Mechanical Ventilator Market Outlook:

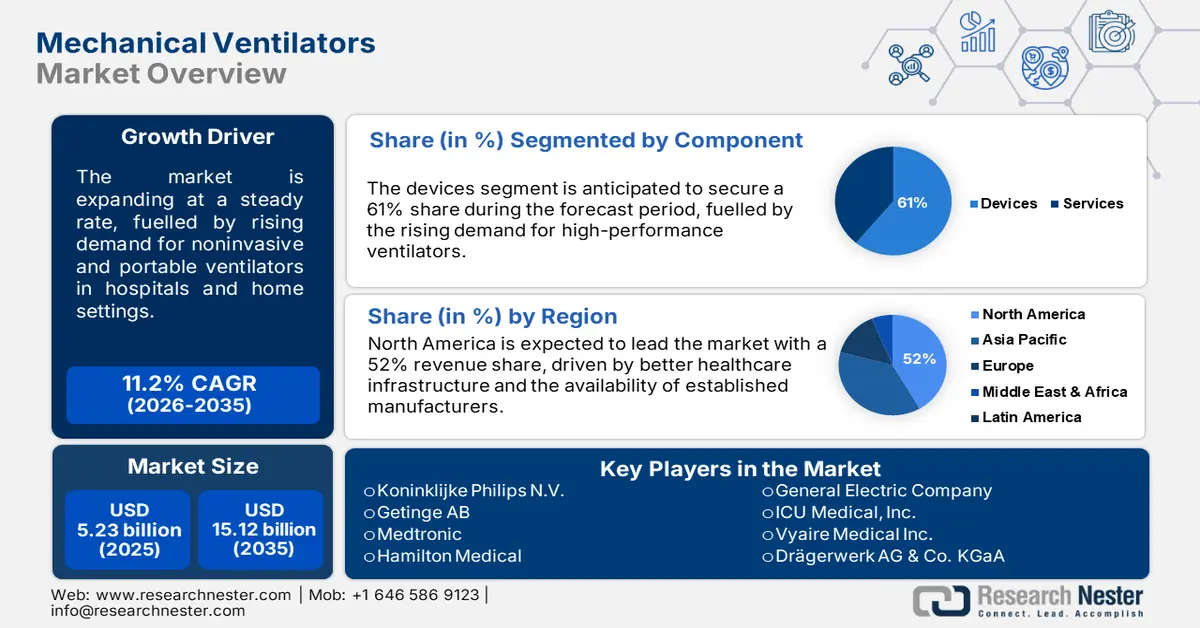

Mechanical Ventilator Market size was valued at USD 5.23 billion in 2025 and is expected to reach USD 15.12 billion by 2035, expanding at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mechanical ventilator is evaluated at USD 5.76 billion.

Mechanical ventilator are anticipated to witness substantial demand with the recent advancements in the field of medical technology, and the growing burden of chronic respiratory conditions across the world. The spike in demand for noninvasive and portable ventilator, both in hospitals and at home, is also poised to be a key driver in the market. The mechanical ventilator companies are focusing on researching innovation and strategic mergers to capture market share. For instance, Medtronic, in February 2024, announced its PMRI segment is being combined into a new unit, the Acute Care and Monitoring unit (ACM). The latest development represents Medtronic's strategic move to streamline its operations in areas of high growth within the ventilator segment.

The mechanical ventilator market is also driven by governmental efforts, particularly those that respond to global health challenges. While the U.S. government made landmark efforts in 2023 at securing low-cost medical devices for the country, the most outstanding among others is that it granted a patent to Villanova University professors who developed NovaVent, a CMV ventilating device that can be used in hospitals. Similarly, the WHO and UNICEF have provided the impetus to make ventilator resources available within low-resource settings under the mandates of their aspirational pact, Every Newborn Action Plan, intended to reduce neonatal mortality through acceleration of the use of essential respiratory devices.

Key Mechanical Ventilator Market Insights Summary:

Regional Highlights:

