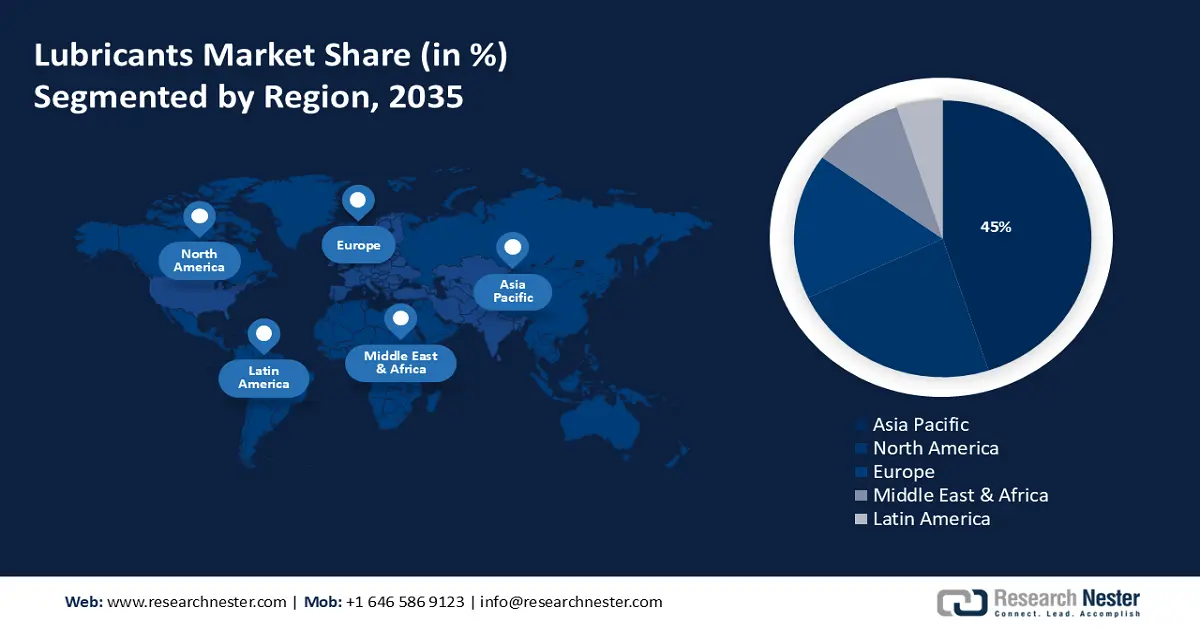

Lubricants Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 45% by 2035. The market growth in the region is expected on account of the increasing manufacturing activities. Presence of many key players like Shell, ExxonMobil, and Total Energies dominate the regional market, focusing more on innovation and sustainability in lubricant products to meet diverse industry needs.

Japan's aerospace sector is now a thriving industry, which may lead to higher demand for lubricants that are used in the production, maintenance, and repair of aircraft, spacecraft, and defense systems and technologies. The aircraft manufacturing business produced over USD 10 billion in fiscal year 2022, up from around USD 7 billion in the previous fiscal year.

In the upcoming years, there is anticipated growth in the lubricants market in China as the country aims to lead the world in smart manufacturing. Moreover, China’s automotive lubricants market is expected to grow at a significant growth rate. For instance, according to the China Association of Automobile Manufacturers, total vehicle sales of both passenger and commercial vehicles increased from 27 million in 2021 to 27.7 million in 2022.

South Korea's robust automobile manufacturing sector is one of the primary growth drivers leading to market expansion. Key players such as Hyundai and Kia are experiencing a constant increase in demand for premium lubricants. Furthermore, the strong industrial sector in South Korea has boosted market growth. This includes the shipbuilding, steel, and electronics sectors, all of which depend on different kinds of lubricants to ensure the reliable and efficient operation of machinery.

North American Market Insights

The North America region will also register tremendous lubricants market revenue during the forecast period. The market expansion is attributed to the rising demand for oil and gas lubricants in the region. This rise has been fueled by factors such as shale production and energy infrastructure investments, in addition to good economic conditions and continuous regional industrial advancements.

The lubricants market in the United States is one of the world's largest, owing to the presence of diverse industrial sectors, wide transportation networks, and robust automobile industry. According to the International Trade Administration in 2020, U.S. light vehicle sales were 14.4 million units.

In Canada the construction sector’s growth and infrastructure development projects create a demand for lubricants for construction equipment and machinery. The Canada construction landscape reached USD 350.1 billion in 2023.