Meat Processing Equipment Market Outlook:

Meat Processing Equipment Market size was over USD 7.8 billion in 2025 and is estimated to reach USD 15.2 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of meat processing equipment is assessed at USD 8.4 billion.

The worldwide meat processing equipment market is considered a critical and dynamic industry within the food manufacturing sector, offering crucial machinery for cutting, processing, packaging, and slaughtering animal proteins. The market is currently witnessing an effective transformation, which is propelled by a mixture of technological, economic, and consumer forces. Besides, according to an article published by NLM in December 2022, it has been predicted that the Internet of Things (IoT) will eventually save 22% to 29% of overall expenses, which accounts for USD 75 to USD 96 billion in yearly benefits. Therefore, the IoT integration ensures real-time data on machine performance, thereby boosting the market’s exposure.

Furthermore, as per a data report published by OECD in July 2025, the overall growth in meat consumption is estimated to be 47.9 million during the upcoming decade. In addition, the yearly per capita consumption is expected to surge by 0.9 kg per capita per year, and is projected to be edible retail weight equivalent by the end of 2034. Moreover, there has been optimization in breeding efficiency, and slaughter yields account for 8%, 27%, and 19% of gains in bovine, pig meat, and poultry meat production. Besides, the aspect of high-pressure processing adoption, waste reduction, sustainability, and the existence of flexible and modular system design are also uplifting the market globally.

Per Capita Meat Consumption By Meat Type and Income Group

|

Components |

Poultry Meat |

Pig Meat |

Beef |

Sheep Meet |

|

Low-income countries |

2022-2024: 2.0 2034: 2.3 |

2022-2024: 1.2 |

2022-2024: 2.3 2034: 2.5 |

2022-2024: 1.2 2034: 1.3 |

|

Low-middle-income countries |

2022-2024: 3.7 2034: 4.8 |

2022-2024: 1.7 2034: 2.1 |

2022-2024: 2.6 2034: 3.0 |

2022-2024: 0.8 2034: 0.9 |

|

Upper middle-income countries |

2022-2024: 13.7 2034: 16.0 |

2022-2024: 17.3 2034: 17.4 |

2022-2024: 6.8 2034: 7.6 |

2022-2024: 1.8 2034: 2.0 |

|

High-income countries |

2022-2024: 21.9 2034: 23.9 |

2022-2024: 21.8 2034: 21.9 |

2022-2024: 13.1 2034: 12.9 |

2022-2024: 1.02 2034: 1.04 |

Source: OECD

Key Meat Processing Equipment Market Insights Summary:

Regional Insights:

