Managed SD-WAN Services Market Outlook:

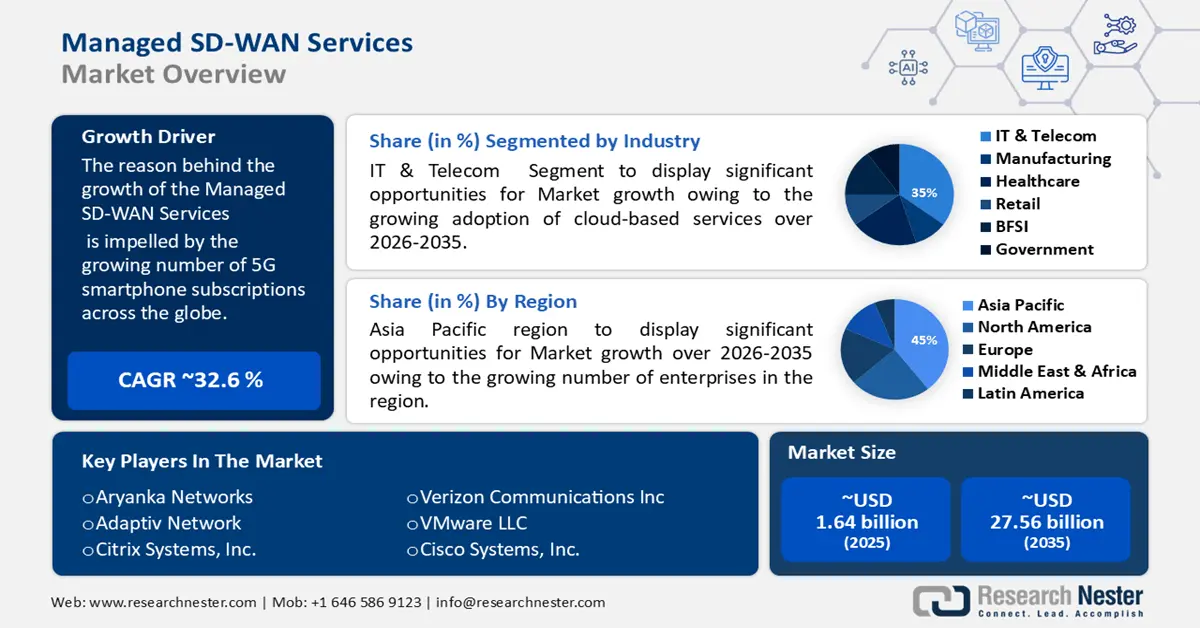

Managed SD-WAN Services Market size was valued at USD 1.64 billion in 2025 and is set to exceed USD 27.56 billion by 2035, registering over 32.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of managed SD-WAN services is estimated at USD 2.12 billion.

The reason behind the growth is impelled by the growing spending on IT and Telecom industry across the globe. In the telecommunications industry, businesses are spending more than ever before as they aim to leverage several geographic and sectoral growth hotspots and leverage new technologies to stay competitive in a rapidly evolving business landscape.

For instance, spending on communications services in 2023 reached over USD 1 trillion, an increase of approximately 3% from the previous year.The growing acquisitions and partnerships are believed to fuel the market growth. For instance, Etisalat by e& together with Versa Networks, VeloCloud, and Fortinet expanded its portfolio for managed software-defined wide area network (SDWAN) services that will allow businesses to benefit from increased operational efficiency, increased security measures, and flexible and responsive networking solutions, which are essential to meeting the dynamic needs of modern business environments.

Key Managed SD-WAN Services Market Insights Summary:

Regional Highlights:

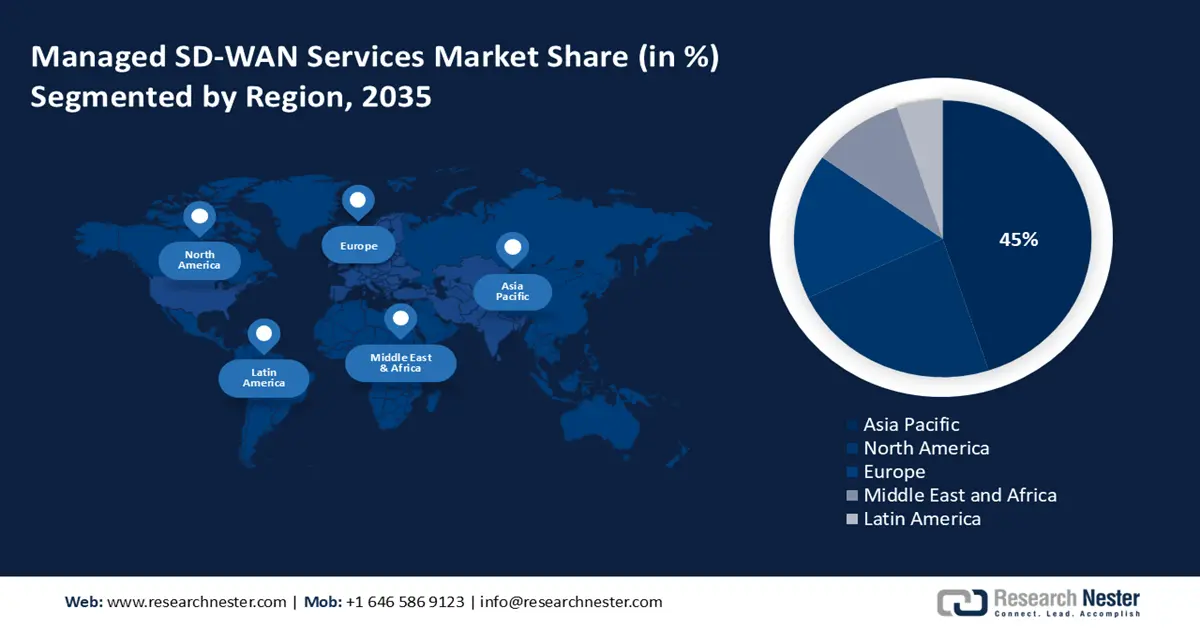

- The North America managed SD-WAN services market will secure over 45% share by 2035, fueled by the growing number of enterprises and the expansion of data centers.

Segment Insights:

- The it & telecom segment in the managed sd-wan services market is forecasted to achieve a 35% share by 2035, driven by the widespread adoption of cloud computing and demand for agile networking.

Key Growth Trends:

- Growing Adoption of 5G Technology

- Increasing Healthcare Industry

Major Challenges:

- Data privacy and security concerns

- Complexity associated with implementing SD-WAN solutions owing to its integration with existing networks

Key Players: Aryanka Networks, Adaptiv Network, Citrix Systems, Inc., Aryaka, Verizon Communications Inc, VMware LLC, Cisco Systems, Inc., AT&T Inc., Silver Peak Systems, Inc., Masergy Communications.

Global Managed SD-WAN Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.64 billion

- 2026 Market Size: USD 2.12 billion

- Projected Market Size: USD 27.56 billion by 2035

- Growth Forecasts: 32.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 16 September, 2025

Managed SD-WAN Services Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Popularity of Remote Work - SD-WAN services replace traditional branch routers with appliance-centric software, which aids in providing users with the best possible connection to the corporate network anytime, anywhere, and also allows teams to work securely in remote locations with full redundancy. For instance, the proportion of employees working remotely around the world has increased from around 19% in 2020 to more than 25% in 2023.

- Growing Adoption of 5G Technology - The adoption of SD-WAN and 5G technologies is increasing around the world as they can complement each other to deliver a seamless network experience by demonstrating high reliability in connecting cash register systems, scanners, security cameras, and PCs. For instance, there are currently more than 295 commercial 5G networks around the world, and this figure is expected to increase to over 435 by 2025.

- Increasing Healthcare Industry - Software-Defined Wide Area Networks (SD-WAN) have the potential to be transformative for healthcare organizations as they help in routing traffic through the ideal delivery channel and ensuring data is delivered securely and precisely, and also provide consistent, secure, and reliable access to important health information to meet patient service standards.

Challenges

-

Data privacy and security concerns - SD-WAN solutions that optimally route traffic over the public Internet suffer from inefficient routing and unreliable connectivity since organizations that use managed network services use the bandwidth of relatively insecure Internet connections, exposing their networks to the risk of data breaches and cyberattacks, thus additional security must be included to ensure data protection even in remote offices. Moreover, cloud-based applications also pose additional security concerns compared to traditional private networks as they utilize the Internet as the transport medium.

- Complexity associated with implementing SD-WAN solutions owing to its integration with existing networks

- Reliance on third-party service providers for network connectivity can impact performance.

Managed SD-WAN Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

32.6% |

|

Base Year Market Size (2025) |

USD 1.64 billion |

|

Forecast Year Market Size (2035) |

USD 27.56 billion |

|

Regional Scope |

|

Managed SD-WAN Services Market Segmentation:

Industry Segment Analysis

The IT & Telecom segment is predicted to account for 35% share of the global managed SD-WAN services market in the coming years owing to the growing adoption of cloud-based services. Cloud adoption is the process by which organizations and businesses move from traditional IT infrastructure to cloud computing, which provides several applications over the Internet with negligible upfront costs, providing network access to a shared pool of configurable computing resources, and pay-as-you-go services. This has increased the adoption of software-defined wide area networking (SD-WAN) which is a cloud-based wide area network (WAN) architecture that enables faster and easier deployment and ensures optimal performance and user experience.

Services Segment Analysis

The SD-WAN Integration segment in managed SD-WAN services market is set to garner a notable share shortly. An SD-WAN platform allows users to seamlessly integrate all services into the existing systems to provide unified visibility and stay responsive to the changing needs of the business.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Deployment |

|

|

Enterprise Size |

|

|

Services |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Managed SD-WAN Services Market Regional Analysis:

North American Market Insights

Managed SD-WAN Services market in North America is predicted to account for the largest share of 45% by 2035 impelled by the growing number of enterprises. The United States has long been recognized as a world leader in entrepreneurship owing to the presence of a stable political climate, diverse market opportunities, and many advantages that attract companies looking to grow and expand, and also plays an imperative role in driving productivity growth in the U.S. economy. For instance, the number of small businesses in the United States reached over 33 million, representing around 99% of all U.S. businesses in 2023.

In addition, Data centers are expanding around the US owing to the rise of big data, cloud computing, and increased demand for colocation services. Moreover, the United States had more than 2,700 data centers in 2022, and this figure reached over 5,370 data centers, more than any other country in the world in 2023. This may drive the demand for Managed SD-WAN Services in the region.

European Market Insights

The Europe Managed SD-WAN Services market is estimated to be the second largest, during the forecast timeframe led by the increasing number of internet users. Northern Europe has the maximum internet penetration rate in the world, which reflects their growing importance in modern life, coupled with the presence of online millennials, highly educated adults, and people with high incomes. Particularly, in 2021, Germany had the maximum number of internet users among all European Union (EU) countries owing to the widespread use of mobile devices and increasing Wi-Fi coverage in several areas. For instance, the number of internet users in Europe is anticipated to continue to grow by around 52 million people from 2024 to 2029.

Managed SD-WAN Services Market Players:

- Aryanka Networks

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Adaptiv Network

- Citrix Systems, Inc.

- Aryaka

- Verizon Communications Inc

- VMware LLC

- Cisco Systems, Inc.

- AT&T Inc.

- Silver Peak Systems, Inc.

- Masergy Communications

Recent Developments

- Masergy Communications announced a partnership with Fortinet, and Exclusive Networks to provide managed SD-WAN services to additional channel partners, and also open new security opportunities for VARs and MSPs, and also diversify their managed services portfolio internationally.

- Aryaka the leader in fully managed SD-WAN and Unified SASE solutions announced investing more in its Hyperscale Point-Of-Presence (POP) footprint and also positioning its innovative AppAssure solution across all current and new POPs to enable SaaS acceleration, improve application performance for an increasingly hybrid workforce, and expand its last mile service offering by supporting wireless connectivity around the world.

- Report ID: 5901

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Managed SD-WAN Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.