Low Voltage Cable Market Outlook:

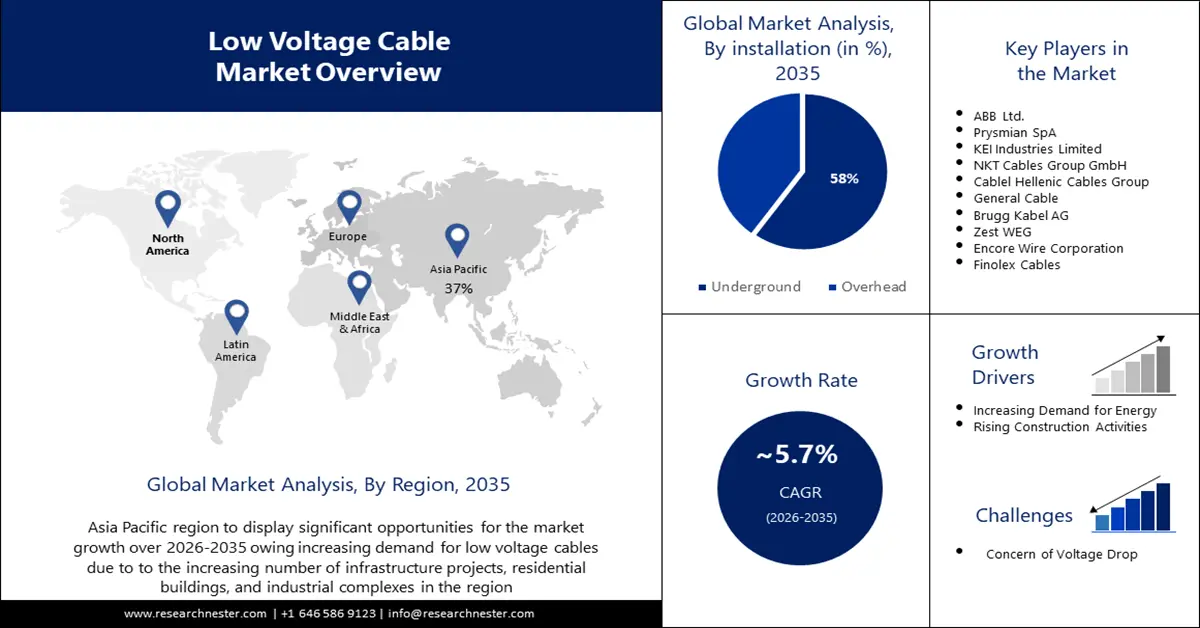

Low Voltage Cable Market size was valued at USD 153.7 billion in 2025 and is set to exceed USD 267.56 billion by 2035, registering over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of low voltage cable is estimated at USD 161.58 billion.

This growth can be attributed to the increasing urbanization and development of infrastructure. As urban areas continue to expand and there is a need for infrastructure like buildings, roads and transportation networks the demand for low voltage cables has also increased. These cables are used in applications such, as power distribution, communication, and data transmission.

Industries that aim for automation and modernization heavily rely on an effective power source. This is typically accomplished by utilizing low voltage cables to distribute electricity within complexes enabling the smooth operation of machinery and equipment. In industrial applications, low voltage cables are often the preferred choice. They have been specifically engineered to handle amounts of power and cover greater distances compared to conventional high voltage cables. As a result, they offer a dependable power supply.

Key Low Voltage Cable Market Insights Summary:

Regional Highlights:

