Mastopexy Market Outlook:

Mastopexy Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.8 billion by the end of 2034, rising at a CAGR of 7.3% during the forecast period, from 2025 to 2034. In 2025, the industry size of mastopexy is estimated at USD 1.7 billion.

There has been consistent progress in the patient pool of mastopexy procedures influenced by the presence of rising aging demographics and post-pregnancy breast reconstruction demand. According to the report published by the World Health Organization in 2024, women aged between 35 to 55 are the key demographics contributing to an estimated 1.5 million yearly procedures in 2024. In addition, the data from the U.S. FDA in 2023 revealed that surgical implants and lifting devices used in this sector rely extensively on the global supply chain, wherein silicone and polymer-based raw materials are critically drawn from the U.S., Germany, and China.

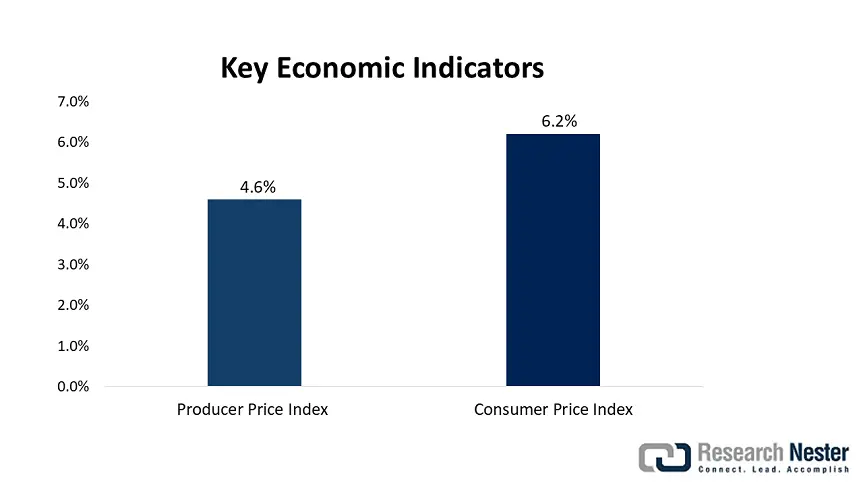

Furthermore, based on the economic aspects, the U.S. Bureau of Labor Statistics Data in 2024 underscores that the Producer Price Index (PPI) for mastopexy-related medical devices displayed a 4.6% year-over-year rise owing to the increased manufacturing costs. Meanwhile, the Consumer Price Index for cosmetic surgeries, including mastopexy, grew by 6.2% year-over-year due to the heightened demand. Moreover, the assembly lines for these mastopexy devices are especially concentrated in the FDA-approved facilities, wherein 66.4% of U.S. demand is met domestically, whereas the remaining is imported from Europe and Asia Pacific manufacturers.

Mastopexy Market - Growth Drivers and Challenges

Growth Drivers

-

Cutting-edge technological advancements in minimally invasive procedures: The aspect of technological advancements is rearranging the growth dynamics in the mastopexy market. Testifying to this U.S. FDA in 2023 stated that its approved laser-assisted mastopexy significantly reduced recovery durations by 40.3% thereby increasing adoption in ambulatory surgical centers. Similarly, the study by the National Institute of Health in 2024 revealed that 3D imaging for surgical planning improved outcomes with 92.4% patient satisfaction in terms of clinical trials, thus a positive market outlook.

-

Medical tourism and cross-border demand: The amplifying demand for breast reconstructions has readily shaped the foundation for the market. The report from USTDA in 2024 denoted that Mexico and Thailand witnessed a 30.4% increase in mastopexy medical tourism, owing to the 50.5% lower costs when compared to other nations. In addition, the OECD health data revealed that Turkey performed 46,000 mastopexy procedures yearly, attracting more patients in Europe, thus allowing a steady business flow.

-

Organizational strategies and market expansion: The strategies implemented by prominent organizations and geographic expansions are facilitating a profitable business environment in the market. The data from the Securities and Exchange Commission in 2024 reported that Allergan, in partnership with over 200 clinics in the U.S., successfully boosted implant-inclusive mastopexy sales by a remarkable 18.6%. In addition, Sientra announced the launch of a cost-optimized scarless mastopexy kit in Asia, which captured 12.5% market share within six months.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

