Manure Handling Equipment Market Outlook:

Manure Handling Equipment Market size was over USD 949.31 million in 2025 and is poised to exceed USD 1.61 billion by 2035, growing at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of manure handling equipment is estimated at USD 995.45 million.

As the global focus shifts towards sustainable farming, efficient manure handling becomes increasingly critical for managing organic waste and promoting soil fertility. For instance, in February 2024, it was published that the area used for organic farming expanded, rising by more than 20 million hectares, or 26.6%, between 2021 and 2022. Proper manure management helps recycle valuable nutrients back into the soil, reducing reliance on chemical fertilizers and enhancing environmental sustainability. As farmers adopt eco-friendly practices to meet the growing demand for organic produce, the need for advanced manure handling equipment grows, driving innovation and expansion in the manure handling equipment sector market.

Additionally, governments are implementing stricter guidelines to reduce pollution, control odors, and prevent contamination of water sources, all of which require advanced handling technologies. According to a report published by the World Bank, in October 2021, livestock sustained the livelihoods and food and nutrition security of about 1.3 billion people worldwide. It accounted for 40% of the value of agricultural output worldwide, projecting growth for the manure handling equipment market. As a result, farmers are adopting more sophisticated manure handling equipment to comply with these regulations, improve waste management efficiency, and mitigate environmental harm. Thus, propelling growth for the market.

Key Manure Handling Equipment Market Insights Summary:

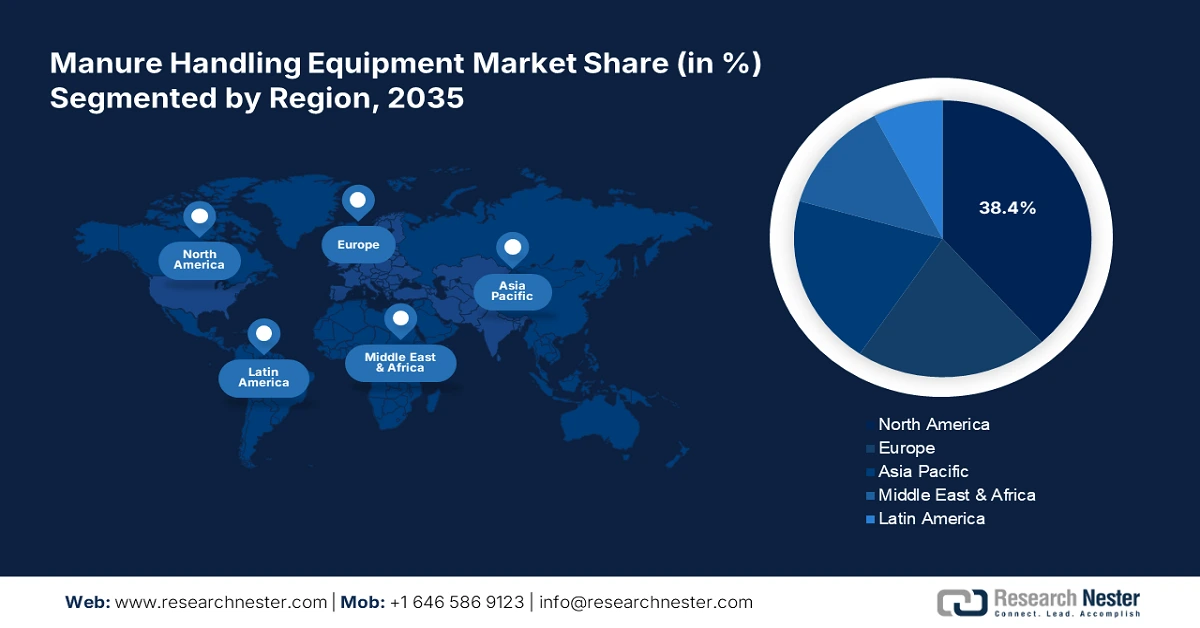

Regional Highlights:

- North America leads the Manure Handling Equipment Market with a 29.1% share, fueled by large-scale livestock farming and stringent environmental regulations in North America, driving growth through 2026–2035.

- Europe's manure handling equipment market is expected to see lucrative growth by 2035, driven by sustainable farming practices and strict manure disposal regulations in Europe.

Segment Insights:

- The Spreader segment is projected to hold a 26.30% market share by 2035, fueled by increasing demand for efficient nutrient distribution in modern farming.

