Lubrication Equipment Market Outlook:

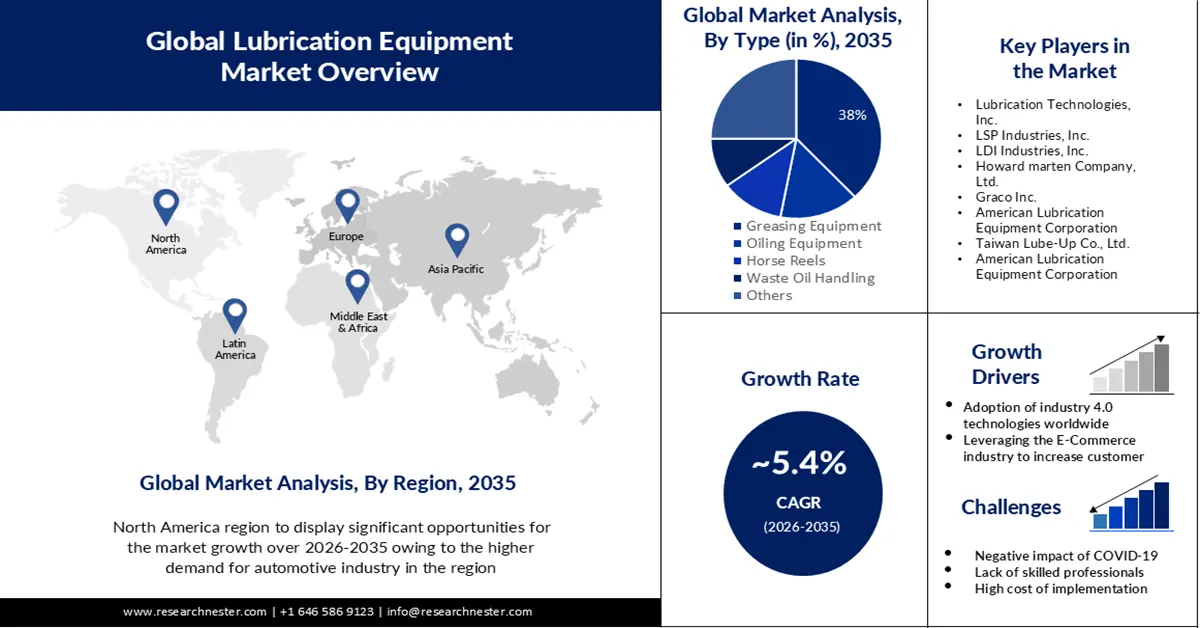

Lubrication Equipment Market size was over USD 32.12 billion in 2025 and is poised to exceed USD 54.35 billion by 2035, witnessing over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lubrication equipment is estimated at USD 33.68 billion.

The growth of the market is due to the rising use of industrial and automotive machinery that is driving up demand for lubricants, which are becoming more and more necessary. In the upcoming years, the demand for lubricating equipment is anticipated to be driven by the expansion of the industrial sector. The Department of Labor Statistics estimates that approximately 1.3 million Americans were employed in the equipment manufacturing industry in 2020. The World Commerce Organization estimates that the overall value of international commerce in industrial machinery was approximately USD 1.5 trillion in 2019, with the major exporters being the United States, Germany, and China.

In addition, the drive to lower energy costs and lessen environmental effect is driving up demand for energy-efficient equipment. The purpose of lubricating equipment is to increase mechanical efficiency, which in turn increases demand for the equipment. Also, constant technical improvements characterize the lubricating equipment market. In the upcoming years, the market is anticipated to be driven by the development of new and sophisticated lubrication equipment, such as automatic lubrication systems.

Key Lubrication Equipment Market Insights Summary:

Regional Insights:

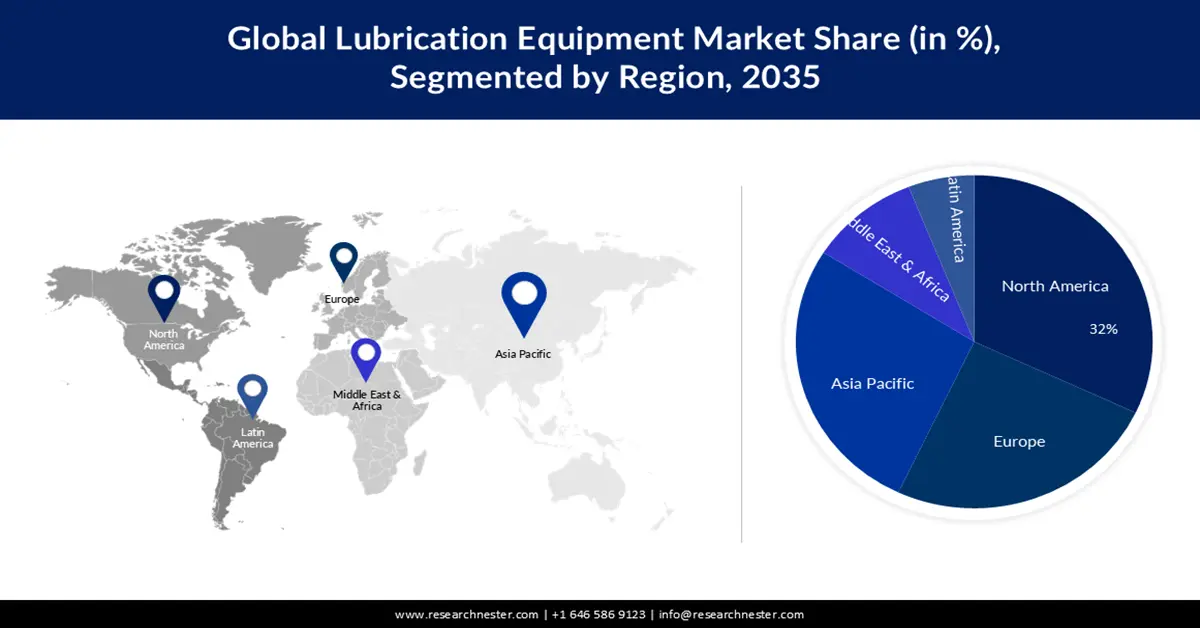

- By 2035, the North America region in the lubrication equipment market is projected to command a 32% share, bolstered by expanding manufacturing activity and rising demand for industrial lubricants.

- The Asia Pacific region is anticipated to capture a 27% share during 2026–2035, supported by accelerating construction activity and increasing industrial investment.

Segment Insights:

- By 2035, the greasing equipment segment in the lubrication equipment market is set to hold a 38% share, reinforced by rising global motor vehicle production.

- The automatics segment is expected to secure a 63% share by 2035, sustained by growing worldwide lubricant consumption.

Key Growth Trends:

- Rise in Automation in the Construction Industry

- Leveraging the E Commerce Industry to Increase Customer Reach

Major Challenges:

- Negative Impact of COVID 19

Key Players: LSP Industries, Inc., LDI Industries, Inc., Howard marten Company, Ltd., Graco Inc., American Lubrication Equipment Corporation, Taiwan Lube-Up Co., Ltd.

Global Lubrication Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.12 billion

- 2026 Market Size: USD 33.68 billion

- Projected Market Size: USD 54.35 billion by 2035

- Growth Forecasts: 5.4%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 26 November, 2025

Lubrication Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Rise in Automation in the Construction Industry- The mechanical components of construction equipment are subjected to constant motion and load as automation rises, necessitating a high level of lubrication to ensure optimal performance and prevent equipment failures. Many heavy-duty pieces of equipment used in the construction sector need to be lubricated on a regular basis. The need for process automation is also being driven by rising labour costs and safety regulations. As a result, the industry is being driven by the majority of businesses automating their processes. Instead of relying on many platforms, 94% of corporate company leaders would want to combine their apps and automate processes using a single platform.

- Leveraging the E-Commerce Industry to Increase Customer Reach- Manufacturers and sellers can offer their construction lubricants straight online through e-commerce, without the need for a store, dealer, or distributor. This platform assists construction lubricant manufacturers in reducing their value chain and increasing their profit margins. Several businesses that manufacture construction lubricants also began to take advantage of this ground-breaking virtual marketplace to expand their clientele through online advertising and digital marketing strategies. The advantages of online retailing are numerous. For example, entrepreneurs can easily access the market through online retail places like eBay and Amazon, which allow anyone to set up an online store and sell products in a short amount of time. Additionally, sellers can save money by not having to pay for labour and staff or the upkeep of a physical store. By 2026, it's anticipated that 24% of retail transactions will happen online.

- Adoption of Industry 4.0 technologies worldwide- The development of intelligent lubrication equipment with real-time monitoring and predictive maintenance capabilities is made possible by the integration of Industry 4.0 technologies, including data analytics and the Internet of Things (IoT). For instance, spending on the Internet of Things (IoT) in Europe surpassed USD 202 billion in 2021. Through 2025, it is anticipated to rise at a double-digit rate. According to recent projections, the global annual generation of data is expected to surpass 180 trillion gigabytes by 2025. The industries that are enabled by IIoT will produce most of this.

Challenges

- Negative Impact of COVID-19- Due to the COVID-19 epidemic and the ensuing lockdown in many nations, production of a number of products in the lubricating equipment industry has stopped. Sales of lubricating equipment were impacted by COVID-19-imposed lockdowns in 2020, although they are predicted to rebound in 2021. Prior to the corona virus's spread, countries like the United States, China, Germany, the United Kingdom, and India accounted for the majority of the market for lubricating equipment. As a result, this demand has since declined. Furthermore, it is now unclear how the lockdown may affect things, and a company's ability to recover financially depends only on its cash reserves. To cut costs, numerous market participants put a stop to their manufacturing for a few weeks.

