Marine Propulsion and Auxiliary Power Market Outlook:

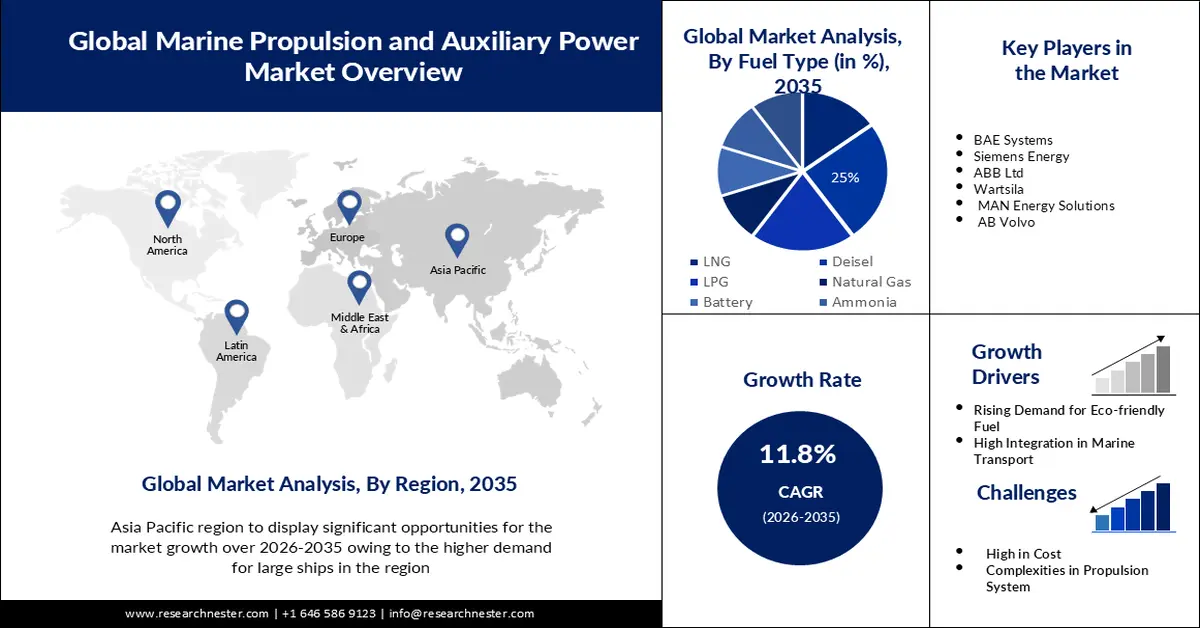

Marine Propulsion and Auxiliary Power Market size was over USD 11.59 billion in 2025 and is projected to reach USD 35.36 billion by 2035, witnessing around 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine propulsion and auxiliary power is evaluated at USD 12.82 billion.

The shipping industry is committed to cutting back on CO2 emissions and fuel use. In order to comply with strict energy restrictions, they are implementing engineering adjustments and implementing renewable and alternative energy sources. The International Maritime Organization (IMO) will implement new rules in January 2020 that will restrict the sulfur content of marine fuels used by ships in international seas to 0.5% by weight. This represents a decrease from the prior worldwide cap of 3.5% established in 2012. Therefore, it is expected that the imposition of strict energy requirements will boost the market value of auxiliary power and marine propulsion in the coming years.

The increase in the marine industry's use of fuel-efficient technologies and the long-term growth of global trade and commerce depends on the marine and shipping sectors is set to boost the marine propulsion and auxiliary power market growth

Key Marine Propulsion and Auxiliary Power Market Insights Summary:

Regional Highlights:

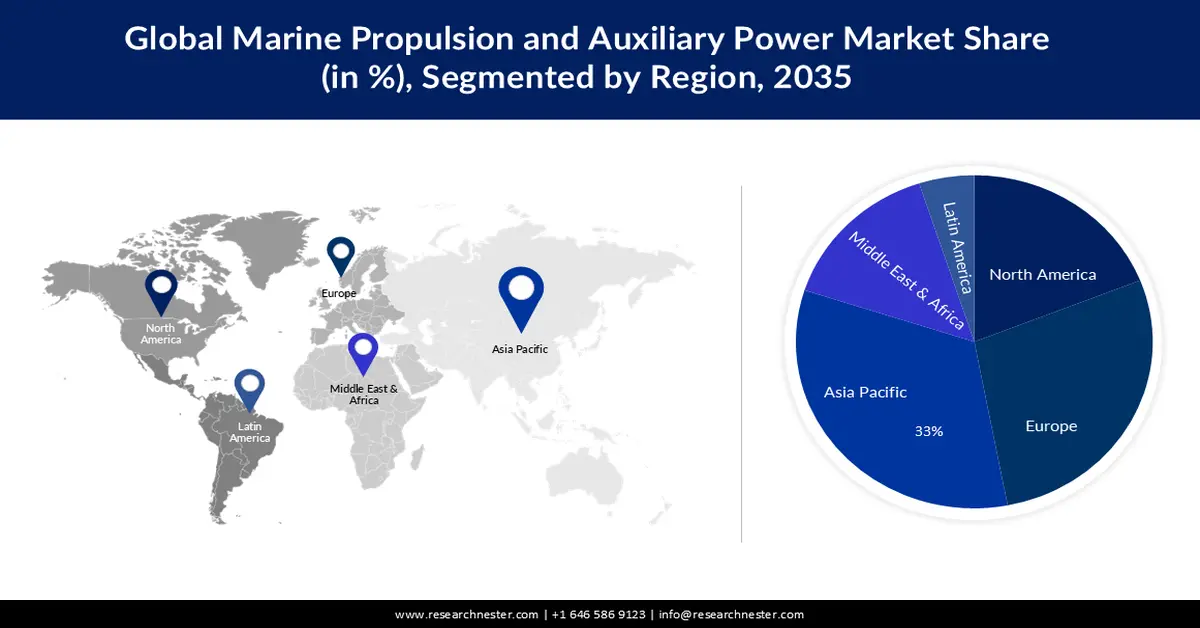

- Asia Pacific marine propulsion and auxiliary power market is expected to hold the largest share of 33%, driven by the rising number of ships, expansion of sea trade, and increased adoption of LNG as marine fuel.

- By 2035, Europe is projected to secure a significant share, supported by the proliferation of cruise ships, maritime tourism growth, and stringent environmental regulations for shipping.

Segment Insights:

- By 2035, the diesel segment is anticipated to capture a 25% share, propelled by continuous advancements in diesel engine technology.

- The ferries segment is set to dominate the market by 2035, driven by the increasing adoption of heavy fuel oils and marine diesel for passenger and vehicle transport.

Key Growth Trends:

- High Focus on Eco friendly Fuels

- High Integration Rate of Marine Transport

Major Challenges:

- Increasing Cost of Fuel

- Growing Complexity of Propulsion Systems

Key Players: Cummins Inc., Caterpillar, General Electric, BAE Systems, Siemens Energy, ABB Ltd, Wartsila, MAN Energy Solutions, AB Volvo, MTU (Rolls-Royce Plc).

Global Marine Propulsion and Auxiliary Power Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.59 billion

- 2026 Market Size: USD 12.82 billion

- Projected Market Size: USD 35.36 billion by 2035

- Growth Forecasts: 11.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Singapore, Indonesia, Australia

Last updated on : 26 November, 2025

Marine Propulsion and Auxiliary Power Market - Growth Drivers and Challenges

Growth Drivers

-

High Focus on Eco-friendly Fuels - Over the projected period, it is expected that the marine industry's increased focus on environmentally friendly fuels will boost marine propulsion and auxiliary power market development. Propulsion and auxiliary power units are widely used because they have low running costs and little administrative work. To get a larger market share, companies in the worldwide marine propulsion and auxiliary power sector are creating electric propulsion systems.

- High Integration Rate of Marine Transport - Over the course of the forecast period, market statistics should rise due to the high rate of adoption of maritime transport for international trade. More than 90% of all global shipping capacity is handled by marine transport throughout Latin America and the Caribbean. Consequently, the region has a major influence on the expansion of the marine propulsion and auxiliary power markets worldwide. With regard to energy efficiency, the government has not given it much assistance.

- Advancement in Propulsion Technology - Continuous R&D efforts are resulting in the creation of more effective propulsion systems that can lower pollutants and fuel consumption, which is a major factor in the marine propulsion and auxiliary power market expansion.

Challenges

-

Increasing Cost of Fuel - Fuel is one of the largest operating costs for shipping companies, and the cost for shipping companies and the cost of fuel has been rising in recent years. This has put pressure on shipping companies to find ways to reduce fuel consumption, and this has led to the development of a number of new technologies such as waste heat recovery systems and hull optimization.

- The Demand for More Efficient and Environmentally Friendly Propulsion Systems is Expected to Pose Limitation on the Market Expansion in Future.

- The Growing Complexity of Propulsion Systems are Expected to Hamper the Market Growth in the Upcoming Period.

Marine Propulsion and Auxiliary Power Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 11.59 billion |

|

Forecast Year Market Size (2035) |

USD 35.36 billion |

|

Regional Scope |

|

Marine Propulsion and Auxiliary Power Market Segmentation:

Fuel Type Segment Analysis

Based on fuel type, the diesel segment is set to hold 25% share of the global marine propulsion and auxiliary power market by the end of 2035. It is expected that during the period under consideration, it will be dominant in this sector. The mixture of hydrocarbons obtained through the distillation of crude oil is diesel fuel. For various fuel grades and in a variety of countries, the specifications for diesel fuels vary. The growth of this segment can be attributed on the back of diesel engine technology advancement. Diesel engine manufacturers are constantly developing new technologies that enhance the efficiency and emissions performance of their engines.

Vesel Type Segment Analysis

In terms of vessel type, the ferries segment is set to dominate the global marine propulsion and auxiliary power market by the end of the forecast period registering a CAGR of 30%. Ferries are vessels of any size carrying passengers and vehicles on fixed routes over short cross-water passageways in many cases. These vessels are intended for the purpose of transporting passengers across a variety of water bodies. Heavy fuel oils and marine diesel are most commonly used on ferry services. An increase in the number of ferries that switch from diesel to heavy fuel oil is expected to drive this segment.

Our in-depth analysis of the global marine propulsion and auxiliary power market includes the following segments:

|

Fuel Type |

|

|

Application |

|

|

Power Rating |

|

|

Vessel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Propulsion and Auxiliary Power Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 33% by 2035. The growth of this market can be primarily driven by the growing prevalence of a large number of ships and the expansion of sea trade in this region. Furthermore, the increasing adoption of LNG as a marine fuel is also driving the market growth in the region.

European Market Insights

The marine propulsion and auxiliary power market in the Europe region is estimated to grow substantially by the end of 2035. The proliferation of cruise ships and the growth of maritime tourism drive market progress in Europe. Sea transport facilitates 77% of European export commerce and 35% of total trade volume between EU members. Also, the European Union has implemented some of the world’s most strict environmental regulations for the maritime sector. These standards are designed to reduce emissions from shipping which is a major source of air pollution.

Marine Propulsion and Auxiliary Power Market Players:

- Cummins Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Caterpillar

- General Electric

- BAE Systems

- Siemens Energy

- ABB Ltd

- Wartsila

- MAN Energy Solutions,

- AB Volvo

- MTU (Rolls-Royce Plc)

Recent Developments

- To cut fuel usage and carbon emissions, the New York City Transit Authority chose BAE Systems in June 2020 to provide 435 electric hybrid generators and propulsion systems for its new fleet of transit buses.

- Volvo Penta and Marell, a Swedish boat builder, worked together to develop the new Marell M15 patrol boat in September 2019. The vessel is custom-built from helm to prop and outfitted with Volvo Penta's most recent D6 engine and DPI system, setting a new benchmark for high-speed operations.

- Report ID: 5444

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Propulsion and Auxiliary Power Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.