Marine Navigation Systems Market Outlook:

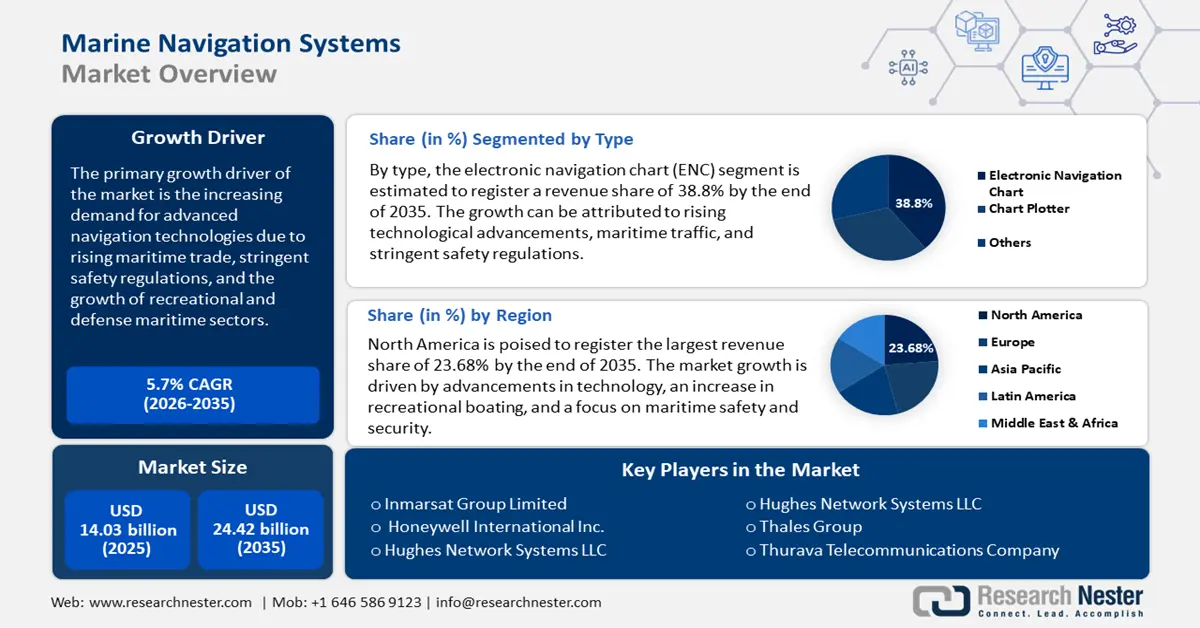

Marine Navigation Systems Market size was over USD 14.03 billion in 2025 and is anticipated to cross USD 24.42 billion by 2035, witnessing more than 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine navigation systems is assessed at USD 14.75 billion.

The primary growth driver of the marine navigation systems market is the increasing demand for advanced navigation technologies due to rising maritime trade, stringent safety regulations, and the growth of recreational and defense maritime sectors. According to the UN Trade and Development (UNCTAD), global maritime trade is a key factor, accounting for over 80% of international trade volume, which necessitates precise and efficient navigation systems to ensure operational efficiency and safety.

Regulatory bodies like the International Maritime Organization (IMO) have implemented strict guidelines under conventions like Safety of Life at Sea (SOLAS). These mandates require vessels to be equipped with advanced navigation systems such as Automatic Identification Systems (AIS), Electronic Chart Display and Information Systems (ECDIS), and Radar Systems. These regulations aim to reduce accidents, ensure compliance with environmental standards, and improve operational efficiency.

Key Marine Navigation Systems Market Insights Summary:

Regional Highlights:

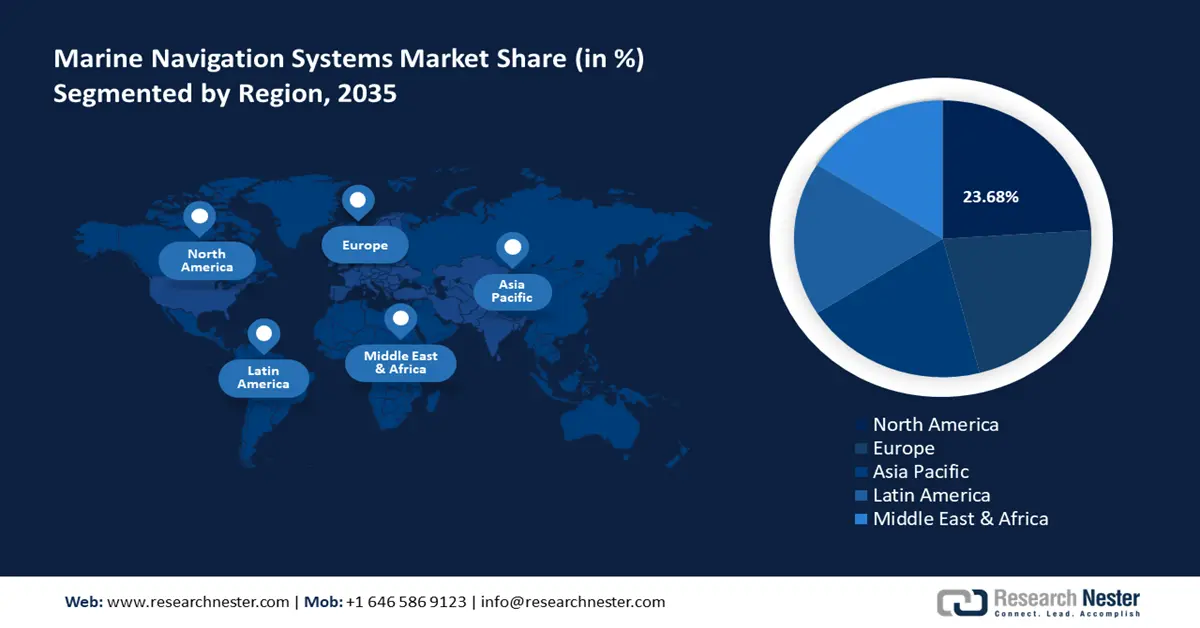

- North America marine navigation systems market will account for 23.68% share by 2035, driven by advancements in technology and focus on maritime safety and security.

Segment Insights:

- The electronic navigation chart segment in the marine navigation systems market is forecasted to capture a 38.80% share by 2035, driven by technological advancements, maritime traffic, and strict safety regulations globally.

Key Growth Trends:

- Growing availability of broadband connections and VSAT connectivity

- Technological advancements

Major Challenges:

- Regulatory complexity

- Cybersecurity threats

Key Players: Honeywell International Inc., Hughes Network Systems LLC, Thales Group, Thurava Telecommunications Company, Safran SA, Network Innovation Inc.

Global Marine Navigation Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.03 billion

- 2026 Market Size: USD 14.75 billion

- Projected Market Size: USD 24.42 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (23.68% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Marine Navigation Systems Market Growth Drivers and Challenges:

Growth Drivers

- Growing availability of broadband connections and VSAT connectivity: Very Small Aperture Terminal (VSAT) connectivity enables constant data exchange between vessels and shore-based systems, improving route optimization, weather forecasting, and fleet management. Broadband internet allows seamless integration of navigation systems with cloud-based solutions for data analytics and predictive maintenance. VSAT technology facilitates remote monitoring of autonomous vessels and offshore operations, which is crucial for the future of smart shipping and navigation.

The increasing demand for uninterrupted connectivity in commercial, defense, and recreational maritime sectors is propelling the integration of broadband and VSAT solutions. For instance, with over 80% of commodities being transported by sea and a 131% annual rise in marine data usage linked to commercial activities, maritime connectivity is essential to maintaining the flow of international trade. - Technological advancements: Artificial intelligence (AI) is utilized for predictive maintenance, autonomous navigation, and route optimization. Expanding satellite networks, such as those from SpaceX and OneWeb, facilitate seamless communication for remote monitoring and data sharing. This is critical for autonomous vessels and smart navigation solutions. Modern systems leverage data analytics, IoT, and automation for dynamic positioning, real-time weather updates, and efficient route planning. These innovations aim to optimize operations and improve decision-making.

Also, Electronic navigation systems, like Electronic Chart Display and Information Systems (ECDIS), are now equipped with more sophisticated features, including augmented reality overlays and dynamic route optimization. Moreover, green technologies, such as wind-assisted navigation systems and energy-efficient route planning tools, help reduce fuel consumption and emissions, aligning with global environmental regulations. - Rising focus on maritime safety: Advanced navigation systems equipped with real-time hazard detection, predictive analytics, and automated collision-avoidance features are reducing accidents caused by human error. Technologies like RADAR, LiDAR, and AI-powered systems improve situational awareness, particularly in congested shipping lanes and adverse weather conditions.

Additionally, Enhanced Global Navigation Satellite Systems (GNSS) are improving the accuracy of distress signal tracking, enabling faster and more effective search-and-rescue operations. According to the European Union Agency for the Space Program, by 2027, GNSS shipments worldwide are expected to reach 2 billion units annually.

Challenges

- Regulatory complexity: The maritime industry must comply with varying regional and international safety and environmental regulations, such as SOLAS and MARPOL. Adapting navigation systems to meet these requirements can be costly and time-consuming.

- Cybersecurity threats: As maritime navigation increasingly relies on digital platforms, the sector faces growing risks of cyberattacks, which could disrupt operations or compromise safety. Protecting against these threats involves additional costs for robust cybersecurity measures.

Marine Navigation Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 14.03 billion |

|

Forecast Year Market Size (2035) |

USD 24.42 billion |

|

Regional Scope |

|

Marine Navigation Systems Market Segmentation:

Type Segment Analysis

By type, the electronic navigation chart (ENC) segment is anticipated to dominate around 38.8% marine navigation systems market share by the end of 2035. The growth can be attributed to rising technological advancements, maritime traffic, and stringent safety regulations. The International Maritime Organization (IMO) mandates the use of ECDIS for large commercial vessels, enhancing the adoption of ENCs globally. These regulations are driving increased implementation across both new and retrofitted vessels.

ENCs offer real-time updates, detailed hydrographic information, and precise positioning, significantly improving navigational accuracy and reducing risks of maritime accidents. These features are critical in busy or hazardous waters. Moreover, ENCs integrate seamlessly with other automated navigation tools, such as GNSS, AIS, and radar overlays, providing a comprehensive and dynamic view of navigational routes.

Application Segment Analysis

By application, the ship segment in marine navigation systems market is expected to register a significant revenue share by the end of 2035. The global shipping industry, responsible for over 80% of global trade volume, is driving demand for navigation systems that improve route optimization, fuel efficiency, and operational safety. Larger vessels, such as container ships and bulk carriers, require advanced systems like ECDIS and AIS to manage complex logistics and routes.

Autonomous ship technologies, especially in commercial and defense applications are increasingly integrating advanced navigation systems to support remote operations, real-time hazard detection, and automated route planning. Countries like Japan are investing in smart ship projects, boosting the segment further. Moreover, passenger ships, including cruise liners and luxury yachts, are adopting navigation systems to ensure safe and smooth voyages. The growing marine tourism sector adds to the demand for these technologies. According to the Organisation for Economic Co-operation and Development (OECD), by 2030, marine and coastal tourism is expected to generate USD 777 billion, making it the largest sector of the worldwide ocean-based economy.

Our in-depth analysis of the global marine navigation systems market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Navigation Systems Market Regional Analysis:

North America Market Insights

North America in marine navigation systems market is likely to dominate over 23.68% revenue share by 2035. The market growth is driven by advancements in technology, an increase in recreational boating, and a focus on maritime safety and security. The region’s focus on maritime defense and security, including the modernization of naval fleets, is a major growth driver, driving the marine navigation systems market.

In the U.S. extensive maritime infrastructure, relies heavily on advanced navigation systems to support trade and secure coastal areas. The U.S. Coast Guard and other government bodies mandate stringent safety and security standards, encouraging the adoption of sophisticated navigation technologies. Furthermore, innovations like digital twin technology and AI/ML integrations are opening new opportunities for further marine navigation systems market expansion, providing real-time analytics, predictive maintenance, and automated decision-making. These advancements are improving both commercial and recreational maritime operations.

The marine navigation systems market in Canada is experiencing steady growth, supported by various factors including increased adoption of advanced navigation technologies and ongoing investments in maritime safety and infrastructure. The Government of Canada is investing in port infrastructure and modernizing its naval fleet, which increases demand for cutting-edge navigation systems.

Europe Market Insights

The marine navigation systems market of Europe is poised to register significant revenue growth by 2035. The growth can be attributed to increasing maritime trade, advancements in navigation technology, and the growing demand for safety and efficiency. The growth is particularly noticeable in the commercial shipping sector, where sophisticated navigation systems like GPS, RADAR, and electronic chart display systems are essential for efficient and safe operation. Additionally, the region is increasingly focused on integrating eco-friendly technologies into marine navigation to comply with stringent environmental regulations.

In Germany, there is a notable trend toward integrating advanced technologies like AI, augmented reality (AR), and cloud-based solutions which improve operational efficiency, safety, and compliance with international maritime standards. Several key players in the marine navigation systems market are driving growth by launching advanced data management systems, which are enhancing navigation and operational efficiency across the maritime industry. In May 2023, SevenCs, a German-based firm, announced its new creation, the S-100 Data Management System (SDMS), which is intended to assist organizations in better managing their S-57/S-100 datasets and comply with the standards' obligations. The future of hydrographic data management lies in SDMS, particularly as S-100 products gain prominence.

The marine navigation systems market in the UK is driven by the expanding marine industries, which are vital contributors to the country’s economy. the demand for maritime navigation systems is aligned with the growth of global trade, offshore renewables, and the evolving need for sophisticated navigation solutions. With over 120 commercial ports along its coastline, the UK's maritime infrastructure accounts for 95% of the country's international trade volume.

Marine Navigation Systems Market Players:

- Inmarsat Group Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Northrop Grumman Corporation

- Honeywell International Inc.

- Hughes Network Systems LLC

- Thales Group

- Thurava Telecommunications Company

- Safran SA

- Network Innovation Inc.

- FLIR Systems Inc

- SevenCs

- Iridium Communications Inc.

Key players are driving growth through a combination of technological innovation, strategic partnerships, and expanding product offerings. These players are particularly focusing on integrating features like automated route planning, collision avoidance, and predictive analytics, which improve safety and operational efficiency for both commercial and recreational vessels. Moreover, mergers and acquisitions are helping companies expand their product portfolios and improve their market reach.

Here are some key players in the marine navigation systems market:

Recent Developments

- In September 2024, Iridium Communications Inc. introduced Iridium Certus GMDSS, a revolutionary leap in marine safety, compliance, and communication. Building on the powerful capabilities of Iridium Certus technology, Iridium Certus GMDSS includes distress alert, safety voice, and Maritime Safety Information (MSI), as well as additional regulated services such as Long Range Identification and Tracking (LRIT) and Ship Security Alert System (SSAS).

- In June 2020, FLIR Systems released Raymarine Axiom+, a series of multifunction displays (MFDs) designed for fishermen, cruisers, and sailors. It also includes enhanced Raymarine LightHouse Charts cartography, providing improved clarity and control for marine navigation.

- Report ID: 6725

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Navigation Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.