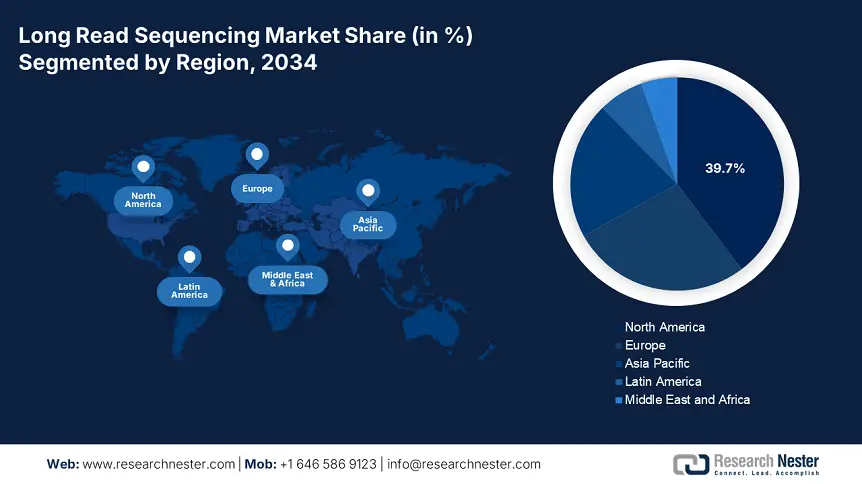

Long Read Sequencing Market - Regional Analysis

North America Market Insights

The North America long read sequencing market has the largest share of 39.7% worldwide and is expected to develop a CAGR of 17.2% during the period 2025-2034, with renewed government investment, highly developed R&D facilities, and accelerating uptake in clinical and research environments. The U.S. is fueling the region's growth by federal investments via NIH, CDC, and CMS, which collectively invested more than $5.4 billion in long read sequencing projects in 2023. Increasing Medicare and Medicaid reimbursement coverage is further driving clinical uptake, mainly for cancer genomics and rare disease diagnostics. North America's robust regulatory platform, national genomics plans, and collaborations between industries and academies will continue to make North America a dominating region.

The U.S. long read sequencing market is growing at a rapid rate, fueled by more NIH-funded genomics initiatives and expanding Medicare/Medicaid support. In 2023, over $500.4 million was spent on long-read genome research via the All of Us Research Program. The CDC further increased pathogen surveillance programs based on long read technologies in 2024 to support infectious disease surveillance. Medicare expenditures for long read sequencing reached $800.5 million in 2024, an increase of 15.4% since 2020. The CMS adapted the models of reimbursement in 2023 to enhance provider access among elderly people. Since the U.S. invests more than 9.5% of its health budget in genomics-based technologies, payer coverage and federal agency programs will accelerate the market penetration in the upcoming years.

Asia Pacific Market Insights

The APAC is the fastest-growing region in long read sequencing market is poised to hold the market share of 20.8% at a CAGR of 18.8% by 2034. India, Japan, China and South Korea are developing the region by genomic infrastructure to address the rising clinical and surgical demand. The AMED and MHLW in Japan has led to a rise of 12.6% of the healthcare budget in 2024 which is a USD 3.3 billion rise over the past three years. Further, Malaysia has doubled its patient treatment volume in the last ten years with the government funding rising up by 20.5%. the region is benefited by rising incidence of rare and genetic diseases, strong public and private R&D, and favorable government policies.

China is expected to hold the largest regional share of 27.1% by 2034 in long read sequencing market. In China, government expenditures on long read sequencing technologies increased by 15.4% during the last five years, which indicates that the nation is on the fast track to developing precision medicine. Nearly 1.8 million patients were diagnosed on long read sequencing platforms in 2023, fueled by the increasing number of complicated genetic diseases. This growth is surged by the National Medical Products Administration and the National Genomics Center, and has prioritized regulatory streamlining and clinical integration. In China, large-scale genomics projects are improving early diagnosis, mainly in the oncology and rare diseases fields.

Country-wise Government Provinces

|

Country |

Government Initiative / Investment |

Launch Year |

Budget / Funding Allocation |

|

Australia |

Genomics Health Futures Mission (GHFM) |

2021 |

AUD 500.4 million over 10 years |

|

Japan |

AMED long read sequencing funding boost via Moonshot R&D Program |

2022 |

$3.6 billion increase in national genomics budget |

|

India |

National Genomics Grid for cancer and rare disease sequencing |

2023 |

₹1,500.8 crore via DBT and ICMR |

|

South Korea |

Biohealth Strategy 2025 initiative on genome-based diagnostics |

2021 |

₩4.6 trillion investment |

|

Malaysia |

National Precision Medicine Initiative (MyPGx) |

2024 |

RM 300.9 million allocated for genomic infrastructure |

Sources: AU Govt, AMED, DBTIndia, MOH, Republic of Korea Government

Europe Market Insights

Europe long read sequencing market is expanding at a strong rate and is expected to occupy the market share of 27.2% at a CAGR of 15.6% during 2034. The region is dominated by the demand for accurate diagnostics and investments in genomic healthcare at the national level. The European Health Data Space and EU4Health Programme have committed more than €2.8 billion in funding through 2025 to support LRS infrastructure, public-private partnerships, and research networks. This joint effort makes Europe a leading global hub for next-generation sequencing, with Germany and the UK leading innovation and adoption.

Germany is expected to maintain the revenue share of 26.7% in 2034 in long read sequencing market. Germany dominates the region via strategic investment and aggressive clinical uptake. Germany's Federal Ministry of Health raised its funding on next-generation sequencing by 20.5% in the last five years, having cumulatively spent €4.4 billion in 2024. This investment highlights the national diagnostics for rare disorders and oncology via public-private partnerships. The GEMEINSAM project, which is a partnership with the German Medical Association (BÄK), accelerates clinical trials with LRS to confirm diagnostic accuracy. The biotechnology ecosystem of the country, combined with the innovation centers in Berlin, Munich, and Heidelberg, makes it a hotspot for research and commercialization.

Government Investments, Policies & Funding

|

Country |

Program / Policy Name |

Launch Year |

Budget / Funding Details |

|

UK |

NHS Genomic Medicine Service (GMS) |

2021 |

Allocated £500.4 M (2021–2023); increased to £750.6 M in 2024 for nationwide LRS diagnostics expansion. |

|

France |

France Genomic Medicine 2025 Initiative |

2021 |

Announced €670.5 M investment from 2021–2025, with €218.4 M earmarked for sequencing platforms. |

|

Italy |

National Genomics Infrastructure Framework |

2023 |

Government invested €350.8 M to build genomic reference centers across 5 regions. |

|

Spain |

Precision Medicine Strategy (IMPaCT Genómica) |

2022 |

Invested €110.5 M in 2022; expanded to €200.4 M by 2024 for sequencing and genomic research (via ISCIII). |

Sources: EMA, NHS, AIFA, AEMPS