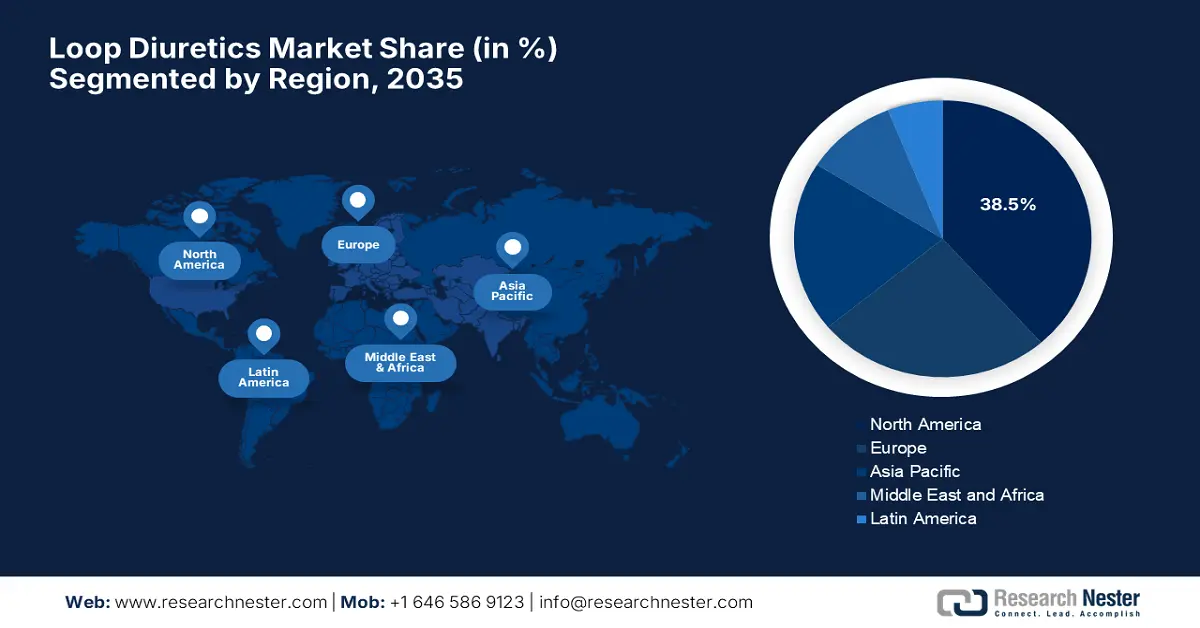

Loop Diuretics Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 38.5% in the loop diuretics market by the end of 2035. The market growth is driven by the higher healthcare expenditures and a surge in government investment. Testifying to this, the NLM in November 2024 observed that adults with hypertension incurred approximately USD 2,926 more in total annual healthcare costs and USD 328 more in out-of-pocket expenses when compared to those without hypertension. These expenses were due to an increase in inpatient and outpatient expenditures, underscoring the presence of strong potential in this field.

The Canada market is also flourishing owing to a surge in product innovations, regulatory support, and a rise in provincial investments in cardiovascular care. In this regard, Pharmascience Canada in August 2023 launched pms-PERINDOPRIL-INDAPAMIDE, which is a new generic medication for the initial treatment of mild to moderate essential hypertension in adults. The company further stated that this drug combines perindopril erbumine, an ACE inhibitor, with indapamide, a diuretic, which work together to effectively lower blood pressure across all age groups.

Key Statistics on High Blood Pressure in the U.S. (2023)

|

Statistic |

Value |

|

Number of deaths where high blood pressure was a primary or contributing cause in 2023 |

664,470 deaths |

|

Percentage of US adults with high blood pressure (≥130/80 mm Hg or on medication) |

48.1% (119.9 million adults) |

|

Percentage of adults with high blood pressure who have it under control |

22.5% (27.0 million adults) |

|

Percentage of adults with uncontrolled high blood pressure with BP ≥140/90 mm Hg |

45% (37 million adults) |

|

Adults who should be on medication but may not be taking it |

34 million adults |

|

Adults with BP ≥140/90 mm Hg among those needing medication |

19 million adults |

Source: CDC

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the loop diuretics market from 2025 to 2035. This rapid upliftment is readily propelled by increasing rates of chronic diseases, coupled with an aging demographic. Besides, countries across this region are improving healthcare infrastructure, wherein growing awareness among clinicians and patients about chronic disease management is also a few boosting factors for this landscape. Furthermore, regulatory bodies and government programs in major nations are expanding access to essential medications, making loop diuretics more accessible.

India is gaining enhanced traction in the market owing to the combination of high disease burden, product innovations, and economic constraints. In June 2024, Zydus Lifesciences Limited received tentative approval from the U.S. FDA to market Azilsartan Medoxomil and Chlorthalidone tablets, which are used for treating high blood pressure. The company also stated that it is a combination of angiotensin II receptor blocker and a thiazide-like diuretic combination tablets, containing 40 mg/12.5 mg and 40 mg/25 mg doses, will be manufactured at Zydus’s formulation facility in Ahmedabad SEZ-II, India.

Europe Market Insights

Europe is expected to retain its position as the second-largest contributor to growth in the loop diuretics market by the end of 2035. The country’s progress in this field is backed by a surge in demand for oral loop diuretics and patient preference for at-home administration. In September 2025, NIH reported that it analyzed over 71,000 patients who were prescribed loop diuretics without a heart failure diagnosis and found that only 14% underwent HF assessment in the U.K., with 15% diagnosed in a span of five years, underscoring the importance of early diagnosis and specialist care for better outcomes in loop diuretic users.

In the U.K., the loop diuretics industry is expanding notably, especially due to the favourable administrative bodies and the government investments in trials focusing on optimizing dosing strategies to reduce hospital readmissions. In June 2025, the country’s Department of Health proposed increasing the payment rate for newer branded medicines under the statutory scheme from 15.5% to 23.8% starting July 2025, due to higher-than-expected sales growth. Rates for 2026 and 2027 are proposed at 24.7% and 26.4% hence benefiting overall market growth.