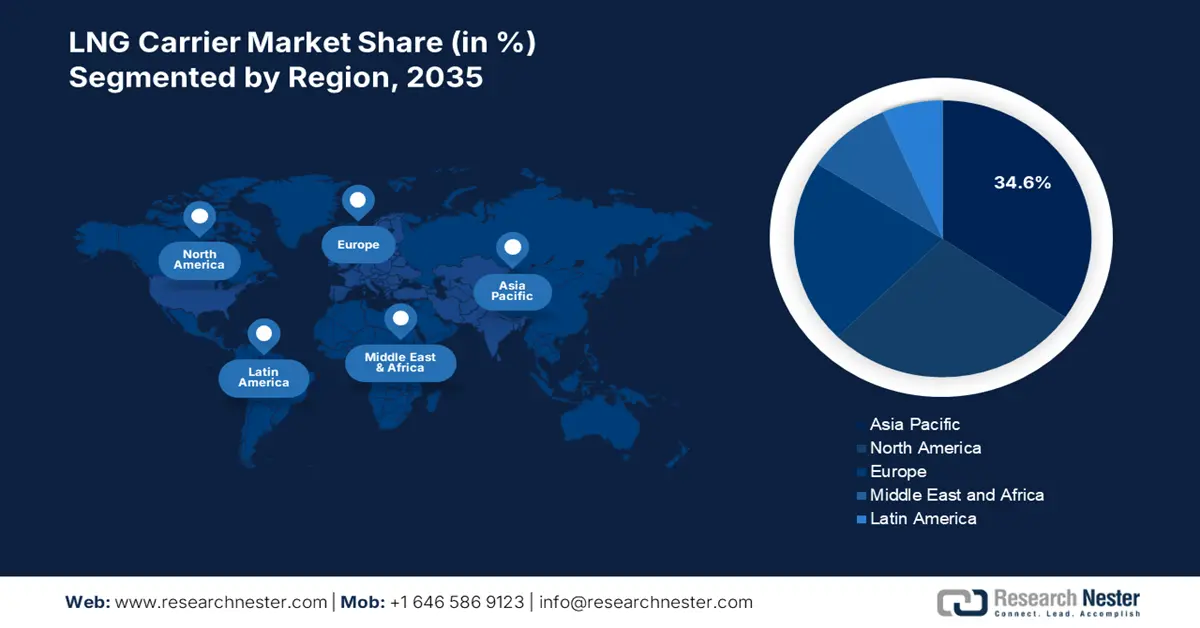

LNG Carrier Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific LNG carrier market is expected to hold 34.6% of the market share due to LNG imports increasing, supportive policies, and transitioning away from traditional sources of energy to more decarbonized sources of energy. Rising industrial developments and Imports from coastal countries are causing investments in LNG carriers. Over the last few years, the Asia Pacific has accounted for a massive percentage of the global orders for LNG shipbuilding, with South Korea, China, and Japan leading the charge. New fleet strategies and regional LNG infrastructure expansion will only contribute positively to long-term carrier acquisitions.

China’s LNG carrier market, to experience significant increases in demand for gas, as well as new domestic experiences for shipbuilding. China’s LNG imports are expected to reach above 131 million metric tons by 2030 as policies from the government continue to focus on transitioning away from cleaner fuel alternatives. Hudong-Zhonghua Shipbuilding Group and COSCO Shipping have become the leading producers of LNG vessels in the world. China's dual-carbon objectives are being added by expanding coastal terminals to utility fleet acquisition strategies. Chinese yards are more recently closing the technology gap with South Korea, thereby adding value-added solutions for both domestic and international LNG shipping.

North America Market Insights

The North American LNG carrier market is expected to hold 27.9% of the market share during the forecast period. Accelerated growth is attributed to rapid liquefaction infrastructure expansion, growing exports, and documented demand for floating storage and regasification units (FSRUs). The region is one of the fastest-growing segments around the world, attributed to advancements in dual-fuel engines and retrofits, among other things. The environment is also being influenced by shale reserves, Gulf Coast terminals, and continuing connectivity with Asia for the trans-Pacific basin and Europe for transatlantic operations.

The U.S. LNG carrier market dominates North America’s LNG carrier activity, requiring additional new vessel tonnage, with researchers estimating perhaps as many as an additional 401 ships will be needed to support the rising export capacity. The U.S., ranked as the global leader in LNG exports since 2023, is projected to further increase its market presence. Data from the Short-Term Energy Outlook (November 2024) indicates that U.S. LNG exports will average 13.7 Bcf/d during the upcoming winter season. This 8% year-over-year increase, equivalent to 1.0 Bcf/d, is directly attributable to the commissioning of new liquefaction projects. Fleet growth continues while minimizing contracted ships in the Atlantic basin. Consequently, decade-low charter rates have balanced spot LNG prices.

Europe Market Insights

The European LNG carrier market is expected to hold 21.6% of the market share due to fleet delivery numbers and contract awards growing around 6% per year. Dual-fuel and membrane tank vessel investments are increasing within EU shipyards because of diversified import terminals. South Korea and China will account for much of the new contracts for European owners. Many of the LNG carrier deliveries also feature biofuel-compatible propulsion systems and boil-off gas reliquefication technology.