc.

The medical composites market is highly competitive, with several prominent players vying for market share. Companies such as Owens Corning, 3M, Royal DSM, and others are leading the market, using their extensive product portfolios, robust research & development capabilities, and strong distribution networks. These companies are expanding their presence in the medical composites market through strategic partnerships, acquisitions, and investments in new technologies. The market is witnessing intense competition in terms of product innovation, pricing, and customer service, with companies focusing on cost-effective, and customized composite solutions for various medical applications.

Recent Developments

- In February 2024, Toray Advanced Composites, a leading developer and manufacturer of innovative composite materials, announced the implementation of a Life Cycle Assessment (LCA) program for their Toray Cetex thermoplastic composite materials. This strategic step demonstrates the company's commitment to environmental responsibility, as it seeks to assess and mitigate the environmental impact of its production operations.

- In June 2022, Owens Corning and Pultron Composites announced today that they have entered into a joint venture to develop industry-leading fiberglass rebar. This agreement reaffirms the companies' commitment to offering more sustainable product solutions and higher-performing concrete reinforcement materials.

- Report ID: 7157

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.