Lymphedema Treatment Market Outlook:

Lymphedema Treatment Market size was over USD 1.01 billion in 2025 and is anticipated to cross USD 2.35 billion by 2035, growing at more than 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lymphedema treatment is assessed at USD 1.09 billion.

The market is experiencing remarkable growth due to the increased risk of prevalence due to growing cancer cases. Surgical or, radiational treatments for cancers such as breast, prostate, and melanoma often result in removal or, damage of lymph nodes, causing this condition. According to an NLM article, published in October 2022, the point incidence of breast cancer associated lymphedema was accounted for 6.8% at baseline. It was followed by 19.9% and 23.8% at two- and seven-years post diagnosis respectively. It indicates the co-relation of this sector’s expansion with the inflating demand for effective treatment for lymphedema. In addition, it is often directed to the symptoms of blood cancer, which contributes to the surge for management solutions.

The frequent events of cancer-related surgical and radiational interventions are raising the demand for pre-hand solution availability, propelling the lymphedema treatment market. This is further inspiring pharmaceutical and therapeutic companies to develop new treatment methods and medications to restore and protect the lymphatic system. They are participating in strategic collaborations to globalize their product pipeline. For instance, in October 2022, ImpediMed Limited signed a global commercial partnership with GenesisCare to launch the Lymphedema Prevention Program in the U.S. for cancer survivors. The pilot program is dedicated to enroll breast cancer patients for lymphedema screening services across the country by establishing five (5) SOZO units initially.

Key Lymphedema Treatment Market Insights Summary:

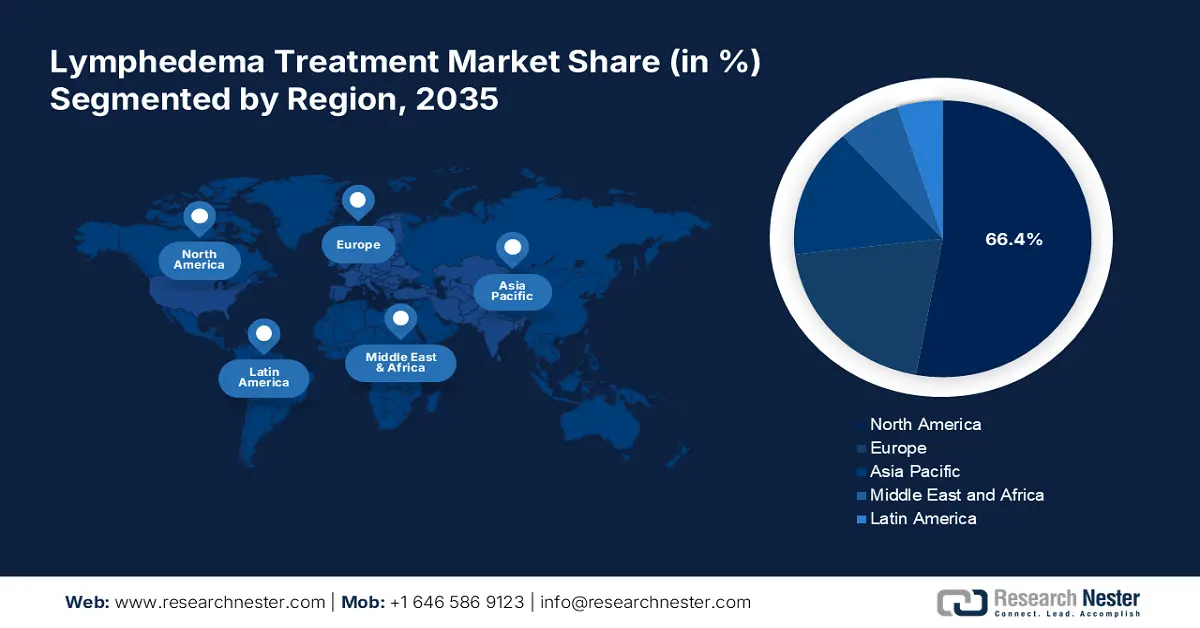

Regional Highlights:

- North America commands a 66.4% share in the Lymphedema Treatment Market, attributed to the growing prevalence of chronic conditions like lymphedema, driving significant growth through 2026–2035.

- The Asia Pacific region is expected to achieve significant growth in the Lymphedema Treatment Market from 2026 to 2035, driven by increased R&D projects for effective lymphedema treatments.

Segment Insights:

- The Lower Extremity segment is anticipated to grow by 2035, driven by the high prevalence of lymphedema cases in legs and feet requiring treatment.

- Secondary Lymphedema segment is expected to capture a 68.10% share by 2035, driven by high prevalence among breast cancer patients requiring treatment.

Key Growth Trends:

- Initiatives from public health organizations

- Advancement in treatment and diagnosis

Major Challenges:

- Limitation in completely effective developments

- Additional cost in the cancer treatment process

- Key Players: AIROS Medical Inc., Koya Medical, 3M, Mego Afek Ltd..

Global Lymphedema Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.09 billion

- Projected Market Size: USD 2.35 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (66.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Lymphedema Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Initiatives from public health organizations: The concerning health effect of this condition is pushing governing bodies to support the growth of the lymphedema treatment market. Their efforts to spread awareness about the diagnosis and prevention of this condition by educating patients about early symptoms and available options are further fueling this sector. For instance, in January 2020, a lymphedema treatment program was launched by the Center for Physical Therapy, Rehabilitation and Balance at Nazareth Hospital. The trained therapists at the institution were engaged to offer available treatments such as Manual lymph drainage (MLD) and compression therapy according to the patient’s needs.

-

Advancement in treatment and diagnosis: Ongoing developments in symptom reduction and pain management have notably accommodated the lymphedema treatment market by introducing innovative solutions. Moreover, utilization of advanced technologies in producing such products is enlarging this sector. For instance, in February 2024, The Ohio State University Comprehensive Cancer Center announced the progress in developing new ultra-high-frequency ultrasound technology to enhance lymphedema treatment. This method is a revolutionary diagnostic solution that uses Vevo MD, manufactured by FUJIFILM VisualSonics, delivering more precise visuals than the existing technologies.

Challenges

-

Limitation in completely effective developments: Medicine or therapy that can entirely cure the condition is still under development, which may raise questions about the effectiveness of available products in the lymphedema treatment market. Thus, patients may lose trust on these solutions due to dissatisfaction in outcomes, preventing them from investing more in this sector. This can further discourage service providers and product suppliers from engaging in the further research and innovations. It may hinder the progress of this sector.

-

Additional cost in the cancer treatment process: Cancer treatment itself is an expensive burden to be borrowed by the patients. Thus, they may refrain from paying for such advanced and associative treatment that. The economical barrier can further limit the consumer base for the lymphedema treatment market, particularly in price-sensitive regions. In addition, these treatments are often discarded from the insurance coverage, where it becomes difficult for the patients to afford high spendings on treatments such as compression garments and devices.

Lymphedema Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 1.01 billion |

|

Forecast Year Market Size (2035) |

USD 2.35 billion |

|

Regional Scope |

|

Lymphedema Treatment Market Segmentation:

Type (Primary Lymphedema, Secondary Lymphedema)

The secondary lymphedema segment is set to account for around 68.1% lymphedema treatment market share by 2035. The major cause of this type of condition is the breast cancer, which is increasing in prevalence each year. According to an article published in March 2023, around 50% of the breast cancer patients, having axillary lymph node dissection are estimated to develop lymphedema. Around 75% of the cases occurs within one year after the surgery, which require serious medical attention. In this developed world, it has become a necessity to incorporate proper management and preventive measures in patient care related to such female prone diseases. Thus, the demand for effective treatment in this segment is rising.

Affected Area (Lower Extremity, Upper Extremity, Genitalia)

Based on affected area, the lymphedema treatment market is estimated to earn a notable amount of profit for the lower extremity segment during the forecast period. Contribution to the disruption in the crucial part of regular mobility puts this segment on the prime focus of patients to seek treatment for. In addition, a majority of lymphedema (LE) cases are registered with a complaint of swelling in legs and feet, raising demand for treatment. The variety in options such as compression garments & stockings, manual lymphatic drainage & physiotherapy, pneumatic compression devices, and surgical procedures also makes it lucrative for the global leaders. For instance, in April 2022, Koya Medical announced the commercial launch of Dayspring active compression system for lower extremity lymphedema.

Our in-depth analysis of the global lymphedema treatment market includes the following segments:

|

Type |

|

|

Affected Area |

|

|

Treatment |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lymphedema Treatment Market Regional Analysis:

North America Market Analysis

North America is projected to dominate the lymphedema treatment market with the largest share of 66.4% during the forecast timeline. The major growth factor of this region is the growing prevalence of such chronic conditions due to various reasons including cancer treatment, surgeries, and genetic disorders. According to a report published by the NLM, in September 2024, around 10 million people in the U.S. and 1 million people in Canada are suffering from LE. These issues are rising primarily due to lymphatic dysfunction or malformations. The governing bodies in this region are proactively promoting the available treatment options through arranging campaigns and building supportive advocacy groups, propelling the sector.