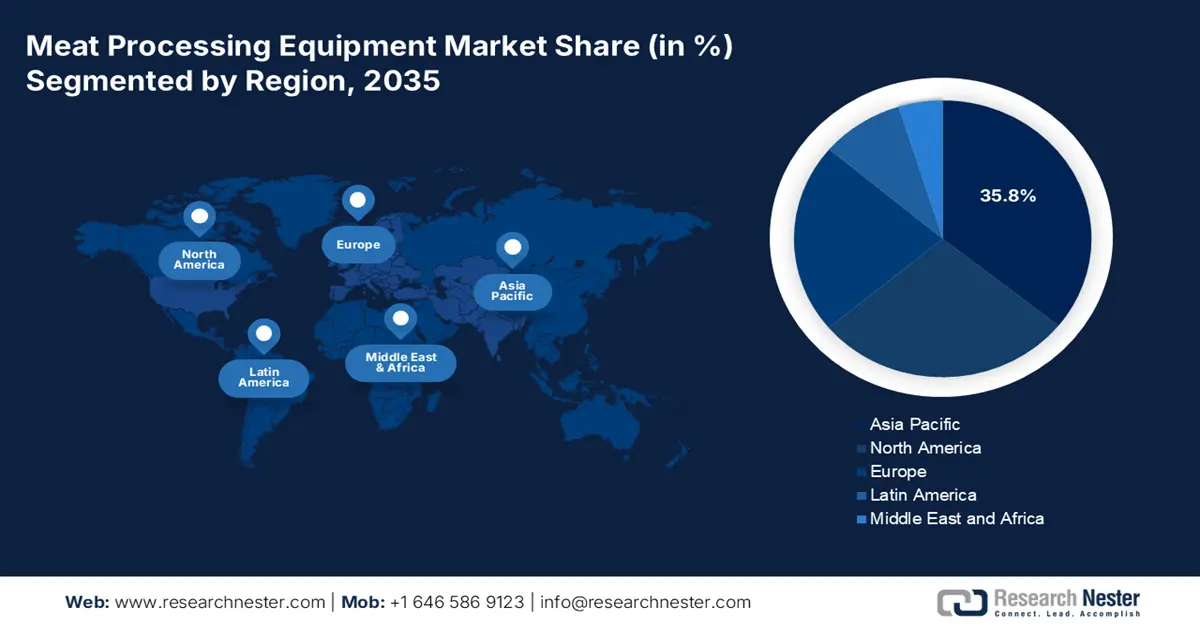

- By 2035, the Asia Pacific region is anticipated to command a 35.8% share in the meat processing equipment market, propelled by the rapid westernization of diets, rising disposable incomes, and the transition toward branded and processed meat products.

- By 2035, Europe is set to emerge as the fastest-growing region, underpinned by stringent food safety regulations, evolving consumer preferences, and deeper technological integration.

Segment Insights:

- By 2035, the automatic equipment segment is projected to capture a 65.8% share in the meat processing equipment market, driven by its ability to improve consistency and productivity while reducing waste and labor.

- By 2035, the industrial-scale processing plants segment is expected to hold the second-largest share, supported by its need for continuous, high-volume operations that rely on fully integrated and automated systems.

Key Growth Trends:

- Rise in consumer demand for value-added products

- Strict food safety regulations

Major Challenges:

- Technical expertise gap and skilled labor shortage

- Raw material expenses and supply chain volatility

Key Players: Marel (Iceland), GEA Group (Germany), JBT Corporation (U.S.), Alfa Laval (Sweden), Bühler Group (Switzerland), Heat and Control, Inc. (U.S.), Baader (Germany), Middleby Corporation (U.S.), SEW-EURODRIVE (Germany), Key Technology (U.S.), Reiser (U.S.), Treif (Germany), Risco USA (U.S.), Dover Corporation (U.S.), Marlen (U.S.), Unitherm Food Systems (U.S.), Fenco Food Systems (Italy), Ruhle GmbH (Germany), Maja GmbH (Germany), Varlet (France)

Global Meat Processing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.8 billion

- 2026 Market Size: USD 8.4 billion

- Projected Market Size: USD 15.2 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Mexico, Indonesia, South Korea

Last updated on : 4 November, 2025

Meat Processing Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Rise in consumer demand for value-added products: The fundamental shift in customer lifestyles towards ready-to-cook and ready-to-eat meals is the ultimate driver for uplifting the market globally. According to an article published by NLM in January 2023, the UK comprises one of the highest ready meal sectors internationally, with a market valuation of more than £3.9 billion. Additionally, it has been estimated that 88% of the adult population in the country consumes ready meals, with 2 out of 5 people consuming them every week. Further, chilled ready-to-eat meals make up almost 70% of the nation’s market share, with frozen meals accounting for the remaining 30%, thereby making it suitable for the market’s growth.

- Strict food safety regulations: International bodies and governments are successfully enforcing stringent food safety protocols, such as EFSA standards in Europe and the FDA’s FSMA in the U.S., which is also bolstering the meat processing equipment market’s growth. This has compelled processors to significantly invest in equipment with advanced hygiene design, data-logging capabilities, and automated inspection systems, including X-rays and metal detectors. The ultimate purpose is to effectively ensure complete traceability from farm to the fork, which denotes an optimistic approach for the market’s growth.

