LNG Carrier Market - Growth Drivers and Challenges

Growth Drivers

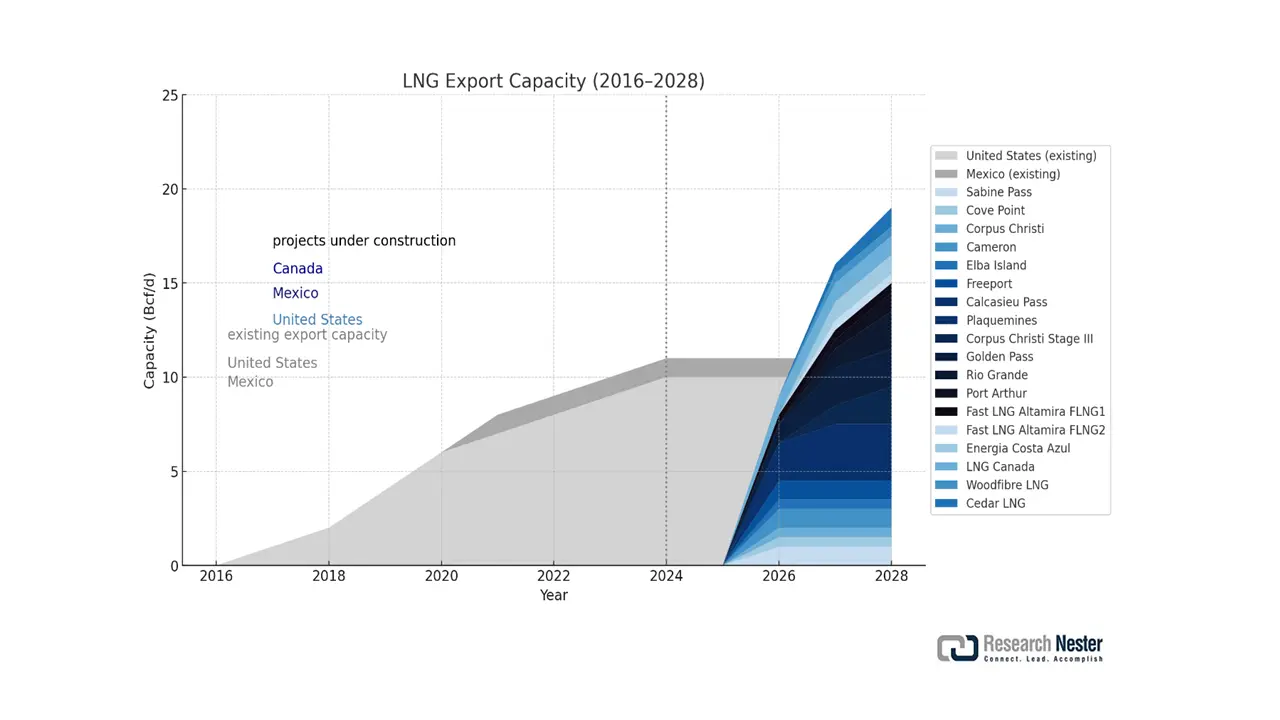

- Expansion of liquefaction and export infrastructure: Global investments in liquefaction terminals have created considerable growth in demand for LNG carriers.North America’s liquefied natural gas outbound trade capacity is set to double between 2023 and 2028, reaching 24.4 Bcf/d in 2028 from 11.4 billion cubic feet per day (Bcf/d) in 2023 (considering present-day operations and future projects). EIA estimates that LNG export will expand by 9.7 Bcf/d in the U.S. and 2.5 Bcf/d in Canada.

North America’s LNG Export Capacity, by 2028

Source: EIA

As per an April 2025 report by the EIA, Canada’s three LNG export projects have a cumulative capacity of 2.5 Bcf/d and are under development in British Columbia. Woodfibre LNG (export of 0.3 Bcf/d) plans to start trading in 2027. Similarly, a FLNG project-Cedar LNG (capacity approximately 0.4 Bcf/d), announced a final investment in June 2024 and is anticipated to initiate exports in 2028. The natural gas utilized for these projects is estimated to be supplied from western Canada. Moreover, the Canada Energy Regulator (CER) has sanctioned four export projects, comprising LNG Canada expansion, with a proposed export capacity of 4.1 Bcf/d.

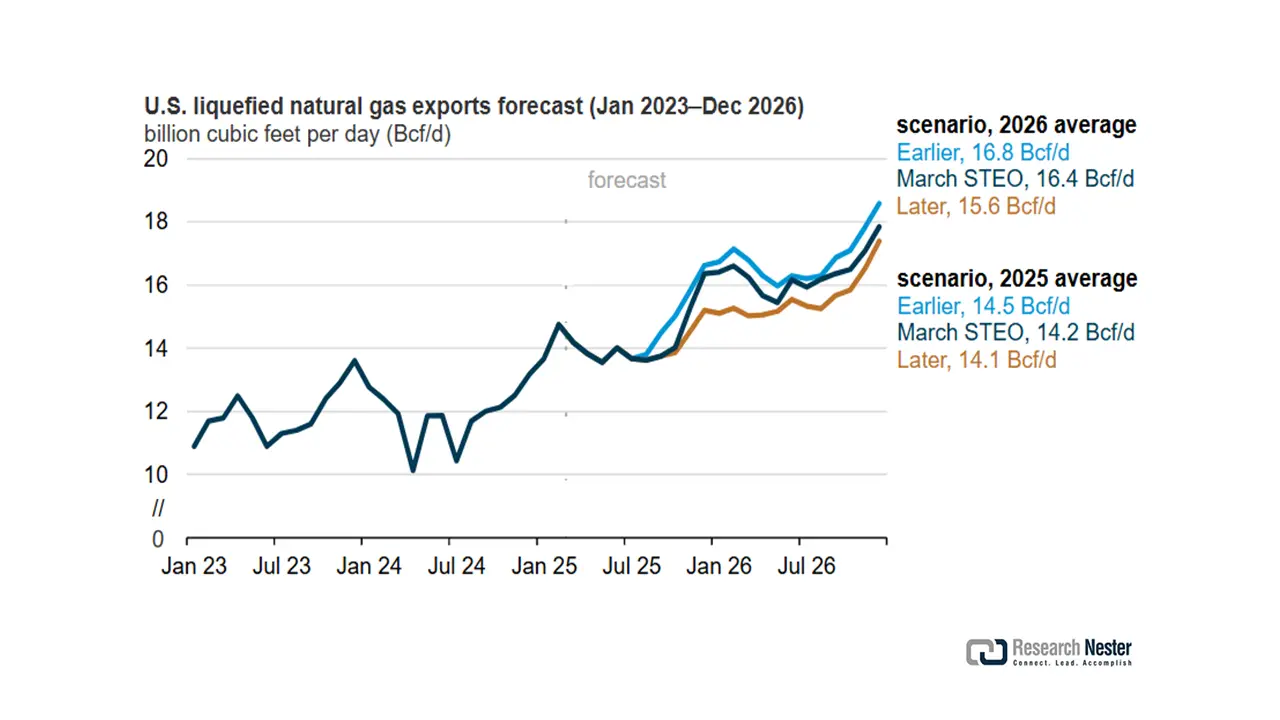

U.S. exports of liquefied natural gas were identified as the largest end user of natural gas in the Short-Term Energy Outlook (STEO) report published in March 2025. LNG gross exports are projected to grow by 15% and cross 16.4 Bcf/d by the end of 2026. The start-up timing of Golden Pass LNG and Plaquemines LNG Phase 2 (including 18 midscale trains), both new LNG export firms, can directly impact forecast predictions as these facilities contribute 19% of incremental LNG export capacity in the country during 2025-2026.

The U.S. LNG exports have snowballed every year since 2016, grossing 11.9 Bcf/d in 2024 from 0.5 Bcf/d in 2016, thereby making the U.S. the largest LNG exporter globally in 2024, globally. The rising international demand for LNG and the buildout of export infrastructure are aiding the market propagation. It is anticipated that U.S. LNG exports will witness a staggering growth owing to the three new facilities: Corpus Christi LNG Stage 3, Plaquemines LNG (Phases 1 and 2), and Golden Pass LNG. A cumulative export of 5.3 Bcf/d or 6.3 Bcf/d peak capacity is expected from these facilities and will boost U.S. LNG exports by 50% once fully operartional (likely to commence by the end of 2026).

U.S. LNG Export Forecast, through 2026

Source: EIA

Source: EIA

New liquidity terminals being developed in Mexico, Africa (Mozambique, Nigeria), and Australia will also contribute to increasing LNG volumes. This rapid growth of export facilities will require a larger LNG carrier fleet to successfully manage exporting gas across continents.

- Fleet modernization and eco-friendly vessels: With the new decarbonization norms implemented by IMO 2023, LNG carriers will continue their transition to dual-fuel engines and energy-efficient designs. There is an increasing demand for ME-GA and X-DF engines to alleviate methane slip and carbon emissions. LNG carriers with increased boil-off gas recovery are the favored choice for increasing numbers within the fleet. Shipowners are investing in upgrading and replacing their vessels environmentally, and a new modernization wave has been adopted across the global LNG fleet.

- Rise of floating LNG infrastructure (FLNG/FSRU): With the expansion of floating LNG units and Floating Storage Regasification Units (FSRUs) supporting LNG as a shipping requirement, demand for LNG shipping is increasing. Facilities like FLNG in Cameroon and Mozambique are transforming LNG production offshore and demanding very specialized logistical support for LNG shipping. In step, offshore facilities typically utilize shuttle LNG carriers, which create steady, localized demand and promote the diversification of fleets and investment in specialized LNG ships.

Challenges

- Volatile LNG prices and trade uncertainty: Market fluctuations in LNG prices impact carrier utilization, profitability, and trading patterns. The volatility also creates route inefficiencies, increasing idle time and difficulties in chartering. Geopolitical challenges, notably Russia-Ukraine, also disrupted shipping lanes and LNG flow into Europe. Uncertainty over long-term LNG contracts disincentivizes investments by shipping companies in new vessels, which increases operational uncertainty.

- Skilled labour shortage and safety concerns: Operating LNG carriers is a highly skilled task. There is, however, a significant shortage of qualified marine engineers and LNG handling specialists in the global labour pool. Safety training is of utmost importance in the transport of LNG. The non-availability of crew may defer scheduled deliveries, which increases insurance timelines, premiums, and the possible non-competence of regulatory requirements, which limits the ability to ramp up market supply.

LNG Carrier Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 16.3 billion |

|

Forecast Year Market Size (2035) |

USD 30.2 billion |

|

Regional Scope |

|