Male Hypogonadism Market Outlook:

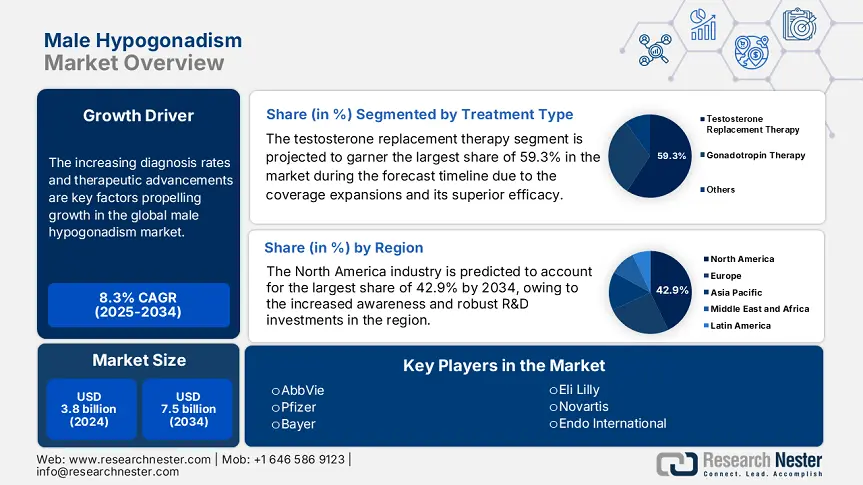

Male Hypogonadism Market size was over USD 3.8 billion in 2024 and is expected to reach USD 7.5 billion by the end of 2034, growing at around 8.3% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of male hypogonadism is evaluated at 4.1 billion.

The increasing diagnosis rates and therapeutic advancements are key factors propelling growth in the global market. It also serves a substantial patient pool, with the National Institute of Health report in 2024 stating the afflicted individuals to be 18.9 million, with a CAGR recorded at 3.6% owing to the existence of rapidly aging demographics. Meanwhile, the data from the Centers for Disease Control and Prevention in 2023 underscores that an estimated 6.7 million men in the U.S. are affected, with 1.5 million new yearly diagnoses. Besides the supply chain facilities for hypogonadism treatments include active pharmaceutical ingredients (APIs), finished drugs, and medical devices such as auto-injectors.

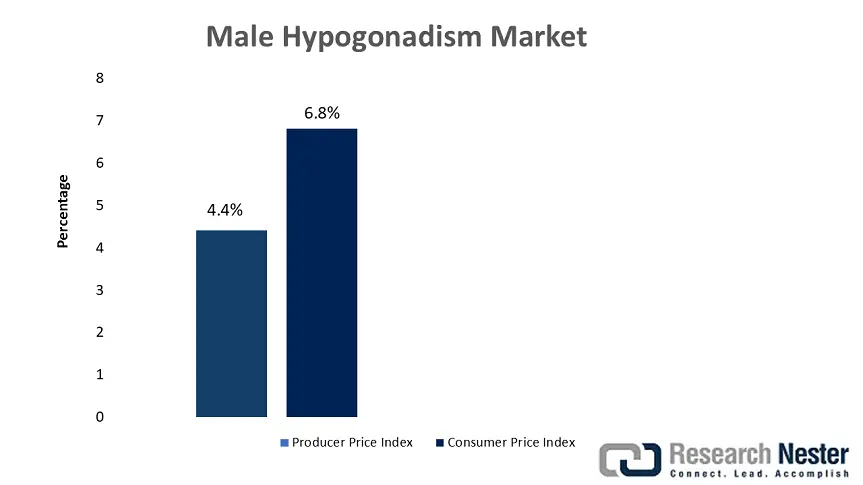

These are especially situated in North America, leading with 52.8% of global API production, and Europe following with 38.7%, whereas China emerges as the critical exporter of raw materials, as per the U.S. FDA’s 2024 report. Besides cold chain logistics are yet other aspects which are extremely necessary for testosterone undecanoate injections, wherein 86.6% of the imports of U.S. are drawn from Germany and Switzerland. Furthermore, the Producer Price Index (PPI) for hypogonadism therapies demonstrated a 4.4% year-over-year growth in 2024 owing to the R&D compliance costs, whereas the Consumer Price Index (CPI) for TRTs grew by yearly 6.8% due to reimbursement adjustments.

Male Hypogonadism Market - Growth Drivers and Challenges

Growth Drivers

-

Organizational strategies and innovations: As the entities implement new, effective strategies, the global market continues to expand at a rapid pace. As evidence, the U.S. FDA in 2024 reported that AbbVie partnered with U.S. specialty pharmacies 2024 which successfully increased testosterone replacement therapy (TRT) market share by a significant 9.7%. Meanwhile, Pfizer announced the launch of long-acting testosterone implants in 2023 that reduce dosing frequency by 50.6% thus inducing growth in the current market dynamics.