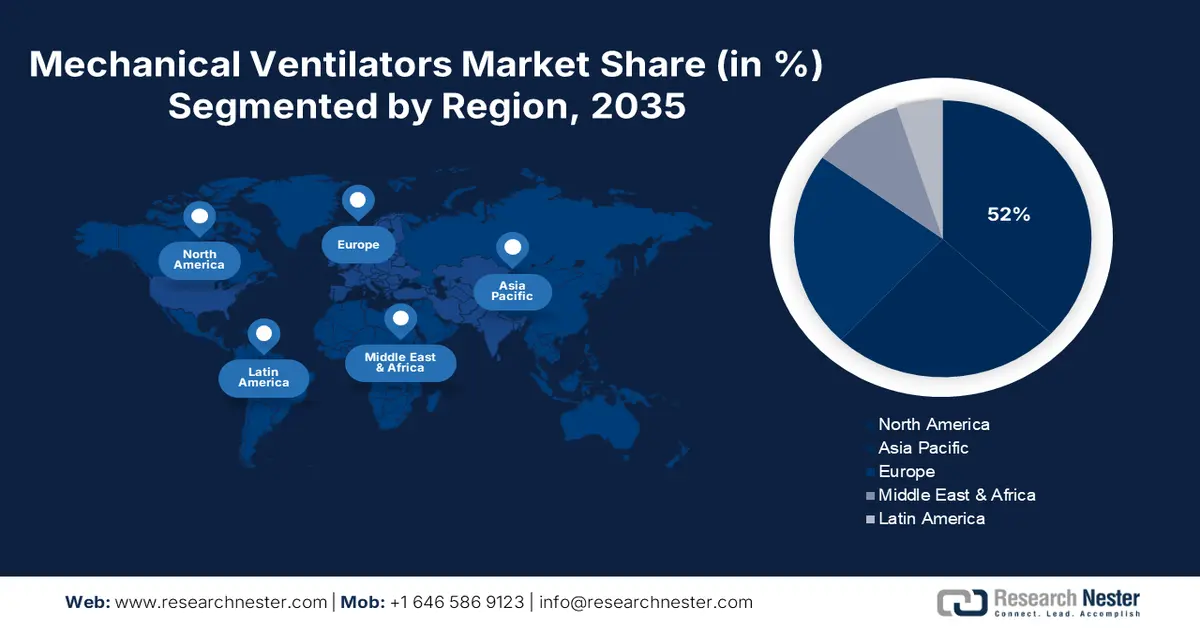

- The North America mechanical ventilator market will dominate around 52% share by 2035, driven by high investment in medical technologies and advanced patient care in the U.S.

- The Asia Pacific market grows rapidly with a strong CAGR during 2026-2035, driven by surging healthcare expenditure and increasing burden of respiratory diseases in major economies.

Segment Insights:

- The devices segment in the mechanical ventilator market is projected to hold a 61% share by 2035, driven by rapid innovation in ventilator technology and usability.

- The non-invasive ventilation segment in the mechanical ventilator market is expected to hold a 53% share by 2035, driven by preference for methods offering patient comfort and fewer complications.

Key Growth Trends:

- Increasing the prevalence of respiratory diseases

- Ventilator technology advancements

Major Challenges:

- Regulatory hurdles and compliance issues

- Disruptions in supply chains and shortages of materials

Key Players: Getinge AB, Medtronic, Vyaire Medical Inc., Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Hamilton Medical, General Electric Company, ICU Medical, ZOLL Medical.

Global Mechanical Ventilator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.23 billion

- 2026 Market Size: USD 5.76 billion

- Projected Market Size: USD 15.12 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Mechanical Ventilator Market Growth Drivers and Challenges:

Growth Drivers:

- Increasing the prevalence of respiratory diseases: One of the key factors contributing to the growth of the mechanical ventilator market is the rising incidence of various chronic respiratory diseases, such as COPD and obstructive sleep apnea. The American Lung Association estimates that over 16.4 million people have COPD, making the condition the third leading cause of death across the country. Thus, an increase in the burden of respiratory diseases due to these conditions calls for increased use of mechanical ventilator for breathing support.

- Ventilator technology advancements: Technological innovation is another key driver of the market, with players continuously making new inventions that can help mitigate the changing healthcare needs. Getinge launched its Servo-c mechanical ventilator in January 2023, based on modular parts for intelligent fleet management with advanced therapeutic functionalities. This will, therefore, guarantee the facilitation of operational cost reductions and desirable patient outcomes, hence accentuating the work in the course of developing highly advanced ventilation modalities fitting both hospital and home care.

Challenges:

- Regulatory hurdles and compliance issues: Some significant challenges that companies have to overcome in the mechanical ventilator market are related to the handling of a high level of regulation in different regions. Increased regulation in a region translates into more product approvals, with the resultant market entry taking place after the approval, affecting the overall growth within the sector.

In January 2024, Koninklijke Philips N.V. decided to reluctantly pull several respiratory products, among them ventilator, from the U.S. market due to the regulatory challenges and increasingly stringent compliance environment. Such pullbacks show how regulatory complexity can affect market dynamics. - Disruptions in supply chains and shortages of materials: Supply chain and material shortages remain the most critical challenges that companies in the mechanical ventilator market face. These have also delayed production and caused an increase in the cost of making it, affecting its timely availability. In October 2023, massive supply chain disruptions in the U.S., for instance, affected the manufacturing and distribution of key medical devices like ventilator.

