Material Handling Robotics Market Outlook:

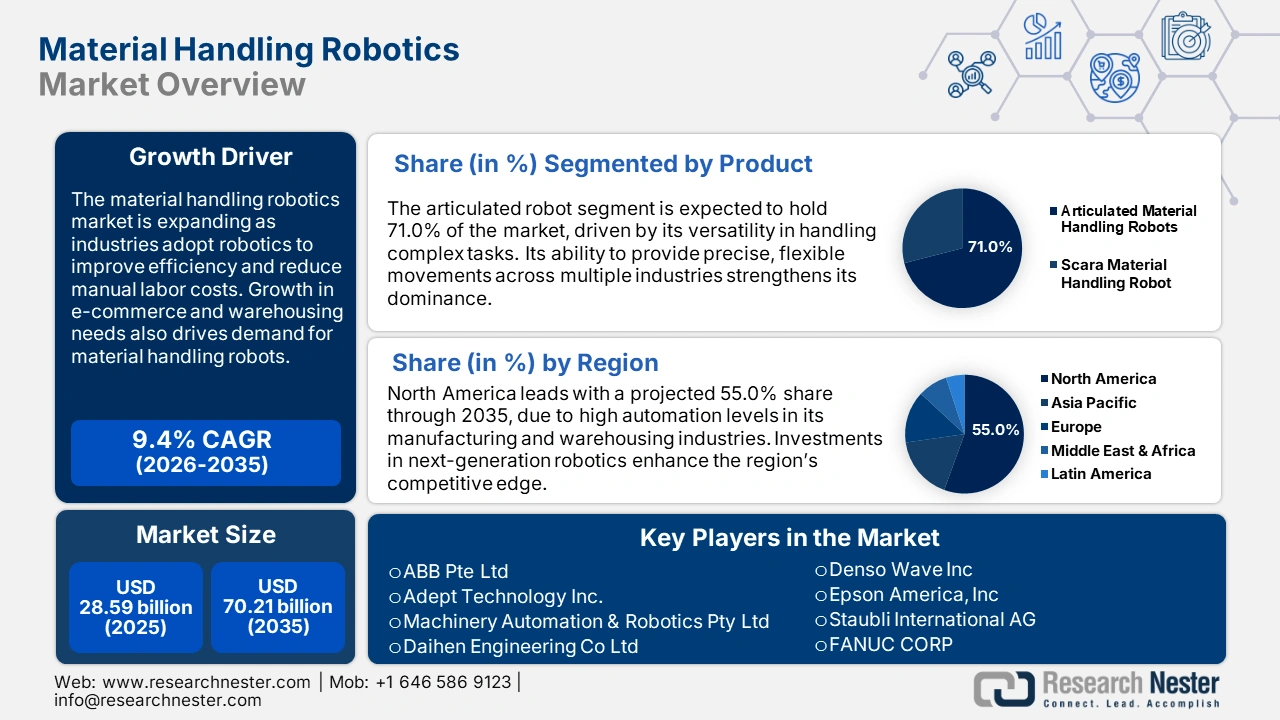

Material Handling Robotics Market size was valued at USD 28.59 billion in 2025 and is expected to reach USD 70.21 billion by 2035, expanding at around 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of material handling robotics is evaluated at USD 31.01 billion.

The increasing prevalence of AI, automation technologies, and the increasing usage of robotics in warehousing and logistics are some of the major factors driving the growth of the material handling robotics market. Material handling robotics is gaining widespread adoption in industries for automating the tasks of palletizing, pick-and-place operations, and inventory management in the most effective and cost-efficient manner, hence saving labor costs. Additionally, various government initiatives toward the modernization of supply chain operations and the encouragement of industrial automation are driving market growth.

Governments worldwide are also investing in robotics and automation initiatives, offering prospects for smart manufacturing and logistics infrastructure. Moreover, material handling robotics market players are paying attention to the integration of cognitive robotics into their operations to tackle labor shortages and improve warehouse safety. For example, in October 2024, Stow Group introduced Movu Robotics, a brand focused on intelligent robotic solutions for material handling with scalable systems for warehouse automation. This growing emphasis on sustainable and efficient material handling solutions places the material handling robotics market in a strategic position for strong growth over the coming years.

