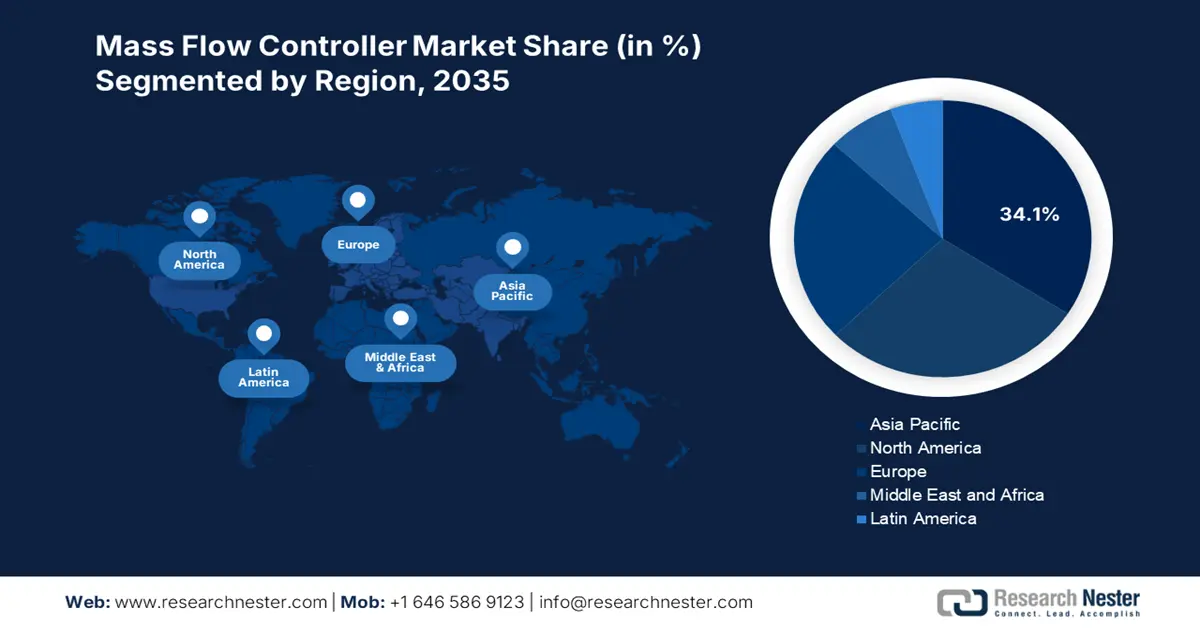

Mass Flow Controller Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific mass flow controller market is expected to hold 34.1% of the global revenue share by 2035, as a result of high fabrication of semiconductors, advancements in biopharmaceutical research, and the precision chemical manufacturing needs. The overall demand is set to increase due to supportive government policies and investment in cleaner energy solutions & electronics. Further, its strategic relevance for manufacturing innovation is contributing to the sales of mass flow controllers.

China is expected to hold a dominant Asia Pacific market share through 2035, owing to aggressive investments in semiconductor foundries and the hydrogen energy and pharmaceutical infrastructure sectors. The Made in China 2025 initiative and government support of subsidies for domestic producers are opening profitable space for investors. Further, the demand from electronics and display parent companies has led to an increase in domestic production and fabrication of MFCs and reduced reliance on imports.

The India mass flow controller market is expected to increase at the fastest CAGR from 2026 to 2035. The demand for mass flow controllers is largely driven by rapid advancement in specialty chemicals, bioscience, and chip manufacturing under the PLI Scheme. The rate of establishment of R&D laboratories in the country has increased with a steady turnover of planning and the continued embrace of digital process controls in pharmaceutical and food applications. Further, the expanding chemical sector is driving the deployment of mass flow controllers. The India Brand Equity Foundation (IBEF) states that the FDI inflows in the chemicals sector, other than fertilizers, were calculated at USD 23.2 billion in FY25. This highlights that investing in India is likely to offer hefty returns.

North America Market Insights

The North America market is estimated to capture 28.7% of the global revenue share throughout the study period. The mass flow controller demand is mainly fueled by the strong presence of highly efficient semiconductor and pharmaceutical industries. The evolving government policies around clean energy, biomanufacturing, and chip manufacturing are also contributing to the high sales of mass flow controllers. The U.S. Department of Energy and Innovation, Science and Economic Development Canada indicate that increasing research and development and manufacturing capabilities are set to directly push the adoption of mass flow controllers.

The U.S. market for mass flow controllers is expected to account for the largest revenue share, as firms ramp up investments in semiconductor manufacturing facilities and biopharma research activities. According to a report by SIA, the overall U.S. semiconductor industry’s investment in R&D totaled USD 62.7 billion in 2024. Such developments directly fuel the demand for ultra-high precision flow controllers. The enhancement of the CHIPS and Science Act also contributes to high domestic production of mass flow controllers.

The Canada mass flow controller market is projected to increase at a robust pace owing to the hefty investments flowing toward clean technologies and scaling up of pharmaceutical production. The supportive government policies and funding are likely to fuel the use of mass flow controllers in areas including biomanufacturing and nanotechnology. The growing adoption of automation strategies in both the chemical and energy sectors is further driving high sales of mass flow controllers.

Europe Market Insights

The Europe mass flow controller market is expected to expand at a CAGR of 6.5% from 2026 to 2035. This growth is primarily supported by a high demand from the semiconductor, pharmaceutical, and chemical sectors, governed by strict regulatory policies and R&D needs. The EU Green Deal, investments in digitally controlled automated flow management, and regional incentives that encourage low-carbon technologies are further accelerating the trade of mass flow controllers. The Netherlands, Germany, the U.K., and France are the most investment-worthy markets in the EU.

Germany leads the sales of mass flow controllers, owing to the strong presence of semiconductor manufacturing and chemical processing bases. The expanding renewable energy sector is also contributing to the high deployment of mass flow controllers. The country is positioning itself as a hub for advanced electronics production, supported by state and EU funding for semiconductor fabs. Nearly 28,355 robotic units were installed in the country in 2023, according to IFR. This indicates that the industrial automation trend is boosting the use of robots, which indirectly is propelling the sales of mass flow controllers.

The demand for mass flow controllers in the Netherlands is poised to increase at a high pace, due to the increasing advancements in semiconductor equipment manufacturing. The country’s focus on sustainable manufacturing is also accelerating the sales of smart mass flow controllers. The government’s climate and energy transition goals are further emerging as a significant driver. The digital transformation and smart manufacturing trends are set to accelerate the adoption of next-generation MFCs.