- For small and medium-sized businesses, the upfront costs of setting up lubrication equipment, particularly automated systems, can be a major barrier.

- Personnel with the necessary skills are needed to operate and maintain lubrication equipment properly. The lack of qualified personnel may impede the expansion of the sector.

Lubrication Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 32.12 billion |

|

Forecast Year Market Size (2035) |

USD 54.35 billion |

|

Regional Scope |

|

Lubrication Equipment Market Segmentation:

Type Segment Analysis

The greasing equipment segment in the lubrication equipment market is anticipated to hold the largest share of about 38% by the end of 2035. Grease pumps suitable for grease distribution in pipe works & installations where simultaneous grease supply on different distributing points at high pressure or in large volume is required. Moreover, grease guns (manual, pneumatic, and electric), which is one of the most common tools in manufacturing plants; push pumps, and various grease dispensers capable of applying the molybdenum; and molybdenum-containing grease are among the grease equipment for industrial maintenance workshops, agricultural, public works, trucks, and cars. 85.4 million motor vehicles were produced globally in 2022, a 5.7% increase from 2021.

Application Segment Analysis

The automatics segment is expected to hold 63% share of the global lubrication equipment market by 2035. A permanent or centralized lubrication system frequently includes automatic lubrication equipment. The use of automatic lubrication systems has various benefits. These include better environmental health and safety, cleanliness, reduced labour, and less waste, and the possibility of bearing failure. It is not enough to simply use automation to guarantee success. Lubricating systems are beneficial to the automotive, food and beverage, mining, printing, packaging, steel, paper, and industrial machining industries. Technology needs to be seen as an instrument to accomplish goals. In 2021, the total amount of lubricants consumed worldwide hit a peak of 37.6 million metric tonnes.

Our in-depth analysis of the global lubrication equipment market includes the following segments:

|

Type |

|

|

Base Oil |

|

|

Equipment |

|

|

Sales Channel |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lubrication Equipment Market - Regional Analysis

North America Market Insights

The lubrication equipment market in the North America region is attributed to hold largest share 32% by the end of 2035. The growth of the market in this region is due to numerous reasons, such as the region's expanding manufacturing and industrial facilities and the growing demand for industrial lubricants, which have contributed to the growth of the lubricating equipment market in North America. Due to the abundance of auto and industry manufacturers in the area, there is a greater need for lubricating equipment. About 2.56 million passenger automobiles were built by North American automakers in 2021. At over 1.5 million, the United States continued to be North America's biggest producer. The market for lubricating equipment has expanded due to the growing demand for energy efficiency and equipment maintenance. The market has expanded as a result of the adoption of new technologies, such as sophisticated lubricating systems. The market has grown as a result of the creation of novel items and the manufacturing sector's growing tendency towards automation. Both new and old businesses have increased the market's level of competition, which has sparked the creation of new goods and services.

APAC Market Insights

The lubrication equipment market in the Asia Pacific region is expected to hold second largest share of about 27% during the forecast period. The growth of the region is due to the increase in building activities, increased industrial investment, expanding population, and the development of its infrastructure in the developing markets of China, Japan, and India, the area will be an ideal place for the construction lubricants business.

Lubrication Equipment Market Players:

- Industrial Innovations, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lubrication Technologies, Inc.

- LSP Industries, Inc.

- LDI Industries, Inc.

- Howard marten Company, Ltd.

- Graco Inc.

- American Lubrication Equipment Corporation

- Taiwan Lube-Up Co., Ltd.

- American Lubrication Equipment Corporation

- Arnold Oil Company

Recent Developments

- Graco Inc., a leading manufacturer of fluid handling equipment, today announced the launch of the GCI™ Series injector platform for single-line parallel automatic lubrication systems. The lubrication industry’s first cartridge injector, Graco GCI establishes a new level of durability and serviceability by delivering up to two times the life of current injectors while cutting replacement time from minutes to seconds. The new design doubles the output of current injectors in its class at a lower cost for unprecedented uptime and savings on labor costs.

- Arnold Oil Company has joined the Aftermarket Auto Parts Alliance's Commercial Vehicle and Heavy-Duty program as the newest member of All-Pro Truck Parts. The move is effective June 7, 2023. “We are delighted to welcome Arnold Oil Company and the Arnold family into the Alliance Commercial Vehicle and Heavy Duty program,” says John R. Washbish, president and CEO of the Aftermarket Auto Parts Alliance. “They have always been an outstanding contributor to the independent aftermarket and we look forward to supporting their growth in the CVHD segment.”

- Report ID: 5377

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lubrication Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.