Growth Rate |

Key Driver |

|

U.S. |

0.87 |

1.68 |

6.9% |

High disposable income, celebrity influence |

|

Germany |

0.35 |

0.62 |

6.1% |

Advanced healthcare, post-pregnancy demand |

|

France |

0.32 |

0.51 |

5.7% |

Medical tourism, aging population |

|

Spain |

0.18 |

0.42 |

9.3% |

Cost advantages, rising medical tourism |

|

Australia |

0.19 |

0.34 |

8.9% |

Cosmetic surgery boom, private healthcare |

|

Japan |

0.29 |

0.46 |

5.2% |

Aging demographics, minimally invasive tech |

|

India |

0.12 |

0.39 |

14.4% |

Urbanization, rising middle class |

|

China |

0.21 |

0.78 |

13.7% |

Medical tourism hubs |

Revenue Opportunities for Mastopexy Manufacturers (2023-2025)

|

Strategy |

Company Example |

Revenue Impact (2023) |

Projected CAGR (2025) |

|

Premium Implants |

Allergan’s Natrelle Boost |

$221.3 million |

9.6% |

|

Emerging Market Expansion |

Sientra’s India entry (2023) |

$96.2 million |

14.9% |

|

Minimally Invasive Tech |

Mentor’s Laser-Assisted Mastopexy |

$180.5 million |

11.9% |

|

Insurance Partnerships |

Polytech’s CMS reimbursement program |

$70.7 million |

8.7% |

Challenges

-

Competition from non-surgical procedures: The existence of non-surgical mastopexy procedures drastically hampers adoption in the mastopexy market. Indicating the same, the American Society of Plastic Surgeons (ASPS) reported that thread lifts grabbed 8.4% of the U.S. market in 2023, which ultimately creates pressure on the traditional mastopexy sales. On the other hand, in South Korea, the non-surgical market displayed a 25.5% year-over-year growth, negatively impacting the current market dynamics.

-

Geopolitical trade restrictions: The administratively imposed trade restrictions on the market products hinder the profitability of international players. For example, in 2023, the U.S.-China trade tariffs increased the mastopexy device costs by a significant 12.4% as of a U.S. Trade and Development Agency study. Simultaneously, in Turkey, the import restrictions caused a delay of 60,500 mastopexy kits in the same year, thus adding to the exacerbated costs for manufacturers.

Mastopexy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.3% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 2.8 billion |

|

Regional Scope |

|

Mastopexy Market Segmentation:

End user Segment Analysis

The specialty clinics segment is anticipated to garner the highest share of 42.8% in the market during the assessed time frame. The dominance of the segment originates from its cost efficiency, which makes it preferable among a wider group of the audience. The World Health Organization study underscores that these clinics offer services at 30.5% cheaper costs and 90.7% higher patient satisfaction. On the other hand, the CMS 2024 data highlighted a 15.6% year-over-year rise in clinic-based mastopexy, thus a wider segment scope.

Type Segment Analysis

The inverted-T mastopexy segment is projected to attain a lucrative share of 35.6% in the market by the end of 2034. The segment’s growth originates from its superior outcomes and surgeon preference. Testifying to this, the U.S. FDA reports that this is preferred for severe ptosis correction due to superior long-term outcomes with a 20.5% lower revision rate when compared to other techniques. In response, the ASPS 2023 data unveiled that 60.6% of U.S.-based surgeons utilize this method for post-pregnancy cases, hence creating a positive market outlook.

Material Segment Analysis

The silicone implants segment is predicted to grow at a considerable rate, with a share of 28.5% in the market during the discussed timeline. The lower complication rates, natural feel, and rupture resistance are key factors propelling the segment’s growth in this sector. In this context, the approvals for gummy bear silicone implants in 2023 resulted in a 22.4% sales rise owing to their natural feel and rupture resistance. Simultaneously, the NIH studies underscore that these silicone implants enable a 40.5% lower complication rate when compared to saline implants in mastopexy augmentation combos.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Type |

|

|

Material |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

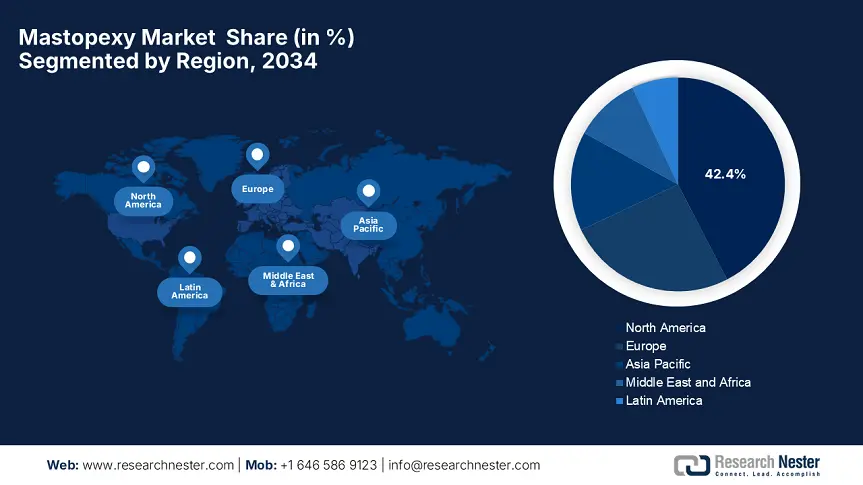

Mastopexy Market - Regional Analysis

North America Market Insights

North America is poised to dominate the global mastopexy market with the largest share of 42.4% during the forecast timeline. The region’s leadership is attributed to its robust healthcare infrastructure and high disposable incomes. The U.S. contributes 90.6% of the regional demand, whereas Canada contributes the remaining 9.4% owing to the strong fiscal backup in the country. The data from the American Society of Plastic Surgeons revealed that the U.S. hosts 1.8 million procedures per year, which is further supported by favorable reimbursement policies. Furthermore, the region hosts the most skilled workforce, thus fostering a competitive business environment.

The U.S. is augmenting its dominance in the regional market on account of strong coverage expansions and high procedural volumes. In this context, the Medicare spending represented a 15.8% year-over-year increase in 2024, which covers post-mastectomy reconstructions as well. Besides, the country witnessed a strong demand for combination procedures such as augmentation + lift, which showcased 45.6% surgeries in 2024. Further, outpatient settings are currently enabling 60.6% of procedures due to their cost efficiency, according to the Agency for Healthcare Research and Quality data.

Canada is portraying steady growth in North America’s market owing to the provincial healthcare expansions. As evidence, Health Canada stated that Ontario’s provision of USD 320.6 million in 2024 served around 230,000 patients yearly, reflecting the presence of a vast consumer base. Besides, the Public Health Agency of Canada stated that public hospitals perform 70.7% of the procedures, whereas private clinics dominate in terms of elective cases. Furthermore, the non-surgical alternatives, such as RF devices, grew by 12.5% year-over-year, thus indicating a positive market outlook.

APAC Market Insights

Asia Pacific is likely to be the fastest-growing region in the mastopexy market from 2025 to 2034. The market’s upliftment in the sector is extensively driven by increasing aesthetic awareness, rising disposable incomes, and medical tourism. The landscape is dominated by China with a 38.8% of regional revenue share, followed by Japan, South Korea, and India. Japan and South Korea are establishing strong opportunities in minimally invasive technologies, wherein laser-assisted lifts are gaining traction, supported by government R&D grants. Hence, all of these factors position Asia Pacific as a global hotspot in this field.

China in the market is augmenting its dominance in the Asia Pacific region, driven by a massive population and the demand for these aesthetic procedures. The National Medical Products Administration (NMPA) notes that government spending on cosmetic products surged 15.7% yearly, surpassing USD 2.3 billion in 2023, catering to 1.8 million mastopexies. The country witnesses such demand from the urban women who are aged between 30 to 50 seeking post-pregnancy or age-associated breast lifts. In addition, the medical tourism sector in the country attracts patients from Russia and Southeast Asia due to its 30.8% lower costs.

India in the market is continuously growing due to the presence of affordable pricing and medical tourism. The Ministry of Health and Family Welfare reported that the government spending increased by 18.7% over the last decade, reaching USD 2.2 billion in 2024, wherein 2.7 million patients received care. The country’s major medical hubs, such as Mumbai and Delhi, witness heightened demand from post-weight-loss and post-pregnancy patients. Furthermore, the private hospitals such as Apollo and Fortis reported a 30.5% increase in mastopexy surgeries from 2022 to 2024, thus reinforcing the country’s captivity over this sector.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

Medicare rebates for reconstructive mastopexy |

$5.6 (annual subsidy) |

2022 |

|

Japan |

"Beauty Medicine" tax incentives for clinics |

$10.8 (private-sector grants) |

2023 |

|

South Korea |

KFDA approval of non-surgical breast lifts |

$8.7 (R&D for minimally invasive tech) |

2024 |

Europe Market Insights

Europe is projected to retain its position as the second-largest stakeholder in the global mastopexy market. This is supported by the presence of rapidly aging populations, medical tourism, and regulatory support. As evidence European Medicines Agency (EMA) stated that 25.6% of women in the country are aged above 50, which remarkably drives demand for ptosis correction. Besides, the EU MDR 2023 successfully streamlined approvals, which reduced the launch timelines by 20.7% according to the EU Health Data Space. Further, the Association of the British Pharmaceutical Industry (ABPI) states that the non-surgical alternatives, such as thread lifts, represented a 15.7% yearly growth in the U.K. and Spain.

