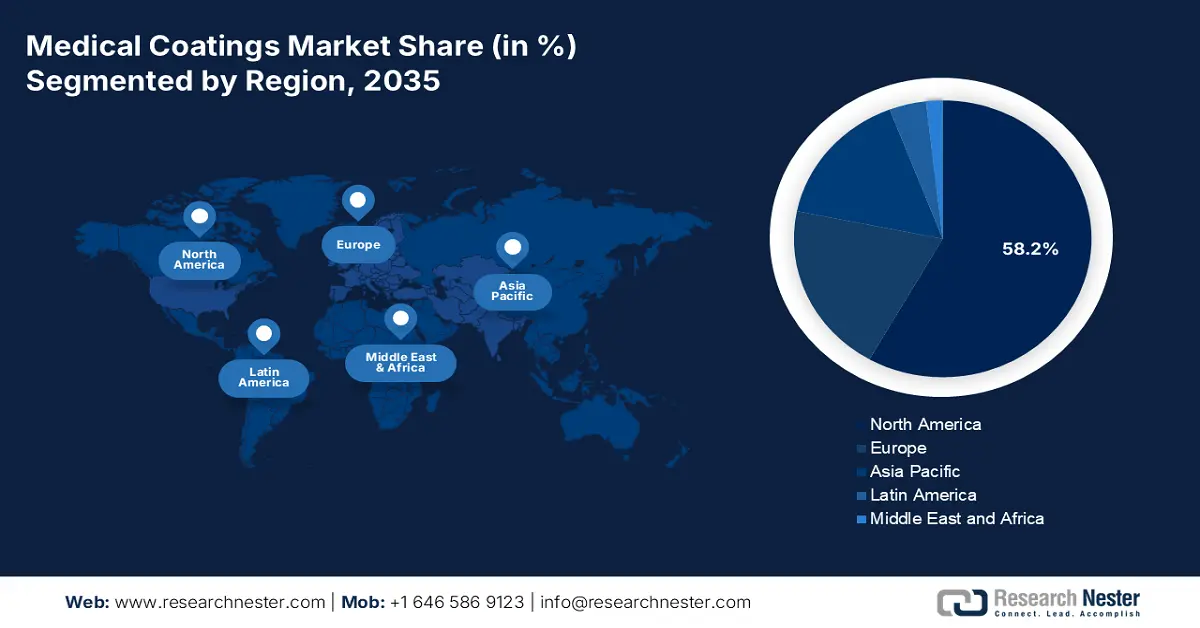

Medical Coatings Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 58.2% in the market during the analyzed tenure. The region’s dominance in this sector is highly attributable to federal infection-control provinces and regulations. In addition, the clinically proven outcomes of reduced HAI risks enable more robust reimbursement coverage from Medicare and Medicaid for coated catheters and stents. Moreover, the regulatory push towards MedTech manufacturers to align with protocols related to hygiene of medical devices to gain commercial and payer priorities is securing a sustainable cash inflow in this landscape.

The U.S. is one of the largest and most progressive consumer bases in the North America market. This can be exemplified by the 2022 report from the NLM, unveiling the annual number of CAUTI cases in the country surpassing 1.0 million, where associated costs of preventable incidences ranged between USD 115 million and USD 1.8 billion. This demography underscores a large-scale utilization of coated medical and surgical instruments, establishing a strong demand base for the merchandise. Evidencing the same, the import and export values of medical dressings, etc., having an adhesive layer, in the U.S. stood at USD 824 million and USD 676 million in 2023, according to the OEC data.

