Mandelic Acid Market Outlook:

Mandelic Acid Market size was valued at USD 357.38 million in 2025 and is set to exceed USD 1.4 billion by 2035, registering over 14.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mandelic acid is estimated at USD 404.34 million.

The mandelic acid market is experiencing strong growth, primarily fueled by its increasing use in the skincare and cosmetics industry. As consumer preferences shift toward gentler, more effective, and scientifically backed ingredients, mandelic acid has gained traction due to its unique properties as an alpha hydroxy acid (AHA). Mandelic acid is used for exfoliation, anti-aging, acne treatment, and skin brightening. Mandelic acid has a larger molecular structure than glycolic or lactic acid, making it less irritating for sensitive skin. Dermatologists and brands recommend it for hyperpigmentation, melasma, and fine lines.

The global anti-aging skincare industry is expanding, driven by increasing consumer interest in youthful, even-toned skin. Mandelic acid helps improve collagen production, reducing wrinkles and fine lines. It is also widely used in acne treatments, as it has antibacterial and anti-inflammatory properties. Moreover, the skincare industry, especially in Asia Pacific, North America, and Europe, is seeing increased spending on high-performance skincare products. K-beauty, J-beauty, and Western brands are incorporating mandelic acid into serums, toners, and peels.

Pricing plays a crucial role in shaping the mandelic acid market, affecting both supply and demand dynamics. Pricing components such as raw material costs, energy, labor, demand trends, and regulations drive the market by influencing production costs, market competitiveness, and end user pricing.

|

Production Description |

Quantity |

Price (in USD) |

|

L (+)-Mandelic acid |

25g |

18.90 |

|

L (+)-Mandelic acid |

100g |

40.30 |

|

L (+)-Mandelic acid |

1kg |

252.50 |

|

(+)-O-Acetyl-L-mandelic acid |

5g |

80.60 |

|

(+)-O-Acetyl-L-mandelic acid |

25g |

307.66 |

|

R-(-)-Mandelic acid |

25g |

20.00 |

|

R-(-)-Mandelic acid |

100g |

25.00 |

|

R-(-)-Mandelic acid |

250g |

30.00 |

|

DL-Mandelic acid |

100g |

20.00 |

|

DL-Mandelic acid |

250g |

45.00 |

|

2-Fluoro-DL-mandelic acid |

5g |

156.43 |

|

2-Fluoro-DL-mandelic acid |

25g |

527.69 |

Key Mandelic Acid Market Insights Summary:

Regional Highlights:

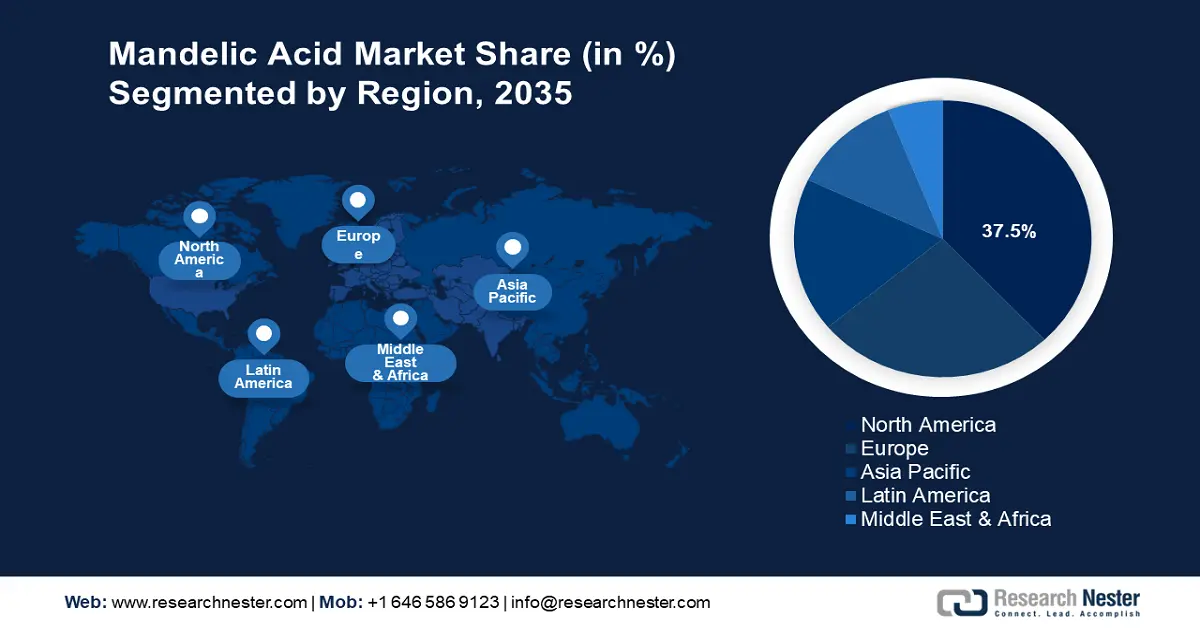

- North America leads the Mandelic Acid Market with a 37.5% share, propelled by versatile applications in pharmaceuticals and cosmetics, supported by industry advancements and evolving consumer preferences, ensuring robust growth through 2026–2035.

- Europe’s Mandelic Acid Market is set for significant growth by 2035, driven by rising consumer awareness and continuous innovation within the beauty and personal care sectors.

Segment Insights:

- The Pharmaceutical segment of the Mandelic Acid Market is poised for substantial growth from 2026-2035, driven by rising demand for antibiotics, antibacterial agents, and dermatological treatments.

- The DL Type segment of the Mandelic Acid Market is forecasted to hold a 56.6% share by 2035, driven by its wide use in pharmaceuticals, cosmetics, and food & beverages due to its antibacterial properties and medical applications.

Key Growth Trends:

- Growing demand for fragrances and preservatives

- Rising disposable income and changing lifestyle trends

Major Challenges:

- Potential skin sensitivity and allergic reactions

- Growing competition from synthetic and multi-ingredient skincare solutions

- Key Players: Spectrum Chemicals, Alfa Aesar (now part of Thermo Fisher Scientific), Avantor, Synerzine, BASF SE, Evonik Industries AG.

Global Mandelic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 357.38 million

- 2026 Market Size: USD 404.34 million

- Projected Market Size: USD 1.4 billion by 2035

- Growth Forecasts: 14.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Mandelic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for fragrances and preservatives: Mandelic acid enhances the longevity and intensity of perfumes by acting as a fixative and helps maintain the optimal pH of fragrance formulations, preventing degradation. Consumers are shifting toward plant-derived and synthetic-free perfumes, boosting the adoption of mandelic acid. The premium perfume sector is growing, with brands emphasizing gentle, long-lasting formulations that benefit from mandelic acid’s stabilizing role.

Moreover, the rising demand for safe and natural preservatives in cosmetics and personal care drives the mandelic acid market. The American Chemical Society states that about 40% of customers prioritize natural ingredients in their beauty and personal care products. As regulatory bans and consumer awareness push companies away from parabens, mandelic acid is emerging as a safer, skin-friendly option. - Rising disposable income and changing lifestyle trends: Consumers have more spending power and are investing in high ingredients like mandelic acid. Premium beauty brands are incorporating mandelic acid into their anti-aging, acne treatment, and hyperpigmentation products, driving mandelic acid market expansion. The rise of self-care and wellness culture has led to increased demand for chemical peels, serums, and anti-aging solutions. Approximately 88% (9 out of 10) of U.S. residents actively engage in self-care, and a third of customers have expanded their self-care practices in 2024. Growing awareness about skincare routines and prevention-based beauty trends is fueling the uptake of exfoliating and brightening products.

Social media and beauty influencers are shaping consumer preferences, encouraging the use of dermatologist-recommended and science-backed ingredients like mandelic acid.