The U.S. is leading the regional growth in the lymphedema treatment market with its strong emphasis on medical industry. The country is predominantly establishing an adequate public healthcare setting, equipped with specially trained professionals and innovative therapeutic solutions. For instance, in March 2024, Bay Pines VA Healthcare System, a crucial organization of the U.S. Department of Veterans Affairs commenced an Occupational Therapy Lymphedema Fellowship. The program enabled the licensed occupational therapists across the country to gain immense knowledge about this condition through its one-year long paid fellowship.

Canada is pioneering opportunities for the participants in the lymphedema treatment market to endeavor their options to generate profitable revenue with regulatory support. It is meticulously improving clinical practices across the country to bring out the best management and treatment facilities for patients. This is further inspiring the global leaders to participate in this landscape. For instance, in January 2021, the government of Ontario issued Assistive Devices Program (ADP) to help patients pay for compression garments, lymphedema pumps, and custom orthotic braces. Such financial support is further encouraging more consumers to invest in this sector.

APAC Market Statistics

The Asia Pacific lymphedema treatment market poised to register the fastest growth in the global landscape during the forecast period, i.e. 2026-2035. The region is highly influenced by the Increased R&D projects to discover more effective techniques and methods are broadening the range of offerings. The cumulative burden of LE incidences is inflating demand in this sector, creating a large consumer base for this sector. The growing economy of this region is a major contributor to the healthcare advancements, such as introduction of treatment for such niche medical categories. According to a WHO report, published in December 2024, the number of registered clinical trials in Western Pacific reached 23,250 in 2023, making it the highest scorer among the WHO regions.

India lymphedema treatment market is fostering a lucrative trading environment for both global and domestic pharma leaders. The exceptional growth in the pharmaceutical industry of this country is notably fueling this sector. It is further utilizing this as a USP in controlling the widespread of such lymphatic conditions. For instance, in August 2024, the 2nd phase of Bi-annual Nationwide Mass Drug Administration (MDA) campaign to fight against lymphatic filariasis, a major cause of lymphedema was launched. This program planned to roll-out preventive measures and medication across 63 districts and 771 blocks in 6 states of India.

China is utilizing its R&D and manufacturing capabilities to lead the regional growth in the lymphedema treatment market. The continuous government fundings, university projects, and hospital demand are accumulatively supporting the country’s ambitious goal in pharmaceutical developments. This is further accelerating its progress in this sector. According to a WHO data, released in December 2024, China topped among the Western Pacific countries in clinical trial registration. In 2024, the country achieved a total 135,747 number of trials, capturing a 14.9% of the global amount.

Key Lymphedema Treatment Market Players:

- Mego Afek Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio Compression Systems Inc.

- SIGVARIS

- Herantis Pharma Plc.

- 3A Health Care

- Wright Therapy Products

- Tactile Systems Technology Inc.

- Lohmann & Rausher

- Juzo

- 3M

- Cardinal Health

- Huntleigh Healthcare Limited

- Koya Medical

- Vet Pharmaceuticals

- AIROS Medical Inc.

- Convatec

- Lymphatica Medtech SA

The global lymphedema treatment market is propagating towards great medical achievements through the R&D efforts made by the global leaders. They are playing a pivotal role in broadening product reach of this sector, widening applications and consumer base. They are also taking part in promoting the effectiveness of the available treatments by participating in campaigns and programs. This is further helping them cultivate positive consumer feedback for their portfolio. For instance, in September 2024, Koya Medical announced the results of the clinical study on Dayspring for lower extremity lymphedema, TEAYS. It highlighted the reduction in limb volume by 369.9 mL and 81% adherence rate in the APCD treatment arm. Such key players include:

Recent Developments

- In October 2024, Lymphatica Medtech raised a B series funding of USD 18.5 million to leverage the clinical development of an implantable device, LymphoDrain for lymphedema treatment. The company expects this fund to work as a financial cushion in evaluating and commercializing this device globally.

- In April 2023, ARIOS Medical announced that FDA approved the commercial distribution of AIROS 8P Sequential Compression Therapy device and garment system for lymphedema treatment. In addition, the 510(k) clearance allows the company to extend the application of larger compression garments in abdominal swelling.

- Report ID: 6985

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lymphedema Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.