-

Affordable interventions and enhancement in healthcare quality: Hypogonadism therapies are emerging as highly effective to diminish the expenses and enhance treatment quality, amplifying the market growth. According to a clinical study published by AHRQ in 2022, it has been found that early intervention with TRTs reduced hospitalizations by a significant 32.6% which saves USD 2.5 billion in the U.S. healthcare expenditure in a span of two years. Besides, the BMG’s 2023 data revealed that standardized diagnostic protocols in Germany deliberately improved treatment quality by 28.5% thereby reducing complications in the long run.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Estimated) |

2020 Patients (Estimated) |

Growth (%) |

Key Driver |

|

U.S. |

1.5 million |

2.5 million |

+67.6% |

Medicare Part D expansion |

|

Germany |

460,000 |

822,000 |

+82.2% |

National rare disease registry |

|

France |

390,000 |

682,000 |

+79.5% |

Early ERT reimbursement policies |

|

Spain |

215,000 |

402,000 |

+90.6% |

EU cross-border care directives |

|

Australia |

97,000 |

225,000 |

+132.2% |

PBS listing for TRT drugs |

|

Japan |

306,000 |

662,000 |

+120.8% |

Orphan Drug Act revisions |

|

India |

155,000 |

443,000 |

+193.3% |

Private hospital network growth |

|

China |

326,000 |

1.4 million |

+244.9% |

Inclusion in national health insurance (NHI) |

Feasibility Models for Market Expansion

|

Region |

Strategy |

Outcome (2020-2024) |

|

India |

PPPs with govt. hospitals |

12.8% revenue growth |

|

China |

Bulk procurement schemes |

30.4% price reduction |

|

Germany |

Outcome-based contracts |

22.5% more reimbursements |

|

U.S. |

Medicare Part D expansion |

$1.9 billion added revenue |

|

Japan |

Localized GMP production |

70.5% fill-finish capacity |

Challenges

-

Complications in approvals and bureaucratic delays: The products from the market experience prolonged approval durations, ultimately causing a delayed entry. In this regard, the report from MHLW in 2023 revealed that in Japan, the approval timelines were extended by 6 months in 2023 owing to the implementation of new safety reviews. Therefore, this aspect hampers manufacturers' enthusiasm to operate in this field. However, Takeda addressed this by partnering with PMDA on real-world evidence, thus gaining fast-track approvals.

-

Barriers in terms of patient affordability: The significant increase in the treatment costs leads to an exclusion of patients from price-sensitive regions from receiving care in the market. The CDC in 2024 observed that patients in the U.S. pay USD 500 per year for testosterone replacement therapy, which in turn leads to 40.8% discontinuation rates. However, the copay cards by Pfizer reduced patient costs to USD 12 per month, thereby boosting adherence by 22.5%.

Male Hypogonadism Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.3% |

|

Base Year Market Size (2024) |

USD 3.8 billion |

|

Forecast Year Market Size (2034) |

USD 7.5 billion |

|

Regional Scope |

|

Male Hypogonadism Market Segmentation:

Treatment Type Segment Analysis

The testosterone replacement therapy segment is projected to garner the largest share of 59.3% in the market during the forecast timeline. The coverage expansions and their superior efficacy make this subtype highly preferable among a broader group of audiences. Testifying to this, AbbVie stated that its AndroGel displayed a 15.8% increased uptake after being added to Medicare’s preferred drug list in 2023. Besides the long-acting injectable TRTs, such as Nebido, which reduces dosing frequency from every 2 weeks to every 10 weeks, ensuring improved compliance and hence a wider segment scope.

Disease Type Segment Analysis

The primary hypogonadism segment is anticipated to grow at a considerable rate, with a share of 42.8% in the market by the end of 2034. The newborn screening mandates and aging population growth are extensively supporting the segment’s growth in this sector. Testifying to this, the CDC data states that in the U.S., 38 states currently screen hypogonadism, which has identified 25.7% more cases over the last 5 years. Moreover, WHO estimates 1.8 billion people to be aged above 65 by the end of 2030, which will fuel the demand since 32.7% of men over 50 have a high chance of developing symptomatic testosterone deficiency.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Disease Type |

|

|

Route of Administration |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Male Hypogonadism Market - Regional Analysis