Further, consumers are increasingly choosing natural, organic, and clean-label cosmetics and wellness goods, indicating a growing shift toward sustainability and organic products. Mandelic acid, being a gentle and naturally derived AHA, is gaining popularity as a safer alternative to harsher acids like glycolic acid. The preference for non-invasive skin treatments and at-home chemical peels has surged, leading to higher demand for mandelic acid-based formulations. Face peel products grew 150% between 2019 and 2020, with a 107% increase in sales in April 2020 compared to March. The Ordinary, QRxLabs, Dr. Dennis Gross, M-61, Bliss, and Neogen Dermalogy are some of the major beauty brands in the online face peel sector.

The combination of higher disposable income, evolving beauty trends, and a shift toward premium skincare products is fueling the mandelic acid market. As consumers continue to prioritize skin health and sustainable beauty, the demand for gentle yet effective active ingredients like mandelic acid will remain strong.

Challenges

-

Potential skin sensitivity and allergic reactions: Risk of skin irritation and sensitivity can cause redness, irritation, and peeling, especially for sensitive skin users. Higher concentrations (>10%) in chemical peels and professional treatments increase the risk of adverse reactions. First-time users may misuse or overapply mandelic acid, leading to irritation and negative consumer perception.

Moreover, allergic reactions and skin conditions such as contact dermatitis or allergic reactions, including itching, burning, or swelling, may develop. Individuals with pre-existing rosacea, eczema, or extremely sensitive skin may experience excessive dryness or flare-ups. The lack of widespread dermatological recommendations compared to other AHAs may limit consumer confidence. - Growing competition from synthetic and multi-ingredient skincare solutions: Modern skincare products now combine multiple active ingredients for enhanced benefits. Consumers prefer all-in-one solutions over single-ingredient products like mandelic acid, limiting its standalone appeal. Brands are increasingly formulating customized blends with AHAs, BHAs, and PHAs, reducing the reliance on mandelic acid alone.

While mandelic acid remains a valuable exfoliant and skincare ingredient, the rise of synthetic, multi-ingredient, and biotech-driven formulations is shifting consumer preference. To stay competitive, mandelic acid brands must develop hybrid formulations, emphasize unique benefits, such as its antibacterial properties for acne-prone skin, and adapt to mandelic acid market trends by integrating advanced skincare technologies.

Mandelic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.6% |

|

Base Year Market Size (2025) |

USD 357.38 million |

|

Forecast Year Market Size (2035) |

USD 1.4 billion |

|

Regional Scope |

|

Mandelic Acid Market Segmentation:

Type (DL, L and D)

DL type segment is projected to hold mandelic acid market share of more than 56.6% by 2035. The market is growing significantly, driven by various downstream (DL) applications across multiple industries, such as pharmaceuticals, cosmetics & personal care, food & beverages, chemical intermediates, and others. Mandelic acid is widely used in antibiotics, urinary tract infection (UTI) treatments, and antiseptics, driving demand from the medical sector. Mandelic acid is used as an antibacterial agent to treat UTIs. It is effective in eradicating 85%-90% of uncomplicated kidney and bladder infections. For mandelic acid therapy to be effective, the urine’s pH must be maintained between 5.3 and 5.5, and the drug concentration in the urine must be between 0.9% and 1.0%. A daily intake of 12 grams of mandelic acid is typically required for satisfactory results.

The increasing use of mandelic acid in skincare products, including anti-aging creams, acne treatments, and chemical peels, is a major growth factor. Its gentle exfoliating properties make it a preferred choice in sensitive skin formulations. Moreover, mandelic acid is utilized in synthesizing various chemicals and esters used in fragrances, dyes, and other industrial applications.

Application (Pharmaceutical, Cosmetics & Personal Care, and Textiles & Dye Intermediates)

The pharmaceutical segment in mandelic acid market is witnessing substantial growth during the assessed period. The market growth is due to the rising demand for antibiotics and antibacterial agents, increasing use in dermatological treatments, and growing interest in drug delivery systems. Mandelic acid has antimicrobial properties, making it effective in treating UTIs and other bacterial infections. It is used in combination with other drugs to enhance antibiotic effectiveness.

Additionally, it is used in topical formulations for acne, hyperpigmentation, and skin rejuvenation. It is milder than glycolic acid, making it appropriate for use on delicate skin. Mandelic acid is also being investigated for its use in controlled medication release formulations. It has the potential to increase the bioavailability of some drugs.

Our in-depth analysis of the global mandelic acid market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mandelic Acid Market Regional Analysis:

North America Market Statistics

North America in mandelic acid market is expected to dominate around 37.5% revenue share by the end of 2035, owing to its versatile applications in pharmaceuticals and cosmetics, supported by industry advancements and evolving consumer preferences. In 2023, North America accounted for 53.3% of global pharmaceutical sales, compared to 22.7% in Europe. In May 2024, the U.S. market accounted for 67.1% of new medication sales from 2018-2023, with Europe accounting for 15.8%.

In the U.S., favorable regulatory frameworks and continuous research and development efforts have facilitated the incorporation of mandelic acid into a variety of products. Innovations in product formulations and delivery systems have expanded its applications, enhancing mandelic acid market penetration. Growing consumer interest in effective skincare solutions has bolstered the incorporation of mandelic acid into various formulations.

Big Pharma companies are also increasing their investments in manufacturing. Eli Lilly has committed over USD 23 billion since 2020 to expand and build manufacturing sites globally. In the U.S., Lilly more than doubled its investment in its Lebanon, Indiana, manufacturing site to USD 9 billion. Further, Amgen is investing USD 1 billion to expand its production in Holly Springs, North Carolina. AstraZeneca is investing USD 35 billion to expand its U.S. R&D and manufacturing footprint. The U.S. government also provides support for drug research through tax credits and financial incentives. The Credit for Researching Activities offers a benefit of 6-13% of every dollar pharmaceutical companies spend on research, and the Orphan Drug Credit returns up to 25% of the costs of clinical trials.

In Canada, educational campaigns and marketing initiatives have raised awareness about the benefits of mandelic acid. As consumers become more informed about its advantages, particularly its suitability for sensitive skin, the demand in the local mandelic acid market continues to rise. Furthermore, ongoing research and development have led to innovative mandelic acid formulations, enhancing their stability and efficacy. Local key players invest in new product development to meet diverse consumer needs, further propelling market growth.

Europe Market Analysis

Europe's mandelic acid market is expected to grow significantly during the projected period. Rising consumer awareness, educational initiatives, and continuous innovation within the beauty and personal care sectors are driving the market. Consumers are increasingly informed about skincare ingredients and their benefits. This knowledge has led to a surge in demand for products containing mandelic acid, known for its gentle exfoliating properties and effectiveness in treating skin concerns such as acne, hyperpigmentation, and signs of aging.

The UK mandelic acid market is experiencing rapid growth, driven by a dynamic beauty industry and increasing consumer interest in advanced skincare products. Further leading the European market share, Germany’s strong cosmetic and pharmaceutical sectors are major contributors to the demand for mandelic acid. Also, key players in France are investing in research and development to create advanced skincare and pharmaceutical products incorporating mandelic acid. This focus on innovation aligns with consumer preferences for high-quality, effective solutions.

Key Mandelic Acid Market Players:

- Sigma-Aldrich

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Spectrum Chemicals

- Alfa Aesar (now part of Thermo Fisher Scientific)

- Avantor

- Synerzine

- BASF SE

- Evonik Industries AG

- Arkema Group

- Guangzhou Tinci Materials Technology Co., Ltd.

- Anhui Sunsing Chemicals Co., Ltd.

Key players are driving the mandelic acid market through technological advancements, expanding distribution, sustainability efforts, and regulatory compliance. These strategies are fueling the growing demand for mandelic acid in skincare, pharmaceuticals, and industrial applications worldwide.

Recent Developments

- In October 2024, BASF Personal Care introduced a new synthetic peptide for skin care applications. Pepsensyal (INCI: Mannitol (and) Acetyl sh-Tetrapeptide-1 (and) Lauroyl sh-Tetrapeptide-1) is clinically shown to prevent and delay the first visible signs of aging, inspired by the skin's natural regenerative process.

- Report ID: 7201

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mandelic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.