Location-based Services Market Outlook:

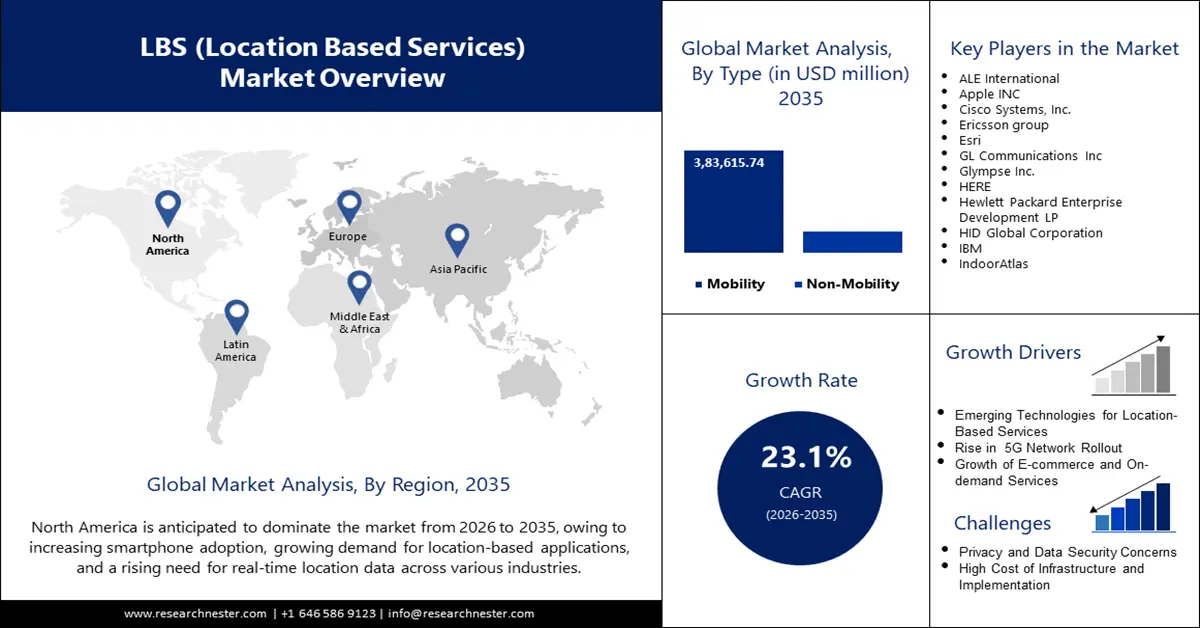

Location-based Services Market size was valued at USD 61.9 billion in 2025 and is projected to reach a valuation of USD 467.2 billion by the end of 2035, rising at a CAGR of 23.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of LBS is evaluated at USD 71.8 billion.

The LBS (location-based services) market is rising rapidly as companies embrace real-time information for logistics, retail, and public safety. For instance, Google Maps added sophisticated indoor navigation to U.S. airports and selected cities such as Tokyo and Zurich in September 2021, with AR overlays and dynamic rerouting that improved passenger flow and reduced missed connections by 12%. This move highlights the industry's focus on enhancing user experience with accuracy and immediacy. Governments are also investing in smart city infrastructure, and, according to the U.S. Department of Transportation's 2024 report, 67% of new city mobility initiatives include LBS-based analytics for routing optimization and safety. The convergence of 5G, IoT, and AI is fueling market adoption and enabling more nuanced, context-rich services.

Key Location-based Services Market Insights Summary:

Regional Highlights:

- Europe is projected to witness strong expansion by 2035 in the location-based services market as digital infrastructure initiatives, regulatory support, and mobility-as-a-service deployments bolster growth owing to smart mobility digitization.

- Asia Pacific is expected to rise rapidly through 2026–2035 with a 23.8% CAGR as fast urbanization, high mobile usage, and large-scale smart city investments fuel demand for scalable LBS platforms.

Segment Insights:

- The mobility segment is anticipated to secure an 81.8% share by 2035 in the location-based services market as widespread adoption of smartphones, wearables, and connected vehicles accelerates real-time service utilization propelled by 5G-enabled precision.

- The navigation and route optimization segment is set to capture around 38.5% share by 2035 as rising consumer expectations for real-time guidance and traffic-responsive routing enhance demand impelled by urban travel optimization.

