LNG Carrier Market Outlook:

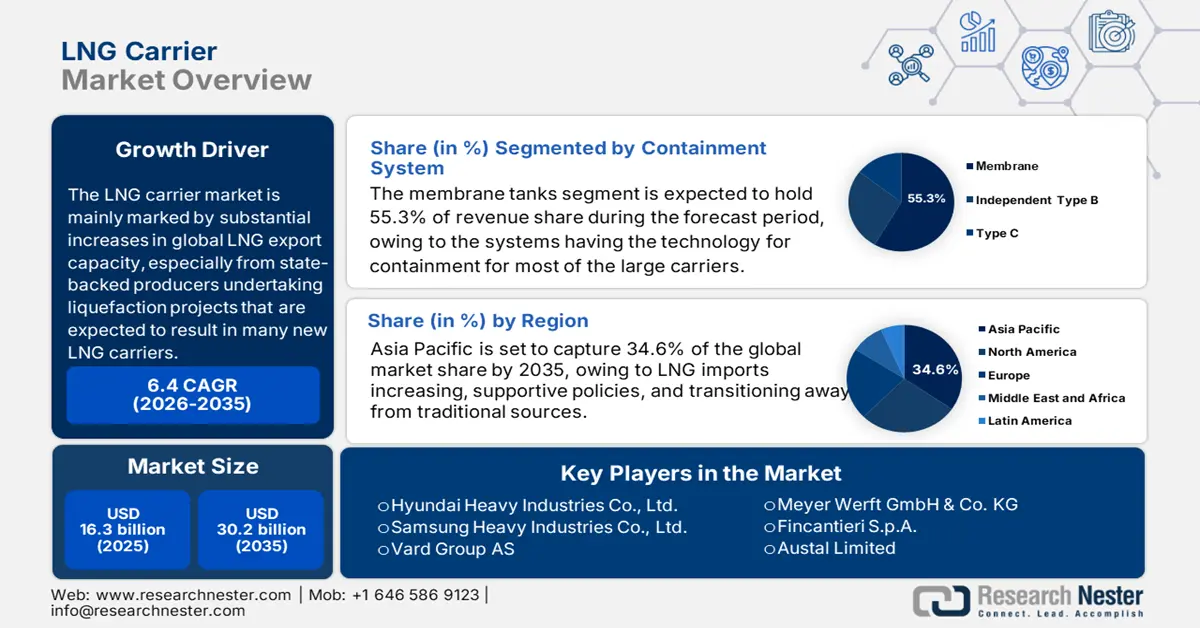

LNG Carrier Market size was estimated at USD 16.3 billion in 2025 and is expected to surpass USD 30.2 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of LNG carrier is estimated at USD 17.4 billion.

According to research, the LNG carrier market is primarily characterized by substantial increases in global LNG export capacity, particularly from state-backed producers undertaking liquefaction projects that are expected to result in numerous new LNG carriers. QatarEnergy's transformative North Field East/South (NFE/NFS) project aims to boost LNG production from 77 million tons (Mt) to 142 MTPA by 2030. These LNG development plans involve orders for at least 36 new LNG carriers from HD Hyundai and China Shipbuilding, with dozens more anticipated, representing several billion dollars in investment. Additionally, Venture Global secured USD 15.1 billion in financing in July 2025 for its CP2 plant in the U.S., which will develop 29 Mtpa of LNG, increasing the nation's overall export capacity in the forthcoming years-again creating demand for new LNG carriers.

From a supply chain perspective, steel and cryogenic containment systems are procured globally. However, approximately two-thirds of new LNG carriers are built in South Korea, while around one-third are produced in Japanese and Chinese shipyards. Further supplier growth is driven by accelerated logistics and the export of raw materials. The U.S. Federal Energy Regulatory Commission (FERC) and the Department of Energy (DOE) fully support initiatives like the McNeese State University LNG Center of Excellence to promote research, development, and training to improve the safety and operations of offshore LNG maritime systems.