Manned Security Services Market Outlook:

Manned Security Services Market size was valued at USD 24.39 billion in 2025 and is expected to reach USD 87.3 billion by 2035, registering around 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of manned security services is evaluated at USD 27.38 billion.

The global manned security services market is driven by increasing security demands across residential, commercial, and public sectors. The U.S. Bureau of Labor Statistics has highlighted the employment growth of security guards, which reflects the rising demand for human-centric security solutions despite advancements in automation. The trend is reinforced by the United Nations Office on Drugs and Crime (UNODC) report, shedding light on the rising concerns over urban crime in emerging economies. The table below highlights trends beneficial for a sustained growth in demand for manned security services.

Security Labor Statistics and Increasing Crime Rates

|

Particulars |

Details |

|

Global percentage of urban residents who have been victims of urban crimes at least once in 5 years. |

60% |

|

Regional percentage of urban residents who have been victims of urban crimes at least once in 5 years. |

70% |

|

Job Outlook for Security Guards & Gambling Surveillance Officers from 2023 to 2033 |

2% Growth |

|

Employment Change from 2023 to 2033 |

26,900 |

Source: UN-Habitat and the U.S. Bureau of Labor Statistics

Organizations increasingly prioritize manned services for their adaptability in complex environments, such as crowd management during large-scale events or real-time response to breaches. The rising demand for manned security services indicates the irreplaceable value of human judgments in adverse scenarios.

Another factor of the manned security services market growth is the surging urbanization across the world. Urbanization, along with rising crime rates and growing demands for safety, has led to an uptick in gated communities that require manned security services. A report by Redseer highlights that in India, the demand for gated communities is expected to increase by 2.6% by 2026, with valuations reaching more than USD 500 billion. Moreover, gated communities are expected to house a significant chunk of the world’s population by 2030, and it is anticipated to bolster the demands for round-the-clock security services, assisting the manned security services market’s continued expansion. The table below highlights urbanization trends predicted by the United Nations, which are poised to be consistent drivers of the market.

|

Particulars |

Details |

|

Estimated increase in urban population by 2050 |

68% |

|

Expected increase in population in urban areas by 2050 |

2.5 billion |

|

Projected regional urban population growth surge by 2050 |

India, China, and Nigeria will account for 35% of the projected growth. |

|

Most urbanized regions in 2018 |

North America (82%), Latin America (81%), Europe (74%) |

Source: UN Department of Economic and Social Affairs

A key shift in the manned security services market is the advent of smart surveillance devices. ASIS International, a leading security industry association, highlighted in their 2023 report that more than 60% of security firms now deploy personnel trained to operate smart systems to improve operational efficiency. The U.S. Department of Homeland Security emphasized the collaboration between private security agencies and public entities to elevate the role of security personnel to proactive risk mitigators. Opportunities are rife for companies offering training modules for manned security and to provide personnel upskilled to curb evolving security threats, to maintain an advantage in the competitive market. Moreover, the manned security services market is set to leverage the growth drivers and maintain robust expansion by the end of 2037.

Key Manned Security Services Market Insights Summary:

Regional Highlights:

