Macrolide Antibiotics Market Outlook:

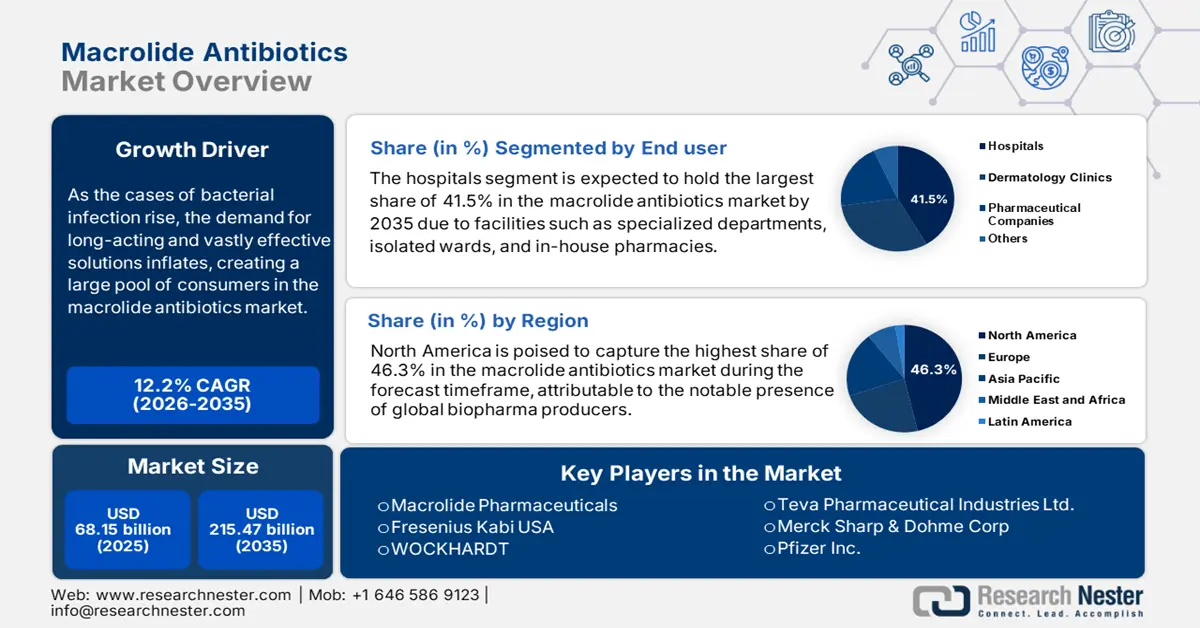

Macrolide Antibiotics Market size was over USD 68.15 billion in 2025 and is projected to reach USD 215.47 billion by 2035, witnessing around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of macrolide antibiotics is evaluated at USD 75.63 billion.

As the cases of bacterial infection rise, the demand for long-acting and vastly effective solutions inflates, creating a large pool of consumers in the macrolide antibiotics market. Infectious diseases such as pneumonia, bronchitis, and tuberculosis are becoming a global health concern. A 2022 study revealed that over 7.7 million fatalities due to these conditions are registered worldwide annually. In addition, the magnifying the volume of the infected population from healthcare-associated bacteria is also contributing to the wide adoption of these antimicrobials. A 2021 clinical study from NLM established 7437 cases to be the annual national incidence rate of healthcare-associated infection (HAI) in Scotland. It further concluded that the majority of HAI occurred in the urinary tract, bloodstream, and lower respiratory tract.

Thus, the epidemiology of such occurrences is garnering the focus of global biopharma leaders to invest in the macrolide antibiotics market. The efficacy of these drugs in retrieving respiratory infections is also creating a reliable healthcare option for older citizens, who are at higher risk. Additionally, the rapid global expansion of the antibiotics industry is evidence of the escalated magnitude of revenues and trade values. 2023 OEC data stated that the merchandise of antibiotics across the globe secured an export value of USD 11.2 billion. The portfolio of its products includes erythromycin derivatives in bulk and salts, which are one of the widely used components in this category.

Global export-import database of antibiotics (2023)

|

Country |

Export (USD, million) |

Import (USD, million) |

|

China |

4840.0 |

407.0 |

|

India |

944.0 |

1950.0 |

|

The U.S. |

588.0 |

671.0 |

|

Italy |

1070.0 |

962.0 |

Source: 2023 OEC Data

Key Macrolide Antibiotics Market Insights Summary:

Regional Highlights:

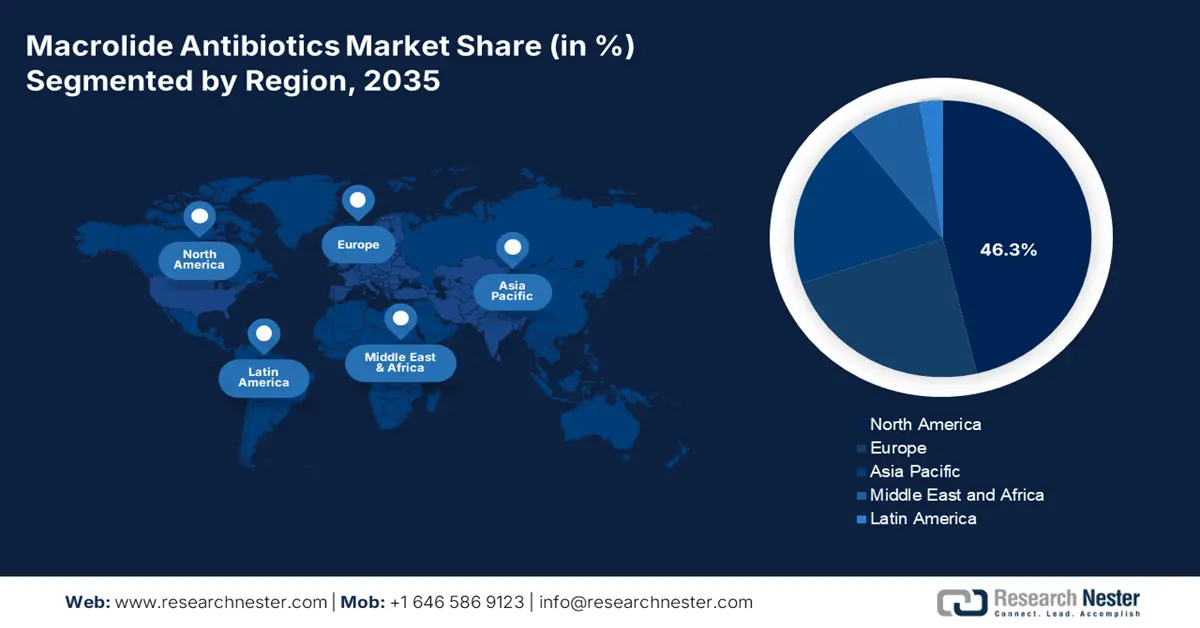

- North America macrolide antibiotics market will account for 46.30% share by 2035, driven by the notable presence of global biopharma producers and the expansion of R&D activities in the region.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, fueled by technological advancements in laboratory operations and large-scale production capabilities.

Segment Insights:

- The hospitals segment in the macrolide antibiotics market is projected to hold a 41.50% share by 2035, driven by specialized departments, isolated wards, and in-house pharmacies attracting patients.

Key Growth Trends:

- Increased exploration for biological advances

- Widening scope of applications and availability

Major Challenges:

- Global burden of resistive infectious diseases

- History and impact of abuse and overdose

Key Players: Neo Química, Macrolide Pharmaceuticals, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Fresenius Kabi USA, WOCKHARDT.

Global Macrolide Antibiotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 68.15 billion

- 2026 Market Size: USD 75.63 billion

- Projected Market Size: USD 215.47 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Macrolide Antibiotics Market Growth Drivers and Challenges:

Growth Drivers

-

Increased exploration for biological advances: Rigorous participation in R&D to curate the most effective formulations and delivery mechanisms is setting a progressive atmosphere for the macrolide antibiotics market. As more biopharma pioneers engage in this cohort, the engagement and diversity in this sector are levitated. As per the conjugated study, led by Johnson & Johnson, the amount of R&D spending from biopharma companies around the world accounted for USD 276.0 billion in 2021, incorporating 4191 individuals. The reports further exposed the value of generated revenue from the ecosystem of 583 merchandise to be at USD 1022.0 billion. This creates a wide spectrum of opportunities for various expertise holders in this category.

-

Widening scope of applications and availability: The strong presence of generic drugs in the macrolide antibiotics market is escalating the rate of adoption. To cope with the enlarging demand, companies are meticulously working to avail a generic form of these medicines, fitting every requirement around budget and accessibility. For instance, in May 2021, Teva Pharmaceuticals announced the commercial launch of oral generic erythromycin therapeutics in 250 mg and 500 mg in the U.S. market. In the same year, the industry size of generics reached USD 390.0 million globally, with around 33.3% share of the total pharma territory. This is an indication of several benefits including sufficient market supply and maximum revenue.

Challenges

-

Global burden of resistive infectious diseases: By this time, the infection-causing microbodies have become resistant to the existing products from the macrolide antibiotics market. The adhering tendency of bacteria often dilutes the effectiveness of antimicrobials, which causes a face-loss for the brands or companies. Thus, the continuously rising cases of resistance worldwide are concerning for optimum adoption. In addition, the additional cost of development and production for newly crafted therapies may become expensive for both manufacturers and consumers, discouraging them from investing.

-

History and impact of abuse and overdose: The macrolide antibiotics market is still facing the consequences of past association with drug overdose. The previous records of side effects and safety concerns are affecting the image of this category, preventing people from using, particularly vulnerable habitats. This shrinks the consumer base of this field. Companies need to be involved in rigorous awareness campaigns to mitigate such stigma. Extensive R&D may also help in retrieving the surge by introducing solutions with better kinematics and less toxicity.

Macrolide Antibiotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 68.15 billion |

|

Forecast Year Market Size (2035) |

USD 215.47 billion |

|

Regional Scope |

|

Macrolide Antibiotics Market Segmentation:

End user Segment Analysis

In terms of end user, the hospitals in macrolide antibiotics market is expected to capture around 41.5% revenue share by the end of 2035. Facilities such as specialized departments, isolated wards, and in-house pharmacies attract patients to invest in this sub-type. According to a 2022 NLM article, the share of hospitals in the total third-party pharmaceutical spending in the countries in Europe ranged from 20% to 50%. Thus, these medical organizations are becoming the target distribution channels for global leaders in this field. Moreover, the contribution of hospitals to the overall healthcare economy is also a strong indication segment’s growth. Being a reliable source of clinical data for drug development is also a major driver in this sub-type.

Drugs Segment Analysis

Based on drugs, the azithromycin segment is predicted to dominate the macrolide antibiotics market with a significant revenue share. The broad spectrum of applications and generic availability are the key drivers in this segment. Efficacy against gram-positive microorganisms and worldwide rapid roll-out during the COVID-19 pandemic are attracting more companies to engage their resources in this category. According to the Journal of Infection in Developing Countries (JIDC), around 13,921 units of azithromycin were commercially purchased in 2021 under the veterinary prescription in Brazil, presenting a 212.0% increment from 2014. This significantly boosted this segment’s proprietorship.

Our in-depth analysis of the global macrolide antibiotics market includes the following segments:

|

End user |

|

|

Drugs |

|

|

Route of Administration |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Macrolide Antibiotics Market Regional Analysis:

North America Market Insights

North America macrolide antibiotics market is projected to hold revenue share of over 46.3% by the end of 2035. The region is pledged to the notable presence of global biopharma producers such as Pfizer, Merck, and Wockhardt, who are extending this sector’s reach in the large marketplaces of the U.S. and Canada. In addition, the frequent R&D activities across this landscape are boosting market availability and product versatility. As per the geographic divisions drafted by the report from Johnson & Johnson, the U.S. attained the highest R&D intensity of 34.0% in 2021, with a total investment of USD 152.6 billion. These figures showcase the propelling growth in this field.

The U.S. is accelerating its pace of development in the macrolide antibiotics market by utilizing its clinical expertise and enlarging its consumer base. The increased expenditure on healthcare is also helping the country improve generic accessibility and achieve nationwide adoption. In addition, the favorable regulatory framework is encouraging more pharma leaders to participate in this marketplace with innovative therapeutics. For instance, in February 2022, Nexus Pharmaceuticals earned clearance for its Erythromycin Lactobionate for Injection, USP in 500mg/vial from the U.S. FDA. This generic form of antibiotic was made available in single-vial doses for retailing.

As Canada witnessed a widespread of HAIs and other bacterial infections, the governing bodies of the country opted for clinically proven medications to combat the situation. They made heavy investments in both research and infrastructure to strengthen its medical system with adequate facilities, crafting a pre-established business environment for the macrolide antibiotics market. For instance, in April 2021, the Ministry of Health in Canada invested USD 10.0 million to form a comprehensive network of researchers, producers, and investors. The community was crafted to cultivate a pile of assets including, macrolide medicines, for fighting the upcoming threats of infectious disease pandemics.

APAC Market Insights

The Asia Pacific macrolide antibiotics market is projected to experience the fastest growth in the world by registering the fastest CAGR by the end of 2035. This landscape is highly influenced by the integration of technological advancements in laboratory operations and large-scale production abilities. Particularly, the region’s strong emphasis on upscale manufacturing techniques indicates a true potential for delivering scalable solutions. In this regard, Research Nester evaluated the 2035 revenue share in the microbial fermentation technology industry, a crucial part of producing antibiotics, at 42.0%. Furthermore, the region is also enriched with ongoing clinical discoveries in this field.

India is becoming a leading pioneer in the macrolide antibiotics market with its emphasis on the biopharmaceutical industry. With the support of government-issued initiatives and a large pool of pneumonia patients, the domestic pioneers are setting their aim at consolidating their leadership in this category. On the other hand, the government is also empowering the national drug discovery cohort by funding several R&D-based projects. For instance, the development of Miqnaf (nafithromycin) by Wockhardt, launched in November 2024, was backed by USD 0.9 million in funding from the Biotechnology Industry Research Assistance Council (BIRAC). This is inspiring more companies to participate in this marketplace.

China is augmenting the macrolide antibiotics market with unmatched export and production capacity. The country has earned excellence in curating essential and most-selling components in this category. For instance, OEC reported that China obtained the top position in exporting antibiotics in 2024, incorporating erythromycin derivatives, with an 11.4% increment from 2023. The country also secured a 25.3% upliftment in imports during the same timeframe. This represents a healthy trading credit of China in this category, which attracts both local and foreign giants to invest their assets. This courage is further propelled by government incentives and subsidiary policies.

2024 import-export data of antibiotics in China

|

Destination/Source |

Export Value (USD, million) |

Import Value (USD, million) |

|

The U.S. |

16.3 |

25.9 |

|

India |

115.0 |

2.6 |

Source: 2024 OEC Data

Macrolide Antibiotics Market Players:

- Merck Sharp & Dohme Corp

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Neo Química

- Macrolide Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.

- Fresenius Kabi USA

- Sandoz International GmbH

- Gland Pharma Limited

- Mylan N.V.

- Wockhardt Ltd.

- Eli Lilly and Company

Key players in the macrolide antibiotics market are majorly competing in consideration of capital influx and new developments. For instance, in August 2021, EpiEndo Pharmaceuticals raised USD 21.0 million in series A funding from a consortium of investors such as ABC Ventures and the European Innovation Council (EIC), led by Fund Flerie Invest and Iðunn Venture Fund. The fund was intended to support the company’s ongoing development project on a non-antibiotic macrolide for the treatment of COPD, EP395. On the other hand, in April 2023, Zydus completed the FDA authorization for Azithromycin Tablets USP, 500 mg. The multidisciplinary drug is designed to treat a wide range of infectious conditions. Such key players are:

Recent Developments

- In January 2025, Wockhardt gained clearance for its new macrolide-based oral drug, Miqnaf (nafithromycin), from the Central Drugs Standard Control Organization (CDSCO). The positive results from the human trials helped the company globalize this pipeline for treating community-acquired bacterial pneumonia (CABP) in adults.

- In April 2024, Eli Lilly and Company announced the expansion of its manufacturing capacity by acquiring a new production facility at Pleasant Prairie, Wisconsin from Nexus Pharmaceuticals. The production house is dedicated to supplying injectable medicines including Erythromycin Lactobionate for Injection, solidifying its position in this sector.

- Report ID: 7232

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Macrolide Antibiotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.