Marine Composites Market Outlook:

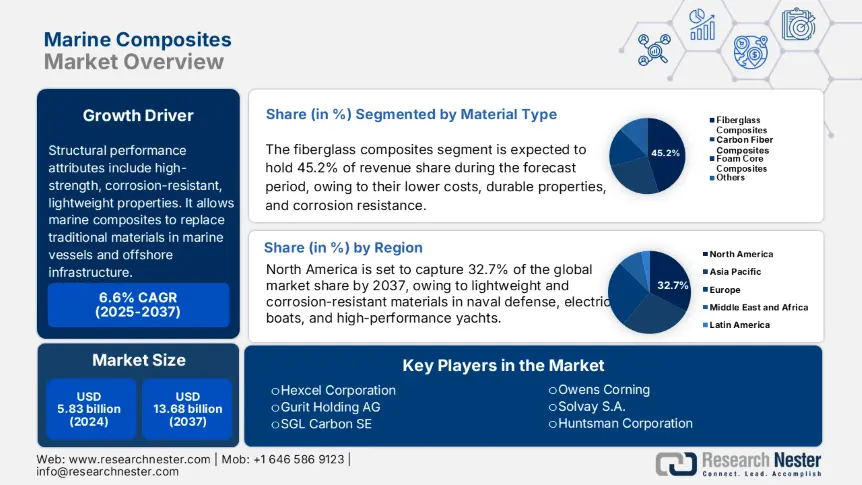

Marine Composites Market size was estimated at USD 5.83 billion in 2024 and is expected to surpass USD 13.68 billion by the end of 2037, rising at a CAGR of 6.6% during the forecast period, i.e., 2025-2037. In 2025, the industry size of marine composites is estimated at USD 6.20 billion.

The structural performance of marine composites will serve as their primary growth driver. Structural performance attributes include high-strength, corrosion-resistant, lightweight properties. The structural performance properties will continue to allow marine composites to replace traditional materials in marine vessels and offshore infrastructure. Department of Energy through the IACMI–NREL CoMET program, providing funding for composite R&D facilities for manufacturing marine and wind structures on a larger scale. These types of funding and investment will continue to advance marine composite usage. For instance, European production of carbon fiber reinforced composites was 58 kt in 2022 and produced nearly 91 kt of natural fiber composites, suggesting expanding feedstock capacity.

While the flow of data through the supply chain appears to show supply scales rising, raw-material inputs. Citing USGS data from the EPA studies, the price for glass spheres is around $0.79/kg, and alumina trihydrate is $0.14/kg to reinforce plastics. The assembly-line capacity is increasing throughout the world through investment in large-format molding and filament winding facilities in Europe and the US (CoMET program). Based on the US BLS composite related PPI for cargo handling, increased from 138.4 in January 2025 to 140.2 in May 2025. A specific CPI for marine composites is not tracked separately, but composite materials seem to follow trends of others in the import/export PPI and IPP. Investment in marine-tech and composite manufacturing was over $3.9 M per US Congressional grants for R&D.