- Expansion in protein consumption: The aspect of an increase in disposable incomes, especially in the Asia Pacific economy, is deliberately resulting in higher per-capita meat consumption, which is boosting the market across different nations. As per an article published by OECD in July 2025, more than 55% of meat production growth will take place in Asia, led by a 15 Mt increase in poultry production. Besides, the post-ASF recovery in China will cater to almost 10% of the international meat production increase, which is followed by significant contributions constituting 8% in India and 7% in Vietnam.

Challenges

- Technical expertise gap and skilled labor shortage: While automation intends to diminish manual labor, it also creates a new challenge in the market, resulting in a severe engineer and technicians shortage in the operating process. Therefore, the sector experiences a dual skills barrier, leading to a reduction in conventional line workers and a deficit of highly trained specialists. This further results in increased reliance on equipment suppliers for support, increased maintenance expenses, and the risk of long-lasting downtime due to a lack of in-house expertise.

- Raw material expenses and supply chain volatility: The processing equipment manufacturing is increasingly susceptible to international supply chain disruptions, as has been observed with specialized components, steel, and semiconductors. In addition, delays in receiving parts can readily stall installation schedules and equipment production for processors. Meanwhile, the presence of volatility in raw material expenses, such as stainless steel, has directly increased the manufacturing expenses of the equipment. Thereby, this volatility eventually makes project planning and budgeting difficult for both clients and equipment manufacturers, resulting in delayed modernization and overrun costs, negatively impacting the meat processing equipment market.

Meat Processing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 7.8 billion |

|

Forecast Year Market Size (2035) |

USD 15.2 billion |

|

Regional Scope |

|

Meat Processing Equipment Market Segmentation:

Mode of Operation Segment Analysis

Automatic equipment segment in the meat processing equipment market is projected to account for the largest share of 65.8% by the end of 2035. The segment’s growth is largely attributed to its ability to enhance consistency, efficacy, and productivity by reducing errors and ensuring complete operations, while reducing expenses by minimizing waste and labor. Besides, according to an article published by NLM in May 2025, the meat market is expanding, with a projected USD 1,210.9 billion valuation by the end of 2027, denoting a 7.0% growth rate. Hence, to cater to the increased demand, approximately 80 billion animals undergo annual slaughter, thus bolstering the meat processing workload, and the rise in equipment manufacturing.

End user Segment Analysis

The industrial-scale processing plants segment in the market is predicted to constitute the second-largest share during the projected period. The segment’s development is fueled by its continuous production line and high-volume capacity for ensuring maximum output and efficiency. These particular facilities are primarily driving the need for automated, completely integrated, and high-capacity equipment systems. Its core requirement is gaining economies of scale, which uplifts it as the leading adopter of robotics for palletizing, slicing, and deboning, along with ensuring sophisticated software for yield optimization and production line management.

Application Segment Analysis

Based on application, the processed meat production segment in the meat processing equipment market is expected to cater to the third-largest share by the end of the forecast duration. The segment’s upliftment is propelled by its crucial role in creating convenient food products, providing different diet options, preserving meat, and expanding meat supplies. As per a data report published by the Ministry of Commerce and Industry in 2024, the processed meat export volume in India accounts for 813.7 MT, with a valuation of USD 2.4 million as of 2024. Therefore, this is positively impacting the segment and readily contributing to the market’s growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Mode of Operation |

|

|

End user |

|

|

Application |

|

|

Meat Type |

|

|

Equipment Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Meat Processing Equipment Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to account for the highest share of 35.8% by the end of 2035. The market in the region is propelled by a strong combination of rapid westernization of diets, a rise in disposable income, and urbanization. In addition, the rapid shift from conventional markets to branded, processed, and packaged meat products, which has necessitated industrial-based processing lines, is also responsible for uplifting the market in the overall region. Furthermore, the middle-tier automation adoption, wherein manufacturers are moving beyond basic machines to fully automatic and semi-automatic systems, is also skyrocketing the market.

The meat processing equipment market in China is growing significantly, owing to the existence of governmental modernization policies and massive regional consumption. According to an article published by the Our World in Data Organization in August 2025, the aspect of meat supply per person has gradually increased 18-fold to 70 kilograms as of 2022. In this regard, pork accounts for 57% of the meat supply in the same year, which is positively uplifting the market’s exposure. Besides, the Made in China 2025 strategy has funneled funds into advanced manufacturing, which includes smart food processing machinery, resulting in increased industrial-grade meat domestic production.

The market in India is also growing due to the aspect of explosive growth, which is significantly supported by the presence of central government schemes. Besides, the country’s Ministry of Food Processing Industries (MoFPI) has generously allocated funds with the objective to modernize facilities, particularly upgrading meat processing plants and granting subsidies for setting up standard infrastructures. As stated in the 2023 Department of Animal Husbandry & Dairying article, a credit guarantee fund of Rs. 750 crores has been established, while the Department made a payment of Rs. 75 crores per year for more than 10 years, thus bolstering the market’s development.

Europe Market Insights

Europe market is projected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly fueled by a robust emphasis on strict food safety regulations, a shift in consumer preferences, and technological integration. Besides, as per an article published by the USDA in February 2025, the organic sector in the overall region is gradually recovering since 2023, with approximate sales of almost USD 50.4 billion, denoting a surge by 10.5% from 2022. This further resulted in a 3% increase in organic agricultural area from 16.9 million hectares in 2022 to 17.4 million in 2023, thus catering to the consumers’ demand for minimally processed meat.

Organic Agriculture Key Indicators in Different Europe-based Countries (2023)

|

Countries |

Relevance/Prevalence |

Indicator |

|

Austria |

27.3% |

Organic share of overall agricultural land |

|

Spain |

316,550 ha (more than 11.8%) |

Increase in organic agricultural land |

|

Finland |

6.9 million hectares |

Wild collection and non-agricultural areas |

|

Germany |

EURO 16.1 billion |

Organic market |

|

Switzerland |

EURO 468 |

Per capita consumption |

|

Denmark |

EUR 362 |

Per capita consumption |

|

Austria |

EUR 292 |

Per capita consumption |

|

Germany |

87 |

Affiliates |

|

Italy |

32 |

Affiliates |

Source: FIBL Organization

The meat processing equipment market in Germany is gaining increased traction, owing to an increase in Industry 4.0 automation, with the intention of maintaining high labor expenses, a competitive edge, and stringent regulations. In this regard, as per the 2024 Consilium Europe report, the expansion in GDP utilization has resulted in an upsurge in the agricultural technology landscape, comprising more than 290 startups. In addition, at present, the country, along with the Netherlands and France, combines to utilize and are willing to adopt at least one technology, accounting for 55%, which is suitable for readily bolstering the market’s growth as well as the demand.

The market in the UK is also improving due to an increase in the focus on food security, as well as supply chain resilience post-Brexit. In addition, the demand to adhere to the country’s very own retained law and the evolution of safety standards by the Food Standards Agency (FSA) has resulted in the need for advanced traceability devices. Besides, according to a data report published by the UK Government in January 2022, almost 432,000 organizations in the country have adopted artificial intelligence, spending a total of £16.7 billion. The average expenditure amounted to £9,500 per small-scale business, £1.6 million per large-scale business, and £380,000 per medium-sized business, thus suitable for ensuring innovation in the market.

North America Market Insights

North America market is expected to grow steadily by the end of the forecast duration. The market’s upliftment in the region is highly driven by intense focus on regulatory compliance and food safety, along with efficient automation, labor cost pressure, product diversification, and increased demand for convenience by consumers. According to an article published by the Meat Institute Organization in March 2025, almost 98% of households in the region purchase meat, and 73% consider meat as a healthy choice. In addition, protein intake is essential for 90% of the population, including 83% eggs, 82% chicken, and 76% beef, thus suitable for the market’s growth.

The meat processing equipment market in the U.S. is gaining increased exposure, owing to increased focus on food safety and automation resilience, which has been mandated by the FDA’s FSMA to enforce strict preventive traceability and controls. Besides, as stated in the August 2022 ITA Government report, industrial robot installations in the country have increased at a 10.2% growth rate. In addition, it has been estimated that 45% of overall work activities in the country can be automated, displaying approximately USD 2.0 trillion in yearly wages, which is positively impacting the overall market.

The market in Canada is also growing due to the aspect of federal and provincial investments for food safety and export-based upliftment. In this regard, as per the August 2024 Government of Canada article, the governments of the country and Ontario are readily investing almost USD 5.0 million through the Sustainable Canadian Agricultural Partnership (Sustainable CAP). The purpose is the assist small-scale businesses in the food and agriculture sector to enhance their respective food safety systems and ensure continuous growth. Therefore, with such governmental contributions, there is a huge growth opportunity for the market in the overall country.

Key Meat Processing Equipment Market Players:

- Marel (Iceland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GEA Group (Germany)

- JBT Corporation (U.S.)

- Alfa Laval (Sweden)

- Bühler Group (Switzerland)

- Heat and Control, Inc. (U.S.)

- Baader (Germany)

- Middleby Corporation (U.S.)

- SEW-EURODRIVE (Germany)

- Key Technology (U.S.)

- Reiser (U.S.)

- Treif (Germany)

- Risco USA (U.S.)

- Dover Corporation (U.S.)

- Marlen (U.S.)

- Unitherm Food Systems (U.S.)

- Fenco Food Systems (Italy)

- Ruhle GmbH (Germany)

- Maja GmbH (Germany)

- Varlet (France)

- Marel is considered the global leader, well-known for its integrated farm-to-fork solution, offering completely automated processing systems and innovative standalone equipment for the majority of meat species. The organization is a pioneer in digitalization, providing sophisticated data analytics and sophisticated software that improve traceability, efficacy, and yield. Based on these, the organization, as per its published 2024 September annual report, has accounted for EUR 1,214.7 million in revenue, along with net cash amounting to EUR 62.7 million.

- GEA Group is one of the premier industrial technology that significantly supplies complete processing lines and highly engineered equipment for processing, cutting, and slaughtering. The company increasingly emphasizes sustainable solutions, with focus on automation technologies, hygienic design, and energy-efficient machinery to diminish waste and consumption.

- JBT Corporation is considered a notable international player, especially strong in offering advanced solutions for meat and poultry processing through its FoodTech segment. Additionally, the firm has focused on value-added technologies, such as packaging systems, frying, and marination. According to its 2024 annual report, JBT has achieved USD 523 million in quarterly orders, resulting in USD 92 million EBITDA, thus denoting a suitable opportunity for digital service expansion.

- Alfa Laval, while not emerging as a primary manufacturer of butchery equipment, is regarded as a critical supplier of high-efficiency heat exchangers, fluid handling systems, and separation technologies. Its contribution is essential for ensuring overall energy efficiency, extending shelf life, and ensuring product safety.

- Bühler Group has successfully leveraged its expertise in plant solutions and process engineering to provide innovative systems for further processing, especially in plant-based hybrid meat products and ready-to-eat production. Its focus on offering scalable and sustainable production technologies has ensured minimal environmental impact, food safety, and consistent quality.

Here is a list of key players operating in the global market:

The international meat processing equipment market is moderately consolidated, with a combination of specialized regional players and established multinational firms. Notable organizations, such as JBT, GEA, and Marel, have been dominating through approaches, including the provision of integrated and complete processing line solutions in comparison to standalone machines. Besides, a tactical initiative is the generous investment in Industry 4.0 and digitalization technologies, which readily embed IoT-based sensors into equipment. Besides, in February 2024, ProMach declared that it has successfully acquired Zanichelli Meccanica S.p.A. The intention is to expand its product portfolio and also strengthen its position as the world’s renowned provider for system integration, filling, and process systems.

Corporate Landscape of the Meat Processing Equipment Market:

Recent Developments

- In January 2025, JBT Marel Corporation notified its completion of settling the voluntary takeover offer to acquire outstanding and issued shares of Marel that has been tendered by shareholders.

- In April 2024, Fortifi Food Processing Solutions announced that it has successfully acquired Nothum Food Processing Systems for effectively expanding its innovative processing solutions, and permitting to serve to customers with excellence.

- Report ID: 8215

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Meat Processing Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.