Marine Chartplotter Market Outlook:

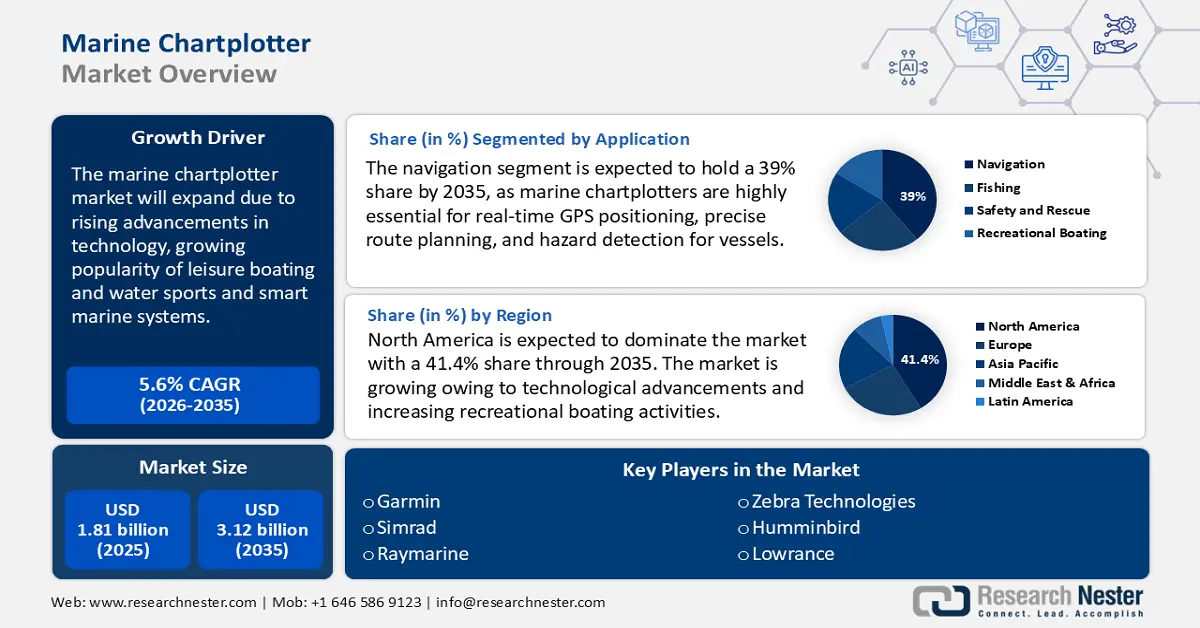

Marine Chartplotter Market size was over USD 1.81 billion in 2025 and is poised to exceed USD 3.12 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine chartplotter is estimated at USD 1.9 billion.

The global marine chartplotter market is expected to witness significant growth owing to the integration of AI, IoT, and cloud-based navigation in marine chartplotters to improve consumer usability and efficiency. Advanced features such as real-time weather updates, radar/sonar connectivity, high-resolution touchscreen displays, and 3D mapping have resulted in increasing the adoption of marine chartplotters. For instance, in January 2025, Timezero partnered with Sea.AI to merge Sea.AI’s data with its navigation software. This collaboration is expected to enhance situational awareness by overlaying Sea.AI’s data and alarms onto Timezero’s cartography, providing mariners with real-time insights for safer navigation. Such technological advancements are transforming marine chartplotters into comprehensive, connected systems to improve safety, efficiency, and user experience.

Moreover, the growing global trade and maritime logistics require advanced chartplotter solutions. According to the UN Trade and Development (UNCTAD), maritime trade is a primary factor for the robust adoption of marine chartplotters, accounting for over 80% of international trade volume. The use of marine chartplotters facilitates precise and efficient navigation, ensuring operational efficiency and safety. The increase in naval defense spending on upgrading fleet navigation and surveillance systems also drives the growth of marine chartplotters.