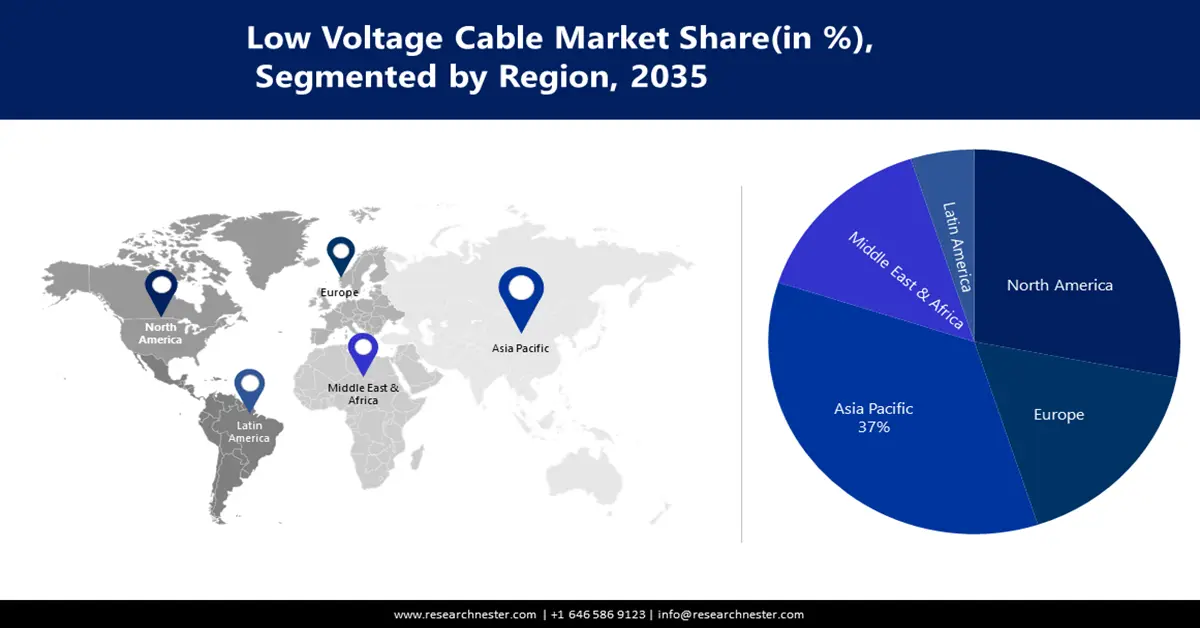

- The Asia Pacific low voltage cable market will hold over 37% share by 2035, driven by increasing demand for low voltage cables from major countries such as India, China, and Japan due to infrastructure projects and residential buildings.

- The North America market will secure 28% share by 2035, attributed to increased demand for cables in residential and commercial sectors for smart cities and digital infrastructure development.

Segment Insights:

- The underground segment in the low voltage cable market is expected to command a 58% share by 2035, fueled by reliable cable performance and lower exposure to weather and hazards.

- The 240v voltage segment in the low voltage cable market is anticipated to achieve a 36% share by 2035, influenced by the increasing demand for higher voltage power to run larger household appliances.

Key Growth Trends:

- Increasing Demand for Energy

- Rising Construction Activities

Major Challenges:

- Concern of Voltage Drop

- Sustainability and Environmental Concerns due to harsh weather conditions

Key Players: ABB Ltd., Prysmian SpA, KEI Industries Limited, NKT Cables Group GmbH, Cablel Hellenic Cables Group, General Cable, Brugg Kabel AG, Zest WEG, Encore Wire Corporation, Finolex Cables.

Global Low Voltage Cable Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 153.7 billion

- 2026 Market Size: USD 161.58 billion

- Projected Market Size: USD 267.56 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Low Voltage Cable Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Energy- The demand for low voltage cables is increasing due to the rising demand for energy. Due to the growth of the global population, it is projected that there will be a 49% surge in global energy demand, over the next two decades. As more people and industries require electricity to power their homes and operations, the need for reliable and efficient cables has become paramount. Furthermore, the shift towards renewable energy sources such as wind and solar power has also contributed to the demand for low voltage cables. These energy sources require specialized cables that can withstand harsh weather conditions and deliver power efficiently over long distances.

- Rising Construction Activities: The rise in construction activities is one of the major factors contributing to the increasing demand for low voltage cables. As more buildings, both residential and commercial, are being constructed, the need for reliable and safe electrical wiring systems has become paramount. Low voltage cables are an essential component of these systems, as they provide a safe and efficient means of transmitting electricity from the source to the end user.

- Advancements in Technology- Advancements in technology have played a significant role in driving the demand for low voltage cables. As technology continues to evolve, so do the requirements for reliable and efficient power transmission. For example, the increasing use of renewable energy sources such as solar and wind power requires specialized low voltage cables that can handle variable loads and transmit power over long distances. In 2022 it was observed that the majority of the growth, in power came from rooftop solar photovoltaic (PV) energy, which saw a significant increase of 191 GW. On the hand geothermal energy experienced a more modest rise of 181 MW.

Challenges

- Concern of Voltage Drop: Low voltage cables are designed to carry lower voltages, and over long distances, they can experience voltage drop, leading to reduced power delivery at the end of the cable. This can result in decreased performance or efficiency for devices and equipment connected to the cable.

- Sustainability and Environmental Concerns due to harsh weather conditions

- Compromised integrity of low voltage cables due to Physical damage from abrasion, crushing, bending, or puncturing

Low Voltage Cable Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 153.7 billion |

|

Forecast Year Market Size (2035) |

USD 267.56 billion |

|

Regional Scope |

|

Low Voltage Cable Market Segmentation:

Installation

The underground segment in the low voltage cable market is estimated to gain the largest revenue share of about 58% in the year 2035. Underground cabling ensures more reliable performance of cables as compared to overhead cabling. This is due to the lesser exposure of underground cables to extreme weather conditions. Underground cabling also helps reduce the risk of fire hazards, as compared to overhead cables, which increases its demand in the market. Furthermore, underground cables are not exposed to UV rays, which can reduce their efficiency over time. This makes them more reliable and durable, which makes them more desirable than overhead cables.

Voltage

The 240V segment is estimated to gain a significant share of about 36% in the year 2035. Higher voltage power is required to power larger appliances such as air conditioners and electric ovens which are increasingly becoming necessities in residential households. This has led to an increase in the demand for higher voltage power, such as 240V, which is expected to continue into the near future. Furthermore, the introduction of new low voltage appliances has made it possible for people to use this range of voltage for their homes, thus increasing the popularity of this voltage range.

Our in-depth analysis of the low voltage cable market includes the following segments:

|

Installation |

|

|

Voltage |

|

|

Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Low Voltage Cable Market Regional Analysis:

APAC Market Insights

Low voltage cable market in Asia Pacific is anticipated to hold the largest with a share of about 37% by the end of 2035. The market growth in the region is also expected on account of the increasing demand for low voltage cables from major countries such as India, China, and Japan. This is owing to the increasing number of infrastructure projects, residential buildings, and industrial complexes, among others, that are being constructed in these countries. For instance, in India there is expected to be an increase in the construction of residential buildings in the coming years. This growth is being supported by the governments Housing For All initiative. The Pradhan Mantri Awas Yojana (PMAY) which is scheduled to be finished by 2020. The PMAY aims to construct 60 million houses by 2022 with 40 million in areas and 20 million, in urban areas.

North American Market Insights

The North America low voltage cable market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The market’s expansion can be attributed majorly to the increased demand for cables in the residential and commercial sectors for the development of smart cities and digital infrastructure, driven by the growing need for energy-efficient solutions. In addition, when installing rooftop solar panels to meet the electricity needs of a single house it is necessary to establish new low voltage lines. It has been noted that in 2021 there was an installation of 513,000 residential solar systems, representing a year-on-year growth rate of 30%. Furthermore, it is projected that there will be a 14% growth, in installations this year.

Low Voltage Cable Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Prysmian SpA

- KEI Industries Limited

- NKT Cables Group GmbH

- Cablel Hellenic Cables Group

- General Cable

- Brugg Kabel AG

- Zest WEG

- Encore Wire Corporation

- Finolex Cables

Recent Developments

- Northern Powergrid, in the UK has recently unveiled a plan aimed at digitizing and decarbonizing its grid over the next five years. The company has set aside a budget of USD 321.5 million to facilitate its transition into a distribution network operator. A significant portion of this funding amounting to USD 8.2 million will be dedicated to the analysis and replacement of low voltage cables.

- Zest WEG has recently signed a supply agreement with Anglo American Platinum. The purpose of this agreement is to install electric control and instrumentation equipment at the North Concentrator Plant, in Mogalakwena mine located in the Limpopo province. As part of this project 70 kilometers of low voltage and medium voltage cable will be laid.

- Report ID: 5150

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Low Voltage Cable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.