Germany in the mastopexy market is portraying its dominance in Europe owing to favourable reimbursement policies and rising demand for 3D and custom implants. In this context, the country’s Federal Ministry of Health (BMG) enables partial coverage for mastopexy in terms of medically necessary cases such as post-mastectomy or severe ptosis. 50.6% of these elective procedures receive partial insurance support, which increases accessibility. Further, the study by EMA in 2024 found that the 3D-printed implants and surgical planning tools grew by 25.7% thereby improving precision in mastopexy with augmentation.

France is solidifying its position in the regional mastopexy market due to the post-pandemic aesthetic surge and cost reduction in terms of public-private partnerships. The country witnessed an 18.5% increase in demand post-COVID as patients started being increasingly conscious about self-care and body rejuvenation. Besides, mastopexy is among the top 3 cosmetic surgeries for women aged 36 to 55 in the country. The EC Health Report, published in 2023, notified the existence of subsidized clinics in the country enabled 15.6% reduced surgery costs. Further, the hybrid financing models make these procedures more affordable, thereby reaching to broad group of audience.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

UK |

NHS limited coverage for severe ptosis cases |

£20.7 (targeted grants) |

2023 |

|

Italy |

Tax deductions for elective aesthetic procedures |

€15.8 (clinic incentives) |

2021 |

|

Spain |

Regional subsidies for minimally invasive techniques |

€10.4 (Andalusia, Catalonia) |

2024 |

Key Mastopexy Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The mastopexy market is witnessing intensifying competition with U.S. and Europe-based pioneers dominating through technological innovations and mergers. Besides, the players are also emphasizing R&D for scar reduction technologies and 3D printed implants, whereas the Asia-based manufacturers, such as KOKEN and HansBiomed, concentrate on minimally invasive solutions. Players such as Allergan are implementing training programs and establishing labs to uplift the market growth internationally. Price competition remains progressive, wherein companies from India, such as Arihant, target cost-conscious service providers. Furthermore, the partnerships with aesthetic clinics and telemedicine platforms are assets of this landscape.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Allergan Aesthetics |

U.S. |

18.9% |

Breast implants and tissue expanders (Natrelle portfolio) |

|

Mentor Worldwide (J&J) |

U.S. |

15.4% |

Silicone implants and mastopexy support systems |

|

GC Aesthetics |

Ireland |

12.3% |

Eurosilicone and Nagor implants for lift procedures |

|

POLYTECH Health & Aesthetics |

Germany |

10.6% |

MemoryShape breast implants for mastopexy |

|

Sientra |

U.S. |

8.8% |

OPUS implants for combined augmentation-mastopexy |

|

Sebbin |

France |

xx% |

Anatomical cohesive gel implants |

|

HansBiomed |

South Korea |

xx% |

Minimally invasive lift devices and bio-absorbable mesh |

|

Establishment Labs |

Costa Rica |

xx% |

Motiva Ergonomix implants for natural-looking lifts |

|

Groupe Sebbin |

France |

xx% |

High-strength silicone gel implants |

|

Aesthetic Group |

Australia |

xx% |

Customizable implant solutions for the APAC market |

|

Implantech |

U.S. |

xx% |

Affordable implant options for emerging markets |

|

CEREPLAS |

France |

xx% |

Textured surface implants for better fixation |

|

HANSBIOMED |

South Korea |

xx% |

Scar-reducing surgical techniques |

|

Nagor |

UK |

xx% |

Gel-Filled mammary implants |

|

Silimed |

Brazil |

xx% |

Porous-surface silicone implants |

|

Arihant Surgicals |

India |

xx% |

Cost-effective surgical kits for emerging markets |

Recent Developments

- In May 2024, Establishment Labs announced the launch of Motiva Flora, which is a Scarless Lift System. This non-surgical mastopexy alternative uses bio-stimulating threads for mild-to-moderate ptosis correction.

- In March 2024, Allergan Aesthetics introduced Natrelle TRUFORM Implant, a next-generation silicone implant, featuring enhanced durability and natural movement. The launch captured 12.8% of the U.S. mastopexy implant market within the 2nd quarter of 2024.

- Report ID: 7927

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mastopexy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert