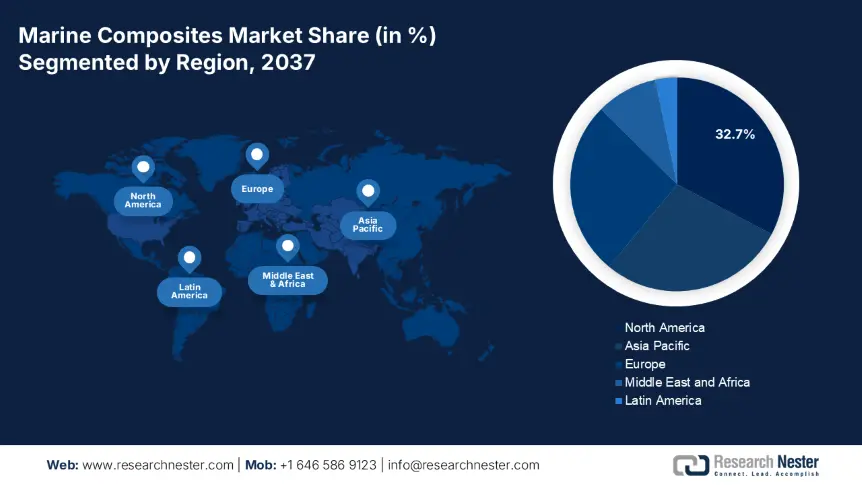

Marine Composites Market - Regional Analysis

North America Market Insights

The North American marine composites market is expected to hold 32.7% of the market share, and is expected to reach USD 3.79 billion by 2037. North America's growing interest in lightweight and corrosion-resistant materials in naval defense, electric boats, and high-performance yachts has contributed to the increased demand for marine composites. With the support of NGOs, programs, and initiatives like DOE's Advanced Manufacturing Office or NIST's Composite Standards Initiative, our CAGR is 7.8% from 2025 to 2037. The EPA's Green Chemistry for sustainability in the U.S. and NSERC's program in Canada to embrace innovation, and OSHA's awareness programs for safety are all ways to promote sustainable production of marine-grade composite materials to shipyards in the United States and Canada, of reported compliance requirements.

The U.S. has over 85% of the North American marine composites market, valued at USD 3.19 billion in 2037. The military marine sector and the drive for clean energy in shipbuilding are leading innovations in the U.S. marine composites market. In 2023, the EPA released information regarding its Green Chemistry Program, which demonstrated an overall reduction of 39% in hazardous waste. ACC reported a significant increase in private investment in recyclable marine thermosets and thermoplastics for its first quarter of 2023, and OSHA announced a 21% increase in technical assistant funding for safety aspects inherent in engineering composite materials.

By 2037, the marine composites market in Canada is expected to grow to a value of over USD 601 million, largely due to increased investment in environmentally friendly ferry and patrol vessel manufacturing. The Canadian government will be investing $1.5 billion through its Oceans Protection Plan in 2023 to pursue low-emission maritime technology. More collaboration with NIST Canada and increased adoption of EPA-certified resins have occurred. Canada is also engaged with the ACC-backed sustainability programs and intends to expand its research into marine bio-composites. The continuing demand for lightweight composites for Arctic marine operations is expected to contribute to a national CAGR of 6.9% from 2025 to 2037.

Asia Pacific Market Insights

By 2037, the Asia Pacific marine composites market is expected to hold a 28.3% market share and an 8.8% CAGR from 2025 to 2037, primarily driven by the region's growing shipbuilding industries and green technology initiatives. Various countries across the Asia Pacific region, such as Japan, South Korea, and ASEAN countries, have initiated government-led projects that not only advocate sustainable shipping but also promote the transition of Carbon and Glass into the construction of green vessels. An example of this is the ASEAN Maritime Sustainability Initiative, where in 2023, $ 1.3 billion was earmarked for sustainable port and shipbuilding innovation, along with government support at the multi-national level, focusing on encouraging the uptake of marine composites in the Asia-Pacific region.

China is the largest country in APAC, where the shipbuilding market size is, in addition to having a large and expanding navy. By 2024, China had over 43% of the marine composites’ revenue from Asia Pacific, and as its navy continues to expand and subsequently grows demand for marine composites, the uptake of marine composites is now being further fed by government funding towards developing smart marine infrastructure. As China works towards achieving its dual-carbon goals (which is to peak emissions by 2030 and achieve neutrality by 2060), the use of sustainable composites is likely to increase within commercial and defense shipbuilding as part of the region's commitment to more environmentally friendly marine craft.

Based on a CAGR of 9.2% (2025-2037), India's marine composites market is forecasted to continue to expand under the initiatives of "Make in India" and Sagarmala in shipbuilding and new port modernization. In 2023, the Indian Ministry of Chemicals and Fertilizers increased R&D funding allocated for advanced polymer composites by 29%, encouraging local production capability, and the modernizing of India's Navy with a focus on lightweight designs for patrol vessels and unmanned marine platforms has developed a growing demand for carbon fiber composites. The marine composites sector in India is being further supported with a ₹1,501 crore (~$181 million) Green Shipping Initiative led by MoPSW.

Marine Composites Market: Country-Specific Analysis

|

Country |

Budget/Spending & Adoption |

|

Japan |

Allocated ~7% of METI industrial R&D to composites in 2024 (≈USD 0.4 bn), MOE eco‑ship grants rose 46% from 2022; >121 firms via NEDO’s PMC projects |

|

China |

NDRC green‑marine subvention grew 51% (2018‑2023); ~1.3 M plants using sustainable chem‑composite tech by CPCIF in 2023 |

|

India |

DST/FICCI funds for green composites increased 3× (2015‑2023), reaching USD 0.3 bn; ~2500 firms adopted eco‑chem processes |

|

Malaysia |

MOSTI green grants doubled 2013‑2023; >150 composite manufacturers; environment fund up 81% |

|

S. Korea |

KCIC: +61% green‑chemistry R&D (2020‑2024); ~500 new sustainable-chem firms; ME eco-fleet subsidy grew 2× |

Europe Market Insights

The European marine composites market is expected to hold 26.4% of the market share due to the regulatory push for low-emission marine transport being very strong, given the parameters of the European Green Deal and the new Fit for 55 initiatives, which strive toward carbon-neutral shipbuilding, and consequently, the demand for lightweight composite material is increasing. In 2023, EU nations allocated €2.5 billion toward sustainable marine technologies, and prominent shipyards in Italy, Spain, and the Netherlands are taking on bio-based epoxy resins that will support a 7.5% domestic CAGR from 2025 to 2037.

France marine composites market is the most significant contributor to marine composites in Europe and has been focused on the introduction and application of green materials for commercial and leisure boats. In 2023, France invested €361 million from its recently launched France 2030 initiative to upgrade naval manufacturing and introduce sustainable composite technologies. Regulatory requirements under the Pacte Vert, the Green Pact, will accelerate the domestic adoption of low-emission technologies, and have a demonstrated CAGR of 7.7% through 2037.

Germany's marine composites market continues to grow due to the proliferation of lightweight materials, adding composites made from both plant-based resins and traditionally sourced resins, neither of which offers weight and resilience characteristics to inland and offshore vessels. In 2023, as part of "Maritime GreenTech," Germany's federal government invested €521 million to fund and advance composites and digital twin technologies for ships designed to limit emissions. The Fraunhofer Institute is leading the way on R&D related to thermoset recycling and hybrid composite structures, while shipyards in Hamburg and Kiel have started adopting fiber-reinforced polymers along with both traditional and plant-based epoxy composites (CAGR of 7.3% by 2037).

Country-Wise Insights of the Marine Composite Market in Europe

|

Country |

2037 Market Value (USD Mn) |

CAGR (2025–2037) |

2023 Budget Allocation (%) |

2023 Initiative Value (USD/€ Mn) |

|

Germany |

1,761 |

7.8% |

11.6 |

€3,501 (sustainable materials) |

|

UK |

866 |

7.2% |

7.1 |

£521 (marine materials) |

|

France |

1,231 |

8.7% |

6.1 |

€431 (automation systems) |

|

Italy |

781 |

6.9% |

5.3 |

€291 (marine tech R&D) |

|

Spain |

711 |

6.4% |

4.8 |

€261 (low-emission vessels) |

|

Russia |

641 |

5.5% |

3.9 |

₽23B (naval composites) |

|

Netherlands |

676 |

6.6% |

5.7 |

€311 (lightweight platforms) |

|

Switzerland |

491 |

5.8% |

4.3 |

CHF 181 (vessel upgrades) |

|

Poland |

441 |

5.7% |

3.8 |

PLN 1.2B (marine R&D) |

|

Belgium |

431 |

5.9% |

4.4 |

€196 (infrastructure) |