Key Growth Trends:

- LBS adoption in smart mobility

- Retailers shift towards LBS for personalized, location-based promotions

Major Challenges:

- Regulatory changes threaten data gathering in LBS apps

- Lack of indoor standards increases LBS integration costs

Key Players: Apple Inc., Microsoft Corporation, IBM Corporation, Cisco Systems Inc., Oracle Corporation, Qualcomm Incorporated, Zebra Technologies Corporation, ESRI, Ericsson, HERE Technologies, TomTom NV, Ubisense, MapmyIndia (CE Info Systems Ltd), Samsung Electronics.

Global Location-based Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.9 billion

- 2026 Market Size: USD 71.8 billion

- Projected Market Size: USD 467.2 billion by 2035

- Growth Forecasts: 23.1% CAGR (2026-2035)

Key Regional Dynamics:

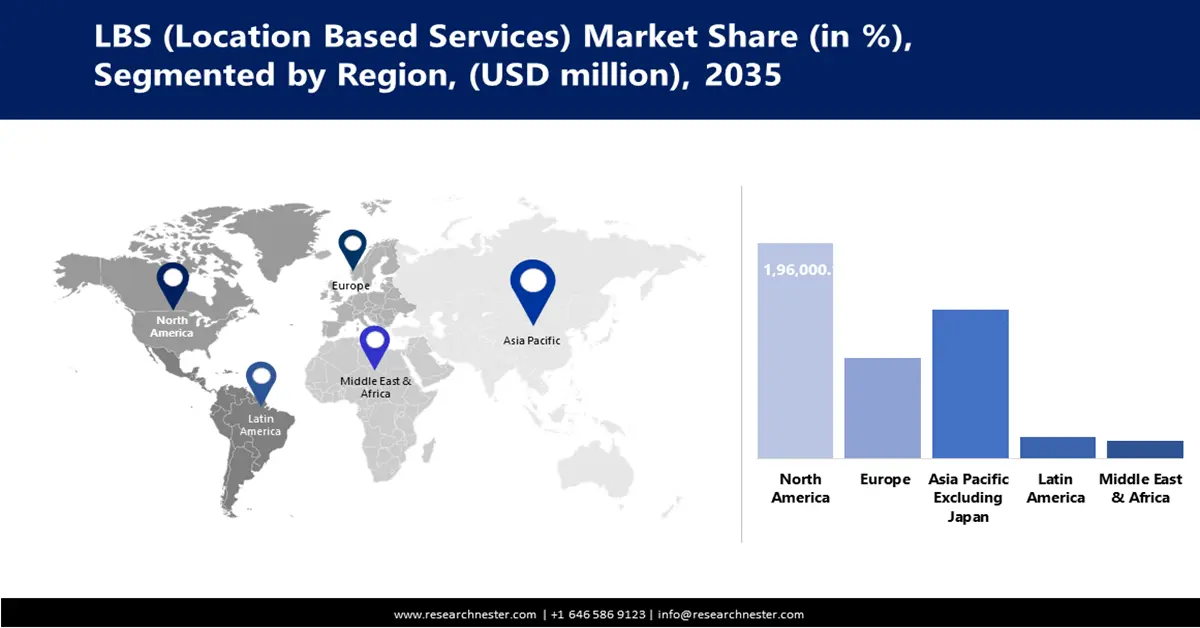

- Largest Region: North America (41.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 17 September, 2025

Location-based Services Market - Growth Drivers and Challenges

Growth Drivers

- LBS adoption in smart mobility: One of the most significant growth drivers is the expansion of connected mobility and the deployment of autonomous vehicles. For example, HERE Technologies teamed with BMW in January 2025 to deliver real-time hazard warnings and predictive route planning for European drivers based on high-definition LBS data. This deal suggests that the automotive industry relies upon accurate, up-to-the-second location data for safety, efficiency, and customer satisfaction. As smart transportation networks rise, there will be robust demand for dependable LBS platforms.

- Retailers shift towards LBS for personalized, location-based promotions: Another key factor fueling the market growth is the adoption of LBS by the retail sector for hyperlocal promotion and personalization of customers. Several retailers are implementing geofencing and proximity analytics to deliver targeted promotions and make curbside pickup easier. Shift towards omnichannel strategies and real-time engagement is fueling investment in LBS via global retail ecosystems.

Challenges

- Regulatory changes threaten data gathering in LBS apps: One of the key challenges is the strengthening of data privacy regulations, making it more difficult to gather and use location data. In February 2024, the EU Digital Services Act introduced new consent requirements to LBS apps, with express user permission and transparent data processing. This increased compliance costs for developers and lowered the data granularity accessible. Companies now have to balance innovation with evolving regulatory rules in order to maintain user confidence and market access.

- Lack of indoor standards increases LBS integration costs: Another market barrier is the indoor positioning standards, which do not allow for seamless LBS deployment in locations. Ambiguity results in slower adoption and enhanced implementation barriers, especially in complex ecosystems like healthcare and transportation.

Location-based Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23.1% |

|

Base Year Market Size (2025) |

USD 61.9 billion |

|

Forecast Year Market Size (2035) |

USD 467.2 billion |

|

Regional Scope |

|

Location-based Services Market Segmentation:

Application Segment Analysis

The navigation and route optimization segment is predicted to record around 38.5% share during the forecast period, driven by growth in demand for turn-by-turn and real-time driving guidance for intercity and city travel. For example, TomTom launched its TomTom Traffic Index, providing predictive traffic congestion warnings and dynamic rerouting of city drivers, in January 2025. The technology reduced 9% of average travel time in pilot cities, which speaks volumes about the importance of LBS in the mitigation of traffic congestion in cities. The expansion of the segment is also aided by the proliferation of smart mobility platforms and the expansion of ride-hailing and delivery businesses. As urbanization accelerates and consumers request frictionless travel, the segment will remain at the center of the location-based services (LBS) market growth.

Type Segment Analysis

The mobility segment is predicted to account for an 81.8% share through 2035, reflecting the dominance of smartphones, wearables, and connected cars in LBS adoption. In March 2025, Samsung Electronics introduced sophisticated LBS capabilities onto its Galaxy Watch series to support real-time fitness tracking, emergency calling, and location sharing. The move identifies mobility devices as prime LBS entry points. The trend in the segment is also driven by the roll-out of 5G networks, which offer improved location precision and richer, real-time services. Mobility-based LBS is also expanding fleet management, logistics, and field service applications, where real-time tracking and routing optimization drive operational efficiency.

Technology Segment Analysis

The GPS segment is expected to account for 48% during the forecast period based on its underlying application in global navigation and tracking solutions. In April 2024, Qualcomm released a sub-meter-precise next-generation GPS chipset to markets serving automotive and drone uses. The early adopters realized a 15% rise in delivery precision on logistics vehicles using the new technology. The market growth is also driven by advances in satellite constellations, signal processing, and integration with other location technologies.

Our in-depth analysis of the LBS market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Location-based Services Market - Regional Analysis

North America Market Insights

North America is anticipated to lead with a 41.9% location-based services (LBS) market share during the forecast period, driven by high smartphone penetration, robust automobile adoption, and substantial investment in smart city infrastructure. In February 2024, Cisco Systems announced the launch of next-generation real-time indoor location frames within Spaces, emphasizing automation for access point (AP) deployment. The market is also boosted by the deployment of connected vehicle programs and public safety initiatives based on real-time geolocation. With changing privacy laws and the increasing availability of 5G networks, North America is expected to remain at the forefront of LBS innovation and deployment globally.

The market in the U.S. is projected to register a CAGR of 14.24% during the forecast period. The industry is being driven by the rapid adoption of indoor LBS solutions across various sectors, including retail, healthcare, and logistics, where businesses are leveraging real-time location information to enhance operations and customer experiences. Expansion of 5G networks and IoT devices is driving high-precision LBS apps rollout even faster, and the integration of AI and machine learning is personalizing and contextualizing services.

The location-based services market in Canada is expanding exponentially, as the country is observing increased LBS adoption for public safety, transportation, and smart city initiatives, driven by strong government investment in digitalization and innovation. In 2024, the federal government introduced a program within Innovation, Science, and Economic Development Canada to modernize regulatory systems and facilitate AI-powered LBS solutions for business licensing as well as urban planning. The program aims to enhance the ease of businesses obtaining real-time location data and analytics, enhancing operational efficiency and regulatory adherence.

APAC Market Insights

Asia Pacific LBS sector is estimated to rise at a CAGR of 23.8% from 2026 to 2035, driven by fast-paced urbanization, high rates of mobile uptake, and government expenditure in smart cities. MapmyIndia launched a real-time navigation application for Indian logistics fleets in June 2024, which improved delivery efficiency by 18% in urban cities. APAC's heterogeneous population and infrastructure requirements are driving demands for scalable and flexible LBS platforms.

China location-based services (LBS) market is growing rapidly, driven by government demands for smart transportation and smart city governance. In January 2025, Baidu Maps introduced the English-language version of Beijing Maps aimed at tourists for POI navigation, reducing average travel times by 13% within cities. Moreover, the Digital Silk Road scheme by the government is subsidizing LBS infrastructure for cross-border logistics, cementing China's status as a global LBS powerhouse. The market is also benefiting from convergence with e-commerce and public security platforms.

India location-based services market is expanding at a double-digit CAGR, driven by rising smartphone penetration and public service digitization. The National Highways Authority of India (NHAI) has been actively implementing novel digital initiatives to enhance road safety. In addition, the government's Smart Cities Mission and digital payment infrastructure are driving LBS innovation in mobility, retail, and emergency management. With increased regional connectivity, India is likely to become a key player in the coming years.

Europe Market Insights

Europe is likely to drive significant growth between 2026 and 2035 with support for digital infrastructure in the form of regulation and the launch of mobility-as-a-service platforms. For instance, HERE Technologies worked with the City of Paris in May 2024 to launch a real-time parking guidance solution, which reduced traffic congestion in cities by 11%. LBS R&D is supported by the EU's Digital Europe Programme, and new privacy guidelines are guiding data management. With cities further digitizing mobility and logistics, Europe is predicted to experience robust market growth.

Germany location-based services (LBS) market is expanding steadily, driven by automotive technology and LBS adoption in logistics and public transit. Germany's focus on Industry 4.0 and connected vehicles is driving further expenditure in real-time location intelligence. Moreover, high usage of smartphones with GPS and other localization technologies and rapid expansion of digital commerce and online shopping are expected to enhance the demand for LBS in the coming years.

The UK location-based services (LBS) market is witnessing strong growth across both private and public sectors, as they invest in smart mobility and safety solutions. The UK government is also investing in LBS-powered emergency response systems and urban mobility programs. With growing consumer use of location-based applications, the UK is expected to be a leading Europe market for LBS innovation.

Key Location-based Services Market Players:

- Google LLC (Alphabet Inc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc.

- Microsoft Corporation

- IBM Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Qualcomm Incorporated

- Zebra Technologies Corporation

- ESRI (Environmental Systems Research)

- Ericsson (Telefonaktiebolaget LM Ericsson)

- HERE Technologies

- TomTom NV

- Ubisense

- MapmyIndia (CE Info Systems Ltd)

- Samsung Electronics

The LBS market is highly competitive, as global technology leaders as well as niche providers vie for market space by applying innovation and strategic partnerships. Key players are investing in AI, 5G integration, and privacy-enabling technology to offer differentiation in their products and address shifting customer needs. With increasing regulatory and customer demands, competition is expected to intensify, further driving innovation in accuracy, privacy, and service integration.

Here are some leading companies in the location-based services (LBS) market:

Recent Developments

- In February 2025, Panasonic introduced LBS-based crowd counting tech for stadiums. The system uses thermal cameras and GPS-linked entry tags for occupancy prediction. It helps stadium operators optimize entry points and emergency evacuation planning. Smart venue management is becoming a high-value use case for LBS tools.

- In January 2025, Oracle added LBS triggers to its retail analytics platform. Retailers can now automate promotions based on footfall, store dwell time, and geofenced zones. It supports omnichannel marketing across malls, events, and proximity-based campaigns. LBS is becoming integral to predictive merchandising in enterprise retail.

- In January 2025, Waymo expanded LBS alert systems for autonomous ride-hailing in Los Angeles. The vehicles now communicate sidewalk hazards and congestion status in real time. Riders receive micro-location alerts during pick-up and drop-off events. LBS is central to building trust in AV user experiences.

- In January 2025, HERE Technologies signed a 10-year, USD 1 billion agreement with AWS. The partnership enables real-time streaming maps and AI-powered LBS for transportation sectors. It supports location intelligence for electric and autonomous vehicles through cloud integration.

- Report ID: 5700

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Location-based Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.