The Canada market is positively growing with the continuous influx of capital from national healthcare authorities to comply with the international infection control standards. Particularly, in long-term and acute care facilities, organizations are actively promoting the adoption of such protective layers to prevent deaths among the geriatric population. Besides, the nation holds a prominent position among the world’s top medical device manufacturers and suppliers, accounting for an industry value of USD 10.0 billion in 2024, which creates a favorable business environment for this sector.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the market by the end of 2035. Being home to international hubs of medical device production and innovation appears to be the strongest accelerator of progress in the APAC landscape. Besides, the growing focus on enhancing healthcare infrastructure and services by enacting strict infection-control regulatory reforms enables greater consumption in this category. On the other hand, government-led R&D budget allocations to med-tech and surgical instruments further facilitates a lucrative cash inflow in this sector.

In China, regulatory reforms by the National Medical Products Administration (NMPA) are increasing participation and investment in the market by mandating hygiene-compliance standards in the national medical system. Testifying to the same, the OEC reported that the robust export value of medical dressings, etc., having an adhesive layer, in China, which surpassed USD 940 million in 2024 alone. This also prompts innovation in the existing pipeline in this sector to align with the region-specific commercialization criteria.

The Japan medical coatings market is benefiting from the government incentive systems for antimicrobial agents and the annual price review system that recognizes the potential of high-cost medical device technologies in delivering better outcomes. Moreover, with one of the highest proportions of elderly citizens globally, there is growing demand for biocompatible and antimicrobial coatings for catheters, implants, and diagnostic tools in Japan. Additionally, the ongoing investments in R&D further strengthen its presence in this field.

Statistical Trends in Cardiac Surgery Demographics

|

Country |

Statistical Overview |

Timeline |

|

China |

A total of 69,000 congenital heart disease surgeries were performed in 728 hospitals nationwide |

2023 |

|

Japan |

Approximately 63,427 cardiovascular surgeries were performed, showcasing a 3.0% increase |

2022-2023 |

|

Australia |

132,000 coronary angiography procedures reported for patients admitted to hospital |

2021-2022 |

|

India |

Annually, 300,000 cardiac procedures were being performed across 420 cardiac centres in the country |

2023 |

|

South Korea |

The number of heart-related procedures is predicted to increase by 947,811 cases annually |

2023-2042 |

Source: NCCD, NLM, and AIHW

Europe Market Insights

The Europe market is estimated to garner a notable industry value from over the timeline between 2026 and 2035. The persistent growth of the region in this sector is primarily backed by regulatory convergence through EU MDR, public health agendas concerning HAIs, and rising R&D funding for novel technologies from the Horizon Europe Platform. Besides, the European Centre for Disease Prevention and Control (ECDC) estimated that HAIs occur in 4.3 million hospitalized patients per annum across Europe. In addition, it has been reported by the NLM in 2025 that HAIs cause 16 million additional days of hospitals stays every year in the region, with associated costs exceeding USD 8.2 billion, leading to a heightened interest in antimicrobial devices.

National reimbursement policies across the UK are favoring the revenue of supplier companies in the medical coatings market. The country is established as a sophisticated landscape, having an explicit focus on infection prevention, regulatory alignment, and cross-border research cohorts. The nation’s emphasis on this sector is also solidified through its stability in public offers, accomplished by ongoing NHS reform and partnerships with ABPI associations. Moreover, regulatory backing and new opportunities from payer-funded budget allocations continue to support the significance of UK in this field.

In Germany, continuous funding for coated devices from BMG-backed procurement programs fosters a well-established industrial strength and supply chain base for the market. On the other hand, the regulated environment of the MDR is assisting the country to speed up the uptake and participation in this sector. Inspired by such a favorable business atmosphere, in June 2024, Freudenberg Medical shared its plans to expand its drug device combination products portfolio by dedicating more than USD 50 million to constructing a new 130,000 sq. ft. Hemoteq AG production facility for drug and hydrophilic coatings for medical devices and components in the Aachen, Germany.

Country-wise Export-Import Data for Medical Dressings, etc.

(Having an Adhesive Layer) (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Germany |

582 million |

491 million |

|

Netherlands |

199 million |

386 million |

|

Ireland |

38.6 million |

34.6 million |

Source: OEC