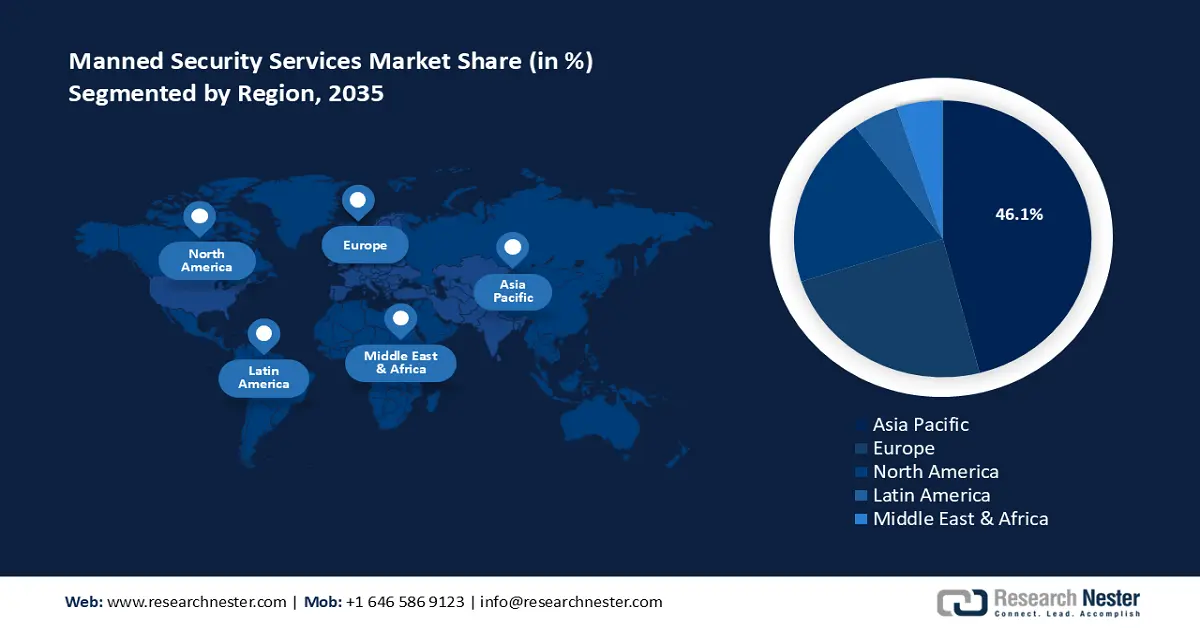

- Asia Pacific holds a 46.10% share in the Manned Security Services Market, propelled by rapid urbanization and significant infrastructure development investments across the region, positioning it for growth by 2035.

- Europe’s manned security services market is projected for significant growth by 2035, driven by heightened security concerns and investments in defense and security technologies.

Segment Insights:

- The Equipment segment is expected to achieve more than 74% share by 2035, driven by the rising adoption of AI-powered surveillance and IoT-enabled security devices.

- The Service segment of the Manned Security Services Market is expected to expand its revenue share from 2026 to 2035, driven by surging demand for patrol, event security, and emergency response services.

Key Growth Trends:

- Rapid increase in large-scale events

- Rising demand in the healthcare and education sectors

Major Challenges:

- High attrition rates and labor shortages

- Competition from technology-driven security solutions

- Key Players: Allied Universal, Securitas AB, GardaWorld. Prosegur, SIS Group Industries, ISS A/S, Brink’s Company, ADT Inc., Transguard Group, Control Risks, Sohgo Security Services Co., Ltd..

Global Manned Security Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.39 billion

- 2026 Market Size: USD 27.38 billion

- Projected Market Size: USD 87.3 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 12 August, 2025

Manned Security Services Market Growth Drivers and Challenges:

Growth Drivers

- Rapid increase in large-scale events: The surge in large-scale events globally is a major factor in the manned security services market’s growth. The post-pandemic resurgence of events such as sports tournaments, concerts, international expos, etc., has significantly boosted the demand for manned security services. For instance, the 2022 FIFA World Cup in Qatar employed over 40,000 security personnel, highlighting the scale of manpower required to host mega-events successfully. Moreover, large-scale events bolster the economic growth of countries, which leads to greater investment in hosting major events. In addition, the increase in disposable income of the population in emerging and major economies enhances the spending power on major outdoor concerts. For instance, in January 2025, more than 0.23 million people attended a music concert in Ahmedabad, India, marking it as the largest concert of this century, as per the Guinness Book of World Records. With major events rising exponentially over the years, the requirement for manned security services from event management companies is projected to surge.