Key Material Handling Robotics Market Market Insights Summary:

Regional Highlights:

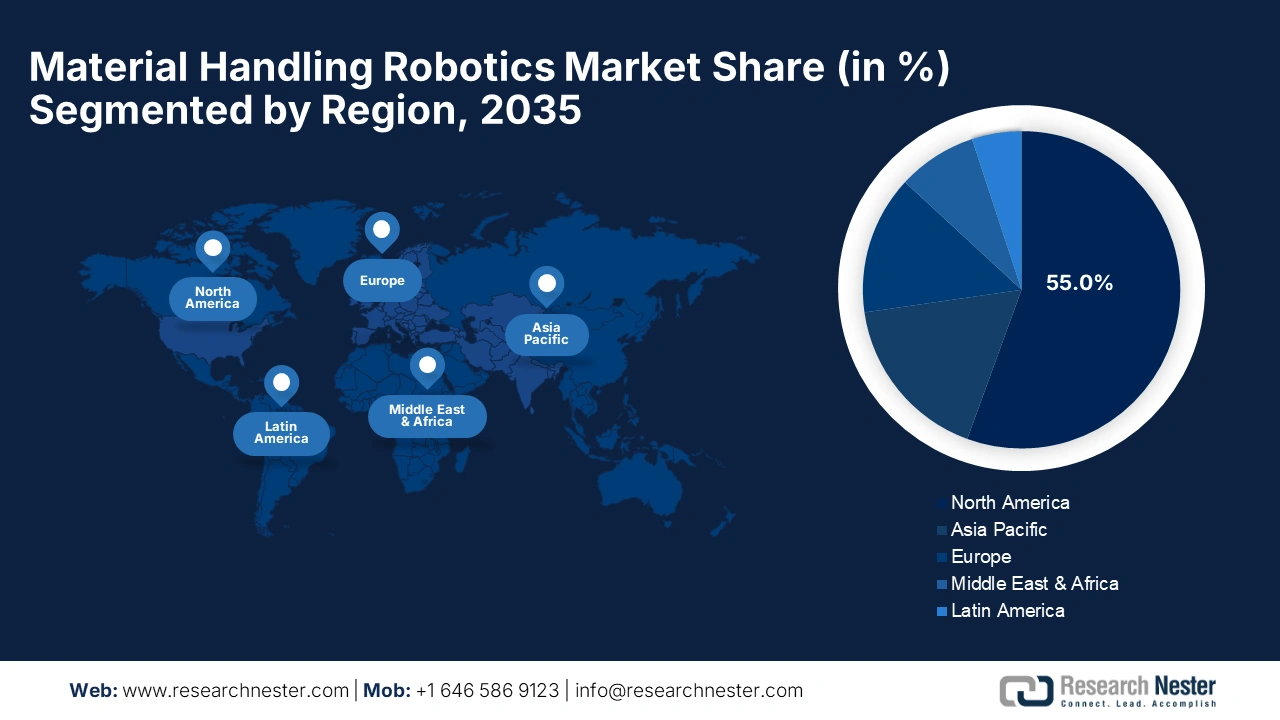

- North America material handling robotics market will account for 55% share by 2035, driven by highly developed industrial infrastructure, automation adoption, and investments in robotics.

- Asia Pacific market will register significant growth during the forecast period 2026-2035, attributed to surging demand from e-commerce and rapid industrial automation supported by government initiatives.

Segment Insights:

- The articulated robots segment in the material handling robotics market is projected to command a 71% share by 2035, driven by the versatility and precision of articulated robots in applications like palletizing, welding, and assembly.

- The pick and place segment in the material handling robotics market is expected to see substantial growth till 2035, driven by its crucial role in enhancing warehouse and manufacturing automation, improving efficiency and minimizing errors.

Key Growth Trends:

- Growing demand for warehouse automation

- Technological advances in robotics

Major Challenges:

- Integration difficulty with the existing structure

- Workforce reskilling and acceptance

Key Players: ABB Pte Ltd, Staubli International AG, Adept Technology Inc., Machinery Automation & Robotics Pty Ltd, Daihen Engineering Co Ltd, Denso Wave Inc, Epson America, Inc, FANUC CORP, KUKA Robotics Corporation, Nachi Robotic Systems Inc.

Global Material Handling Robotics Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.59 billion

- 2026 Market Size: USD 31.01 billion

- Projected Market Size: USD 70.21 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Material Handling Robotics Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for warehouse automation: Due to growth in e-commerce, there is an increasing demand for faster order fulfillment, which in turn drives the use of robotics in warehouse operations. Automation started changing the supply chain by smoothing the workflow, improving the accuracy of inventories, and greatly reducing operational costs. In September 2024, Seegrid closed its Series D funding round, raising USD 50 million for continued development and enhancement of its autonomous lift truck offering, the Lift CR1. This novel solution uses cognitive robotics to navigate challenging environments, automates material handling, and helps make industrial areas much safer and more productive.

- Technological advances in robotics: Ongoing innovations in robotics technology, including the integration of AI and advanced navigation systems, drive robots to perform even the most complicated operations and execute them with a high degree of precision. In September 2024, Mobile Industrial Robots introduced the MiR1200, an autonomous pallet jack capable of heavy loads, which will be able to provide much more sophisticated safety compared to earlier models. These technological advances expand material handling robots' capabilities further, resulting in increased adoption across industries.

- Sustainability and safety in focus: Robotics systems for energy use optimization and workplace safety enhancement. Such solutions address the twin challenges of sustainability and operational risk management concerns. ChargePoint Technology, in June 2024, launched a robotic material handling solution for the pharmaceutical industry and attained enhanced safety and contamination control. Such innovations showcase the industry's commitment to innovating sustainable and safe automation systems.

Challenges

- Integration difficulty with the existing structure: The difficulty in integrating such robotic systems into the existing infrastructure may be serious for old, legacy warehouses. It often results from complications arising out of incompatibility among aged equipment and processes. Most legacy infrastructure lacks the modularity required for an effortless implementation of robotics. Due to this fact, customization and complete system remodeling will be needed. These changes can be time-consuming and costly, especially for small-scale enterprises that have relatively limited budgets and lack a technical background.

- Workforce reskilling and acceptance: In most cases, material handling robotics includes an extensive workforce training or reskilling process, which emerges as an obstacle to industries that are resistant to change. Moreover, other competencies to be developed in the workforce regarding operation, maintenance, or interaction with robotic systems add another layer of complexity for implementation. Resistance to automation can also rise due to the perception of job loss or lack of understanding of high-end technologies.

Material Handling Robotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 28.59 billion |

|

Forecast Year Market Size (2035) |

USD 70.21 billion |

|

Regional Scope |

|

Material Handling Robotics Market Segmentation:

Product Segment Analysis

Articulated robots segment is expected to account for more than 71% material handling robotics market share by the end of 2035, considering the versatility and precision that articulated robots show in handling various tasks. In the applications of articulated robots, a wide range stretches from palletizing to welding and assembly. In April 2024, Liberty Robotics introduced VPick and VPack, AI-powered articulated models for palletizing and depalletizing, primarily highlighting their leading position in industrial automation. The segment shows an increase in demand for both flexible and efficient robotic solutions.

Application Segment Analysis

By 2035, pick and place segment is projected to dominate over 67% material handling robotics market share, as it plays a crucial role in disrupting warehouse and manufacturing automation. In this segment, robots facilitate higher efficiency and minimize errors in inventory management. KION North America announced in May 2024 its collaboration with Fox Robotics in developing autonomous forklifts optimized for no-contact pick-and-place tasks, further underlining the growing importance of this segment. This will continue to remain the dominant application because of its wide usage in logistics and production.

Our in-depth analysis of the material handling robotics market includes the following segments:

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Material Handling Robotics Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 55% by 2035, driven by highly developed industrial infrastructure, widespread adoption of automation, and significant investments in robotics technologies. Accordingly, it has sparked continuous innovation and market enlargement for the improvement of operational safety and efficiency in the region. E-commerce, automotive, and manufacturing industries are some key drivers behind the growth as these robotics help improve productivity by lowering costs. The strategic partnerships forged across companies accelerate the development of advanced robotic solutions that are tailored to regional needs.

The U.S. is leading the material handling robotics market due to the rapid adoption of robotics, and companies are continuously investing in new technologies to improve material handling processes. In November 2023, SSA Terminals, LLC ordered 33 terminal tractors equipped with fully automated high-power Quick Charging Connector (QCC) systems. This initiative is expected to enhance operational efficiency by reducing charging times and minimizing equipment downtime. Innovation and favorable regulatory support are fueling these advances in the country. The U.S. also has a large research community with collaboration between start-ups and established companies, which is driving the market growth.

With the support of the government for robotics innovation and its cooperation, the material handling robotics market is steadily growing in Canada. The country's focus on developing sustainable and efficient robotic solutions involves a number of investments and partnerships. For example, CopCoesia expanded its U.S. and Canada presence when it acquired Automation & Modular Components LLC in February 2024, further proving the region's commitment to investment in high-end automation. Applications of material handling robotics in industries such as warehousing, logistics, and manufacturing drive this adoption.

Asia Pacific Market Insights

Asia Pacific region is likely to observe significant growth till 2035, driven by surging demand from the e-commerce segment and rapid industrial automation across key economies such as China, India, and Japan. The region also benefits from a robust manufacturing ecosystem and heavy government initiatives in support of automation projects. Burgeoning labor costs and the need for streamlined warehouse operations act as additional accelerating factors for the market.

The material handling robotics market in India is amongst the fastest-growing industries in the world, enabled by advances in AI and robotics. In April 2024, Addverb Technologies opened its Software Development Center at Noida to reinforce AI-powered warehouse management systems. This move underlines the ambition of India in bringing forward innovative logistics and manufacturing solutions. Initiatives such as the "Make in India" program have meanwhile lured in substantial foreign investment, further strengthening the nation's local manufacturing capabilities.

China continues to lead robotics adoption in the region, driven by growing government investments and a relentless e-retail sector. According to the National Bureau of Statistics, total retail sales in China consumer goods market reached about CNY 41,860.5 billion (approximately USD 5,786.31 billion) in 2023. Online buyers increased from 34 million in 2006 to more than 915 million by 2023, promoting the rapid expansion of the country's online purchasing market. The surge has created an urgent need for higher-functioning warehouse robotics that will expedite order fulfillment efficiency. The strategic positioning by China regarding automation and self-reliance ensures that its robotics market will see robust, long-term growth.

Material Handling Robotics Market Players:

- ABB Pte Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Adept Technology Inc.

- Machinery Automation & Robotics Pty Ltd

- Daihen Engineering Co Ltd

- Denso Wave Inc

- Epson America, Inc

- Staubli International AG

- FANUC CORP

- KUKA Robotics Corporation

- Nachi Robotic Systems Inc

The material handling robotics market is highly competitive with several big players' presence, such as ABB Pte Ltd, Staubli International AG, Adept Technology Inc., Machinery Automation & Robotics Pty Ltd, Daihen Engineering Co Ltd, Denso Wave Inc, Epson America, Inc, FANUC CORP, KUKA Robotics Corporation, and Nachi Robotic Systems Inc. Many of the listed companies have invested in R&D and various forms of partnerships to provide specific solutions catering to industry needs.

In November 2024, Agility Robotics, supported by Amazon, announced plans to implement its first automated storage and retrieval system (AS/RS) in January 2025. This initiative aims to enhance warehouse efficiency by integrating advanced robotics into fulfillment operations, reducing manual labor, and accelerating order processing times. This development reveals the market focus on integrating advanced technologies for streamlining operations with lower labor dependence to improve productivity and ensure continued growth and innovation in the material handling robotics industry.

Here are some leading players in the material handling robotics market:

Recent Developments

- In March 2024, Wolter Inc secured a significant growth investment from BBH Capital Partners. This strategic partnership aims to accelerate Wolter's expansion plans, including acquisitions and real estate investments, thereby strengthening its industry position.

- In November 2023, ForwardX Robotics introduced the Max 1500-L Slim, an autonomous mobile robot (AMR) designed for warehouse logistics and manufacturing. Standing at 245mm (9.6 inches) tall, it offers a payload capacity of 1500kg (3,306 pounds), providing a compact yet powerful solution for material handling.

- Report ID: 6717

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.