Low Carbon Hydrogen Market Outlook:

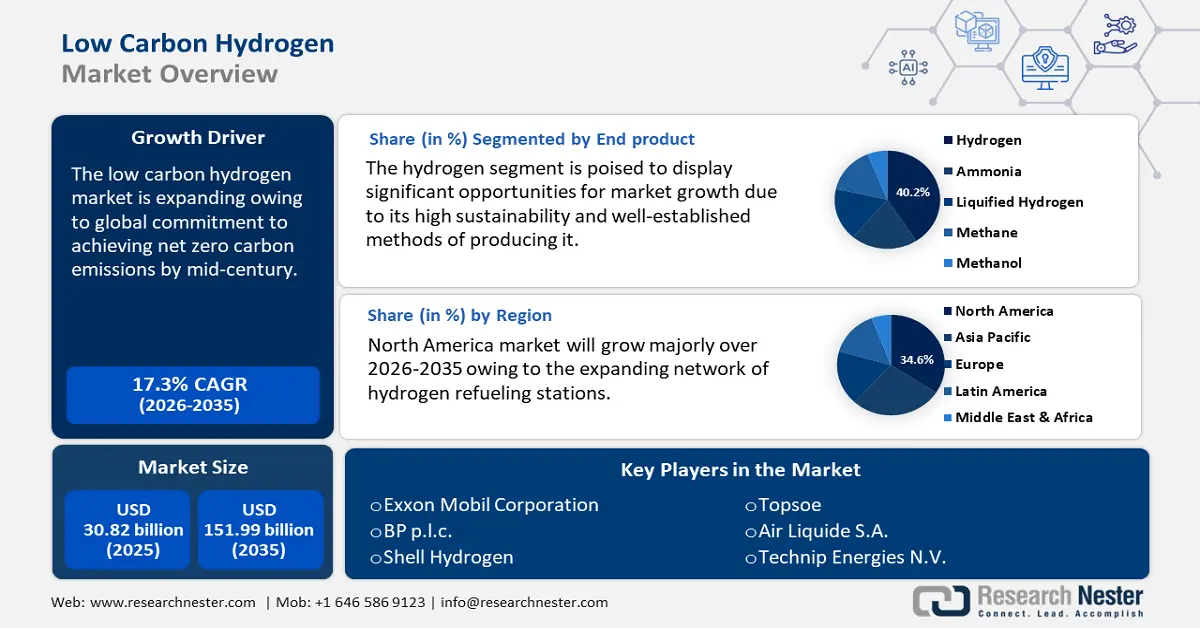

Low Carbon Hydrogen Market size was over USD 30.82 billion in 2025 and is poised to exceed USD 151.99 billion by 2035, growing at over 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of low carbon hydrogen is estimated at USD 35.62 billion.

The global low carbon hydrogen market is anticipated to escalate owing to the global commitment to achieving net zero carbon emissions by mid-century. To counteract the negative impacts of climate change, governments worldwide are establishing aggressive climate objectives, and low-carbon hydrogen is becoming an increasingly important part of this shift. The International Energy Agency (IEA) reported that the number of projects that have made final investment decisions has doubled in the last 12 months. By 2030, this is expected to boost the world's production of low-emissions hydrogen fivefold. There are now 20 gigawatts (GW) of electrolyzer capacity worldwide that have reached the final investment decision.

Minimal emissions in industries including heavy manufacturing and long-distance transportation where emissions are difficult to reduce and alternative solutions are either unavailable or challenging to adopt, hydrogen and hydrogen-based fuels can be crucial to the decarbonization of those sectors. The IEA reported that the global hydrogen production released 920 million tons of CO2 in 2023. About 20% came from unabated coal, which emits 22–26 kg CO2-equivalent (CO2-eq)/kg H2, while about two-thirds came from unabated natural gas, which emits 10–12 kg CO2-eq/kg H2.

The graph below demonstrates the carbon emissions from global hydrogen production:

Key Low Carbon Hydrogen Market Insights Summary:

Regional Highlights:

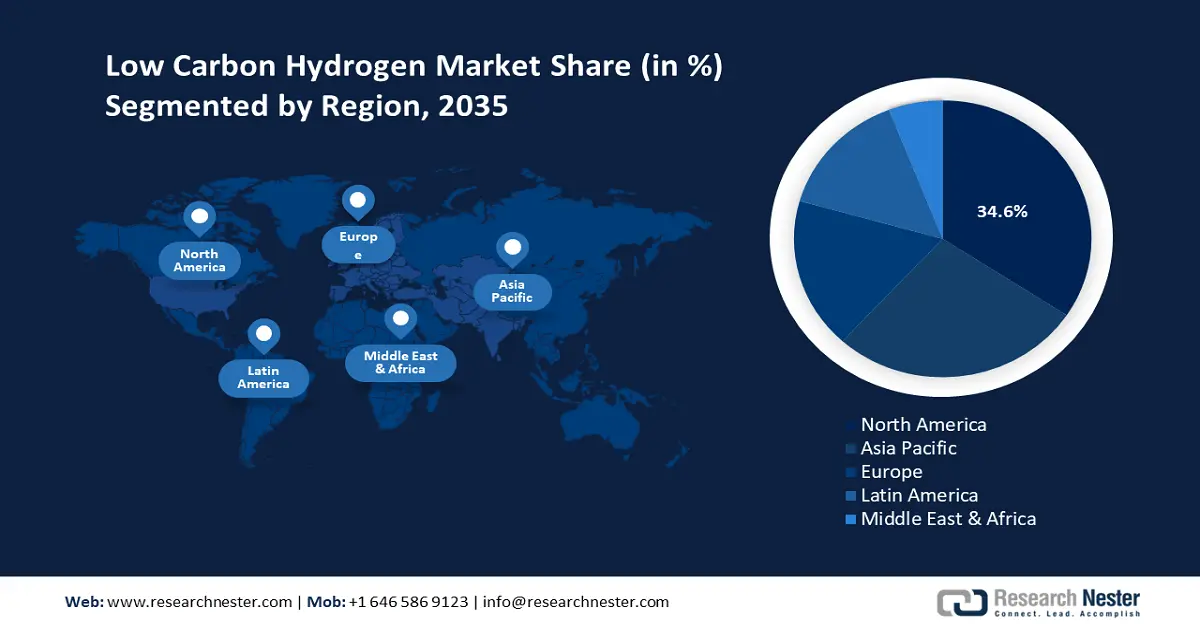

- North America low carbon hydrogen market will account for 34.60% share by 2035, driven by strong government backing, investments, and commitment to decarbonization.

- Asia Pacific market will register significant growth during the forecast period 2026-2035, attributed to substantial industrial demand, aggressive decarbonization goals, and government backing.

Segment Insights:

- The hydrogen segment in the low carbon hydrogen market is projected to hold a significant share by 2035, driven by rising demand due to hydrogen's sustainability and its use in transportation and power generation.

- The steam methane reforming (smr) segment in the low carbon hydrogen market is projected to hold a significant share by 2035, fueled by proven methods, affordability, and lower greenhouse gas emissions when combined with carbon capture.

Key Growth Trends:

- Increased adoption in the industrial sector

- Surging investments in hydrogen infrastructure

Major Challenges:

- Higher production costs

- Underdeveloped infrastructure

Key Players: Exxon Mobil Corporation, BP p.l.c., Shell, Topsoe, Air Liquide S.A., Technip Energies N.V., TotalEnergies SE, Green Hydrogen International, Intercontinental Energy Corp, Fortescue Future Industries Pty Ltd..

Global Low Carbon Hydrogen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.82 billion

- 2026 Market Size: USD 35.62 billion

- Projected Market Size: USD 151.99 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 18 September, 2025

Low Carbon Hydrogen Market Growth Drivers and Challenges:

Growth Drivers

- Increased adoption in the industrial sector: In light of their reliance on fossil fuels and high-temperature processes, industries like steel, cement, and chemicals are among the most difficult to eliminate from the economy in terms of carbon emissions. One practical option to drastically cut emissions in these areas is through low-carbon hydrogen. Direct reduction techniques based on hydrogen can be used to create steel with lower CO2 emissions than conventional blast furnaces. Similar to this, hydrogen can be used as a vital feedstock in the chemical sector to produce methanol and ammonia without the carbon impact that comes with using traditional methods.

In addition to helping these businesses fulfill strict emission standards, the use of low-carbon hydrogen gives them a competitive advantage as the demand for environmentally friendly products rises globally. Businesses and nations can establish themselves as leaders in the developing green industrial economy by making early investments in hydrogen infrastructure and technologies. A key component of the worldwide shift to a low-carbon future, hydrogen solutions can also be developed and implemented in industrial applications more rapidly owing to international cooperation and supportive regulations.