Key Marine Chartplotter Market Insights Summary:

Regional Highlights:

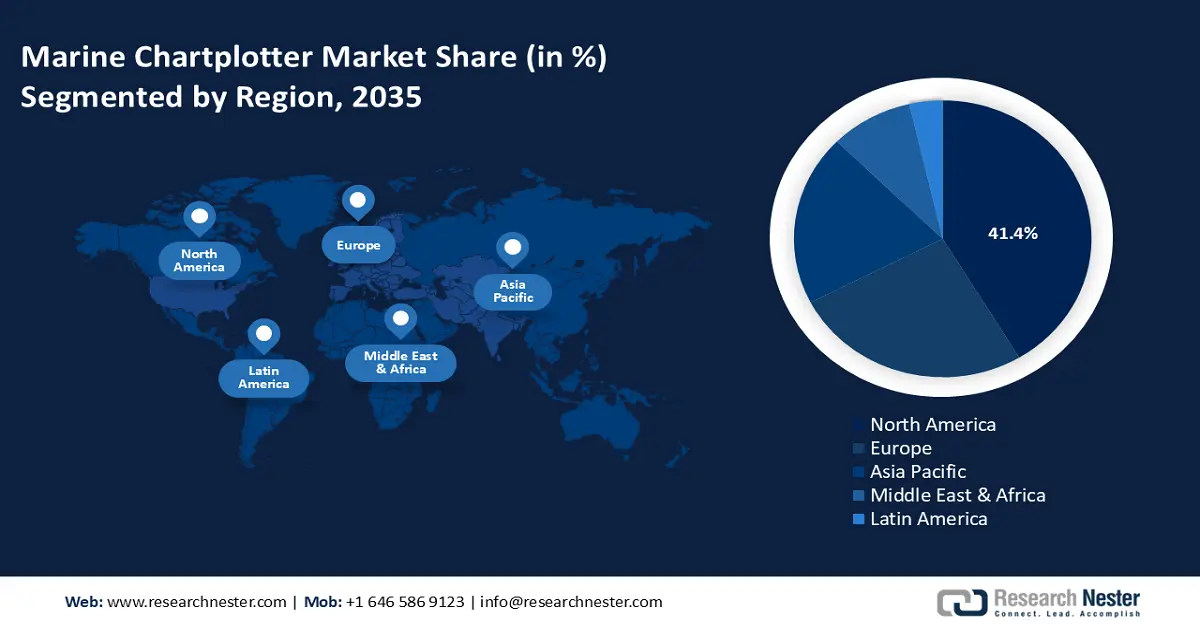

- North America marine chartplotter market will account for 41.40% share by 2035, driven by technological advancements and increased recreational boating activities.

Segment Insights:

- Navigation segment in the marine chartplotter market is forecasted to achieve 39% growth by the forecast year 2035, driven by increasing integration of AI, GPS, AR, and smart connectivity for safer navigation.

- The commercial vessels segment in the marine chartplotter market is projected to experience significant growth till 2035, driven by rising adoption of AI-powered chartplotters for real-time navigation and fuel efficiency.

Key Growth Trends:

- Growth in recreational boating and fishing activities

- Strict maritime safety and navigation regulations

Major Challenges:

- High initial costs and maintenance

- Complex operational and user training process

Key Players: Garmin Ltd., Raymarine (FLIR Systems), Furuno Electric Co., Ltd., Navico (Lowrance, Simrad, B&G), Humminbird (Johnson Outdoors), Japan Marina Co., Ltd., Si-Tex Marine Electronics, Standard Horizon (Yaesu), B&G (Navico), Wärtsilä Corporation.

Global Marine Chartplotter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 3.12 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, United Kingdom, China

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 18 September, 2025

Marine Chartplotter Market Growth Drivers and Challenges:

Growth Drivers

- Growth in recreational boating and fishing activities: The growing popularity of leisure boating and water sports has boosted the demand for advanced and reliable navigation systems. Leisure boaters prioritize safe navigation as they hover in unfamiliar waters. As more people engage in recreational boating and water sports, the demand for user-friendly navigation systems continues to grow. The expanding maritime tourism, yachting, and sport fishing industries also drive demand. Boat owners are upgrading to advanced digital navigation systems for convenience and safety. In addition to this, strict government regulations also drive the use of marine chartplotters for better navigation. For instance, in February 2025, the Tamil Nadu Government announced a strategic amendment to the Tamil Nadu Marine Fisheries' Regulation Act and Rules to prevent rising turtle death rates. In a move to curb rising mortality rates, it plans to penalize fishermen who turn off GPS transponders in fishing boats. The use of chartplotters ensures accurate positioning and route planning and helps in avoiding collision, which is highly necessary for commercial and recreational boating.

