- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- Data Triangulation

- Client-specific Requirements and Tailored Solutions

- Executive Summary

- Global Industry Overview

- Market Segmentation

- Regional Synopsis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Panasonic Corporation

- Blackmagic Design Pty. Ltd.

- RED Digital Cinema LLC

- Canon Inc.

- ARRI AG

- Z CAM

- Yealink Inc

- Sony Corporation

- GoPro Inc.

- Logitech Inc.

- Nikon Corporation

- Ongoing Technological Advancements

- Camera Type Analysis

- Actual Usage Pattern of Live Streaming Video and Camera Market Region-Wise Analysis

- SWOT Analysis

- Price Benchmarking

- Application Analysis

- Recent Development Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Global Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Regional Synopsis (USD Million), 2019-2037, By

- North America, Value (USD Million) & Volume (Thousand Units)

- Europe, Value (USD Million) & Volume (Thousand Units)

- Asia Pacific Excluding China, Value (USD Million) & Volume (Thousand Units)

- China, Value (USD Million) & Volume (Thousand Units)

- Latin America, Value (USD Million) & Volume (Thousand Units)

- Middle East and Africa, Value (USD Million) & Volume (Thousand Units)

- Product Type

- North America Market Overview

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Country Level Analysis

- US, Value (USD Million) & Volume (Thousand Units)

- Canada, Value (USD Million) & Volume (Thousand Units)

- Product Type

- Europe Market

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Country Level Analysis

- UK, Value (USD Million) & Volume (Thousand Units)

- Germany, Value (USD Million) & Volume (Thousand Units)

- France, Value (USD Million) & Volume (Thousand Units)

- Italy, Value (USD Million) & Volume (Thousand Units)

- Spain, Value (USD Million) & Volume (Thousand Units)

- Russia, Value (USD Million) & Volume (Thousand Units)

- NORDIC, Value (USD Million) & Volume (Thousand Units)

- Rest of Europe, Value (USD Million) & Volume (Thousand Units)

- Product Type

- Asia Pacific Excluding China Market

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Country Level Analysis

- Japan, Value (USD Million) & Volume (Thousand Units)

- India, Value (USD Million) & Volume (Thousand Units)

- Australia, Value (USD Million) & Volume (Thousand Units)

- Singapore, Value (USD Million) & Volume (Thousand Units)

- Malaysia, Value (USD Million) & Volume (Thousand Units)

- Thailand, Value (USD Million) & Volume (Thousand Units)

- Vietnam, Value (USD Million) & Volume (Thousand Units)

- South Korea, Value (USD Million) & Volume (Thousand Units)

- Rest of Asia Pacific Excluding China, Value (USD Million) & Volume (Thousand Units)

- Product Type

- China Market

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Product Type

- Latin America Market

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Country Level Analysis

- Brazil, Value (USD Million) & Volume (Thousand Units)

- Mexico, Value (USD Million) & Volume (Thousand Units)

- Argentina, Value (USD Million) & Volume (Thousand Units)

- Rest of the Latin America, Value (USD Million) & Volume (Thousand Units)

- Product Type

- Middle East and Africa Market

- Market Value (USD Million) & Volume (Thousand Units), Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- DSLR

- Mirrorless

- Camcorder

- PTZ Camera

- Action Camera

- IP Cameras

- Webcams

- Camera Type, Value (USD Million) & Volume (Thousand Units)

- Streaming Hardware, Value (USD Million)

- Video encoders

- Video transcoders

- Others

- Resolution, Value (USD Million)

- 2K

- 4K

- 8K

- Application, Value (USD Million)

- Social Media Live Streaming

- Business Live Streaming

- Classroom Live Streaming

- Events Live Streaming

- Live Streaming

- E-Commerce

- Others

- Country Level Analysis

- GCC, (USD Million) & Volume (Thousand Units)

- Israel, (USD Million) & Volume (Thousand Units)

- South Africa, (USD Million) & Volume (Thousand Units)

- Rest of the Middle East and Africa, (USD Million) & Volume (Thousand Units)

- Product Type

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Live Streaming Video and Camera Market Outlook:

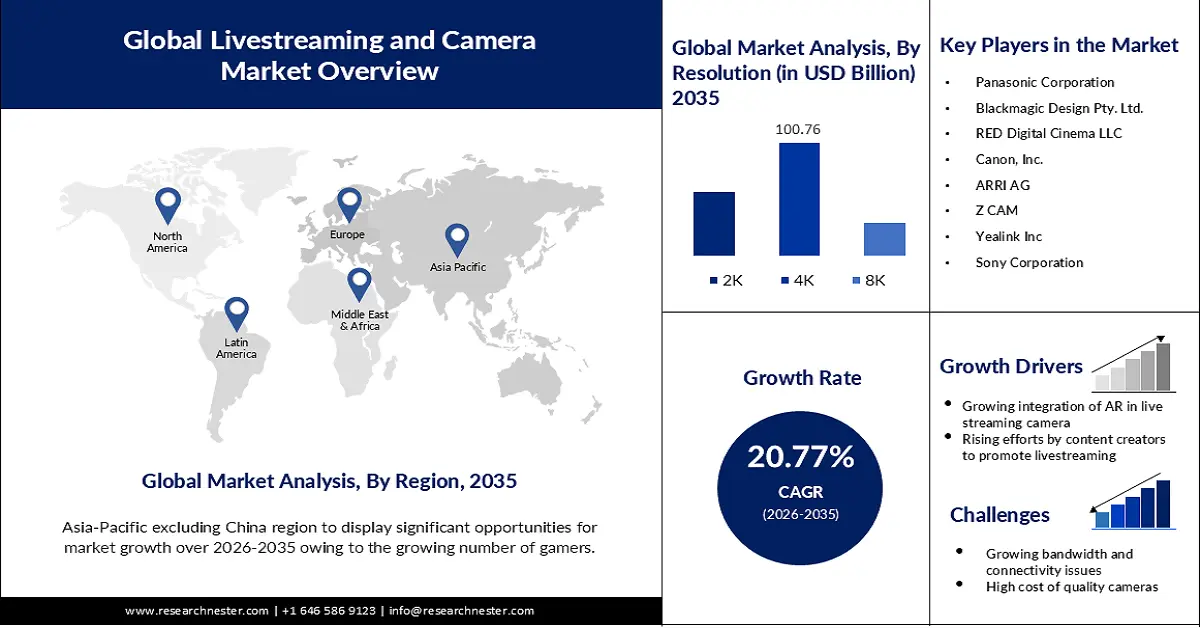

Live Streaming Video and Camera Market size was valued at USD 35.36 billion in 2025 and is likely to cross USD 233.4 billion by 2035, expanding at more than 20.77% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of live streaming video and camera is estimated at USD 41.97 billion.

The increasing accessibility of high-speed internet, in addition to the advent of 4G and 5G networks, has resulted in better availability and reliability of live streaming broadcasters and spectators. Governments across the world are making efforts to encourage the adoption of high-speed networks. For instance, the Department of Telecommunications (DoT) has established a sixth-generation (6G) innovation committee to promote 6G technologies. Bharat6G Alliance website was also launched with an aim to partner and synergize with other 6G global alliances and promote global cooperation and information sharing.

Manufacturing companies in the live streaming video and camera market are constantly striving to launch novel gadgets and devices with advanced features to cater to rising demand for better communication, entertainment, and engagement.

Key Live Streaming Video and Camera Market Insights Summary:

Regional Insights:

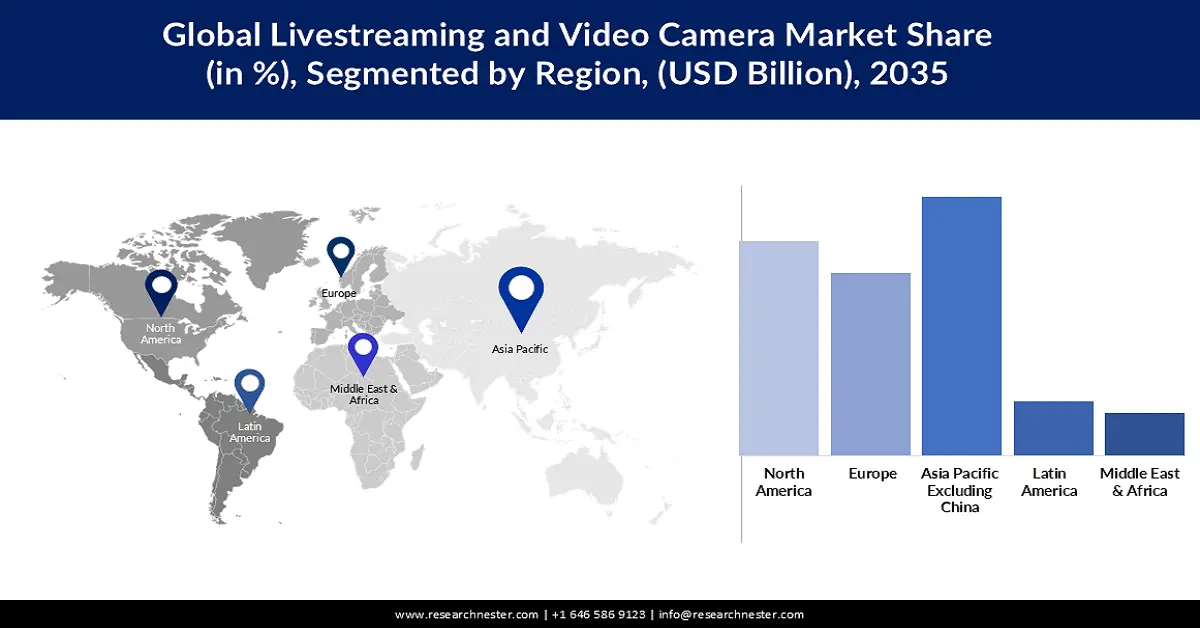

- By 2035, Asia Pacific excluding China is projected to capture significant revenue share in the live streaming video and camera market, fueled by a large population base, widespread smart device usage, and a growing gamer population.

- North America is anticipated to achieve notable revenue share by 2035, supported by advanced technological infrastructure, high social media influence, and widespread adoption of smartphones and smart devices.

Segment Insights:

- The 4K segment of the live streaming video and camera market is projected to secure a remarkable share by 2035, driven by widespread adoption of 4K-compatible devices offering high clarity at affordable prices.

- The camera segment is expected to witness significant revenue growth by 2035, with DSLR cameras leading the segment due to advanced sensors, low-light performance, and versatility across photography genres.

Key Growth Trends:

- Integration of augmented reality in live streaming camera

- Rising efforts by content creators to promote live streaming

Major Challenges:

- Growing bandwidth and connectivity issues

- Surging concerns over security

Key Players: Panasonic Corporation, Blackmagic Design Pty. Ltd., RED Digital Cinema LLC., ARRI AG, Z CAM, Yealink Inc, Sony Corporation, GoPro Inc., Logitech Inc., and Nikon Corporation.

Global Live Streaming Video and Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.36 billion

- 2026 Market Size: USD 41.97 billion

- Projected Market Size: USD 233.4 billion by 2035

- Growth Forecasts: 20.77%

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding China (Significant Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Japan, Germany, United Kingdom, South Korea

- Emerging Countries: India, Australia, Brazil, Singapore, Malaysia

Last updated on : 19 November, 2025

Live Streaming Video and Camera Market - Growth Drivers and Challenges

Growth Drivers

- Integration of augmented reality in live streaming camera – The increasing integration of augmented reality (AR) in live streaming is drastically changing the way content is created and consumed. AR allows streamers to create interactive scenarios that can engage more audiences. Streamers can also use AR technology to personalize their content for viewers. In July 2020, Blippar became the first company to launch AR product launch event for OnePlus. The company extended its typical short-from AR environment and created a completely new and immersive format with 26-minute live-streamed event.

- Rising efforts by content creators to promote live streaming - By constantly communicating in real-time with their audiences, influencers, and content creators have contributed substantially to the popularity of live streaming. Social media influencers, content creators, and celebrities constantly communicate with their audiences through live streaming, enhancing its popularity. They use several platforms such as Twitch, YouTube, Facebook, and even TikTok and use various graphics, virtual environments and interactive elements to create immersive experiences and interact with their audiences.

Zhejiang Luyuan Electric Vehicle Co., Ltd, became officially recognized as having the longest live stream video on September 20, 2022, reporting in 624 hours, 37 minutes, and 55 seconds. The prior record was set by YouTuber AboFlah, also known as Hassan Suleiman, who streamed "The World's Coolest Winter," an attempt to raise money for refugee help. - Rising number of workforces operating remotely - COVID-19 has drastically changed the way traditional organizations used to operate. It accelerated the remote work model which further influenced the need for live streaming. According to the U.S. Bureau of Labor Statistics, in August 2023, approximately one in five workers (19.5%) worked distantly in the U.S. Hence, an excellent way to communicate and work collaboratively with distant staff is through live streaming. Corporate companies are inclined towards live streaming to make any event such as virtual meetings, brainstorming workshops, training courses, or social gatherings, more engaging and interesting.

Challenges

- Growing bandwidth and connectivity issues - Delivering high-quality streams requires greater bandwidth. This latency can affect viewer experience in live events in which real-time interaction is necessary. Buffering and low-quality streams can be a result of low internet connectivity and insufficient bandwidth. This can also restrict live streaming video and camera market expansion in regions with inadequate network connections.

- Surging concerns over security - Live streaming platforms at times collect personal information from the users. Thus, ensuring that this information is protected against unauthorized access is crucial. Many companies and individuals may lack enough funds to deploy advanced security solutions which can hamper overall live streaming video and camera market growth during the forecast period.

Live Streaming Video and Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.77% |

|

Base Year Market Size (2025) |

USD 35.36 billion |

|

Forecast Year Market Size (2035) |

USD 233.4 billion |

|

Regional Scope |

|

Live Streaming Video and Camera Market Segmentation:

Resolution Segment Analysis

4K segments is expected to account for remarkable live streaming video and camera market share by 2035, owing to the high usage of devices such as modern TVs, smartphones, and laptops that support maximum 4K resolution. 4K provides greater clarity than lower resolutions constitute one of the most obvious advantages of the format. More pixels allow users to produce more clearer images, capturing more colors, textures, and details. Furthermore, if compared to 8K resolution the price offered by 4K is usually affordable, making it an ideal option for the middle-class consumer.

Product Type Segment Analysis

The camera segment in live streaming video and camera market is anticipated to observe a significant revenue increase over the coming years. DSLR camera subsegment is expected to hold remarkable market share by 2035, owing to rising availability of advanced DSLR cameras with high-resolution sensors, low light performance, and interchangeable lenses According to a recent report from Canon, DSLR cameras are estimated to possess a bright future ahead. While mirrorless cameras are increasingly adopted by photographers in genres including, wedding, and portrait, DSLRs continue to be the industry standard for photographers documenting sports, wildlife, and various other genres with fast action.

Moreover, a new class of professional DSLRs is launched by the Canon EOS-1D X Mark III. Its features comprise 5.5K RAW video shooting, an entirely novel CMOS imaging sensor design that offers greater dynamic range, up to 16fps with full AF/AE tracking (or 20fps in Live View), and machine learning technology for improved autofocus accuracy.

Application Segment Analysis

Events livestreaming segment is poised to hold substantial live streaming video and camera market share by the end of 2035, owing to rising preference for live streaming. Live streaming allows events to reach a global audience, enabling a larger population to connect from any part of the world. This also reduces the overall costs associated with venue, logistics, travel constraints, and even limited ticket availability.

The trend of events live streaming has drastically increased post-COVID-19 pandemic. Companies started shifting to social media platforms as gatherings were restricted. For instance, according to estimates, 89 million U.S. viewers are expected to stream a sports event at least once a month by 2025, an upsurge from about 56 million in 2021.

Our in-depth analysis of the global live streaming video and camera market market includes the following segments:

|

Product Type |

|

|

Resolution |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Live Streaming Video and Camera Market - Regional Analysis

APEC Market Insights

In live streaming video and camera market, Asia Pacific excluding China region is estimated to capture significant revenue share by the end of 2035. This growth can be attributed to factors such as a large population base and high usage of smart devices and social media platforms. The surge in number of gamers across the region excluding China is anticipated to influence the expansion of the live streaming video and camera market revenue going ahead. For instance, in the year 2024, Asia Pacific is projected to experience the highest number of gamers reaching over 1 billion who are actively playing compared to all other regions.

Moreover, many key players are heavily investing in several e-sports events, leading to expansion of market. For instance, the League of Legends 2023 World Championship become the highest-watched eSports tournament of all time, with a stipulated 6.4 million peak watchers. The second highest-watched tournament was the Free Fire World Series 2021 in the nation of Singapore, with 5.41 million peak spectators.

The live streaming video and camera market in India is expected to register a substantial revenue CAGR over the forecast period owing to rising number of OTT platforms in this country, significantly providing various offers and cost cuts to the customers and rising number of social media influencers and content creators.

The live streaming video and camera market in Japan is expected to experience rapid growth between 2026 and 2035. This growth can be attributed to the surging genZ population and increasing investments in launching new products and technology.

North America Market Insights

The live streaming video and camera market in North America is poised to gather notable revenue during the forecast period owing to the presence of advanced technological infrastructures and social media influencers and high penetration of smartphones, laptops, and other smart devices. For instance, as per GSMA, North America is predicted to see 87% of smartphone adoption by 2028.

The U.S. market is a significant contributor due to high internet penetration, rise of 4G and 5G technologies, and increasing usage of smartphones for live streaming Moreover, there are many key players in the US, focused on launching novel technologies and devices. This is expected to boost market demand in this country.

The live streaming video and camera market in Canada is expected to register rapid revenue growth in the coming years owing to increasing mobile penetration and high adoption of advanced livestreaming devices and technology.

Live Streaming Video and Camera Market Players:

- Panasonic Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blackmagic Design Pty. Ltd.

- RED Digital Cinema LLC

- Canon, Inc.

- ARRI AG

- Z CAM

- Yealink Inc

- Sony Corporation

- GoPro Inc.

- Logitech Inc.

- Nikon Corporation

The live streaming video and camera market is highly competitive and consists of several key players operating at global and regional levels. The key players are utilizing several strategies such as mergers and acquisitions, product launches, partnerships, and license agreements to enhance their product base and cater to the rising demand for advanced cameras and streaming solutions. Companies like Canon, Sony, GoPro, and Panasonic are focused on developing and launching high-quality imaging technology to cater to the rising demands of live streaming while several companies are providing tools and advanced software for managing and enhancing live streams. Here is a list of some dominant players in the live streaming video and camera market.

Recent Developments

- In May 2024: Canon U.S.A., Inc. announced that its parent company, Canon Inc., is working on the EOS R1, a full-frame mirrorless camera, as the first flagship model for the EOS R SYSTEM with an RF mount, with a release date of 2024. The camera is expected to improve the performance of both videos and still images, meeting the requirements of professionals working in video production, sports coverage, or news reporting.

- In October 2022: Panasonic Connect Co., Ltd. announced the launch of a novel AK-PLV100GSJ 4K studio camera with a 5.7K Super 35 mm sensor and PL mount in the first quarter of CY2023. The camera is expected to help production teams across several industries enhance the video quality and make their streaming platforms and broadcast channels more exciting and engaging.

- Report ID: 3239

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.