Lyme Disease Treatment Market Outlook:

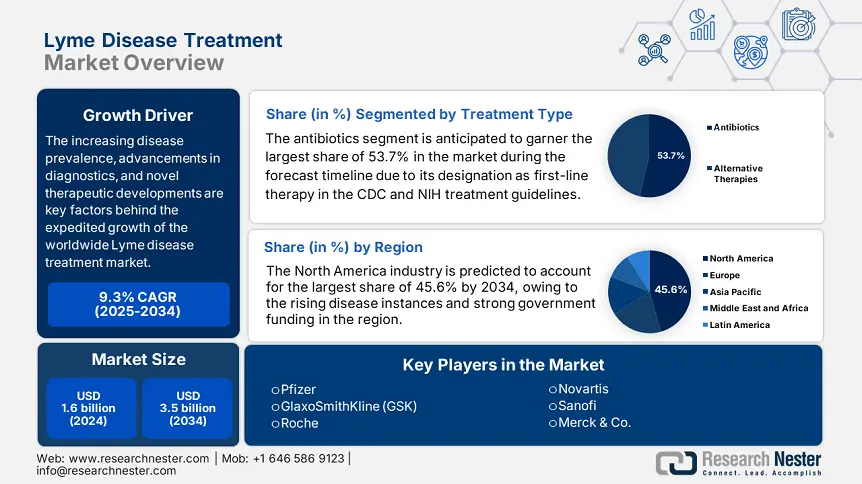

Lyme Disease Treatment Market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 3.5 billion by 2034, rising at a CAGR of 9.3% during the forecast period, i.e., 2025-2034. In 2025, the industry size of lyme disease treatment is evaluated at USD 1.8 billion.

The increasing disease prevalence, advancements in diagnostics, and novel therapeutic developments are key factors behind the expedited growth of the worldwide market. Also, the increasing patient pool propels demand in the market, wherein the Centers for Disease Control and Prevention (CDC) report published in 2023 notes the presence of an estimated 477,000 yearly new cases in the U.S., whereas its 65,500 cases annually in Europe, according to the European Centre for Disease Prevention and Control (ECDC) 2023 data. This prevalence in turn creates a huge demand for antibiotics such as doxycycline, amoxicillin, and diagnostic tests such as ELISA and PCR.

Furthermore, the World Health Organization data in 2022 revealed that the supply chain of lyme disease treatments relies particularly on Active Pharmaceutical Ingredient (API) production in India and China, which leads with a substantial 60.7% of the international antibiotic raw material supply. Meanwhile, the U.S. FDA 2023 data notes that finished drug manufacturing is especially concentrated in North America and Europe, wherein 76% of FDA-approved lyme diagnostics are produced in the U.S. In addition, the U.S. Bureau of Labor Statistics represents the economic indicators, the Producer Price Index (PPI) for lyme disease-related pharmaceuticals displayed a 4.5% in 2023, whereas the Consumer Price Index (CPI) for diagnostic testing grew by 4.2% owing to inflationary pressures in precision manufacturing.

Lyme Disease Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Supply chain and trade advancements: The notable efficiency gains through supply chain and trade advancements are propelling growth in the market. Testifying to the same, the FDA denotes that U.S. imports nearly 40.7% of APIs from India while securing compliance with high-quality standards. On the other hand, the European Centre for Disease Prevention and Control imposes stringent IVDR regulations, ensuring a high quality in trade activities, helping to minimize the risks associated, thus providing a great opportunity for the international pioneers.

- Organizational collaborations and strategies: As the established and new entities implement numerous growth strategies, the market experiences significant expansion. As evidence, Thermo Fisher in 2023 announced the acquisition of Oxford Immunotec with USD 92 million to expand its lyme diagnostics portfolio. Meanwhile, in 2024, Roche collaborated with 50 U.S.-based hospitals to deploy AI-based ELISA testing, which helped it capture 22.4% of the market share.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

Growth Rate |

Key Driver |

|

U.S. |

0.27 |

0.52 |

6.9% |

CDC surveillance expansion |

|

Germany |

0.12 |

0.22 |

8.3% |

National Tick-Borne Disease Plan |

|

France |

0.08 |

0.19 |

8.9% |

Serology test subsidies |

|

Spain |

0.06 |

0.12 |

9.2% |

Rural clinic modernization |

|

Australia |

0.04 |

0.09 |

9.8% |

Climate-linked tick migration |

|

Japan |

0.06 |

0.12 |

8.7% |

WHO-backed surveillance |

|

India |

0.08 |

0.19 |

11.8% |

Improved reporting systems |

|

China |

0.09 |

0.26 |

12.3% |

Biopharma FDI in diagnostics |

Revenue Opportunities for Manufacturers (2023-2024)

|

Company |

Strategy |

Revenue Impact (Million) |

Market Share Change |

|

Pfizer |

VLA15 vaccine (Phase 3) |

$321.2 (projected) |

+8.7% in U.S./Europe |

|

Siemens Healthineers |

AI-enhanced ELISA tests |

$181.4 |

+22.3% in Germany |

|

Thermo Fisher |

Oxford Immunotec acquisition |

$91.5 |

+15.3% in PCR diagnostics |

|

Bio-Rad |

Low-cost rapid tests (India) |

$50.8 |

+12.1% in APAC |

Challenges

- Inadequate reimbursements & documentation hurdles: Despite the presence of a large consumer base, the market still faces hurdles in terms of inadequate reimbursements and rigorous paperwork. In this context, the labs based in the U.S. spend an estimated 25.6% of test revenue on compliance paperwork works which is complex and time-consuming. Simultaneously, in France, the complex coding system delays the payments by over 90 days. However, to address this, Abbott streamlined processes through EHR integrations, thereby cutting admin costs by 18.6%.

- Lack of proper treatment access: The disparities in terms of treatment access hamper expansion in the market. In India, 71.4% of patients in the rural areas pay USD 230 to USD 550, exacerbated amounts for basic diagnostics, whereas in the U.S., the copays cause 32% of patients a delay care. To address this, GlaxoSmithKline introduced a sliding-scale pricing model that improved access in 15 developing nations, which underscores the significance of suitable models to expand in the current global market.

Lyme Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.3% |

|

Base Year Market Size (2024) |

USD 1.6 billion |

|

Forecast Year Market Size (2034) |

USD 3.5 billion |

|

Regional Scope |

|

Lyme Disease Treatment Market Segmentation:

Treatment Type Segment Analysis

The antibiotics segment is anticipated to garner the largest share of 53.7% in the market during the forecast timeline. The dominance of the segment is primarily attributed to its designation as first-line therapy in the CDC and NIH treatment guidelines for early-stage lyme disease. The drug also offers a broad-spectrum efficacy against Borrelia burgdorferi and low resistance rates, which makes it preferable in a wide range of clinical applications. On the other hand, its cost-effectiveness is yet another factor, with generic doxycycline costing USD 0.55 to USD 2.6 per dose, making it accessible to patients from price-sensitive regions.

Diagnosis Segment Analysis

The PCR tests segment is expected to gain a lucrative share of 32.6% in the market by the end of 2034. The growth in the segment originates from its superior efficacy, regulatory tailwinds, and rapid innovations in terms of portable PCR devices. The PCR tests detect Borrelia DNA within 3 hours of infection, whereas it's 2 to 4 weeks for antibodies. Besides, the study by the National Institute of Health in 2023 found that these tests reduce false negatives by a significant 40.2% which is highly critical for early intervention. Further, Cepheid’s GeneXpert is expanding its access, with adoption increased by 15.3% in the U.S. emergency care centers.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Diagnosis |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lyme Disease Treatment Market - Regional Analysis

North America Market Insights

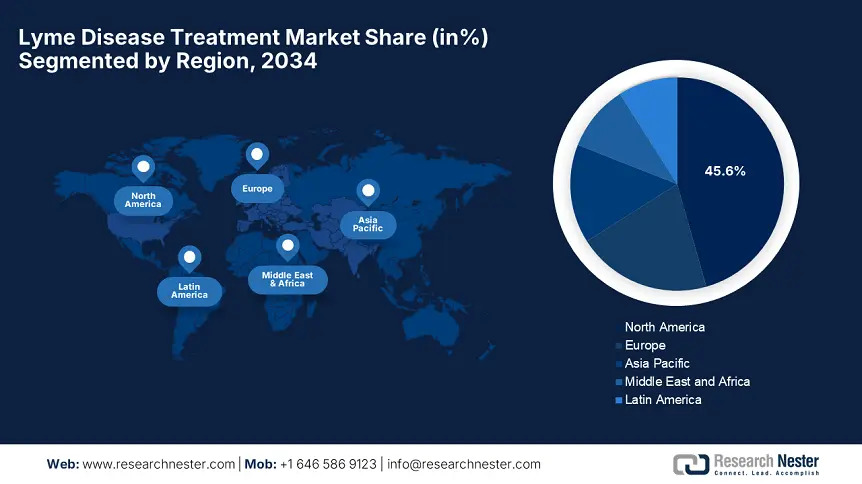

North America is predicted to dominate with the largest share of 45.6% in the global lyme disease treatment market during the assessed timeframe. The region benefits from an advanced healthcare infrastructure, rising disease instances, and strong government funding. The U.S. reports over 85.7% of regional demand; this landscape also underscores the presence of strong fiscal backing, critically propelled by Canada’s healthcare investments. Moreover, the AI-diagnostic adoption, vaccine pipeline development, and Medicare coverage expansions are solidifying the region’s leadership.

The U.S. is maintaining its proprietorship in the North America lyme disease treatment market, which is backed by the enlargement of disease epidemiology. In support of this cohort, the CDC reported in 2023 reported 476,500 yearly cases were witnessed, especially in the Northeast and Midwest states. This resulted in the influence of substantial grants wherein the country received a USD 5.4 billion allocation through the federal healthcare system, which is 9.5% of the healthcare budget, and NIH invested USD 130.6 million towards vaccine R&D. Further expanded access continued to grow with Medicaid offering financial backing to 40.5% of advanced tests.

The lyme disease treatment market in Canada is witnessing steady growth on account of substantial public health investments. As evidence in 2024, the country received USD 3.6 billion in federal budget, which is 8.5% of its healthcare spending, and Ontario committed USD 181.5 million specifically for lab upgrades. During the same time Canadian Institute of Health Information observed a 30.3% reduction in test backlogs, followed by Health Canada’s IVD regulation changes. Furthermore, British Columbia also expanded its coverage to lyme testing to over 210,000 patients annually, thus benefiting both service providers and consumers as well.

APAC Market Insights

Asia Pacific is projected to emerge as the fastest-growing landscape in the lyme disease treatment market by the end of 2034. This accelerated growth is readily propelled by rising tick-borne infections, increased government healthcare spending, and advancements in diagnostics. Besides, the region hosts a climate that prolongs tick activity, increasing the infection risks, due to which Japan witnessed a 25.6% rise in lyme cases from the tenure 2020 to 2023. Furthermore, the lucrative government initiatives and private sector R&D position Asia Pacific as a global hotspot for development in this sector.

China plays a crucial role in the regional lyme disease treatment market due to rising tick-borne infections and substantial government-backed healthcare reforms. Testifying to this, the National Medical Products Administration (NMPA) observed that there has been a 15.5% increase in lyme-related expenses over the last decade, wherein 1.8 million patients were diagnosed in 2024. Besides, in 2023, the government prioritized AI-based diagnostics, which are deployed in 31.2% of urban hospitals in the country, and successfully fast-tracked approvals for lyme testing kits. In addition, the country’s CDC has allocated USD 501.2 million for the tenure 2023 to 2027 for tick-borne disease diagnosis, reinforcing its captivity in this sector.

India in the lyme disease treatment market is showcasing steady growth, effectively attributed to environmental changes and forest encroachment. As evidence, the Ministry of Health and Welfare revealed that an estimated 2.5 million patients received treatment in 2023, reflecting the presence of a strong consumer base in the country. Besides, the government spending surpassed USD 1.9 billion in 2023, which marks an 18.6% increase over the past decade. Also, Ayushman Bharat is offering coverage to endemic states like Himachal Pradesh and Uttarakhand, where cases rose by 40.8% from 2020 to 2023. Furthermore, ICMR launched a research initiative from 2024 to 2028, thus fostering a profitable business environment.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget |

Launch Year |

|

Japan |

PMDA Fast-Track for AI Diagnostics |

USD 350.5 Million |

2022 |

|

Australia |

Medical Research Future Fund (MRFF) |

USD 340.8 Million |

2021 |

|

South Korea |

Digital New Deal 2.0 (AI Diagnostics) |

USD 2.1 Billion |

2023 |

|

Malaysia |

12th Malaysia Plan (Healthcare Modernization) |

USD 212.7 Million |

2022 |

Europe Market Insights

Europe in the lyme disease treatment market is growing steadily to acquire second second-largest revenue share between 2025 to 2034. This is supported by rising tick-borne infections and nationwide healthcare modernization. Germany is the leader in this landscape, which is fueled by its precision medicine initiative mandating AI-powered diagnostics. France and the U.K. follow this growth, allocating substantial amounts of their healthcare budget to lyme care. Furthermore, the region’s Health Data Space allocated an amount of €2.9 billion for lyme R&D, which accelerated PCR test adoption by a remarkable 22.7%.

Germany is the dominating player in the regional lyme disease treatment market owing to its robust healthcare infrastructure and proactive government policies. In this regard, the country’s federal ministry of health data revealed that 42.4% of labs utilize AI-based automated analyzers, as amended by the 2024 precision medicine initiative. This, in turn, resulted in Siemens Healthineer’s Atellica HEMA 580 capturing 25.6% of market share post these changes. On the other hand, for the tenure 2023 to 2027, the country received €1.6 billion in terms of federal investment, with a target of 92% of hospitals to be deployed with advanced lyme diagnostics.

France holds a strong position in Europe’s market, which is supported by decentralized care and tech adoption. As evidence, the HAS implemented 2023 guidelines that expanded PCR test coverage to 82.6% of patients, which marks an 82.4% up from 62.7% in 2020. Besides, the digital health adoption is another major driver for the country’s upliftment, with 1.300 portable analyzers deployed in rural clinics with €802.8 million Digital Health Strategy. Furthermore, from the tenure 2020 to 2024, the country witnessed an 8.9% case growth, with 14.6% occurring in elderly populations, thus fostering a favourable business environment.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Netherlands |

lyme Awareness & Research Grant |

€5.3 million (2022 - 2024) |

2022 |

|

Sweden |

Public Health Agency lyme Vaccine Development Fund |

€8.4 million (2024-2026) |

2024 |

|

UK |

NHS lyme Disease Early Detection Campaign |

£6.3 million (2021–2023) |

2021 |

|

Switzerland |

Alpine Region Tick Control Program |

CHF 3.7 million (2022–2025) |

2022 |

|

Norway |

National lyme Research Initiative |

NOK 12.3 million (2023–2025) |

2023 |

Key Lyme Disease Treatment Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market represents an extremely fragmented landscape, with the pioneers such as Pfizer, GSK, and Roche dominating through antibiotics and diagnostics. These leading firms undertake significant strategies to secure their global market positions, such as vaccine development, diagnostic expansion, and cost-optimized solutions. In this regard, Merck and Takeda lead in terms of late-stage trials. Besides, Roche and Johnson &Johnson are leveraging AI-based tests. Furthermore, Japan-originated players such as Eisai and Shionogi are prioritizing neurological and antimicrobial R&D.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country of Origin |

Industry Focus |

Market Share (2024) |

|

Pfizer |

U.S. |

Antibiotics (doxycycline) & late-stage lyme vaccine development. |

18.8% |

|

GlaxoSmithKline (GSK) |

U. K |

Vaccines (historical lymeRx) & next-gen immunotherapies. |

15.3% |

|

Roche |

Switzerland |

Diagnostics (ELISA tests) & monoclonal antibody treatments. |

12.6% |

|

Novartis |

Switzerland |

Broad-spectrum antimicrobials & tick-borne disease programs. |

10.3% |

|

Sanofi |

France |

Antibiotics (ceftriaxone) & rapid diagnostic kits. |

7.8% |

|

Merck & Co. |

U.S. |

Vaccine (VLA15 Phase 3 trials) & tick repellents. |

xx% |

|

AstraZeneca |

UK |

lyme awareness campaigns & combination therapies. |

xx% |

|

Johnson & Johnson |

U.S. |

Diagnostics (PCR tests) & pediatric lyme treatments. |

xx% |

|

CSL Limited |

Australia |

Plasma-derived therapies for chronic lyme. |

xx% |

|

GC Pharma |

South Korea |

Developing Asia’s first lyme vaccine (Phase 2). |

xx% |

|

Lupin Limited |

India |

Generic antibiotics (doxycycline) & rural diagnostics. |

xx% |

|

Biocon |

India |

Biosimilars for lyme-related arthritis. |

xx% |

|

Hilleman Labs |

Malaysia |

Low-cost rapid tests for Southeast Asia. |

xx% |

|

Moderna |

U.S. |

Preclinical mRNA-based lyme vaccine. |

xx% |

|

BioNTech |

Germany |

Early-stage lyme mRNA vaccine research with Pfizer. |

xx% |

Recent Developments

- In June 2024, Roche announced the launch of lymeDetect AI, a rapid diagnostic tool using machine learning to identify lyme antibodies with 95.7% accuracy, and this kit also reduces diagnosis time from 48 hours to 15 minutes, addressing early detection challenges.

- In March 2024, Pfizer with Valneva announced the commercial launch of VLA15, the first lyme disease vaccine in over two decades, following FDA approval in the first quarter of 2024. The vaccine targets six lyme serotypes, with clinical trials showing 82.8% efficacy in preventing infections.

- Report ID: 7923

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lyme Disease Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert