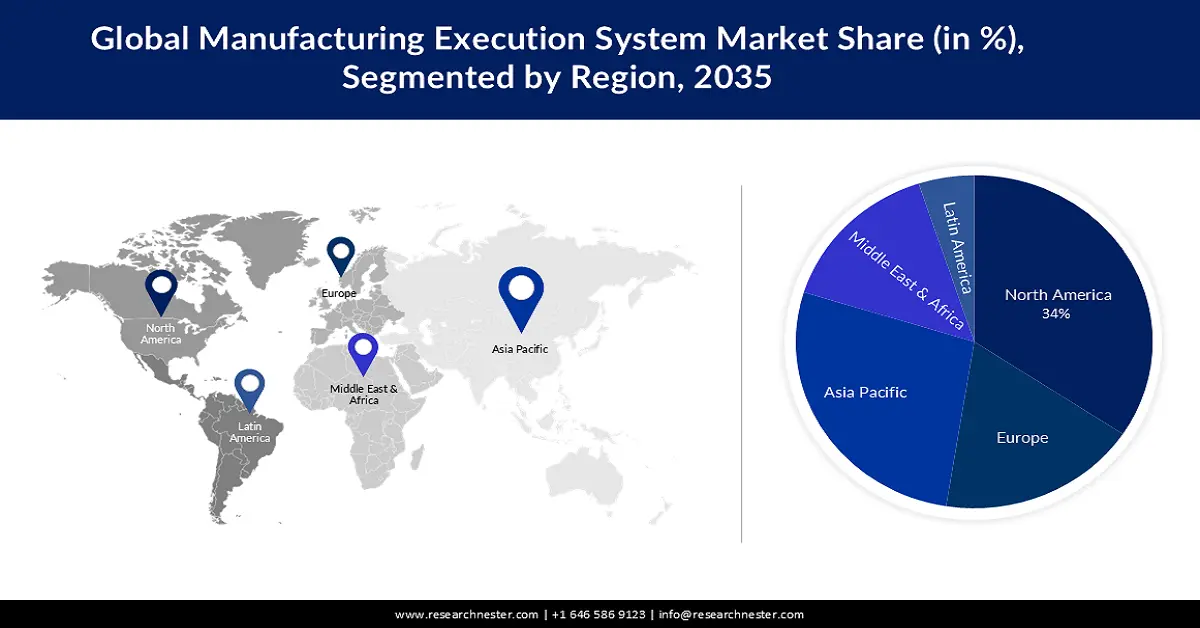

Manufacturing Execution Systems Market Regional Analysis:

North American Market Insights

The manufacturing execution systems market in North America is poised to account for the largest share of 33.0% throughout the analyzed timeframe. The region is impelled by the existence of major pioneers and service providers in this field. In addition, the growing investment in extensive research & development to create more advanced MES solutions, addressing the unmet needs of different entities, is bringing innovation to this landscape. For instance, in August 2024, Nanotronics introduced a next-generation AI-driven manufacturing process control platform, nSpec Copilot, to drive production excellence. Therefore, several large and small enterprises are increasingly adopting this new range of flexible and scalable MES.

The U.S. is augmenting the market with the magnifying production and economic output from its industrial territory. As per the Federal Reserve System, the nationwide industrial production (IP) grew at an annual rate of 5.5% in the first quarter of 2025. Particularly, the contribution of this country in cultivating innovation for the pharma, MedTech, and biotech industries is glorifying its significance in regional growth. On this note, in February 2023, GE Digital enabled new MES enhancements in its Proficy Smart Factory portfolio and presented customer-driven results at the 27th Annual ARC Industry Forum. The company mentioned that its MES software helped a paper company make an annual savings of USD 4.0 million and an automotive manufacturer reduce inspection costs by 40.0%.

APAC Market Insights

The Asia Pacific manufacturing execution systems market is estimated to be the second largest shareholder and to exhibit a notable CAGR by 2035. The region’s fast propagation is led by rising industrialization and manufacturing capacities. On this note, the United Nations predicted the manufacturing value added (MVA) per capita in the upper middle-income countries (UMICs) in Asia Pacific to surpass USD 4344.0 by 2030. Developing nations, such as China and India, are increasingly becoming the primary source of growing demand for comprehensive software programs that maximize the effectiveness of manufacturing processes and gather data about overall plant activities.

China is an internationally recognized hub of manufacturing and industrialization in the world, making it a lucrative business opportunity for global pioneers. According to a report from the Center for Strategic & International Studies, the country’s MVA accounted for USD 4.6 trillion in 2023, representing 29.0% of the total global MVA. It also mentioned that the trade balance of manufactured goods in China reached USD 1.8 trillion in the same year, where 24.0% of the exported goods in 2020 were electronics. Thus, the enlarging consumer base, distributed across various industries such as pharmaceutical and electronics, in this country is fostering a progressive atmosphere for the market.