- The Individual Farmers segment is set to expand significantly from 2026 to 2035, propelled by the rising adoption of sustainable farming practices among small and medium-sized farms.

Key Growth Trends:

- Growth of Livestock Farming

- Economic Growth in Emerging Markets

Major Challenges:

- Lack of Awareness and Knowledge

- High Initial Investment Costs

- Key Players: Cadman Power Equipment, Daritech, GEA Group.

Global Manure Handling Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 949.31 million

- 2026 Market Size: USD 995.45 million

- Projected Market Size: USD 1.61 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29.1% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, China, Canada, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Manure Handling Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Growth of Livestock Farming: The expanding livestock industry, fueled by growing global demand for animal products, generates large volumes of manure that must be efficiently handled, stored, and processed. According to a PIB report published in December 2023, from 2014–15 to 2021–22, the livestock sector in India expanded at a Compound Annual Growth Rate (CAGR) of 13.36%. To address improper management, farmers are increasingly turning to advanced manure handling equipment to ensure effective waste management, prevent contamination, and optimize manure for use as fertilizers or renewable energy. This is further boosting demand for manure handling equipment market.

- Economic Growth in Emerging Markets: As developing countries, especially in Asia Pacific and Latin America, expand their agricultural sectors and focus on increasing livestock production, the demand for manure handling equipment is growing significantly. East Asia and the Pacific are expected to increase at a rate of 4.8% in 2024 and 4.4% in 2025, according to World Bank projections, published in October 2024. Thus, with rising populations and an increasing need for food security, these regions are investing in efficient agricultural practices, including better waste management. This promotes sustainability and ensures compliance with environmental regulations, driving manure handling equipment market growth in these areas.

Challenge

- Lack of Awareness and Knowledge: Some manure handling systems are complex and require specialized training to operate effectively, which can be a significant barrier for farmers without technical expertise. Additionally, ongoing maintenance of these systems can be challenging, especially if the equipment is sophisticated or requires specific knowledge. This leads to higher operational costs and may deter adoption, particularly in rural or remote regions where access to skilled professionals and service providers is limited, slowing the manure handling equipment market growth.

- High Initial Investment Costs: Advanced manure handling equipment often comes with a high initial investment, which can be a major hurdle for small-scale farmers or those in developing regions with limited financial resources. Although these systems provide long-term benefits such as improved efficiency, reduced environmental impact, and cost savings, the substantial upfront costs make it difficult for many farmers to adopt these technologies. As a result, this financial barrier slows the widespread implementation of modern manure management solutions. Thus, limiting the manure handling equipment market.

Manure Handling Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 949.31 million |

|

Forecast Year Market Size (2035) |

USD 1.61 billion |

|

Regional Scope |

|

Manure Handling Equipment Market Segmentation:

Equipment (Pumps, Spreaders, Agitators, Barn cleaners, Liquid manure separators)

Spreader segment is poised to hold manure handling equipment market share of over 26.3% by the end of 2035. The segment’s growth is attributed to the increasing demand for efficient nutrient distribution in modern farming. A 2022 OEC report states that manure spreaders and fertilizer wholesalers traded total commerce of USD 737 million in 2022, with a 10.5% growth in exports. Spreaders ensure even application of manure, enhancing soil fertility and crop yield while reducing waste. As sustainable farming practices gain traction, farmers are adopting advanced spreader technologies to improve operational efficiency. Thus, projecting the market.

End user (Individual farmers, Cooperative farms, corporate farms)

Based on end user, the individual farmers segment is estimated to hold the majority of manure handling equipment market share over the forecast period. The segment’s growth is due to the rising adoption of sustainable farming practices among small and medium-sized farms. Farmers are increasingly investing in compact, cost-effective equipment to manage manure efficiently, enhance soil fertility, and comply with environmental regulations. Government subsidies and financial incentives further encourage individual farmers to adopt advanced manure handling solutions, driving manure handling equipment growth in this segment as they seek improved productivity and sustainability.

Our in-depth analysis of the global market includes the following segments:

|

Equipment |

|

|

Operation |

|

|

End user |

|

|

Application |

|

|

Animals |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Manure Handling Equipment Market Regional Analysis:

North America Market Statistics

North America manure handling equipment market is set to hold revenue share of over 29.1% by the end of 2035. The region has a large and expanding livestock industry, generating significant volumes of manure. According to a USDA research report, published in February 2023, there were 64,100 farms in Wisconsin and 44,300 farms in Nebraska functioning in 2022. Efficient handling and management of this waste are essential for maintaining farm productivity and complying with environmental standards, driving the demand for manure-handling equipment. Strict waste disposal regulations minimize contamination, driving farmers to adopt advanced manure handling technologies and boosting the manure handling equipment market growth.