- Strict maritime safety and navigation regulations: Maritime safety authorities such as the International Maritime Organization (IMO), United States Coast Guard (USCG), and EU require vessels to have electronic navigation aids. These regulatory bodies mandate the use of modern electronic navigation systems, including chartplotters, for safety. The rising strict safety and compliance standards globally are pushing commercial and recreational vessel operators to invest in sophisticated advanced chartplotters. Thus, the adoption of Automatic Identification System (AIS) and collision avoidance technologies are becoming mandatory for better vessel tracking.

Challenges

- High initial costs and maintenance: Advanced chartplotters with GPS, AIS, radar, and sonar integration are expensive. This can lower its adoption to a certain extent, especially among budget-constrained economies and companies. The installation and maintenance of these chartplotters require specialized knowledge, which increases the overall cost for users. Further, advanced chartplotters with increased connectivity such as IoT, and AIS integration make chartplotters vulnerable to cyberattacks. Hackers can manipulate navigation data, posing safety risks to vessels.

- Complex operational and user training process: Many chartplotters have advanced functionalities that require training for effective use. Thus, a lack of familiarity with digital navigation tools among traditional mariners and fishermen can limit adoption. Additionally, many older boats still use analog or outdated digital systems, which makes the integration difficult. Thus, upgrading to modern smart marine systems can increase the retrofitting prices.

Marine Chartplotter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 1.81 billion |

|

Forecast Year Market Size (2035) |

USD 3.12 billion |

|

Regional Scope |

|

Marine Chartplotter Market Segmentation:

Application Segment Analysis

Navigation segment is projected to account for marine chartplotter market share of more than 39% by the end of 2035. Marine chartplotters are highly essential for navigation as they provide real-time GPS positioning, precise route planning, and hazard detection for vessels. They integrate with AIS radar and sonar to enhance safety and situational awareness at sea. Modern chartplotters use AI and IoT for smart navigation that offers real-time weather updates and automated collision avoidance. A recent example of an advanced marine chartplotter is Garmin’s latest navigation system, which was launched in February 2025. This integrates augmented reality (AR), smart wearables, and enhanced connectivity to provide safer and more efficient boating experiences. The system offers real-time positioning, route planning, and hazard detection while incorporating AI-driven features and cloud connectivity for smarter marine navigation. As maritime industries evolve, digital navigation systems are becoming necessary for both commercial and recreational boating.

End user Segment Analysis

The commercial vessels segment is poised to register significant marine chartplotter market growth during the forecast period. Commercial vessels such as cargo ships, tankers, and fishing fleets rely on marine chartplotters for precise navigation and route optimization. These vessels use chartplotters integrated with AIS, radar, and ECDIS to enhance safety for precise routing and comply with IMO and SOLAS regulations. The demand for real-time data, automated route planning, and collision avoidance is driving the adoption of AI-powered chartplotters. Smart navigation systems help commercial fleets to optimize fuel efficiency, reduce operational costs, and improve maritime safety. The rise of autonomous shipping and digital transformation is further accelerating the growth of marine chartplotters in this sector.

Our in-depth analysis of the global marine chartplotter market includes the following segments:

|

Application |

|

|

End use |

|

|

Type |

|

|

Display Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Chartplotter Market Regional Analysis:

North America Market Insights

North America marine chartplotter market is set to dominate revenue share of around 41.4% by the end of 2035, owing to technological advancements and increasing recreational boating activities. Further, the expansion of commercial shipping, fishing fleets, and yacht tourism fuels the adoption of AI-integrated and cloud-connected chartplotters. Top companies such as Garmin, Raymarine, and Simrad are innovating with touchscreen interfaces, real time weather updates, and enhanced GPS functions. Government regulations for Automatic Identification Systems (AIS) and Electronic Chart Display and Information Systems (ECDIS) are also accelerating the adoption of marine chartplotters in the region.

The U.S. marine chartplotter market is expanding due to the rising adoption of advanced navigation systems in commercial and recreational vessels. The country’s large coastline, extensive inland waterways, and strong fishing industry drive demand for high-precision GPS and sonar-integrated chartplotters. Government initiatives promoting safe and efficient maritime operations, including stricter AIS and ECDIS regulations, are fueling market growth. Additionally, the growing popularity of smart boating and autonomous vessel technology is pushing innovation in next-generation marine chartplotters.

The marine chartplotter market in Canada is growing due to the country’s vast coastline of 2.76 million square kilometres. The use of marine chartplotters is becoming evident due to the expansion of the commercial fishing industry, maritime trade, and recreational boating. The demand for electronic navigation systems in Canada is rising as vessels use AIS, radar integration, and real time GPS tracking. Additionally, Canada’s harsh weather condition and complex coastline makes advanced navigation systems essential for safe and efficient maritime operations. The growth of ecotourism and recreational boating in regions such as British Columbia, the Atlantic coast, and the Great Lakes is further boosting the adoption of smart marine chartplotters.

Europe Market Insights

Europe is anticipated to garner a remarkable marine chartplotter market share from 2026 to 2035. The market in Europe is witnessing growth due to the expansion of commercial shipping, maritime trade routes, and strict environmental regulations. The enforcement of strict navigation safety regulations by the local government is boosting the adoption of AIS and ECDIS-equipped vessels. Additionally, the rise of smart ports, digital navigation systems, and autonomous shipping technologies is further driving demand for advanced marine chartplotters across the region.

The marine chartplotter market in Germany is growing due to the country’s strong ship-building industry, the advanced maritime technology sector and expanding inland waterway transport. German ports such as Hamberg and Bremen are driving demand for high-precision navigation systems in commercial shipping. Additionally, the focus on sustainable maritime solutions and digitalization is increasing the adoption of AI-powered and eco-friendly chartplotters. The rise of autonomous and smart shipping initiatives in Germany further fuels innovation in marine navigation technology.

The marine chartplotter market in the UK is rising due to increasing maritime trade, strong fishing industries, and advanced naval technologies. Major ports such as London, Liverpool, and Southampton are increasing demand for modern navigation systems. The focus on maritime safety and digital transformation is further driving the use of AIS and GPS-integrated chartplotters. The growth of recreational boating and yacht tourism in the UK is boosting the marine chartplotter market for user-friendly and high tech marine chartplotters.

Marine Chartplotter Market Players:

- Simrad

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Garmin

- Raymarine

- OceanGrafix

- Zebra Technologies

- Garmin Marine

- VAISALA

- Humminbird

- CMAP

- Sierra

- SRT Marine Systems

- B and G

- Navico

- Lowrance

The marine chartplotter market is dominated by top companies such as Garmin, Raymarine, Simrad, Furono, and Lowrance which are highly known for their innovative navigation solutions. These companies lead the industry with high-precision GP, AI-driven mapping and smart connectivity features. The chartplotters developed by them ensure safe and efficient navigation in commercial vessels, fishing fleets, and recreational boats. Moreover, continuous innovation in touchscreen interfaces, real time data integration and autonomous navigation keep them ahead in the market.

Here are some leading players in the marine chartplotter market:

Recent Developments

- In September 2024, Garmin launched the GPSMAP 9500 Black Box System that offers the same functions as the GPSMAP 9000 series chartplotters but in a compact black box. It has seven times more processing power than older models, connects to third party monitors and provides faster networking and better connectivity across the vessel.

- In July 2024, Raymarine introduced new fishing features for Axiom displays. With the Lighthouse 4.7 software upgrade, users can control their boats directly from the chartplotter screen including Power Pole anchors and MOVE trolling motors. Additionally, the upgrade also included a new Smart Drift feature that helps to save time.

- Report ID: 7324

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Chartplotter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.