- Rising demand in the healthcare and education sectors: Hospitals are experiencing an increase in footfall, which has added to the need for security personnel. Emerging economies, especially India, have experienced an uptick in violence against medical staff, which adds to the calls for trained security services. Third-party security firms bring specialized training and expertise to major hospitals that experience the largest patient footfalls. This is expected to fuel the demand for manned security services. In addition, the growth of educational institutions worldwide, with a steady increase in residential educational institutions in the backdrop of rising investments in private universities, has contributed to an increase in the calls for manned security services.

- Growing requirement for critical asset protection: The rising requirement for critical asset protection is poised to ensure sustained demand for manned security services. Governments worldwide are allocating substantial budgets to improve the national security infrastructure. For instance, the U.S. Department of Defense’s 2025 budget emphasizes bolstering the defense ecosystem to address evolving threats. Moreover, trends indicate that infrastructure operators now rely on a hybrid model of automated and manned security, creating a heightened demand for security personnel with expertise in handling security tech. An emerging opportunity for security firms is the expansion of renewable energy projects. High-value projects as such require investments to bolster security, while the growth of investments to improve stadium security is tied up with the increasing calls to improve manned security services.

Challenges

- High attrition rates and labor shortages: The industry can experience constraints in attracting and retaining skilled labor. High attrition rates plague the manned security services market, owing to grueling working conditions. The U.S. Bureau of Labor Statistics highlights more than 60% turnover rates driven by 12-hour shifts and minimal career progression. These issues can undermine service quality, adversely impacting the sector’s growth.

- Competition from technology-driven security solutions: The traditional manned guarding services face surging competition from technology-driven security services, which include remote monitoring and automated systems. The rise of autonomous security robots has reshaped the security industry, creating direct competition for traditional manned guarding services. Additionally, the shift toward automation is evident in high-security environments such as industrial facilities and airports.

Manned Security Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 24.39 billion |

|

Forecast Year Market Size (2035) |

USD 87.3 billion |

|

Regional Scope |

|

Manned Security Services Market Segmentation:

Type (Equipment, Service)

Equipment segment is projected to account for manned security services market share of more than 74% by the end of 2035. This growth can be attributed to the rising adoption of AI-powered surveillance systems and IoT-enabled devices, which allows security personnel to monitor and respond to threats efficiently. Sectors that require extensive security measures are leading the adoption of advanced equipment for security services. In February 2024, ASIS International released a report highlighting that the manned security market is employing upwards of 30 million people, with around 210,000 employed in the security equipment sector. Furthermore, opportunities are poised to emerge to provide next-generation advanced security equipment.

The service segment is poised to expand its revenue share throughout the forecast period. owing to the surging demand for patrol services, event security, and emergency response. The post-pandemic rise in large-scale public events has escalated the demand for professional event security services, with businesses increasingly outsourcing security needs to professional firms.

End user (Commercial Buildings, Industrial Buildings, Residential Buildings)

The commercial buildings segment is anticipated to be the largest end user of manned security services market during the forecast period due to the surging requirement to protect high-value assets. Commercial buildings in developed markets employ hybrid security models that combine personnel with advanced technology. For instance, the Urban Land Institute (ULI) highlights that properties with robust security measures command higher rental premiums and attract premium tenants, bolstering outsourcing rates to security firms for manned security services.

Our in-depth analysis of the global manned security services market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Manned Security Services Market Regional Analysis:

Asia Pacific Market Forecast

APAC in manned security services market is anticipated to hold over 46.1% revenue share by the end of 2035, attributed to the rapid urbanization rates and significant infrastructure development investments across the region. China and India are leading the revenue share in APAC owing to a surge in demand for professional security personnel to safeguard the expanding commercial establishments, residential complexes, critical public infrastructure, etc. Emerging trends within APAC include Singapore’s Home Team Science and Technology Agency (HTX) emphasizing hybrid security models for Changi Airport and maritime ports. Meanwhile, APAC’s booming tourism sector fuels demand for event security, boosting sustained growth of the sector.

