Marine VFD Market Outlook:

Marine VFD Market size was over USD 1.38 billion in 2025 and is anticipated to cross USD 2.49 billion by 2035, growing at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine VFD is assessed at USD 1.46 billion.

The rising industrial and sea trade activities worldwide are augmenting the need for energy-efficient systems including, marine (VFDs). These drives help enhance the operational efficiency and speed of electric motors installed in ships. According to the UN Trade and Development Organization, around 11 billion tons of goods were traded through sea routes in 2021. Maritime trade is comparatively cost-effective due to lower freight rates, and the increasing preference of traders for seaborne transportation of goods and products. The International Chamber of Shipping (ICS) estimates that 90% of global trade is carried out through shipping.

Moreover, manufacturers in the marine VFD market are focused on developing high-power drives and technologies to cater to the growing need for enhanced energy-efficient systems in the marine sector. In October 2021, Invertek Drives, a global manufacturer of VFDs and AC drives announced the launch of a novel range of high-power VFDs; size 8 IP20 and IP55 optidrive VFDs, capable of controlling electric motors up to 48 Amps.

Key Marine VFD Market Insights Summary:

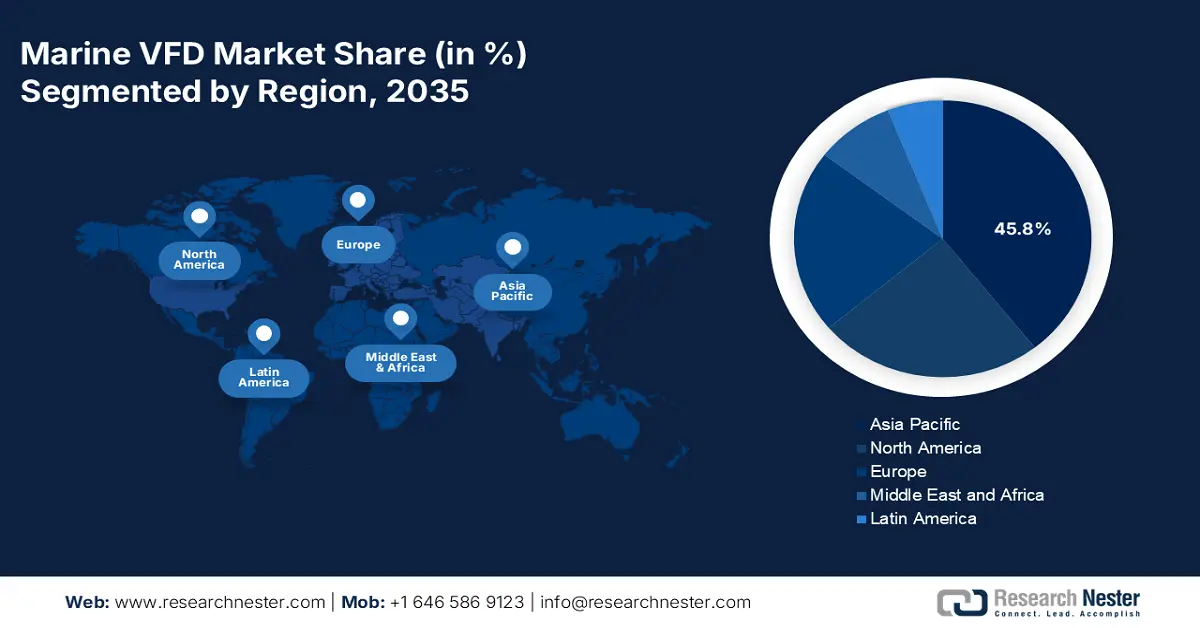

Regional Highlights:

- Asia Pacific dominates the Marine VFD Market with a 45.8% share, driven by increasing industrial and offshore trading activities and tech adoption, ensuring robust growth through 2026–2035.

