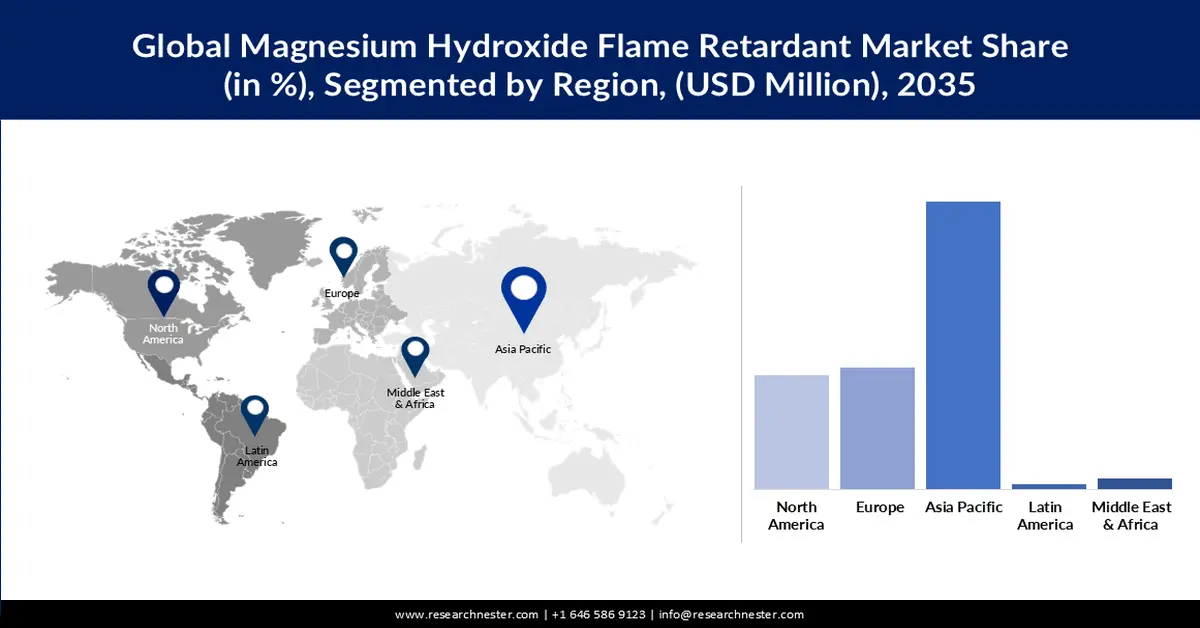

Magnesium Hydroxide Flame Retardant Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 53% by 2035. The growth is due to the increasing population and urbanization across Asian countries. This has led to a surge in demand for housing, commercial buildings, and public infrastructure, all of which require fire-resistant materials. For instance, according to the World Bank, value added by industry (including construction) in East Asia & Pacific was 11.37 trillion in 2022 which experienced an increase of 3.1% over 2021. Moreover, increasing production of electronics in the region will propel the demand of magnesium hydroxide flame retardant. For instance, according to the Association of Southeast Asian Nations, among the total value of exports in the most countries of Asia, the electronics sector accounts for 20% to 50%.

North American Market Insights

The North America magnesium hydroxide flame market shows promising CAGR during the forecast period. The North America market for magnesium hydroxide flame retardant is growing faster due to regional regulatory requirements. North America has some of the most stringent regulations governing the use of flame retardants in building materials. According to the United States Environmental Protection Agency, the Toxic Substances Control Act (TSCA) restricts the use of some halogenated flame retardants in children's products in the United States and many other regulatory bodies namely the National Fire Protection Association (NFPA) has framed regulations for fire safety. Such regulations require manufacturers to use flame retardants that are environmentally friendly, safe, and effective.