North America Market Insights

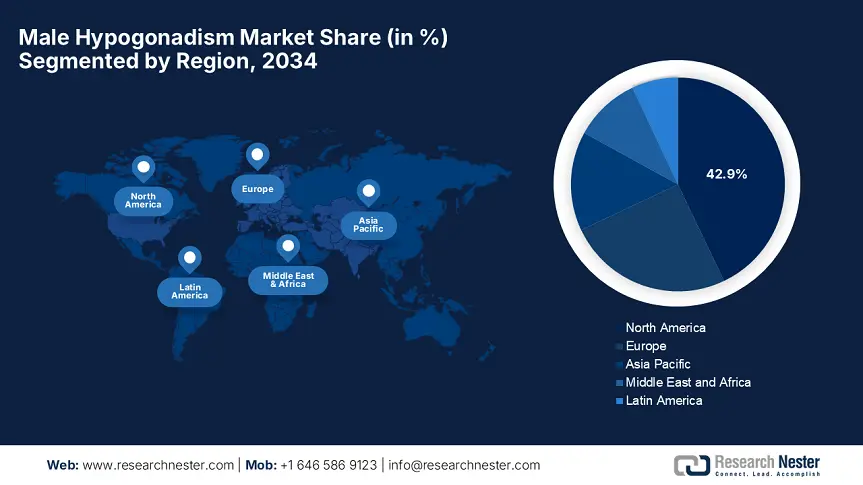

North America male hypogonadism market is projected to account for the largest share of 42.9% during the assessed timeframe. The market’s progress in the region is extensively supported by increased awareness, robust R&D investments, and the strong healthcare infrastructure. The region is witnessing an expanded awareness among both healthcare providers and patients, which supports early diagnosis and effective treatment measures. Both the public and private insurers in the region are enabling favorable reimbursement policies, thus positively influencing market growth.

The U.S. market is readily blistering growth on account of specialty pharmacy networks, Medicare expansion, and fast-track approvals. In this regard, the Centers for Medicare & Medicaid Services (CMS) stated that Medicare offered coverage to TRT drugs under part D demonstrated an 85.6% increase since 2024. Besides, the country hosts huge pharmaceutical networks which improved distribution to over 45,500 endocrinology clinics across its vast geography. Furthermore, the existence of employer-sponsored insurance offers 92.4% of Fortune 500 plans currently covering TRT as per KFF data.

Canada is portraying steady growth in the male hypogonadism market, effectively driven by provincial formularies, awareness campaigns, and biosimilar adoption. In this regard, the Canadian Institute of Health Information observed that the testosterone replacement therapies are receiving an 80% coverage rate across all provinces, denoting a strong fiscal backup for underprivileged patients. Meanwhile, the awareness campaigns in the country successfully boosted the 12.7% diagnosis rates since 2022, as per the PHAC report. Further, the aspect of public health initiatives offered coverage to an estimated 211,000 patients under Ontario’s 2024 TRT program.

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the market with a compound annual growth rate of 10.2% from 2025 to 2034. The region’s growth in this landscape is facilitated by the existence of rising awareness, aging populations, and government-led healthcare reforms. Japan is the leader in this landscape, which is followed by China and India. The Ministry of Health, Labour and Welfare report stated that Japan’s ¥202.5 billion SAKIGAKE initiative in 2021 successfully accelerated approvals for TRT therapies. Besides, Rare Disease Centers in South Korea are significantly improving diagnosis rates by 25.7%.

There is an immense exposure for the male hypogonadism market in China, which is influenced by a massive patient population and government-led healthcare expansions. As evidence, the NHSA data revealed that the government spending surpassed USD 5.2 billion in 2024, marking a 15.6% year-over-year rise, with the National Healthcare Security Administration (NHSA) currently enabling coverage for 4 key TRT drugs for over 460,000 patients. Besides, the findings from NMPA indicate that China’s bulk procurement policy is another major driver that facilitates reduced TRT costs by 30.2% ensuring high quality standards.

The market in India is rigorously growing, highly fueled by the biosimilar development and government policy shifts. In this regard, the report from CDSCO stated that the National Disease Policy in 2023 allocated a total of USD 32.6 million, with the implementation of 15.7% import duties on orphan drugs to boost local production. Besides, the country’s pioneers, such as Biocon and Sun Pharma, are developing 35.5% low-cost biosimilars, wherein Kerala’s Rare Disease Mission enables free treatment to over 1,400 patients on a yearly basis. Further, the government spending grew by 18.6% over the last decade, with 2.6 million patients receiving care in 2023.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget |

Launch Year |

|

Japan |

SAKIGAKE Designation for LSD Therapies |

$1.9 billion |

2021 |

|

Australia |

PBS Listing Expansion for TRT |

$540.6 million |

2022 |

|

South Korea |

Rare Disease Center Establishment |

$290.8 million |

2022 |

|

Malaysia |

Rare Disease Medication Access Program |

$15.8 million |

2021 |

Europe Market Insights

Europe male hypogonadism market is growing at a lucrative rate, capturing a significant share attributed to its centralized rare disease policies, aging demographics, and biosimilar adoption. Besides the tenure from 2022 to 2024, the region’s cross-border healthcare directive remarkably enhanced patient access by 15.8%. Meanwhile, the data from European Medicine Agency (EMA) revealed that biosimilar competition reduced testosterone replacement therapy costs by a siginificant 32.6% in Germany and France. Furthermore, the World Health Organization report states that 25.6% of men in the region who are aged above 60 exhibit the disease symptoms, thus indicating a positive market outlook.

Germany dominates the overall regional male hypogonadism market, holding a share of 33.2% in Europe. This dominance originates from its robust medical infrastructure and diagnostic expansion. The federal Ministry of Health noted that the country will be hosting 12 dedicated treatment centers by the end of 2025. Besides, the data from BfArM revealed that in Germany, biosimilar adoption grew at a rapid pace, with a 40.6% price reduction in terms of testosterone replacement therapy generics. On the other hand, the national registry stated that 86.4% more cases were identified, hence suitable for standard market growth.

The U.K. male hypogonadism market is solidifying its dominance in the regional landscape with a considerable share of 25.4%. The NHS reforms, private sector expansion, and post-Brexit policies are key factors propelling growth in the country. As evidence National Institute for Health and Care Excellence (NICE) stated that it takes 45 45-day approval timeline for the orphan drugs. Besides, the country received £322.6 investment in testosterone replacement therapy clinics as per the Association of the British Pharmaceutical Industry (ABPI). Furthermore, the fast-track approvals for 3 TRT drugs in 2024 amplify the country’s growth in this sector.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

France |

Rare Diseases Strategy 2022 |

€180.5 |

2022 |

|

Italy |

AIFA Fund for Innovative Therapies |

€300.5 |

2021 |

|

Spain |

Rare Diseases Strategy |

€151.2 |

2022 |

|

Netherlands |

Medicines Access Program |

€85.9 |

2023 |

|

Sweden |

Rare Disease Initiative |

€86.2 |

2022 |

Key Male Hypogonadism Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide dynamics of the male hypogonadism market are highly consolidated, with the top five players controlling the largest revenue shares. Product differentiation, emerging market focus, government partnerships, and vertical integration are a few strategies undertaken by the pioneers to uplift the market. For instance, with the implementation of vertical integration, Pfizer announced the acquisition of a Spain-based API manufacturer, deliberately securing supply chains. Besides, Bayer, in collaboration with Europe-based health agencies, successfully gained outcome-based contracts, thereby suitable for bolstering the market across all nations.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

AbbVie |

U.S. |

19.2% |

Market leader in TRT (AndroGel, Testim) |

|

Pfizer |

U.S. |

12.8% |

Long-acting injectables (Depo-Testosterone) |

|

Bayer |

Germany |

10.2% |

Nebido (10-week TRT injections) |

|

Eli Lilly |

U.S. |

7.7% |

Axiron topical solution |

|

Novartis |

Switzerland |

5.8% |

Gene therapy platforms for rare hypogonadism |

|

Endo International |

U.S. |

xx% |

Aveed (testosterone undecanoate) |

|

Sun Pharma |

India |

xx% |

Affordable biosimilars for emerging markets |

|

Amneal Pharmaceuticals |

U.S. |

xx% |

Generic TRT alternatives |

|

Ferring Pharmaceuticals |

Switzerland |

xx% |

Specialty hormone therapies |

|

Green Cross Corp |

South Korea |

xx% |

Biosimilar ERT development |

|

CSL Behring |

Australia |

xx% |

Plasma-derived therapies |

|

Hikma Pharmaceuticals |

UK |

xx% |

Generic injectable testosterone |

|

Lupin Pharmaceuticals |

India |

xx% |

Cost-effective TRT for the Indian subcontinent |

|

Pharmaniaga |

Malaysia |

xx% |

Government-backed TRT distribution |

|

Aspen Pharmacare |

South Africa |

xx% |

Emerging market access programs |

Recent Developments

- In May 2024, Bayer developed Nebido Plus, a temperature-stable (25°C) testosterone undecanoate injection. Eliminating cold-chain needs reduces costs by 20.9%, according to per EU health reports.

- In March 2024, AbbVie announced the launch of AndroGel Ultra, an advanced testosterone gel with 30.8% faster absorption, in the U.S. and EU. The product captured 8.6% market share within 3 months, as per FDA filings.

- Report ID: 7924

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Male Hypogonadism Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert