Mass Notification System Market Outlook:

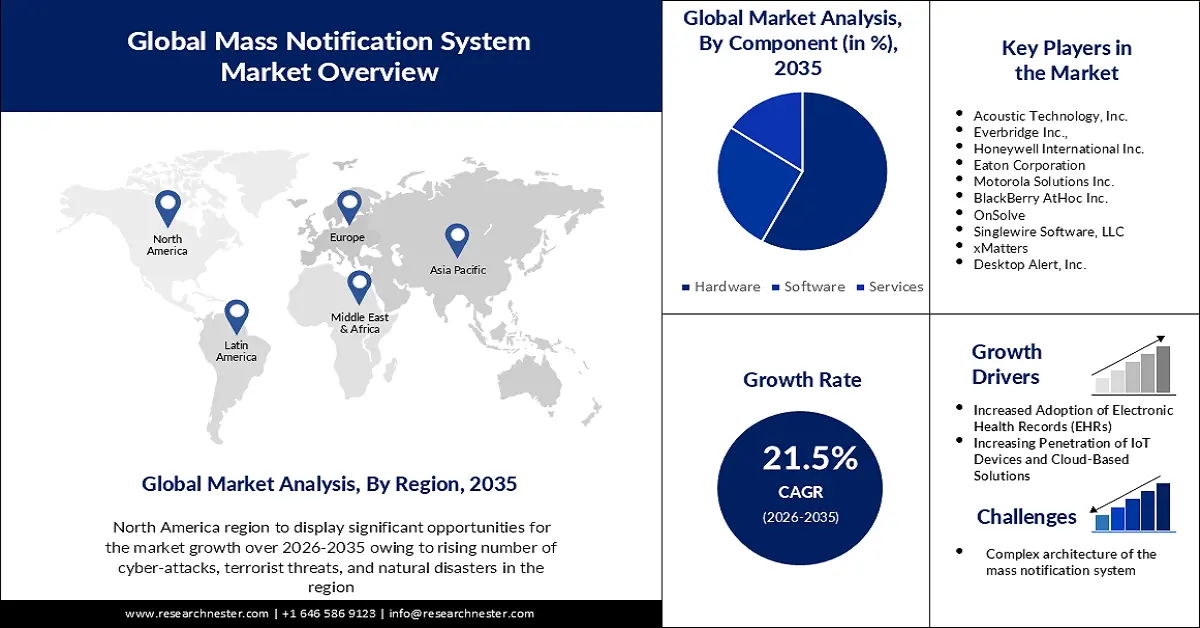

Mass Notification System Market size was over USD 21.1 billion in 2025 and is poised to exceed USD 147.93 billion by 2035, witnessing over 21.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mass notification system is estimated at USD 25.18 billion.

The market’s expansion can be ascribed to the increasing number of natural disasters, such as the leak of fuel gas from an industrial reactor, and natural catastrophes like floods, hurricanes, and earthquakes, which can cause extensive damage to both people and property. It is estimated that approximately 6,700 natural disasters occur each year around the world. A natural disaster kills an average of 60,000 people worldwide each year. MNS enables emergency services to quickly and easily send out warnings and updates to the public in times of disaster.

In addition, the increasing popularity of bring your own device (BYOD) in the workplace and the education sector is expected to drive mass notification system market growth. For instance, the number of employees using personal devices at work worldwide is 68%. The percentage of organizations adopting BYOD has increased to 57%. With the BYOD trend, organizations are relying on mass notification systems to reach employees quickly and effectively. As these systems allow them to send out messages to multiple devices at once, making sure that their messages are received in a timely manner.

Key Mass Notification System Market Insights Summary:

Regional Highlights:

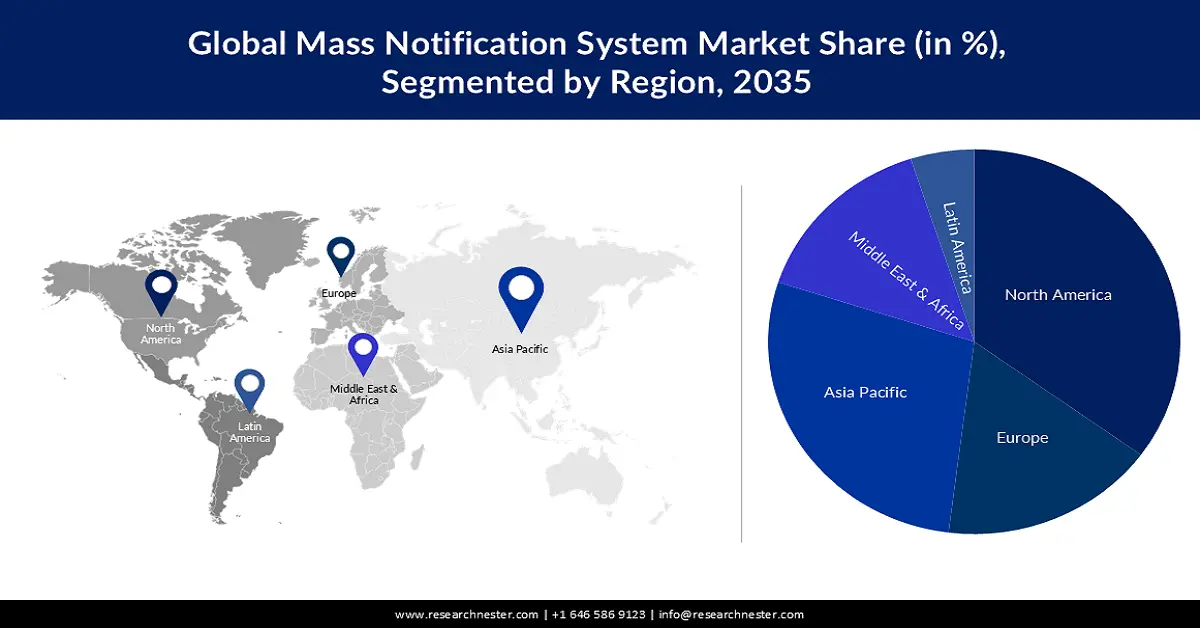

- North America mass notification system market will dominate more than 38% share by 2035, driven by increased terrorism threats and need for rapid communication systems.

- Asia Pacific market will secure 27% share by 2035, driven by increasing demand for secure digital communication.

Segment Insights:

- The large enterprises segment in the mass notification system market is expected to capture a 53% share by 2035, driven by the increasing need for risk management and real-time communication in large organizations.

- The hardware segment in the mass notification system market is expected to secure a 43% share by 2035, driven by the rising use of sensors and transmitters in smart cities and emergency systems.

Key Growth Trends:

- Rising Digitalization Across Various Business Sectors

- Growing Need for One-Way Communication in Government and Local Administration

Major Challenges:

- Complex Architecture of the Mass Notification System

- High Capital Investments

Key Players: Acoustic Technology, Inc., Everbridge Inc., Honeywell International Inc., Eaton Corporation, Motorola Solutions Inc., BlackBerry AtHoc Inc., OnSolve, Singlewire Software, LLC, xMatters, Desktop Alert, Inc.

Global Mass Notification System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.1 billion

- 2026 Market Size: USD 25.18 billion

- Projected Market Size: USD 147.93 billion by 2035

- Growth Forecasts: 21.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Mass Notification System Market Growth Drivers and Challenges:

Growth Drivers

- Rising Digitalization Across Various Business Sectors - For instance, the majority of businesses are engaged in some form of digital initiative, and 86% of senior business leaders believe that digitalization should be a priority for their company. More than 80% of companies have successfully adopted a digitally-driven business strategy. With the rise of digital technology, businesses have been able to automate many of their processes, making them more efficient and allowing for faster communication. MNSs can be used to quickly alert employees and customers of any changes or updates, which has made them increasingly popular in a wide range of industries.

- Growing Need for One-Way Communication in Government and Local Administrations- A growing number of government agencies and local administrations are using mass notification systems to communicate with individuals in a one-way manner. For instance, AlertMedia, Inc., launched emergency communication software that enables enterprise-wide communication, confirms a resolution, and connects security teams across an enterprise. This software helps organizations quickly communicate with their employees in case of an emergency.

- Increasing Crimes in Schools Necessitating MNS Use in the Educational Sector- In the 2019–20 school year, 75% of public schools in the United States reported that at least one incident of crime occurred, which amounts to 1.2 million incidents. MNS allows schools to quickly alert students and faculty of any potential danger, allowing them to be prepared and take necessary action. They also enable schools to keep an accurate record of any incidents that occur on campus, which can be used to identify potential threats and help prevent future incidents.

- Increased Adoption of Electronic Health Records (EHRs)- The number of practice-based physicians adopting any electronic health record (EHR) has increased to nearly 89% as of 2021, with nearly 79% adopting certified EHRs. MNS system can help health care providers quickly and reliably send notifications to patients and other providers about important updates to their records. This can ensure that everyone is informed about changes in a timely manner and can help reduce potential errors.

- Increasing Penetration of IoT Devices and Cloud-Based Solutions- It is estimated that there are more than 12 billion connected IoT devices across the globe. In addition, end-user spending on public cloud services is expected to reach USD 590 billion by 2023. IoT devices provide a secure and cost-effective way to send and receive notifications. Cloud-based solutions also allow for scalability and flexibility to accommodate a variety of notification methods, such as text messages, emails, and push notifications.

Challenges

- Complex Architecture of the Mass Notification System - the complexity of the architecture often causes the installation and maintenance processes to be long and expensive, which makes it difficult for small and medium-sized organizations to invest in the system. This, in turn, limits the mass notification system market growth potential.

- High Capital Investments

- Limited Penetration of the Internet in Certain Regions

Mass Notification System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.5% |

|

Base Year Market Size (2025) |

USD 21.1 billion |

|

Forecast Year Market Size (2035) |

USD 147.93 billion |

|

Regional Scope |

|

Mass Notification System Market Segmentation:

Component Segment Analysis

In the year 2035, the hardware segment is expected to hold around 43% share of the global mass notification system market. The segment's expansion can be related to the increasing adoption of hardware components such as sensors, transmitters, and receivers, among others. It is primarily owing to the growing need for real-time monitoring and notification of various activities, including emergency services, public safety, and others. An increasing number of smart city projects are also driving the growth of the hardware segment. For instance, at present, China is implementing approximately 750-880 smart city programs nationwide. Smart cities are powered by IoT devices that use mass notification systems for communication in case of emergencies.

Enterprise Size Segment Analysis

The large enterprise segment in the mass notification system market is expected to attain a major revenue share of almost 53% by 2035. The rising usage of mass notification systems across a wide range of industries is primarily responsible for the growth of the large enterprise segment. This is mainly driven by the need for better communication among employees, customers, and suppliers, coupled with the need for efficient risk management. Additionally, large organizations are increasingly recognizing the need for effective risk management strategies. As a result, there is a demand for emergency alert systems that quickly and accurately disseminate critical information in times of crisis.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Deployment Mode |

|

|

By Enterprise Size |

|

|

By Type |

|

|

By Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mass Notification System Market Regional Analysis:

North American Market Insights

The mass notification system market in North America is expected to be the largest among all regions, with a share of almost 38% by the end of 2035. The rising number of cyber-attacks, terrorist threats, and natural disasters also add to the demand for mass notification systems in North America. In 2022, eight men in the United States were charged with jihadi terrorism. The United States has charged more than 500 individuals with terrorism since 9/11. Mass notification systems offer an effective way to quickly alert and inform large numbers of people about a potential threat. With the increasing number of terrorist threats in North America, more organizations are turning to mass notification systems to ensure their safety and security.

APAC Market Insights

The Asia Pacific mass notification system market is expected to be the second largest, accounting for around 27% of the total by the end of 2035. The market's expansion can be traced primarily to the increasing demand for secure digital communication among organizations, as well as the growing requirement to protect public safety while reducing operational costs, which are likely to fuel regional market expansion. Moreover, the growing trend of mobile-first technologies and the increasing deployment of mass notification systems for various applications, such as public safety, emergency warning, and public address, are expected to drive the market in the Asia Pacific region.

Mass Notification System Market Players:

- Acoustic Technology, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Everbridge Inc.,

- Honeywell International Inc.

- Eaton Corporation

- Motorola Solutions Inc.

- BlackBerry AtHoc Inc.

- OnSolve

- Singlewire Software, LLC

- xMatters

- Desktop Alert, Inc.

Recent Developments

- Next Generation Outdoor High Power Speakers Stations (HPSS) were announced by Acoustic Technology, Inc., a world leader in providing Mass Notification Systems (MNS), Emergency Communications Systems (ECS), and Military Giant Voice Systems with superior intelligibility.

- A new generation of Travel Risk Management (TRM) has been launched by Everbridge Inc., for new and existing business customers. The new TRM tool provides businesses with real-time data and insights to help them to assess and manage the risk of their business travel, as well as providing automated travel alerts and notifications. It also helps businesses to track their team’s travel plans and locations, to ensure they are always aware of their team’s safety and security.

- Report ID: 4848

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mass Notification System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.