Segment Insights:

- The Low Voltage segment is expected to dominate with an 84.2% market share by 2035, fueled by increased production output, energy savings, and rising automation in marine operations.

- The AC Marine VFD segment is projected to capture an 80.5% share by 2035, fueled by the need for fuel efficiency, lower emissions, and IMO regulations compliance.

Key Growth Trends:

- Introduction of IoT, AI, and ML

- Strict environmental regulations driving advanced marine VFD sales

Major Challenges:

- High installation costs

- Supply chain disruptions

- Key Players: ABB Ltd, Danfoss, GE Vernova Inc., Honeywell International, Inc., Rockwell Automation, and Siemens Energy.

Global Marine VFD Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.38 billion

- 2026 Market Size: USD 1.46 billion

- Projected Market Size: USD 2.49 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, South Korea, Singapore, Malaysia

Last updated on : 14 August, 2025

Marine VFD Market Growth Drivers and Challenges:

Growth Drivers:

-

Introduction of IoT, AI, and ML: The integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) in marine VFD is one of the key factors boosting marine VFD market growth. These technologies help in assessing the health of the equipment in real time and making suitable decisions before system failures. This feature not only optimizes the performance of the vessel but also helps to reduce overall operational costs. For instance, 92% of enterprises are reporting positive ROI from IoT implementation, worldwide.

- Strict environmental regulations driving advanced marine VFD sales: The stringent regulations regarding emissions and energy consumption are pushing shipbuilders and operators to adopt smart VFDs for better compliance. Various countries and regions implement their own emissions regulations often more stringent than international standards, which drives high demand for advanced technologies that ensure compliance. For instance, the U.S. Environmental Protection Agency (EPA) has several rules and regulations for the shipping industry such as the Greenhouse Gas Reporting Program, National Emission Standards for Hazardous Air Pollutants (NESHAP), and Nonroad Engines, Equipment and Vehicles.

In addition, technologically advanced VFDs that allow for precise control of motor speeds and aid in optimizing energy consumption, helping vessels comply with regulations are gaining high demand.

Challenges

-

High installation costs: The installation of advanced marine VFD requires high upfront costs, and shipowners or operators with lower budgets often deter from installing advanced technologies. The integration of VFDs into existing systems requires extensive modifications to electrical and mechanical systems. This involves high labor costs, engineering expenses, and potential downtime for vessels during installation, which hampers the marine VFD market growth to some extent.

- Supply chain disruptions: The VFD systems rely on several critical components such as semiconductors, capacitors, and control systems. Any disruptions in the availability of these parts halts the production process, leading to high overall production costs. The marine VFD supply chain is often global and multi-tiered, making it susceptible to disruptions from geopolitical events such as the Russia & Ukraine and Palestine & Israel War, natural disasters, or logistical challenges, hindering the marine VFD market growth.

Marine VFD Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.38 billion |

|

Forecast Year Market Size (2035) |

USD 2.49 billion |

|

Regional Scope |

|

Marine VFD Market Segmentation:

Voltage (Low, Medium)

Low voltage segment is set to dominate marine VFD market share of around 84.2% by the end of 2035. The low voltage variable frequency drive offers increased production output and energy savings owing to its flexible and high-performance motor control features. The increasing trend towards automation in marine operations is fuelling the sales of low voltage variable frequency drives. In June 2019, CG Power & Industrial Solutions Ltd. announced the launch next generation of compact low-voltage VFD for industrial automation, including, marine sector.

Drive (AC, DC, Servo)

In marine VFD market, AC marine VFD segment is anticipated to account for revenue share of around 80.5% by 2035. The AC drive technology is gaining widespread popularity in the marine and offshore sectors due to its ability to adjust motor speed and mitigate energy consumption. Stringent regulations on emissions and energy consumption by the International Maritime Organization (IMO) are driving shipbuilders and operators to adopt advanced technologies such as AC drives that support compliance through improved fuel efficiency and lower emissions. Many long-haul vessels across the world are employed with conventional direct diesel propulsion, but to comply with strict regulations they are shifting toward hybridization by adopting advanced AC drive technologies.