The China manned security services market is anticipated to expand during the forecast period. The proliferation of AI-driven facial recognition systems in public spaces to cut crimes, i.e., the Sharp Eyes or Xueliang project, has driven the requirement for trained security deployment. Additionally, China is one of the global leaders in major infrastructure projects such as the Belt & Road Initiative, and upcoming global sports events such as the World Games in 2025 are projected to create sustained opportunities for the deployment of manner security services. The rising urbanization in China is projected to create sustained demand for manned security services in residential and commercial services throughout the stipulated timeframe.

The India manned security services market is forecast to exhibit robust growth by the end of 2035. The Private Security Agencies Regulation Act (PSARA) has formalized the industry. Surging demands in IT parks, clubs, malls, and gated communities, and increasing large-scale events in the market are projected to maintain the sector’s growth curve. The manned security services market’s growth is connected with the expansion of gig economy platforms in India, including GuardWell, which connects certified security guards to end users. Moreover, rapid expansion of the healthcare sector and private university campuses in the country has boosted the requirement for manned security services.

Europe Market Forecast

The Europe manned security services market is assessed to register the second-largest revenue share by the end of 2035 due to heightened security concerns and investments in defense and security technologies. In 2024, venture capital funding for defense-related technologies in Europe surged by more than 20%. The influx of capital has bolstered the capabilities of manned security solutions. Moreover, Europe has a burgeoning sports culture, led by soccer, which requires robust manned security for large-scale events such as weekly Premier League Matches, EURO, FA Cup, and more.

The Germany manned security services market is envisioned to register the largest revenue share in Europe. The market’s growth is owed to industrial security demands in the country, security for the thriving techno culture in Berlin, and the weekly soccer matches of various tiers organized across the nation necessitating trained manned security services. The Sicherheitspartnerschaften model in Germany for collaborative security partnerships between private security firms, law enforcement agencies, community organizations, etc., positively impacts the market’s growth by creating a comprehensive security architecture. Moreover, vocational training with programs such as IHK Security Specialist Certification in Germany provides opportunities for security firms to ensure a workforce of skilled security guards to maintain an advantage in the competitive market.

The France manned security services market is estimated to expand during the projected timeline. Global events such as the Paris 2024 Olympics have accelerated the hiring of multilingual, tech-savvy guards who find continued employment opportunities in cities such as Paris, which experience heightened tourist footfalls. Furthermore, France has a thriving soccer culture and strong groups of ultras, which has led to violence in the past, underscoring the rising investments by soccer clubs in bolstering stadium security. The outsourcing of security requirements of stewards in soccer stadiums creates sustained opportunities in the manned security services market.

Key Manned Security Services Market Players:

- Allied Universal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Securitas AB

- GardaWorld

- Prosegur

- SIS Group Industries

- ISS A/S

- Brink’s Company

- ADT Inc.

- Transguard Group

- Control Risks

- Sohgo Security Services Co., Ltd.

The manned security services market is set for expansion during the forecast period. The key players in the sector are actively expanding revenue shares via strategic acquisitions and diversification of services. For instance, in September 2021, Allied Universal announced the acquisition of Security Guards Inc. to expand security services to major corporations in the U.S. Security firms are enhancing portfolios by incorporating advanced technologies such as AI-driven surveillance systems and biometric controls to assist security personnel. Furthermore, expansion to emerging markets provides lucrative opportunities for businesses within the sector. Here are some key players in the manned security services market:

Recent Developments

- In February 2025, Prosegur Security announced a partnership with DBA-Kinetic Global to improve global risk management solutions. The collaboration is poised to improve access to Critical Event Management (CEM) platform modules for clients.

- In November 2024, Garda World Security Corporation completed the acquisition of Stealth Monitoring. The acquisition is poised to provide product expertise in video monitoring for security solutions for GardaWorld.

- Report ID: 7292

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Manned Security Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.