- Surging investments in hydrogen infrastructure: The economic appeal of producing low-emission hydrogen in areas with a wealth of renewable energy sources will grow as demand rises, necessitating greater transportation to link production facilities with demand centers. Governments and private sector players are offering funds to build pipelines, storage facilities, and integrated hydrogen hubs, creating a robust supply chain that supports industries aiming to decarbonize. The IEA indicated that there are currently over 5,000 kilometers of hydrogen pipes in use globally, most of which are privately owned and serve to link industrial customers. The H2CAST Etzel project, for example, successfully transformed two sizable salt caverns used to store gas into hydrogen storage facilities in December 2023. Leak tests were finished in 2024. At a salt cavern in northern Germany, Uniper launched a hydrogen storage test project in August 2024. Other forms of subsurface hydrogen storage are being tested, albeit at a lesser technological maturity level.

Furthermore, as infrastructure expands, the cost of low-carbon hydrogen decreases, boosting its adoption across sectors such as transportation, power generation, and heavy industry, thereby advancing global climate goals. Conversely, the cost of low-carbon hydrogen produced using renewable electricity should go down as the cost of electrolysis technologies and renewable electricity will continue to decline, primarily as a result of learning effects, technological advancements, and the realization of economies of scale.

The graph below indicates the cost of low-carbon hydrogen from renewable electricity: -

Challenges

- Higher production costs: The cost of production and infrastructure development is a significant barrier to the low carbon hydrogen market's expansion. The electrolysis process of producing low-carbon hydrogen, particularly green hydrogen, necessitates a large energy input from renewable sources, which might be costly. The cost of producing green hydrogen is still higher than that of producing conventional hydrogen from fossil fuels, even though the cost of renewable energy has been falling.

- Underdeveloped infrastructure: Production, storage, distribution, and transportation of hydrogen all depend on underdeveloped infrastructure that costs a lot of capital. It costs a lot of financial resources to build new pipelines, storage facilities, and hydrogen recharging stations. The extensive use of hydrogen as a fuel source is constrained by the absence of current infrastructure, which presents logistical difficulties. Moreover, the scalability of low-carbon hydrogen production is still in its early phases. The large-scale commercial viability of advanced technologies such as carbon capture, utilization, and storage (CCUS) for blue hydrogen is also still a long way ahead. Large-scale deployment and integration into current energy systems are hampered by these economic and technological uncertainties.

Low Carbon Hydrogen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 30.82 billion |

|

Forecast Year Market Size (2035) |

USD 151.99 billion |

|

Regional Scope |

|

Low Carbon Hydrogen Market Segmentation:

Process Segment Analysis

The steam methane reforming (SMR) segment is projected to gain a significant low carbon hydrogen market share by 2035. Due to its proven methods and affordability, steam methane reforming is currently the most extensively used procedure. In essence, it is the process by which steam and natural gas combine to form hydrogen, carbon monoxide, and a trace quantity of carbon dioxide. In addition to producing hydrogen, or blue hydrogen, this entire result greatly lowers greenhouse gas emissions when paired with carbon capture, utilization, and storage methods. In steam-methane reforming, methane, and steam combine with a catalyst at pressures ranging from 3 to 25 bar (1 bar = 14.5 psi) to create hydrogen, carbon monoxide, and a negligible quantity of carbon dioxide. Steam reforming is endothermic, meaning that for the reaction to occur, heat must be applied to the process.

End product Segment Analysis

Hydrogen segment is projected to dominate low carbon hydrogen market share of around 40.2% by the end of 2035. The market is experiencing a rise in demand for hydrogen owing to its high sustainability and well-established methods of producing it. Given its versatility, hydrogen is therefore being used as a preferred energy source in a variety of industries, including transportation and power generation. Furthermore, the growing technological advancements in hydrogen, particularly in renewable energy generation sources including solar and wind power, are driving the market.

Our in-depth analysis of the global low carbon hydrogen market includes the following segments:

|

Process |

|

|

Energy Source |

|

|

End product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Low Carbon Hydrogen Market Regional Analysis:

North American Market Insights

North America in low carbon hydrogen market is expected to hold more than 34.6% revenue share by 2035. Strong government backing, large investments, and a resolute dedication to decarbonization are propelling the industry in the region. The region's sophisticated R&D skills, expanding network of hydrogen refueling stations, and existing infrastructure all contribute to North America's low carbon hydrogen market dominance. North America is in a strong position to spearhead the global shift to hydrogen-powered electricity as the need for clean energy alternatives grows. With their advanced technology, a wealth of natural resources, and progressive politics, the U.S. and Canada are leading this expansion.

The Infrastructure Investment and Jobs Act, which provides a sizable amount of cash for hydrogen projects, is one of the comprehensive policies the U.S. government has implemented to support the hydrogen economy. To hasten low carbon hydrogen market acceptance, the U.S. Department of Energy's Hydrogen Shot project seeks to lower the price of clean hydrogen within ten years. The most comprehensive legislative support for the clean hydrogen sector in the world is provided by the Bipartisan Infrastructure Law and the Inflation Reduction Act. Heavy industry and other hard-to-transition sectors of the economy are predicted to benefit greatly from the expansion of the production of low-carbon fuels like hydrogen.

Major industries and academic institutes are working to develop and scale up hydrogen technology, ensuring the U.S. remains a global leader. This fuels the low carbon hydrogen market expansion.

Canada likewise makes significant investments in the low-carbon hydrogen sector due to its abundant renewable energy supplies and robust environmental regulations. With an emphasis on production, local use, and export potential, the Canadian government's Hydrogen Strategy provides a framework for positioning Canada as a global leader in hydrogen. Natural Resources Canada indicated that Low-carbon hydrogen is a key component of the framework outlined in the Hydrogen Strategy for Canada, which aims to reach net-zero emissions by 2050 while boosting employment, the economy, exports, and environmental protection. Interest in low-carbon hydrogen is soaring across Canada. There have been about 80 low-carbon hydrogen production projects reported, which indicates that more than USD 100 billion in prospective investment is interested in pursuing this clean energy option.

APAC Market Insights

Asia Pacific low carbon hydrogen market is expected to grow at a significant rate during the projected period. Fastest-growing low-carbon hydrogen market throughout the projected period, propelled by a confluence of substantial industrial demand, aggressive decarbonization goals, and robust government backing. The region is the fastest-growing worldwide because of coordinated efforts throughout the region, aided by advantageous regulations, significant investment, and technical improvements.

Furthermore, China’s low carbon hydrogen market is experiencing significant growth, propelled by robust government policies and substantial investments. In December 2024, the Chinese government unveiled a plan aimed at boosting demand and cutting costs to expedite the use of low-carbon hydrogen in industrial sectors. Driven by state-owned energy enterprises represented by Sinopec, China is on track to reach its targets of producing 100,000–200,000 mt/year of hydrogen based on renewables by 2025.

Without establishing a specific goal, the Ministry of Industry and Information Technology (MIIT) stated that the steel, ammonia synthesis, methanol synthesis, and refining industries should all implement low-carbon hydrogen on a considerable scale by 2027. To develop several novel low-carbon hydrogen use cases in shipping, aviation, rail transit, power generation, and energy storage by 2027, MIIT also supports additional demonstration projects in the power and transportation sectors.

In India, the low carbon hydrogen market is driven by government policies, industrial demand, and global climate commitments. The Press Information Bureau highlighted that India's goal to become a global leader in the production and export of green hydrogen is embodied in the National Green Hydrogen Mission. This program, which was started by the Union Cabinet in January 2022, intends to produce 5 million tons of green hydrogen annually by 2030. To encourage the production of green ammonia, specifically for the fertilizer industry, the Ministry of New and Renewable Energy (MNRE) launched the SIGHT Programme - Component II.

Similarly, South Korea has set up an institutional framework for the use of clean hydrogen in the electricity sector after realizing that it is crucial to reaching its Nationally Determined Contributions (NDCs). Invest Korea highlights that a target of 2.1% hydrogen to ammonia ratio in power generation (13 TWh) by 2030 was set in 2023 by the 10th Master Plan for Power Supply and Demand. To encourage power companies to freely engage in this objective, the Clean Hydrogen Production Standard (CHPS) system was created as a bidding low carbon hydrogen market.

Low Carbon Hydrogen Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BP p.l.c.

- Shell Hydrogen

- Topsoe

- Air Liquide S.A.

- Technip Energies N.V.

- TotalEnergies SE

- Green Hydrogen International

- Intercontinental Energy Corp

- Fortescue Future Industries Pty Ltd

The low carbon hydrogen market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves like mergers, acquisitions, and expansions to increase their low carbon hydrogen market presence and effectively fulfill the growing demand.

Recent Developments

- In November 2024, Topsoe, a global leader in carbon emission reduction technologies, and Aramco, a global integrated energy and chemicals company, signed a joint development agreement (JDA) to produce low-carbon hydrogen, also known as blue hydrogen, using Topsoe's ground-breaking eREACT technology at Aramco's Shaybah NGL facility.

- In June 2024, ExxonMobil and Air Liquide announced an agreement to support the production of low-carbon hydrogen and low-carbon ammonia at ExxonMobil's Baytown, Texas facility. The agreement will enable the transportation of low-carbon hydrogen through Air Liquide's existing pipeline network. Additionally, Air Liquide will build and operate four Large Modular Air separation units (LMAs) to supply 9,000 metric tons of oxygen and up to 6,500 metric tons of nitrogen daily.

- Report ID: 7412

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Low Carbon Hydrogen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.