Mechanical Ventilator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 5.23 billion |

|

Forecast Year Market Size (2035) |

USD 15.12 billion |

|

Regional Scope |

|

Mechanical Ventilator Market Segmentation:

Product Segment Analysis

The intensive care ventilator segment is expected to dominate the mechanical ventilator market, with an estimation of 38% by 2035. This growth is due to increasing demand for high-performance ventilator for critical care patients who require continuous and precise respiratory support. These factors justify the need for intensive care ventilator to manage severe respiratory conditions, particularly in an ICU setup where the prognosis of the patients is under close observation. In October 2023, Movair introduced Luisa, an advanced ventilator both for hospital and home care. Such product developments are a testament to the growing importance of intensive care ventilator in the market.

Ventilation Mode Segment Analysis

The non-invasive ventilation segment is anticipated to continue its dominance in the mechanical ventilator market and account for 53% of the total revenue share by 2035. The growth of the segment is predetermined by the growing preference toward non-invasive methods that have fewer complications and more comfort for patients. Non-invasive ventilation is helpful for patients at the stage of mild and moderate respiratory distress to avert invasive procedures such as the insertion of intubation. In August 2023, Getinge received FDA approval for its non-invasive mechanical ventilator, the Servo-air Lite, which indicates rising demand for treatment modes that are less invasive and solidifying dominance in the segment.

Component Segment Analysis

The devices segment is likely to lead the mechanical ventilator market with a share of 61% during the forecast period. This is because manufacturers are continuously deploying innovative technologies in ventilator and launching new products. Easy operation, high performance, and long life of ventilator with the latest technology have led to an increased focus by manufacturers on developing such devices to meet the requirements of patients with diverse natures.

In February 2023, Getinge launched its Servo-c ventilator, designed with modular parts to enable better functionality and allow a reduction in the cost of operation. This launch highlights the importance of this segment in the market, given that ventilator technology is continuously changing so that it meets different needs in today's health settings.

Our in-depth analysis of the mechanical ventilator market includes the following segments

|

Product |

|

|

Ventilation Mode |

|

|

Type |

|

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mechanical Ventilator Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 52% by 2035. The U.S. is dominating the market due to the high investment in medical technologies and advanced patient care. For instance, On July 4, 2024, Air Liquide Medical Systems announced the launch of the Monnal TEO-Resuscitation Ventilator for intensive and critical care in the U.S. market. This new ventilator, designed and built in France, demonstrates the continuous commitment of the company to developing mechanical ventilation.

Meanwhile, in Canada, the mechanical ventilator market is witnessing a rising trend, driven by the country's universal healthcare system. The initiatives toward better respiratory care in a growing incidence of chronic obstructive pulmonary disease also push the demand. Further, the modernizing of healthcare facilities in the country by the government is driving the advancement in medical devices, which further bolsters the market's growth in this country.

Asia Pacific Market Insights

Asia Pacific mechanical ventilator market is anticipated to continue to experience rapid CAGR through 2035 owing to surging healthcare expenditure and an increasing burden of respiratory diseases in some major economies such as India, China, and Japan. The market is growing across China as the government emphasizes enhancing healthcare facilities and ensuring better treatment for cases of respiratory illness, especially among the aged population. The initiatives to reduce air pollution, the most important cause of respiratory disease, will considerably hamper the growth of the mechanical ventilator market in the country.

Mechanical ventilator demand in India is on the rise, especially in rural areas, where evidence of critical care is still at a nascent stage. This market is expected to register significant growth as many governments are taking initiatives to improve healthcare infrastructure and trying to make the needed essential medical devices available on a large scale. One of the cases in point is the Indian government initiative, Ayushman Bharat-universal health coverage, which has a strong effect on changing market demand for critical care devices, such as ventilator, amongst others.

Mechanical Ventilator Market Players:

- Koninklijke Philips N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Getinge AB

- Medtronic

- Hamilton Medical

- General Electric Company

- ICU Medical, Inc.

- Vyaire Medical Inc.

- Drägerwerk AG & Co. KGaA

- ZOLL Medical Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

The mechanical ventilator market is highly competitive, with several major players dominating the landscape based on technological advancements and strategic acquisitions. The major players involved in this business include Medtronic, Getinge, and Nihon Kohden in the lead, although each radiates its expertise in controlling a significant share of the market. There is continual investment by these companies in research and development to come up with new innovative products that can meet the emerging needs of healthcare providers. The intensity of competition is further increased by key regional players such as Air Liquide Medical Systems and Dräger, which focus on localized strategies to gain a high share of the market.

Here are some leading players in the mechanical ventilator market:

Recent Developments

- In October 2023, Concern Radio-Electronic Technologies reported that the factory test of Mobivent Oxy mechanical ventilator made in Russia had been completed. The Mobivent Oxy made by the Urals Instrument-Making Plant is intended for high-flow oxygen therapy in children and adults.

- In May 2022, Fisher & Paykel Healthcare introduced the Airvo 3 high flow system targeted for oxygen therapy. This development is reflective of how the industry has been working to meet the demand for sophisticated solutions that have been improving respiratory care.

- Report ID: 6363

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mechanical Ventilator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.