Our in-depth analysis of the global market includes the following segments:

|

Voltage

|

|

|

Drive |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine VFD Market Regional Analysis:

Asia Pacific Market

Asia Pacific marine VFD market is set to hold revenue share of over 45.8% by the end of 2035, owing to the increasing industrial and offshore trading activities and rapid adoption of advanced technologies. India and China are witnessing high trade through sea routes, augmenting robust demand for advanced VFD in marine vessels. Japan and South Korea are well known for technological advancements and the market is no exception.

The India marine VFD market is foreseen to exhibit high growth due to the presence of large maritime sectors, an increasing industrial base, and rising external trade activities. For instance, according to the India Brand Equity Foundation, prime ports in the country handled around 783.50 million tonnes of cargo traffic in FY23 and the top 12 ports handled 819.227 million tonnes of cargo traffic in FY24. Moreover, rising government support and policies for advancing the shipping industry and rapidly expanding shipbuilding and repair sectors are anticipated to boost the marine variable frequency drive sales in the country going ahead. The Ministry of Shipping witnessed the allocation of USD 281.2 million in the Interim Union Budget 2024-25.

In China, the marine VFD market is expected to expand at a robust CAGR between 2026 and 2035 owing to high dominance in shipbuilding and growing adoption of advanced VFDs in new products to meet standards for energy efficiency and emission reduction. In addition, the government’s commitment to reach carbon neutrality by 2060 and the electrification of marine vessels are expected to contribute to market growth going ahead.

North America Market Statistics

The North America marine VFD market is expected to expand fast pace owing to the increasing adoption of advanced technologies. The companies in the region are investing heavily in R&D for the production of innovative technologies that aid in energy consumption and boost the operational efficiency of marine vessels.

The increasing offshore activities and strict emission regulations are pushing the marine VFD market growth in the U.S. To comply with rules implemented by the U.S. EPA the ship owners or operators are adopting energy-efficient marine VFD that aid in mitigating fuel consumption and emissions. For instance, the Bureau of Transportation Statistics reveals that marine vessels hold around 40.0% of U.S. international trade value.

Canada has the longest coastline in the world and connects the Great Lakes and the Atlantic, Pacific, and Arctic Oceans, booming the marine trade. For instance, the marine trade in Canada was valued at USD 345.0 billion in 2022. This trade hike is augmenting the need for marine vessels with advanced technologies such as variable frequency drives. Also, with the increasing contribution and leadership in marine trade, the country was re-elected to the International Maritime Organization Council for a two-year term in 2023.

Key Marine VFD Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danfoss

- GE Vernova Inc.

- Honeywell International, Inc.

- Rockwell Automation

- Siemens Energy

- Triol Industrial Solutions

- WEG

- Leonardo DRS

- BERG Propulsion

- Bosch Rexroth Corporation

- CG Power & Industrial Solutions Ltd.

- Parker-Hannifin Corporation

- Invertek Drives Ltd.

Leading companies in the marine VFD market are employing several organic and inorganic strategies to earn high profits and reach a wider customer base. Key market players are forming strategic partnerships with other players and technology firms to co-develop innovative technologies and expand their geographical reach. Industry giants are focusing on advancing their after-sales services including maintenance, training, and technical support to attract more customers and encourage repeat business. Some of the key players include:

Recent Developments

- In April 2024, Rockwell Automation announced the launch of its latest PowerFlex 6000T medium voltage variable frequency drive (VFD). This technology supports efficient permanent magnet motor applications effectively. By this product folio expansion, the company aims to earn high profits in the coming years.

- In June 2023, ABB Ltd announced its partnership with Türkiye-based Sanmar Shipyards and Elkon in a zero-emission tugs project. ABB is set to play a vital role in this project by providing its liquid-cooled drive technology.

- Report ID: 6514

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine VFD Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.