Logistics Robots Market Outlook:

Logistics Robots Market size was over USD 17.65 billion in 2025 and is poised to exceed USD 87.04 billion by 2035, growing at over 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of logistics robots is estimated at USD 20.4 billion.

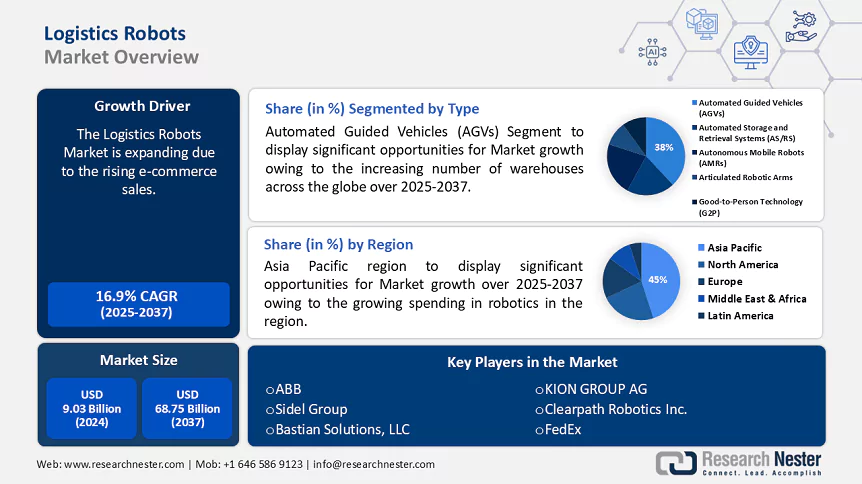

It is believed that rising e-commerce sales are driving this market expansion. The surge in online orders has leveled off; therefore, ecommerce companies operating locally and internationally have embraced cutting-edge technologies such as logistics robots to develop an effective logistics and supply chain.

According to the International Trade Administration, over the past ten years, worldwide B2B e-commerce sales have been consistently increasing year over year, with the market expected to reach USD 36 trillion by 2026.

Key Logistics Robots Market Insights Summary:

Regional Highlights:

- The Asia Pacific logistics robots market will dominate around 45% share by 2035, driven by companies investing in logistics robots to achieve higher efficiencies and improve worker safety.

- The North America market will exhibit tremendous growth during the forecast timeline, driven by the increasing purchase of robots by companies to enhance industrial automation.

Segment Insights:

- The automated guided vehicles segment in the logistics robots market is projected to experience significant growth till 2035, fueled by the increasing number of warehouses globally.

- The palletizing and de-palletizing segment in the logistics robots market is anticipated to experience substantial growth till 2035, influenced by the burgeoning packaging industry.

Key Growth Trends:

- Surging labor shortage

- Rising adoption of artificial intelligence

Major Challenges:

- Exorbitant deployment costs

- Technical complexity

Key Players: ABB, Sidel Group, Bastian Solutions, LLC, KION GROUP AG, Clearpath Robotics Inc., FedEx, Krones AG, Fetch Robotics, Inc, Midea Group, DHL International GmbH, Universal Robots, Clipper Logistics plc.

Global Logistics Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.65 billion

- 2026 Market Size: USD 20.4 billion

- Projected Market Size: USD 87.04 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Logistics Robots Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing installation of robots in warehouses - The need for more effective logistics is driving an exponential development in the usage of robotics in warehouses to optimize safety, automate product flows, and increase efficiency in warehouse operations.

For instance, by 2030, there will be more than 400,000 autonomous mobile robots (AMRs) installed worldwide in warehouses. - Surging labor shortage - Logistics companies are investing more in logistics robots since it has the potential to bridge the skills gap in the workforce, reduce labor costs for warehouses by over 65%, and enable businesses to operate profitably day and night.

In 2022, there were more than 25% more enterprises worldwide citing labor shortages in their filings than in 2021. - Rising adoption of artificial intelligence - Currently, over 25% of logistics businesses are using AI in robotics. Moreover, logistics robots is yet another AI innovation that is being heavily invested in to improve supply chain management for companies, improve the management of unpredictability and variability, and quickly fulfill orders by sorting, picking, packing, and organizing inventories. In 2023, over 75% of multinational corporations had implemented AI to enhance their business processes.

Challenges

-

Exorbitant deployment costs - The cost of implementing robotics systems is one of the main obstacles since for many firms, particularly small businesses, this price tag may be a turnoff as they do not have the same funding as larger corporations.

-

Technical complexity - It can be difficult and time-consuming to integrate robotics systems with current IT and infrastructure as warehouses and logistics centers are extremely complicated environments with numerous machinery and systems that run various software programs.

Logistics Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 17.65 billion |

|

Forecast Year Market Size (2035) |

USD 87.04 billion |

|

Regional Scope |

|

Logistics Robots Market Segmentation:

Type (Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Articulated Robotic Arms, Good-to-Person Technology (G2P))

Automated Guided Vehicles (AGVs) segment is projected to hold logistics robots market share of more than 38% by 2035. The segment growth can be accredited to the increasing number of warehouses across the globe. In 2020, the total number of warehouses worldwide was estimated to be over 150,000.

Automated Guided Vehicles (AGVs) are fully automated transport systems that are sometimes used to oversee warehouse operations for repetitive, large-volume material movement jobs that are normally performed by forklifts, and conveyor systems.

The AGV falls under the umbrella of logistics robots that helps with order picking by directing warehouse workers through activities and moving selected items to workstations for packaging and shipping.

Function (Palletizing and De-palletizing, Pick and Place, Loading and Unloading, Packaging and Co-packing, Shipment and Delivery)

The palletizing and de-palletizing segment in logistics robots market is estimated to grow at a substantial CAGR in the coming years. The major factor in the expansion of the segment is the burgeoning packaging industry. For instance, the market for plastic packaging was estimated to be worth over USD 264 billion globally in 2022.

Palletizing and depalletizing automatically is now a crucial component of the packaging sector for achieving unmatched accuracy and a constant high throughput.

Moreover, palletizing is the process of packing or arranging goods for transportation or storage onto a wooden, plastic, or metal pallet, whereas depalletizing is the process of methodically taking packed goods off of a pallet that has been loaded.

End-Use (Healthcare, Retail, Agriculture, Manufacturing, E-commerce, Automotive, Food and Beverage)

By the end of 2035, the e-commerce segment in logistics robots market is predicted to have a significant revenue share led by the increasing popularity of online shopping. Nowadays, more than 2 billion people shop online, a huge rise from just a few years ago. Global e-commerce revenues increased by over 6% in 2022 over the previous year.

The e-commerce sector is using logistics robots to help it meet the constantly shifting needs of its online customers, manage a bigger volume of orders, and adhere to strict delivery windows as more and more customers shop online.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Component |

|

|

Operation Environment |

|

|

Function |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Logistics Robots Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is estimated to account for largest revenue share of 45% by 2035. As a result, more and more companies in the region are investing in logistics robots to achieve higher efficiencies, reduce downtime, and improve worker safety. For instance, Asia Pacific spending on robotic systems was over USD 90 billion in 2021.

In Japan, more and more businesses are utilizing robots to move goods automatically through their factories and warehouses to overcome labor shortages in e-commerce, increase efficiency, and optimize logistics.

The deployment of logistics robots seems to have picked up speed in China owing to technological development, increased domestic production, and quick expansion.

South Korea's restaurants are emerging as the most adoptive of robots, which may drive market growth in the coming years.

North American Market Analysis

The North American logistics robots market region will also register a tremendous CAGR through 2035 owing to the increasing purchase of robots by companies. For instance, in 2023, more than 30,159 robots were purchased by North American industries.

Particularly, in April 2023, over 45 investments totaling around USD 1 billion were made in robotics by US-based robotics startups.

Canada is well-known around the world as a center for innovation in industrial automation, leading to growth in the discipline of robotics in day-to-day jobs.

Logistics Robots Market Players:

- KUKA AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Sidel Group

- Bastian Solutions, LLC

- KION GROUP AG

- Clearpath Robotics Inc.

- FedEx

- Krones AG

- Fetch Robotics, Inc

- Midea Group

- DHL International GmbH

- Universal Robots

- Clipper Logistics plc

It is projected that the top five companies will control the majority of the market share of logistics robots as they are taking a variety of calculated risks, and are constantly collaborating, expanding, making agreements, and taking part in joint ventures to fortify their positions in the industry.

Recent Developments

- Sidel Group partnered with Elettric80 to offer beverage and food, home, and personal care (FHPC) companies comprehensive services ranging from manufacturing to warehouse, distribution center, and logistics management to boost their clients' operational sustainability and efficiency and increase their commercial prospects.

- KUKA AG collaborated with Upper Bavarian company digital workbench to provide a tangible good in the form of a mobile harvesting robot that will aid fruit growers in the apple harvest, and also provide a wealth of insightful information for their upcoming developments about fruit growing automation.

- Report ID: 6252

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Logistics Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.