Growing consumer preference in the U.S. for organic products has increased the demand for organic fertilizers. According to a report published by LETIS, in May 2024, about 80% of families purchased organic goods in the U.S. in the same year. Manure processing equipment enables the production of high-quality fertilizers, boosting its adoption among farmers aiming to meet this demand. Innovations like automated spreaders, separators, and composting systems enhance efficiency, driving U.S. farmers to adopt modern manure handling equipment, and projecting growth for the manure handling equipment market.

Farmers in Canada are increasingly adopting sustainable farming methods to enhance soil fertility and reduce chemical fertilizer use. Advanced manure handling equipment facilitates the recycling of nutrients from manure, promoting sustainable agriculture and supporting the manure handling equipment market growth. The focus on renewable energy in Canada drives the adoption of manure handling equipment for biogas production, boosting demand and farmer revenues. According to a report published by the Government of Canada, in August 2024, 16.9% of primary energy supply in Canada came from renewable sources in 2022. Thus driving the market.

Europe Market Analysis

In Europe manure handling equipment market is slated to hold a lucrative revenue share over the forecast period. Farmers in Europe are increasingly adopting sustainable agricultural practices to reduce environmental impact. In December 2024, the European Environment Agency published a report on the agricultural and food systems of this region. It stated that organic farming accounted for 9.9% of all agricultural land in the EU in 2021 due to regulatory support and growing consumer demand for organic products. Manure handling equipment plays a critical role in recycling nutrients and minimizing pollution, making it essential for achieving sustainability goals. Strict environmental regulations in Europe on manure disposal drive farmers to invest in advanced handling systems for compliance and risk reduction.

Germany has strong commitment to renewable energy has increased the adoption of manure handling equipment capable of converting manure into biogas. In September 2024, it was published in Clean Energy Wire, that 22 percent of the nation's gross final energy consumption came from renewable sources in 2023. This provides farmers with additional income streams and supports the country's energy transition goals, further boosting demand for such technologies. The rising demand for organic farming and fertilizers drives the need for manure handling equipment to produce high-quality compost. Thus, propelling the manure handling equipment market.

Commitment to reducing carbon footprint in the UK encourages farmers to adopt technologies that minimize greenhouse gas emissions. To achieve 'net-zero' greenhouse gas (GHG) emissions by 2050, the UK government formally committed to this goal in June 2019. It mentioned, 10% of the UK's total greenhouse gas emissions come from agriculture, with livestock producing 62% of these emissions, nutrient management contributing 28%, and agricultural fuel usage contributing 10%. Manure handling systems, especially those that convert waste into renewable energy or organic fertilizer, align with this environmental goal, driving adoption and propagating the manure handling equipment market.

Key Manure Handling Equipment Market Players:

- Bauer Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bazooka Farmstar

- BouMatic

- Cadman Power Equipment

- Daritech

- GEA Group

- Lely

- Vogelsang GmbH & Co. KG

- Patz Corporation

- Phil's Pumping & Fabrication

- Valmetal

Key companies in this manure handling equipment market are driving innovation by developing advanced technologies such as automated manure spreaders, nutrient recycling systems, and waste-to-energy solutions. For instance, in September 2021, by introducing its own line of manure spreaders, Pichon expanded and developed, completing its product line for improving organic fertilizers. These innovations enhance operational efficiency, reduce labor costs, and improve sustainability by converting manure into valuable resources such as organic fertilizers or biogas. Leading companies focus on integrating smart technologies, such as sensors, and IoT, to optimize manure management, meeting the growing demand for eco-friendly and efficient solutions. Such key players include:

Recent Developments

- In November 2021, the Vogelsang GmbH & Co. KG press screw separator was introduced. At the internal trade show Gülle Professional Days, the mechanical engineering firm unveiled it together with other advancements for effective liquid manure management.

- In November 2020, the Vogelsang Unispread was launched with its compact system for spreading liquid manure close to the ground with low emissions, featuring the ExaCut precision distributor for even distribution.

- Report ID: 6883

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Manure Handling Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.